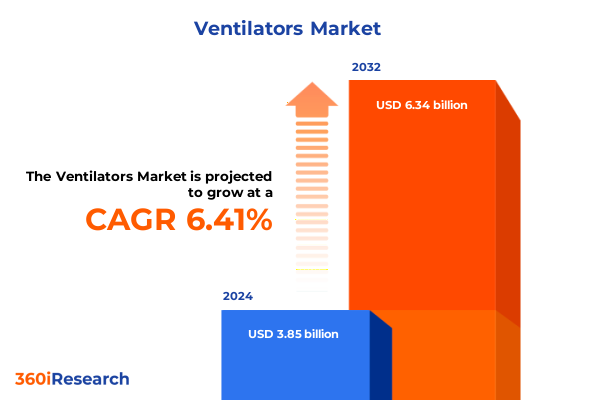

The Ventilators Market size was estimated at USD 4.10 billion in 2025 and expected to reach USD 4.36 billion in 2026, at a CAGR of 6.42% to reach USD 6.34 billion by 2032.

Understanding the landscape of ventilator technology adoption and market dynamics shaping patient care and industry innovation in a post-pandemic context

Ventilator technology has transitioned from a critical response tool in acute care to a cornerstone of long-term respiratory support across clinical settings. The rapid scale-up of production capacities during the COVID-19 pandemic accelerated innovation cycles, driving both public and private stakeholders to refine product designs, streamline supply chains, and advance digital integration. In the years that followed, the focus shifted toward enhancing patient outcomes through smarter, more intuitive interfaces, remote monitoring capabilities, and tighter interoperability with hospital information systems.

This executive summary synthesizes the latest advances and market influences that continue to shape ventilator adoption globally. It provides an entry point for decision-makers to understand the forces at play-technology evolution, regulatory recalibrations, trade policies, and shifting care protocols. Drawing on extensive stakeholder interviews and rigorous secondary research, the report contextualizes how clinical needs intersect with commercial imperatives, laying the groundwork for strategic investments and collaboration.

By unpacking transformative shifts, tariff-driven adjustments, segmentation strategies, regional dynamics, and competitive landscapes, this introduction sets the stage for a nuanced exploration. It highlights why ventilators remain a high-priority area within respiratory care, how emerging trends present both risks and opportunities, and why a holistic approach to market analysis is essential to navigate the future landscape.

How advancements in respiratory care technology and emerging clinical protocols are redefining ventilator applications and shaping future patient outcomes

Over the past several years, ventilator design and deployment have undergone profound transformation, driven by both clinical insights and technological breakthroughs. Manufacturers have embraced advanced algorithms and AI-powered decision support to enhance ventilation protocols, reducing the incidence of ventilator-associated lung injuries by enabling more precise control of pressure and volume parameters. Simultaneously, the rise of tele-ICU solutions has facilitated remote monitoring and real-time adjustments, granting critical care teams greater flexibility and responsiveness in patient management.

Moreover, the integration of modular hardware architectures has improved scalability, allowing providers to tailor ventilator configurations to specific care environments, from neonatal units to emergency transport vehicles. Clinical protocols have adapted in parallel, with lung-protective ventilation strategies becoming standard of care and new hybrid ventilation modes offering clinicians broader therapeutic options. In turn, these innovations have catalyzed a shift toward value-based purchasing models in both public health systems and private hospitals.

Consequently, the ventilator landscape has become a dynamic intersection of medical device ingenuity, digital connectivity, and evolving clinical guidelines. Stakeholders must now navigate a matrix of regulatory approvals, interoperability standards, and user-experience expectations, underscoring the need for agile development cycles and cross-disciplinary collaboration across engineering, clinical, and commercial teams.

Assessing the ripple effects of recently implemented United States tariffs on ventilator imports and domestic manufacturing competitiveness

In early 2025, the United States enacted a series of tariffs on medical device imports, including ventilator components, to bolster domestic production and reduce reliance on international supply chains. These trade measures targeted key subassemblies and modules sourced primarily from Europe and Asia, triggering a recalibration of procurement strategies among Original Equipment Manufacturers and Tier-1 suppliers. As import duties increased, downstream costs rose, compelling manufacturers to explore alternative sourcing and onshore production partnerships.

Domestic contract manufacturers saw increased demand for low-volume, high-mix production runs, driving investments in flexible automation and workforce training. At the same time, certain providers of specialist components faced compressed margins as they balanced the need to retain competitive pricing against rising material and labor costs. Healthcare purchasers, particularly those operating under fixed-budget constraints, began to re-evaluate purchasing cycles, with some deferring non-urgent ventilator upgrades in favor of maintenance extensions.

Despite these headwinds, the tariffs have stimulated greater collaboration between government agencies and industry consortia to streamline certification for domestically produced devices. The policy environment has also encouraged accelerated innovation in low-cost, modular ventilator platforms aimed at both acute care and outpatient settings. Moving forward, stakeholders will need to balance cost pressures with the imperative to maintain the high performance and reliability standards that underpin patient safety.

