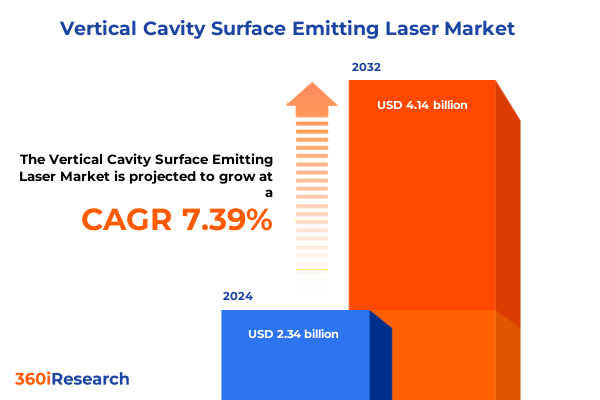

The Vertical Cavity Surface Emitting Laser Market size was estimated at USD 2.49 billion in 2025 and expected to reach USD 2.65 billion in 2026, at a CAGR of 7.52% to reach USD 4.14 billion by 2032.

Setting the Stage for Vertical Cavity Surface Emitting Laser Innovations as the Cornerstone of Next-Generation Optical and Sensing Solutions

The rapid evolution of Vertical Cavity Surface Emitting Lasers (VCSELs) marks a pivotal moment in photonics, where device miniaturization and performance convergence are reshaping high-speed optical communications and precision sensing applications. Initially introduced for optical mice and short-reach datacom links, VCSELs have transcended their early niche to underpin transformative innovations in smartphones, automotive LiDAR, and 3D imaging. As they enable devices to perceive depth, transfer data at unprecedented rates, and operate in constrained thermal environments, VCSELs are emerging as a strategic enabler in next-generation systems ranging from consumer electronics to industrial automation.

Against this backdrop, industry stakeholders are increasingly recognizing the strategic importance of VCSELs for overcoming the limitations of conventional edge-emitting lasers. Their inherent reliability, scalability, and cost efficiency offer a compelling value proposition, particularly as new form factors demand integration of high-density emitter arrays and advanced packaging methods. Consequently, VCSELs are at the forefront of enabling sensor proliferation and high-speed data protocols, providing a foundation for future-ready photonics ecosystems that balance performance with manufacturability.

Exploring How Disruptive Technological Advancements Are Reshaping the Competitive Dynamics and Applications Ecosystem of Vertical Cavity Surface Emitting Lasers

Technological breakthroughs have propelled VCSELs from laboratory curiosities to core components in a broad array of applications, driving sweeping shifts in photonic architectures. In automotive, recent announcements by key LiDAR suppliers signal a dramatic reduction in sensor costs, making advanced driver assistance systems more accessible across vehicle segments. For instance, Hesai Group’s strategy to halve LiDAR prices by deploying self-developed VCSEL chips underscores how integrated photonic solutions are redefining cost structures and enabling mass-market adoption in electric and autonomous cars.

Simultaneously, consumer electronics firms are embedding VCSEL arrays in emerging virtual and augmented reality headsets, leveraging their compact size and low power dissipation to deliver more immersive experiences. In data centers, VCSEL modules facilitate terabit-level optical interconnects, satisfying the insatiable demand for bandwidth in cloud computing and artificial intelligence workloads. Furthermore, medical and industrial segments have embraced VCSEL-based diagnostics and manufacturing lasers, respectively, as these devices increasingly support higher densities and tailored wavelengths. Taken together, these advancements illustrate a transformative shift, where VCSELs serve as a unifying platform across diverse industries, reshaping both value chains and system-level performance expectations.

Evaluating the Layered Impact of United States Trade Policies and Tariff Measures on the Vertical Cavity Surface Emitting Laser Supply Chain and Costs

United States trade policy has introduced new layers of complexity to the VCSEL supply chain, particularly through Section 301 tariffs on Chinese semiconductor imports. Effective January 1, 2025, all semiconductor products classified under HTS headings 8541 and 8542 have been subject to a 50% duty, up from the previous 25% rate. This escalation has reverberated across VCSEL manufacturing, as raw wafers, die fabrication, and final photonic components now face materially higher landed costs.

Moreover, the Office of the United States Trade Representative extended exclusions on certain semiconductor integrated circuit imports through August 31, 2025, offering temporary relief for specific product lines. Beyond that date, the expiration of these exclusions is poised to elevate component costs further, challenging manufacturers to absorb or pass through the additional duties. At the wafer level, critical materials such as silicon and III-V substrates were also targeted with a 50% Section 301 tariff, intensifying pressure on supply continuity and price stability for VCSEL fabs.

