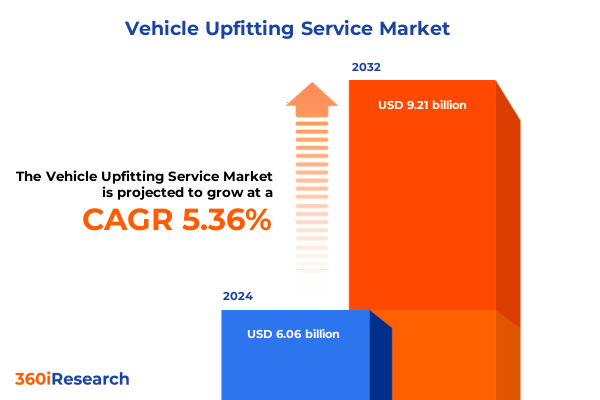

The Vehicle Upfitting Service Market size was estimated at USD 5.95 billion in 2025 and expected to reach USD 6.26 billion in 2026, at a CAGR of 5.40% to reach USD 8.60 billion by 2032.

Navigating the Rapid Evolution of Vehicle Upfitting Services Amid Global Market Dynamics and Cutting-Edge Technological Innovations

As businesses and fleets face evolving operational demands, vehicle upfitting services have emerged as a critical enabler of customized solutions that drive efficiency and productivity. The market’s momentum is propelled by the need to tailor commercial vehicles to specific vocational uses, whether outfitting service vans with modular interiors or enhancing work trucks with advanced safety systems. Sustainability considerations further fuel innovation, with upfitters offering eco-friendly conversions, electric vehicle adaptations, and lightweight materials that align with environmental regulations and corporate responsibility mandates.

Simultaneously, the integration of digital technologies and telematics solutions has redefined the upfitting landscape. Fleet managers increasingly demand real-time connectivity, advanced GPS tracking, and remote diagnostics to optimize vehicle utilization and maintenance schedules. Upfitting now encompasses the installation of telematics hardware, connectivity solutions, and software-defined vehicle platforms that support over-the-air updates and data analytics, enabling proactive decision-making and reduced downtime.

In parallel, regulatory shifts are reshaping supply chain strategies. The March 26, 2025 proclamation imposing a 25 percent tariff on imported vehicles and key automotive parts has elevated the importance of domestic sourcing and strategic supplier partnerships. Upfit providers are adapting by strengthening U.S. manufacturing capabilities, diversifying supplier networks, and exploring tariff exemption processes. These dynamics underscore the critical role of agile upfitting operations that can respond swiftly to policy changes while maintaining cost competitiveness.

Unprecedented Shifts Redefining Vehicle Upfitting Services Through Electrification, Digitalization, and Industry Disruption

The vehicle upfitting sector is undergoing transformative shifts that transcend traditional customization services. Electrification stands at the forefront, driven by mandates for zero-emission fleets and incentives for green transportation. Upfitting specialists are expanding their offerings to include battery management systems, EV charging infrastructure installations, and lightweight composite materials that enhance range and energy efficiency. This convergence of environmental stewardship and technical innovation is redefining the parameters of upfitting service portfolios.

Digitalization likewise exerts a profound influence, as upfitters incorporate software-defined vehicle architectures and connected platforms into their core competencies. The rise of software-defined vehicles enables seamless feature enhancements through over-the-air updates, allowing fleet operators to access new functionalities without physical modifications. This paradigm shift toward digital integration necessitates a new skill set among upfit technicians and a deeper collaboration between upfit providers, OEMs, and software developers to ensure compatibility and security.

Moreover, industry disruption is fueled by modular design principles that emphasize flexibility and rapid reconfiguration. Modular upfit systems empower fleet managers to repurpose vehicles across multiple vocational applications, reducing downtime and maximizing asset utilization. As standardized modules become widely adopted, upfitters face the challenge of differentiating their solutions through advanced materials, ergonomic designs, and specialized integrations that cater to emerging use cases such as mobile health clinics and remote work offices.

Assessing the Far-Reaching Consequences of the 2025 Twenty-Five Percent U.S. Tariffs on Vehicle Imports and Automotive Parts

On March 26, 2025, the U.S. administration enacted a 25 percent tariff on all imported passenger vehicles and light trucks, effective April 3, 2025, under Section 232 of the Trade Expansion Act, with a 25 percent tariff on specified automotive parts, including engines and electrical components, to take effect by May 3, 2025. The cumulative tariff impact elevates the MFN rate for passenger vehicles to 27.5 percent and light trucks to 50 percent, marking one of the most significant cost shifts in recent automotive trade history.

