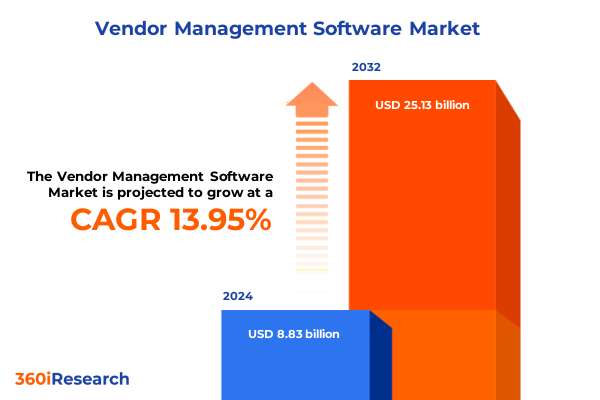

The Vendor Management Software Market size was estimated at USD 10.03 billion in 2025 and expected to reach USD 11.40 billion in 2026, at a CAGR of 14.01% to reach USD 25.13 billion by 2032.

Exploring the Growing Significance and Strategic Opportunities in the Evolving Vendor Management Software Ecosystem Amid Digital Transformation Demands

In today’s fast-paced digital economy, organizations across industries recognize that effective vendor management software is critical to driving operational efficiency, reducing risk, and maximizing the value of supplier relationships. As enterprises contend with increasingly complex global supply chains and escalating regulatory demands, the ability to centralize contract data, automate invoice workflows, and monitor supplier performance has shifted from being a nice-to-have capability to a strategic imperative. Consequently, leadership teams are prioritizing technology investments that consolidate disparate systems, deliver real-time analytics, and empower informed decision-making at every stage of the sourcing lifecycle.

Moreover, the growing emphasis on cost optimization and resilience has placed vendor management platforms at the forefront of digital transformation initiatives. Procurement, finance, and risk management functions are aligning around shared platforms to eliminate silos, enhance collaboration, and increase transparency. As a result, organizations are gaining deeper visibility into spend categories, supplier dependencies, and contractual obligations, which directly contributes to stronger negotiation outcomes and improved compliance. This introduction outlines how vendor management software serves as a foundational enabler for enterprise agility and supplier-centric innovation.

Uncovering Key Technological Advances and Operational Transformations Redefining Vendor Management Software to Address Modern Enterprise Agility Requirements

The vendor management software landscape has undergone significant technological and operational shifts in recent years, driven by the need for integrated, scalable, and intelligent solutions. First, artificial intelligence and machine learning capabilities have transitioned from peripheral add-ons to core differentiators. Predictive analytics now deliver proactive insights into supplier risk, contract renewals, and spend anomalies, enabling organizations to anticipate disruptions and negotiate from a position of strength. In parallel, robotic process automation has streamlined repetitive tasks such as purchase order matching, invoice reconciliation, and supplier onboarding, freeing procurement teams to focus on strategic initiatives rather than manual workflows.

Additionally, the rise of open APIs and low-code platforms has facilitated seamless integration with ERP systems, procurement suites, and third-party data sources. This interoperability not only enhances data fidelity but also accelerates deployment timelines. Cloud-native architectures have supplanted legacy on-premises deployments, offering elastic scalability and lower total cost of ownership. Consequently, software providers are embracing microservices and containerization to deliver more agile, update-driven releases, further supporting continuous innovation. These transformative shifts underscore how next-generation vendor management solutions are redefining the way organizations source, contract, and collaborate with suppliers.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on Vendor Management Software Supply Chains and Innovation Trajectories

United States tariff policies implemented in 2025 have exerted a profound influence on vendor management software supply chains and associated ecosystem dynamics. As duties on imported hardware components and software licenses increased, organizations experienced sharper cost pressures on infrastructure investments and vendor-provided services. In response, IT and procurement leaders reassessed their sourcing strategies, driving a surge in demand for platforms that could simulate “what-if” tariff scenarios and model total cost of ownership under fluctuating duty structures. This, in turn, accelerated the adoption of solutions with advanced scenario planning modules and dynamic cost-analysis dashboards.

Furthermore, the imposition of new tariffs stimulated a broader shift toward regionalization and nearshoring among enterprises aiming to mitigate exposure to duty-related volatility. Organizations began restructuring supplier portfolios, favoring local or allied markets where tariff impacts were less severe. Consequently, vendor management software providers enhanced geo-analysis features to track supplier locations, trade classifications, and duty contexts in real time. These cumulative effects illustrate how 2025 tariff measures not only reshaped cost considerations but also fueled innovation in risk management and scenario modeling within the vendor management domain.

