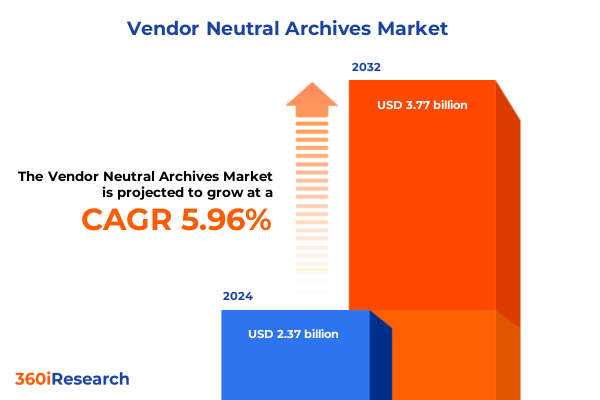

The Vendor Neutral Archives Market size was estimated at USD 2.50 billion in 2025 and expected to reach USD 2.65 billion in 2026, at a CAGR of 5.99% to reach USD 3.77 billion by 2032.

Unveiling the Growing Importance of Vendor Neutral Archives in Modern Healthcare Data Management and Interoperability Challenges

Vendor neutral archive (VNA) solutions have rapidly transitioned from niche applications to indispensable components of today’s healthcare infrastructure. These platforms provide a centralized repository that harmonizes diverse medical imaging formats and associated clinical data, enabling seamless interoperability across various clinical systems. By decoupling image management from proprietary vendor ecosystems, healthcare organizations can achieve a level of flexibility and control over their data previously unattainable through traditional picture archiving and communication systems. This shift has become particularly critical as healthcare providers strive to optimize care pathways and accelerate diagnostic workflows in an increasingly data-driven environment.

Moreover, the consolidation of imaging records into a unified framework not only supports radiology and cardiology departments but also extends benefits to multidisciplinary teams involved in oncology, neurology, and telemedicine. As patient care becomes more collaborative, timely access to comprehensive imaging histories supports more accurate diagnoses and improved treatment planning. The adoption of a neutral archive mitigates the risk of data silos and vendor lock-in, thereby enhancing organizational agility when integrating emerging technologies or transitioning between IT frameworks.

As digital transformation continues to gain momentum within healthcare, the adoption of vendor neutral archives is increasingly viewed as a strategic imperative rather than a mere operational enhancement. Organizations that invest in these platforms position themselves to capitalize on advanced analytics, machine learning, and cloud-based innovations, all of which rely on high-quality, accessible image repositories. This report offers a deep dive into the evolving VNA ecosystem and sets the stage for understanding the factors that will shape the next wave of innovation and adoption.

Examining Key Technological Advances and Strategic Shifts Reshaping the Future of Vendor Neutral Archives Across Diverse Healthcare Settings

The vendor neutral archive landscape is being fundamentally reshaped by a host of technological and strategic forces that are redefining how imaging data is stored, accessed, and leveraged. First, the maturation of interoperability standards such as DICOMweb and HL7 FHIR has laid the groundwork for more seamless integration between VNA platforms and enterprise electronic health record systems. In parallel, the proliferation of application programming interfaces has given rise to modular, microservices-based architectures that enable rapid deployment of new functionalities without disrupting core workflows.

Concurrently, cloud computing has emerged as a transformative catalyst, offering healthcare providers scalable storage and on-demand processing power. This shift away from purely on-premises implementations affords organizations the flexibility to manage peaks in imaging volume, support remote and teleradiology use cases, and reduce the burden of in-house infrastructure maintenance. Edge computing solutions further augment this model by addressing latency and bandwidth challenges, particularly in settings with limited connectivity.

Artificial intelligence and advanced analytics are also unlocking significant value within VNA environments. Machine learning algorithms trained on large archives of imaging studies can automate critical processes such as image quality control, lesion detection, and metadata annotation. Furthermore, heightened emphasis on cybersecurity is driving the adoption of zero-trust frameworks, encryption at rest and in transit, and advanced auditing capabilities to safeguard sensitive patient information. Collectively, these technological advances are reshaping the contours of the VNA market and setting a new benchmark for performance and innovation.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Hardware Costs Supply Chains and Pricing Dynamics in Healthcare Archives

In early 2025, the United States government enacted a series of tariff adjustments targeting importation of select hardware components used in medical imaging and archiving appliances. These measures, which encompass duties of up to 15 percent on storage arrays, networking equipment, and semiconductor elements sourced from overseas, have introduced new cost pressures across the procurement lifecycle. Healthcare IT decision-makers are now facing higher upfront capital expenditures for on-premises infrastructure, prompting a recalibration of budget allocations and project timelines.