The ramifications for upfitting services are profound. Upfitters reliant on imported chassis, body equipment, and electronic components face elevated input costs and extended lead times. Major OEMs have reported billions in additional tariff-related costs, with some passing up to 80 percent of these expenses to end customers through altered pricing structures and reduced discounting. At the same time, U.S. manufacturers are accelerating investments in domestic production to mitigate these burdens, realigning supply chains, and qualifying for tariff offsets under a newly established adjustment process managed by the Department of Commerce.

Looking ahead, upfitters must navigate a landscape defined by ongoing policy uncertainty and potential retaliatory measures. Firms that can rapidly qualify for tariff exemptions, localize critical components, and foster deeper collaboration with U.S.-based suppliers will gain a competitive edge. Meanwhile, the long-term permanence of these tariffs underscores the necessity of strategic planning that prioritizes supply chain resilience, cost transparency, and value-driven partnerships within the upfitting ecosystem.

Illuminating Critical Segmentation Strategies That Drive Precision and Customization in the Vehicle Upfitting Market

When examined through the lens of vehicle type, the upfitting market reveals a nuanced architecture of demand. Commercial vans command a prominent share, with heavy, medium, and light variants each catering to distinct vocational needs. Meanwhile, pickup trucks bifurcate into light-duty and heavy-duty segments, reflecting diverging requirements for payload capacity and chassis robustness. Specialty vehicles, encompassing everything from customized chassis platforms to purpose-built emergency response units and recreational vehicles, underscore the bespoke nature of the upfitting value proposition. Heavy-duty, medium-duty, and light-duty trucks provide the backbone for large-scale operations, demanding robust upfit installations that support high payloads and rigorous duty cycles.

The mosaic of end user industries further refines this segmentation. Construction fleets leverage a spectrum of configurations ranging from commercial and infrastructure builds to residential support vehicles, each requiring tailored shelving, safety barriers, and power systems. Emergency services and healthcare providers rely on highly specialized ambulance, fire, and policing vehicles equipped with integrated life-saving equipment and redundant power sources. Government and utility sectors engage upfitters for municipal services, electrical maintenance fleets, and water and sewage operations, emphasizing durability and compliance. Logistics operators focus on courier, freight, and parcel delivery vehicles optimized for rapid access, while telecommunications firms demand modular mobile offices and maintenance service vans capable of supporting network installation tasks.

Upfit type segmentation paints another dimension of opportunity. Connectivity solutions integrate telematics, fleet management systems, and mobile office setups to drive data-driven operations. Electrical systems upfits encompass lighting, power inverters, and wiring harness installations that support auxiliary equipment. Exterior modifications range from ladder racks and body coatings to aerodynamic enhancements, while interior upfits deliver flooring, seating partitions, and storage assemblies. Safety equipment installations, including cameras, sensors, and protective barriers, address both regulatory requirements and risk mitigation for asset protection.

Sales channel dynamics bridge the aftermarket and OEM worlds. Independent upfitters and franchise dealerships operate within the aftermarket sphere, delivering specialized services and regional expertise. OEM partnerships and dealership‐backed upfit programs ensure seamless integration with factory warranties and standardized quality protocols, fostering customer confidence and streamlined delivery timelines.

Fuel type segmentation layers an additional axis. Battery electric vehicles necessitate bespoke charging solutions, battery management upfits, and thermal control systems. Hybrid platforms, whether mild or plug-in, require integration of auxiliary power units and power distribution modules. Internal combustion engine vehicles, spanning gasoline and diesel variants, maintain a robust demand for traditional body modifications and equipment installations that support established workflows.

This comprehensive research report categorizes the Vehicle Upfitting Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Upfit Type

- Fuel Type

- Vehicle Type

- End User

- Service Channel

Unveiling Regional Dynamics Shaping the Future of Vehicle Upfitting Across the Americas, EMEA, and Asia-Pacific

Across the Americas, upfitting services align closely with robust commercial vehicle production and evolving trade policies. In the United States, the imposition of Section 232 tariffs has incentivized domestic sourcing of upfit components and accelerated investments in U.S.-based manufacturing partnerships. Canada and Mexico, under the USMCA framework, navigate transitional exemptions, enabling continued cross-border supply while awaiting formal tariff adjustment processes. Meanwhile, Latin American fleets in Brazil and Argentina witness rising demand for climate-controlled transport and bulk agricultural upfits, with Brazilian operators reporting a significant year-on-year increase in sealed container installations that safeguard sensitive exports.