Deconstructing Market Segmentation to Illuminate the Diverse Components Deployment Modes Scales Verticals and User Roles Shaping Software Adoption

A nuanced analysis of vendor management software adoption reveals that market segmentation plays a pivotal role in vendor selection and solution utilization. When evaluating components, organizations differentiate between services and solutions. Services encompass strategic consulting, implementation and integration, and ongoing training and support, enabling enterprises to tailor platforms to their unique processes. In contrast, solutions break down into analytics and reporting, contract management, invoice management, risk management, and supplier management modules, each addressing specific phases of the source-to-pay continuum.

By deployment mode, enterprises opt for cloud-native platforms that promise rapid provisioning and seamless updates while hybrid architectures cater to those balancing performance and compliance. On-premises deployments remain prevalent among organizations with stringent data residency requirements. Moreover, organization size dictates buying behavior: large enterprises prioritize scalability and end-to-end integration, whereas small and medium-sized enterprises focus on modular, cost-effective solutions that can be rapidly adopted. Industry verticals further shape feature priorities, with banking and insurance firms emphasizing regulatory compliance, healthcare organizations stressing risk mitigation, IT and telecom companies prioritizing supplier performance analytics, manufacturers focusing on inventory and contract management efficiencies, and retail and e-commerce businesses valuing dynamic invoice processing capabilities. In addition, end-user departments such as finance, IT, procurement, and risk management each drive different requirements, from spend forecasting and system integration to vendor risk monitoring and streamlined procurement workflows. Collectively, these segmentation insights underscore the need for highly configurable vendor management solutions that resonate with diverse enterprise demands.

This comprehensive research report categorizes the Vendor Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Mode

- Organization Size

- Industry Vertical

- End-User

Identifying Regional Dynamics and Growth Patterns Across Americas Europe Middle East & Africa and Asia Pacific Vendor Management Software Landscapes

Regional dynamics in the vendor management software landscape underscore varying adoption velocities, regulatory drivers, and ecosystem partnerships. In the Americas, enterprises benefit from mature procurement practices and robust cloud infrastructures, leading to widespread uptake of integrated source-to-pay suites. Advanced analytics and supplier collaboration tools are particularly in demand, as organizations seek real-time insights into spend categories and supplier performance across North and South American operations.

Conversely, Europe, Middle East & Africa markets exhibit a strong focus on regulatory compliance and data sovereignty, prompting investments in platforms that offer granular audit trails and on-premises or private-cloud options. Emerging economies in EMEA are simultaneously exploring hybrid models to reconcile digital progress with legacy on-premises systems. Looking east, Asia-Pacific has become a hotbed for innovation as manufacturers, telecom providers, and e-commerce giants adopt vendor management solutions to navigate complex multi-tiered supply chains. Across APAC, rapid digitization initiatives and government-driven technology incentives have catalyzed demand for AI-enabled risk management and contract automation capabilities. These regional insights highlight how geographic nuances influence feature stacks, deployment preferences, and partner ecosystems in the vendor management software market.

This comprehensive research report examines key regions that drive the evolution of the Vendor Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Companies Driving Innovation Differentiation and Competitive Strategies in the Global Vendor Management Software Market

The competitive landscape within vendor management software is defined by a mix of established enterprise players and agile, specialized providers. Leading names such as Coupa have leveraged AI-driven analytics and business spend management integrations to capture market mindshare, while SAP Ariba continues to strengthen its global reach through comprehensive ERP interface capabilities. Ivalua has differentiated itself with a highly configurable platform that appeals to complex sourcing scenarios, and GEP has emphasized its unified approach to procurement, supply chain, and contract management services.

Furthermore, Jaggaer stands out for its deep vertical expertise, particularly in life sciences and higher education, enabling tailored supplier management and compliance features. These companies are engaging in strategic partnerships, ecosystem expansions, and targeted acquisitions to enrich their product portfolios. They are also investing heavily in user-experience design to facilitate intuitive workflows across diverse stakeholder groups. Collectively, these competitive insights reveal how leading vendors are balancing breadth of functionality with specialized depth, positioning themselves to serve both global enterprises and niche sectors.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vendor Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 360factors, Inc.

- Avaali Solutions Pvt Ltd.

- Bentley Systems, Inc.

- Corcentric, Inc.

- Coupa Software Inc.

- Deskera US Inc.

- eSellerHub

- Freshworks Inc.