The ripple effects extend beyond pure hardware pricing. Supply chain disruptions, including extended lead times and reduced availability of key components, have prompted some providers to adopt dual-source strategies or pivot toward domestically manufactured alternatives. Meanwhile, global logistics bottlenecks have further compounded the challenge, with freight costs and customs clearance delays contributing to an overall 10 to 12 percent increase in total landed cost for new appliances.

These headwinds have accelerated the appeal of cloud-centric VNA deployments that shift capital outlays into operational expense models. By leveraging cloud service providers’ existing infrastructure, organizations can sidestep tariff-induced cost spikes and maintain predictable, subscription-based pricing structures. Nevertheless, this transition requires careful consideration of data sovereignty, regulatory compliance, and long-term service agreements. Ultimately, the 2025 tariff landscape has underscored the importance of adaptable deployment strategies that balance economic efficiency with robust disaster recovery and business continuity capabilities.

Uncovering Critical Insights from End User Deployment Mode and Component Segmentation for Optimized Vendor Neutral Archive Strategies

Insights drawn from end user segmentation reveal distinct requirements and adoption patterns across clinics, diagnostic centers, hospitals, and teleradiology service providers. Smaller outpatient clinics often prioritize lightweight, cloud-based archive services that minimize on-site infrastructure, whereas large hospital networks demand enterprise-grade solutions capable of supporting millions of studies per year with advanced disaster recovery capabilities. Diagnostic imaging centers, which handle high volumes of cross-modality studies, typically require scalable architectures that can seamlessly integrate third-party viewers and AI applications. Meanwhile, teleradiology providers emphasize low-latency access and geographic redundancy to ensure uninterrupted service delivery across disparate locations.

When examining deployment mode segmentation, the divide between cloud and on-premises models becomes apparent. On-premises implementations offer greater direct control over hardware and data residency, making them appealing for organizations with stringent regulatory or privacy requirements. In contrast, cloud deployments deliver rapid scalability, reduced maintenance overhead, and streamlined updates, attributes particularly valued by entities seeking to avoid large capital investments and minimize IT staffing burdens. A hybrid approach is also emerging, in which core archive functions reside in the cloud while select workloads and large file caches remain on-site for performance-sensitive applications.

Component-based segmentation further illuminates the ecosystem of services and solutions that underpin the VNA market. Service offerings encompass consulting engagements for workflow optimization, professional integration services that tailor system configurations to specific clinical environments, and ongoing support and maintenance contracts designed to preserve peak operational performance. Solutions themselves bifurcate into hardware appliances-dedicated storage arrays and network appliances optimized for medical imaging-and software platforms that deliver comprehensive management, orchestration, and analytics capabilities. Understanding these nuanced segments enables stakeholders to tailor procurement and implementation plans to their unique operational and financial objectives without sacrificing functionality or scalability.

This comprehensive research report categorizes the Vendor Neutral Archives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- End User

- Deployment Mode

Analyzing Regional Trends and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific to Guide Strategic Archive Deployments

Across the Americas, the VNA market is characterized by rapid adoption of cloud architectures, driven by large integrated delivery networks seeking to harmonize patient records across multiple states and facilities. Regulatory frameworks such as HIPAA and emerging state-level data privacy statutes have elevated the importance of robust encryption and audit trails, prompting vendors to embed advanced security features directly into their platforms. In addition, government incentive programs for value-based care initiatives are reinforcing investments in data interoperability, positioning vendor neutral archives as key enablers of population health management and care coordination.