In Europe, Middle East, and Africa, stringent emission standards and regulatory frameworks define the upfitting roadmap. The EU’s Euro VI mandates and Whole Vehicle Type Approval requirements necessitate recertification for aftermarket modifications, imposing certification costs and influencing upfitter service offerings. Gulf Cooperation Council markets, particularly Saudi Arabia and the UAE, prioritize desert-grade filtration systems, extended-range fuel solutions, and multi-compartment retail vehicles that serve both oilfield support and urban commerce. African markets present diverse needs: mining operations in South Africa rely on explosion-proof lighting and reinforced undercarriages, while East African health initiatives drive mobile clinic upfits with solar-powered refrigeration. These regional conditions demand upfitters that can adapt rapidly to local standards and environmental extremities.

Asia-Pacific stands at the vanguard of fleet modernization, propelled by rapid urbanization, digital infrastructure rollouts, and green mobility mandates. China’s adherence to GB17691-2018 emission protocols parallels Euro VI requirements, triggering the need for compliant upfit modifications. India’s construction sector boom has spawned hundreds of thousands of tipper body installations, while Japan’s aging demographic sustains a high-growth ambulance upfitting segment. Australia, responding to increased bushfire and emergency response needs, integrates large-capacity water tank and drone launch platform upfits. Across the region, connectivity adoption accelerates with 5G networks, fostering demand for C-V2X telematics and AI-driven fleet management solutions that enhance safety and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the Vehicle Upfitting Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Pioneering Solutions and Strategic Alliances Driving Leadership in the Vehicle Upfitting Ecosystem

At the forefront of digital marketplace innovation, Ford Pro has launched an open upfitted vehicle locator platform, enabling customers to instantly find in-stock, factory-backed upfitted F-Series Super Duty pickups, Transit vans, and E-Transit electric vans through a seamless online interface. This integration with Work Truck Solutions underscores Ford Pro’s commitment to streamlining the upfitting process, reducing lead times, and enhancing data connectivity between dealers, upfitters, and end users.

General Motors’ Envolve division continues to refine its Business Choice Offers, providing cash allowances for upfits on a broad range of Silverado, Sierra, and Express chassis cab models. GM’s Upfitter Integration program delivers comprehensive body builder manuals, electrical schematics, and factory-approved modification protocols, ensuring seamless compatibility and warranty preservation for a diverse fleet portfolio.

Workhorse Group’s strategic partnership with Surefitters marks a significant advancement in electric commercial vehicle upfitting. The ship-thru upfit program delivers pre-configured packages optimized for last-mile delivery and vocational trades on Workhorse medium-duty EV chassis, enabling streamlined quality control and volume efficiencies for electric fleets.

Adrian Steel Company secured industry recognition by winning the 2025 Truck Upfit Package of the Year award for its Pepsi F-150 Electrified Service Solution. This cutting-edge package integrates tool storage systems and mobile power solutions into electric service vehicles, showcasing the company’s leadership in electrified upfit innovation.

Ranger Design continues to set benchmarks in utility system design, debuting the Trazer Utility System-a fully modular, forklift-loadable rack and toolbox ecosystem-and first-to-market curated upfit packages for Chevrolet BrightDrop 400 and 600 electric vans. These solutions underscore Ranger Design’s dedication to late-point configurability, rapid installation, and EV-optimized interiors that meet the demands of modern fleet operators. Furthermore, the acquisition of Ranger Design by Clarience Technologies enhances its digital safety and visibility capabilities, positioning the combined entity for accelerated innovation in the upfit domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vehicle Upfitting Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Knapheide Manufacturing Company

- J.B. Poindexter & Co.

- Holman Enterprises Inc.

- Clarience Technologies.

- Utilimaster Corporation

- BearCom Group, Inc.

- Stellar Industries, Inc.

- Day Wireless Systems

- Adrian Steel Company, Inc.

- Advantage Outfitters

- Aebi Schmidt Group

- American Communications

- Assembly Systems, Inc.