Diving deep into how modes, product types, technologies, applications, and end-user segments reveal nuanced opportunities and challenges for ventilator providers

A nuanced look at ventilator market segmentation underscores the distinct value propositions and growth levers across different categories. Invasive and non-invasive modes reveal divergent technological requirements: while invasive ventilators demand robust pressure-cycle control and infection-control features, non-invasive systems prioritize patient comfort and leak compensation algorithms. These mode-focused innovations, in turn, map onto diverse product portfolios, spanning anesthesia, emergency transport, ICU, neonatal, and portable devices, each with specialized interface and software demands.

Technological segmentation further highlights the trade-offs between blower, piston, and turbine mechanisms, with blower systems offering compact designs suitable for transport applications, piston architectures providing high pressure-output stability, and turbines delivering seamless performance at varying altitudes and environmental conditions. Application-based divisions into adult, neonatal, and pediatric uses shape user-interface design as well as alarm and safety protocols, necessitating distinct calibration and validation processes for each patient cohort.

End-user analyses draw attention to the contrasting operational imperatives of ambulatory surgical centers, home-care programs, and hospitals. Outpatient facilities often require portable, intuitive ventilators with minimal footprint, whereas home-care solutions emphasize remote monitoring and user training support. Hospital purchasers demand scalable ICU platforms that integrate with electronic health records and central monitoring systems, reflecting their need for interoperability and data-driven clinical management.

This comprehensive research report categorizes the Ventilators market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mode

- Product Type

- Technology

- Application

- End User

Uncovering strategic regional dynamics across the Americas, EMEA, and Asia-Pacific that influence ventilator deployment, regulatory frameworks, and growth trajectories

Regional market dynamics in the Americas hinge on evolving reimbursement frameworks and regulatory pathways. In North America, public procurement for acute care is increasingly tied to outcome-based contracts, incentivizing providers to adopt advanced ventilator systems that demonstrate improved clinical metrics. Meanwhile, Latin American markets are expanding through targeted partnerships with local distributors and growing investments in critical care infrastructure across urban and rural hospital networks.

Europe, the Middle East, and Africa present a mosaic of regulatory regimes and financing models. The European Union’s Medical Device Regulation continues to harmonize product standards, prompting manufacturers to align development roadmaps with the European Database on Medical Devices (EUDAMED). In the Middle East, government-led healthcare modernization initiatives have accelerated ventilator procurement for newly established tertiary care centers, whereas in parts of Africa, donor-funded programs are driving demand for rugged, low-maintenance devices.

Asia-Pacific growth is propelled by rapidly expanding healthcare access and capital investment in critical care. China’s emphasis on domestic innovation has led to the rise of local OEMs, while India’s private hospital sector increasingly prioritizes high-throughput ICU solutions to serve a growing patient base. In Southeast Asia and Australasia, regulatory bodies are streamlining approval processes, creating opportunities for market entrants willing to invest in regional service networks and technical support capabilities.

This comprehensive research report examines key regions that drive the evolution of the Ventilators market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading manufacturers’ strategic initiatives, partnerships, and innovation pipelines that are driving leadership and disruption within the global ventilator arena

Industry leaders have pursued differentiated strategies to capture value from the ventilator market’s complexity. Several global OEMs have forged partnerships with software firms to integrate predictive analytics and remote diagnostics into their platforms, enabling service-as-a-solution models that extend beyond initial hardware sales. Others have invested heavily in modular design principles, reducing time-to-market for new variants and facilitating regional customization without extensive re-engineering.

A number of companies have also targeted the rising demand for portable and emergency transport ventilators by developing lightweight chassis and intuitive interfaces, supported by robust training programs for paramedical staff. In the neonatal segment, specialized niche players continue to refine gentle ventilation algorithms and miniaturized hardware suited for underdeveloped healthcare settings, often collaborating with academic hospitals for clinical validation.

Meanwhile, established conglomerates leverage global manufacturing footprints to achieve scale efficiencies, balancing production across low-cost regions with strategic assembly hubs in key markets. These firms often align with regulatory consultants early in the product development cycle to preempt compliance delays, ensuring faster market entry. Across the spectrum, the unifying theme remains a commitment to embedding digital services, from remote firmware updates to cloud-based performance dashboards, as a core component of competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ventilators market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aeonmed Co., Ltd.

- Air Liquide Medical Systems S.A.

- Allied Medical, LLC

- Avasarala Technologies Limited

- Becton, Dickinson and Company

- Bio-Med Devices, Inc.

- Bunnell Incorporated

- Drägerwerk AG & Co. KGaA

- Fisher & Paykel Healthcare Corporation Limited

- GE HealthCare Technologies Inc.

- General Electric Company

- Getinge AB

- Hamilton Medical AG

- Heyer Medical AG

- Koninklijke Philips N.V.