In the Europe, Middle East & Africa region, diverse regulatory landscapes and varying levels of infrastructure maturity present both opportunities and challenges. The European Union’s stringent GDPR guidelines impose rigorous data protection requirements, compelling providers to adopt on-premises or private cloud solutions with strict access controls. In the Middle East, investments in cutting-edge medical infrastructure are fueling demand for hybrid VNA deployments that integrate local data centers with global cloud platforms. Meanwhile, in selected African markets, limited broadband connectivity and budget constraints favor leaner, software-centric approaches that can function with intermittent network access and smaller data footprints.

Within the Asia-Pacific region, government-led digital health agendas in countries such as Australia, Japan, and Singapore are catalyzing the replacement of legacy PACS with more flexible vendor neutral architectures. Rapid technological adoption and favorable reimbursement models for telemedicine are further accelerating demand in both urban centers and emerging secondary markets. Vendors are responding by establishing regional data centers and forging partnerships with local systems integrators to address language, regulatory, and support nuances, thereby ensuring that deployments align with each country’s unique clinical workflows and security mandates.

This comprehensive research report examines key regions that drive the evolution of the Vendor Neutral Archives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players Innovations and Competitive Strategies Shaping the Vendor Neutral Archive Market Landscape

The competitive landscape of vendor neutral archives features a diverse mix of long-established technology giants and innovative challengers. Several leading players have leveraged deep domain expertise in imaging and enterprise IT to deliver end-to-end platforms that integrate seamlessly with existing hospital information systems. These vendors often distinguish themselves through extensive professional services arms and global customer support networks, enabling them to execute large-scale, multi-site rollouts with minimal disruption.

Notably, multinational corporations with legacy footprints in medical imaging have expanded their portfolios through strategic acquisitions and partnerships. By integrating advanced analytics and cloud hosting capabilities into their VNA offerings, they are positioned to meet the evolving demands of large health systems seeking both performance and scalability. At the same time, specialized niche providers are carving out competitive advantages by focusing on modular, API-first solutions that can be rapidly deployed and customized to emerging clinical use cases, such as cardiology image exchange and AI-driven workflow optimization.

A third cohort of market participants comprises cloud-native entrants that emphasize subscription-based consumption and continuous feature delivery. These pure-play vendors appeal to progressive organizations that prefer OPEX-centric budgeting models and value a pay-as-you-grow approach. Their platforms often include built-in analytics dashboards and machine learning modules, enabling providers to derive actionable insights with minimal upfront configuration.

Finally, a number of regional integrators and smaller technology firms play a critical role in tailoring VNA solutions to local markets. Through partnerships with global brand vendors, these companies offer complementary services such as on-site support, training, and localized compliance consulting, ensuring that deployments meet the nuanced requirements of each healthcare environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vendor Neutral Archives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Carestream Health, Inc.

- Fujifilm Holdings Corporation

- GE HealthCare Technologies Inc.

- Hyland Software, Inc.

- Intelerad Medical Systems, Inc.

- International Business Machines Corporation

- Koninklijke Philips N.V.

- Merge Healthcare Inc. by IBM Corporation

- Novarad Corporation

- OnePACS, LLC

- PaxeraHealth, Inc

- Sectra AB

- Siemens Healthineers AG

- SoftTeam Solutions Pvt Ltd

- Visus Health IT GmbH by CompuGroup Medical

Delivering Strategic and Actionable Recommendations to Empower Industry Leaders in Optimizing Vendor Neutral Archive Investments and Operations

Healthcare organizations seeking to maximize the value of their vendor neutral archive investments should prioritize interoperability by selecting platforms that support the latest DICOMweb, HL7 FHIR, and IHE profiles. This approach lays the foundation for seamless integration with electronic health records, enterprise viewers, and analytics dashboards, thereby reducing custom development costs and accelerating time to value. Leaders should also evaluate hybrid deployment models that combine cloud flexibility with on-premises performance, enabling them to optimize storage costs while maintaining control over latency-sensitive imaging workloads.

Strategic partnerships with established AI and cybersecurity vendors can further strengthen archive deployments. By embedding machine learning modules for automated indexing and anomaly detection, organizations can streamline radiology workflows and enhance data governance. In parallel, adopting a zero-trust security framework with multi-factor authentication and end-to-end encryption will ensure that patient data remains protected throughout its lifecycle, satisfying both regulatory requirements and institutional risk management objectives.