- BlueLine Enterprises

- Canfield Equipment Service Incorporated

- CapFleet Upfitters

- CARTWRIGHT VEHICLE CONVERSIONS

- Clark Truck Equipment

- Fleet Electric, Inc.

- Ford Motor Company

- GM Envolve

- Harbor Truck Bodies, Inc.

- Independent Truck Upfitters

- Kranz Body Co.

- LINE-X Protective Coatings

- MCA, Inc

- Mike Albert Upfit

- National Fleet Services

- Pro Comm Inc

- RCS Communications.

- Rosenbauer Beteiligungsverwaltung GmbH

- Scelzi Enterprises, Inc.

- U.S. Upfitters

Strategic Imperatives for Building Resilient, Digitally Enabled Vehicle Upfitting Operations in a Volatile Trade Environment

To thrive amid evolving market conditions, upfitters should establish agile supply chain frameworks that incorporate dual-sourcing strategies and leverage tariff exemption processes to minimize cost exposure. By forging deeper partnerships with domestic chassis and component manufacturers, firms can secure production continuity and buffer against policy shocks. Implementing robust scenario planning protocols will enable rapid resource reallocation in response to trade policy adjustments and raw material price fluctuations.

Investment in digital upfitting capabilities will differentiate service providers by offering connectivity solutions, remote diagnostics, and software-defined enhancements that transcend physical modifications. Upfitters should develop in-house expertise in telematics integration, cybersecurity standards, and OTA update management to fulfill the growing demand for smart and scalable fleet solutions. Collaboration with OEM software teams and industry consortia can accelerate certification of digital upfit modules and ensure interoperability across vehicle platforms.

Leveraging Multimodal Research Techniques and Stakeholder Engagement to Achieve Rigorous Market Analysis and Actionable Insights

Our research methodology combined extensive secondary research with rigorous primary engagement to ensure comprehensive market coverage and data validity. We conducted in-depth interviews with key stakeholders, including fleet managers, upfitting specialists, OEM technical experts, and regulatory authorities, to capture qualitative insights on emerging trends and operational challenges.

Secondary research encompassed trade publications, regulatory filings, OEM whitepapers, and industry association reports. Data triangulation methods aligned quantitative data points from multiple sources, while expert panel reviews validated assumptions and refined forecasts. A multi-stage quality control process, including peer reviews and consistency checks, ensured the accuracy and reliability of the research outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vehicle Upfitting Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vehicle Upfitting Service Market, by Upfit Type

- Vehicle Upfitting Service Market, by Fuel Type

- Vehicle Upfitting Service Market, by Vehicle Type

- Vehicle Upfitting Service Market, by End User

- Vehicle Upfitting Service Market, by Service Channel

- Vehicle Upfitting Service Market, by Region

- Vehicle Upfitting Service Market, by Group

- Vehicle Upfitting Service Market, by Country

- United States Vehicle Upfitting Service Market

- China Vehicle Upfitting Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Perspectives on How Technological Innovation and Policy Shifts Are Shaping the Future Trajectory of Vehicle Upfitting Services

In conclusion, the vehicle upfitting service market stands at a pivotal juncture, propelled by disruptive trends in electrification, digitalization, and regulatory policy. The application of modular design principles and advanced connectivity solutions has redefined the value proposition, enabling fleet operators to achieve unprecedented levels of operational efficiency and customization. Meanwhile, the introduction of substantial tariffs on imported vehicles and parts underscores the need for strategic supply chain realignment and domestic sourcing initiatives to safeguard competitive positioning.

By embracing a holistic segmentation framework, understanding regional dynamics, and analyzing the strategies of industry leaders, stakeholders can identify high-impact opportunities and mitigate risks. The convergence of environmental imperatives, technological innovation, and evolving customer expectations promises to shape the next era of upfitting, rewarding companies that invest in digital capabilities, strategic partnerships, and resilient operational models.

Empower Your Business with Exclusive Market Intelligence Through a Direct Conversation with Our Associate Director of Sales & Marketing

Ready to take your fleet’s capabilities to the next level? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive vehicle upfitting service market research report. Learn how tailored insights and strategic data can empower your team to anticipate market shifts, optimize upfitting investments, and drive competitive advantage. Contact Ketan today to unlock the insights that industry leaders rely on when planning for growth, innovation, and long-term success.

- How big is the Vehicle Upfitting Service Market?

- What is the Vehicle Upfitting Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?