- Magnamed Tecnologia Médica S/A

- Medtronic plc

- Mindray Medical India Pvt. Ltd.

- Nihon Kohden Corporation

- ResMed Inc.

- Schiller AG

- Smiths Group plc

Strategic recommendations empowering ventilator industry leaders to capitalize on emerging technologies, operational efficiencies, and evolving clinical and regulatory needs

Industry leaders should prioritize continued investment in AI-driven ventilation algorithms to improve patient outcomes and reduce clinician workload. By leveraging real-world data and machine learning models, design teams can refine adaptive ventilation modes that automatically adjust to changing lung mechanics, delivering personalized respiratory support.

Strengthening the supply chain through diversified sourcing and strategic partnerships will mitigate risks from future tariff adjustments or geopolitical disruptions. Cultivating relationships with regional contract manufacturers and localizing critical subcomponent production can lower lead times and enhance cost management under evolving trade policies.

Expanding digital service offerings through remote monitoring platforms and predictive maintenance programs will unlock recurring revenue streams and deepen customer engagement. Training clinical and biomedical engineering teams on new digital functionalities ensures rapid adoption and optimizes device uptime, translating into improved return on investment for healthcare providers.

Targeted market entry strategies in high-growth regions-supported by tailored regulatory and reimbursement roadmaps-will bolster market presence and first-mover advantages. Forming alliances with local distributors and clinical centers to pilot new ventilator models can smooth regulatory approvals and accelerate stakeholder buy-in.

By adopting an agile innovation framework that integrates end-user feedback and clinical trial insights early, organizations can streamline development cycles and preempt performance gaps. Cross-functional teams combining engineering, clinical affairs, and market intelligence should collaborate continuously to align product roadmaps with emergent clinical and operational needs.

Detailing a rigorous mixed-method research framework combining primary stakeholder interviews, field observations, and secondary data analysis for ventilator market insights

This research employed a mixed-method approach to deliver comprehensive insights into the ventilator landscape. Secondary data collection encompassed regulatory filings, clinical guidelines, industry white papers, and peer-reviewed journals to map historical trends and current best practices. The team supplemented this desk research with technical specifications from major device registries and standards organizations to ensure a robust understanding of technological architectures.

Primary research included in-depth interviews with key stakeholders spanning hospital clinical directors, biomedical engineers, procurement officers, and OEM executives. These conversations provided firsthand perspectives on purchase drivers, usability challenges, and unmet clinical needs. Field observations within intensive care units and transport ambulance settings enabled validation of device performance in real-world environments.

To ensure analytical rigor, the findings were triangulated across multiple data sources, cross-referencing quantitative inputs with qualitative insights. An expert advisory panel reviewed preliminary drafts, offering feedback on regional variances and technology adoption curves. All proprietary data were anonymized to maintain confidentiality and objectivity, with methodological transparency upheld through detailed documentation of interview guides and data-validation protocols.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ventilators market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ventilators Market, by Mode

- Ventilators Market, by Product Type

- Ventilators Market, by Technology

- Ventilators Market, by Application

- Ventilators Market, by End User

- Ventilators Market, by Region

- Ventilators Market, by Group

- Ventilators Market, by Country

- United States Ventilators Market

- China Ventilators Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing key takeaways on ventilator market evolution, strategic inflection points, and imperative actions for sustained innovation, growth, and competitive differentiation

The ventilator market stands at a strategic inflection point where clinical expectations, technological capabilities, and policy initiatives converge. Advanced pneumatic architectures and AI-enhanced software are redefining what modern ventilators can achieve, while trade policies and regional regulations continually reshape the competitive terrain. Segmentation insights reveal that success hinges on aligning product portfolios with mode-specific requirements and end-user preferences, from neonatal ICUs to home-care environments.

Regional dynamics underscore the importance of customizing market entry strategies, with each geography presenting unique regulatory hurdles and reimbursement incentives. Leading manufacturers illustrate that digital services and strategic partnerships serve as key differentiators, driving long-term customer loyalty and opening new revenue channels.

By synthesizing these trajectories, industry stakeholders can anticipate disruptions, prioritize investments in high-impact innovations, and navigate policy headwinds with agility. The insights presented here equip decision-makers to forge resilient supply chains, optimize R&D pipelines, and deliver ventilator solutions that meet the evolving demands of global healthcare systems.

Engage with Ketan Rohom to explore comprehensive ventilator market intelligence and secure your access to actionable research insights today

Ready to gain a competitive edge in the evolving ventilator market? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at our firm, who can guide you through the comprehensive research findings and advise on actionable strategies tailored to your organization. Whether you need deeper insights on tariff impacts, segmentation nuances, or regional growth levers, Ketan stands prepared to demonstrate how this report can inform your decision-making. Contact him today to secure your copy of this definitive market research report and transform insights into measurable outcomes.

- How big is the Ventilators Market?

- What is the Ventilators Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?