- Gatekeeper

- GEP

- HICX Solutions

- Ingram Micro, Inc.

- Intelex Technologies Inc.

- International Business Machines Corporation

- Ivalua Inc.

- LogicManager, Inc.

- Mailchimp

- MasterControl, Inc.

- MetricStream Inc.

- Ncontracts LLC

- Proactis Holdings PLC

- Quantivate, LLC

- SalesWarp

- SAP SE

- TYASuite Software Solutions Pvt. Ltd.

Establishing Actionable Strategies for Industry Leaders to Navigate Vendor Management Software Complexities and Capitalize on Emerging Opportunities

Industry leaders can capitalize on evolving market dynamics by prioritizing several actionable strategies. First, investing in AI and machine learning capabilities within vendor management platforms will enable predictive risk modeling and advanced spend optimization, directly supporting proactive decision-making. Second, embracing a hybrid deployment approach allows organizations to align data residency requirements with cloud scalability, ensuring both performance and compliance.

In addition, fostering cross-functional collaboration between procurement, finance, IT, and risk management teams will drive holistic adoption and minimize silos. Leaders should also pursue partnerships with complementary technology providers, integrating vendor management software with broader source-to-pay ecosystems to create seamless end-user experiences. Finally, establishing continuous training and support frameworks will accelerate user proficiency and reinforce best practices. By executing these recommendations, organizations will navigate market complexities more effectively and position themselves to capitalize on the next wave of vendor management software innovation.

Detailing a Rigorous and Multi-Faceted Research Methodology Incorporating Primary Expert Insights and Data Triangulation for Software Market Analysis

This research is underpinned by a comprehensive methodology combining both primary and secondary data sources. In the secondary phase, proprietary databases, white papers, industry journals, and corporate filings were systematically reviewed to map the vendor management software landscape. Concurrently, a series of in-depth interviews was conducted with senior procurement executives, IT directors, and risk officers from a cross-section of industries to capture nuanced perspectives on solution requirements and adoption drivers.

Quantitative surveys supplemented these qualitative insights, gathering input from end users on feature usage, deployment preferences, and satisfaction levels. Data triangulation techniques were employed to reconcile information from multiple sources, ensuring robustness and minimizing bias. Furthermore, analysts validated key findings through peer reviews and market feedback sessions. This multi-faceted approach provides a reliable foundation for the strategic and operational insights presented throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vendor Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vendor Management Software Market, by Component

- Vendor Management Software Market, by Deployment Mode

- Vendor Management Software Market, by Organization Size

- Vendor Management Software Market, by Industry Vertical

- Vendor Management Software Market, by End-User

- Vendor Management Software Market, by Region

- Vendor Management Software Market, by Group

- Vendor Management Software Market, by Country

- United States Vendor Management Software Market

- China Vendor Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Illuminate Critical Success Factors and Strategic Imperatives for Vendor Management Software Stakeholders

The synthesis of market drivers, technological innovations, and regulatory influences reveals several critical success factors for vendor management software stakeholders. Proven capabilities in predictive analytics, seamless integration, and automated workflows are imperative for driving value across procurement lifecycles. Additionally, adaptability to evolving tariff landscapes, compliance standards, and regional preferences remains a strategic differentiator. By aligning product roadmaps with these imperatives, vendors can deliver solutions that resonate with enterprise priorities and foster long-term customer loyalty.

Looking ahead, stakeholders should maintain vigilance regarding emerging trends such as supplier ecosystem marketplaces, blockchain-enabled contract verification, and advanced risk intelligence. Fostering collaborative innovation with clients through co-development programs will also accelerate feature adoption and reinforce vendor-customer partnerships. Ultimately, those who leverage these insights to refine their strategies will be best positioned to thrive in a vendor management software market characterized by rapid change and escalating expectations.

Inviting Decision-Makers to Connect with Ketan Rohom for a Customized Vendor Management Software Market Research Report Purchase Experience

To explore the full depth of these insights and obtain a tailored analysis of the vendor management software market, we invite decision-makers to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. By engaging with Ketan, you will gain personalized guidance on report customization, ensuring the research aligns precisely with your strategic priorities. His expertise will help you navigate the complexity of vendor ecosystems and extract actionable intelligence that supports your investment and operational decisions. Reach out to arrange a private briefing, discuss bespoke add-on modules, and secure your copy of the comprehensive market research report designed to empower your next phase of growth and innovation.

- How big is the Vendor Management Software Market?

- What is the Vendor Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?