On the operational front, it is critical to invest in change management and staff training initiatives. Radiologists, IT administrators, and clinical support personnel must be equipped with the skills to leverage advanced archive functionalities and to troubleshoot integration points effectively. Finally, maintaining flexible vendor contracts that include clear service-level agreements and provisions for scaling capacity will enable organizations to respond rapidly to emerging clinical demands and evolving policy landscapes.

Demonstrating a Rigorous Multiphase Research Methodology Ensuring Validity Reliability and Depth in Vendor Neutral Archive Analysis

This research employed a multiphase methodology designed to ensure both depth and rigor in its exploration of the vendor neutral archive market. The secondary research phase commenced with a comprehensive review of publicly available regulatory filings, industry white papers, and technology standards documentation. This desk research established the foundational understanding of key market drivers, emerging regulations, and vendor solution architectures.

In the primary research phase, in-depth interviews were conducted with healthcare IT executives, radiology department heads, systems integrators, and technology providers. These discussions yielded qualitative insights into decision-making criteria, deployment challenges, and future adoption plans. Supplementing these interviews was a targeted survey of over one hundred healthcare organizations across diverse geographies, which provided quantitative validation of emerging trends and requirement priorities.

Data triangulation techniques were applied to cross-verify findings, ensuring consistency between qualitative inputs and survey results. A steering committee of industry advisors and subject matter experts reviewed interim deliverables, offering feedback on hypothesis testing and analytical frameworks. Finally, all insights were synthesized into a cohesive narrative, emphasizing actionable intelligence and strategic relevance for decision-makers evaluating VNA investments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vendor Neutral Archives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vendor Neutral Archives Market, by Component

- Vendor Neutral Archives Market, by Application

- Vendor Neutral Archives Market, by End User

- Vendor Neutral Archives Market, by Deployment Mode

- Vendor Neutral Archives Market, by Region

- Vendor Neutral Archives Market, by Group

- Vendor Neutral Archives Market, by Country

- United States Vendor Neutral Archives Market

- China Vendor Neutral Archives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Takeaways and Strategic Imperatives for Future Growth and Innovation in Vendor Neutral Archive Deployments

As this executive summary has underscored, vendor neutral archives have evolved into pivotal enablers of healthcare interoperability, operational efficiency, and data-driven innovation. The convergence of advanced interoperability standards, cloud computing, and artificial intelligence is redefining the parameters of archive performance, while regulatory shifts such as new U.S. tariff regimes are reshaping cost considerations and procurement strategies.

Segmentation analysis reveals that end user requirements differ significantly across clinics, hospitals, diagnostic centers, and teleradiology providers, while choices between cloud, on-premises, and hybrid deployments hinge on factors such as data sovereignty, budget models, and performance needs. Component segmentation further highlights the interplay between consulting services, integration efforts, hardware appliances, and software platforms in delivering comprehensive solutions. Regionally, the Americas, Europe Middle East & Africa, and Asia-Pacific each present distinct regulatory and technological contexts that vendors and healthcare providers must navigate to optimize adoption.

Competitive dynamics are characterized by the coexistence of legacy imaging vendors, cloud-native entrants, and specialized integrators, all vying to deliver enhanced functionality and service quality. Against this backdrop, the actionable recommendations outlined earlier offer a roadmap for organizations aiming to enhance interoperability, strengthen cybersecurity, and leverage hybrid architectures. These imperatives will guide future growth and innovation, ensuring that vendor neutral archives continue to underpin high-quality patient care and operational excellence across the global healthcare ecosystem.

Connect Directly with Ketan Rohom to Secure Comprehensive Market Intelligence and Tailored Insights for Vendor Neutral Archive Implementation Decisions

To explore the full breadth of insights contained within this comprehensive Vendor Neutral Archive market analysis and to receive customized guidance aligned with your organization’s strategic priorities, contact Ketan Rohom, Associate Director of Sales & Marketing. His expertise and consultative approach will ensure you gain instant access to the actionable data and in-depth conclusions that can drive more informed investment and operational decisions. Seize this opportunity to transform your imaging data infrastructure and unlock new efficiencies by engaging directly to secure your copy of the definitive market research report.

- How big is the Vendor Neutral Archives Market?

- What is the Vendor Neutral Archives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?