In this context, the cumulative impact of U.S. tariffs has spurred industry participants to explore alternative sourcing strategies, accelerate domestic capacity investments, and renegotiate long-term supplier agreements. These measures aim to mitigate duty exposure while maintaining the performance, yield, and cost benchmarks that underpin VCSEL adoption across key end markets.

Uncovering Critical Segmentation Insights Revealing the Diverse Applications Wavelengths and Configurations Driving Vertical Cavity Surface Emitting Laser Adoption

A nuanced understanding of market segmentation reveals the wide-ranging applications driving VCSEL demand, from automotive biometric access and in-cabin gesture control and lidar to consumer electronics features such as 3D sensing in smartphones, VR/AR headsets, and wearable devices that monitor health metrics. Data communication workloads demand arrays optimized for long-reach metro links, mid-reach campus interconnects, and short-reach rack-to-rack connections, while defense applications rely on precision range finding and target designation under harsh environmental conditions.

Industrial lasers leverage VCSEL arrays for high-precision cutting, engraving, and welding tasks, benefiting from uniform beam profiles and scalable power outputs. In medical settings, diagnostics tools employ VCSEL sources for non-invasive imaging modalities, whereas therapeutic platforms exploit high-density power outputs for localized treatments. Additionally, sensing use cases encompass biometric authentication, distance measurement, gesture recognition, and presence detection, each requiring tailored wavelengths-ranging from 650 nm through 1550 nm channels-and specific power tiers, whether high power for long-distance sensing, medium power for data links, or low power for battery-powered devices.

Emitter configuration further refines performance: single-emitter devices deliver targeted coupling efficiency, while one-dimensional and two-dimensional emitter arrays enable rapid scanning and high-throughput processing. Finally, packaging choices-from surface-mount modules favoring compact form factors to through-hole and coaxial options designed for thermal robustness-ensure that VCSEL components integrate seamlessly into end-user products, balancing manufacturability with operational requirements.

This comprehensive research report categorizes the Vertical Cavity Surface Emitting Laser market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Wavelength

- Power Output

- Emitter Type

- Packaging Type

- Application

Analyzing Regional Dynamics and Market Drivers Across the Americas Europe Middle East Africa and Asia Pacific in the Vertical Cavity Surface Emitting Laser Landscape

Regional dynamics exert a significant influence on VCSEL market development, beginning with the Americas, where innovation hubs in the Silicon Valley corridor and major optical device manufacturers have cultivated deep supply networks and collaborative research programs. This region’s strong venture capital ecosystem supports startups exploring novel VCSEL architectures, while legacy semiconductor fabs continue to adapt to photonics integration requirements.

In Europe, Middle East, and Africa, automotive suppliers and aerospace integrators leverage VCSEL sensing for advanced driver assistance and unmanned aerial systems. Regional regulatory frameworks around automotive safety have accelerated the deployment of in-cabin biometric monitoring and exterior lidar, creating a demand center for customized photonic modules. Meanwhile, research institutions across the EMEA region are advancing wafer-level photonics, driving material innovations that feed into VCSEL production pipelines.

Asia-Pacific remains the largest manufacturing nexus, with major production capacity in Taiwan, South Korea, and China. Government initiatives to onshore chip fabrication and reduce dependency on imports have strengthened localized VCSEL production. Aggressive investment in optical component fabs, coupled with cost-competitive assembly operations, positions APAC as a fulcrum for both large-scale data center deployments and consumer electronics rollouts, fueling rapid adoption across multiple application vectors.

This comprehensive research report examines key regions that drive the evolution of the Vertical Cavity Surface Emitting Laser market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Industry Players and Strategic Initiatives Shaping the Competitive Landscape of Vertical Cavity Surface Emitting Laser Development and Commercialization

The competitive landscape of VCSEL technology is shaped by global and regional leaders that continuously push the envelope in device performance and integration. Legacy semiconductor firms have established VCSEL product lines that cater to telecom and datacom applications, while diversified photonics companies are expanding their portfolios to include high-power and specialized wavelength offerings.

Simultaneously, vertically integrated suppliers are investing in in-house epitaxial growth, wafer processing, and advanced packaging to optimize assembly yields and thermal performance. In parallel, emerging players from APAC are leveraging scale manufacturing and iterative design cycles to capture share in consumer electronics and automotive sensing. Partnerships between fabless photonics designers and foundries have become commonplace, enabling rapid prototyping and volume ramp-up of custom VCSEL arrays. This interplay of established incumbents and agile challengers ensures that the VCSEL market remains both dynamic and competitive.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vertical Cavity Surface Emitting Laser market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ams Osram AG

- Broadcom Inc.

- Coherent Corp.

- Hamamatsu Photonics K.K.

- Intel Corporation

- IQE plc

- Lumentum Holdings Inc.

- Mitsubishi Electric Corporation

- MKS Instruments, Inc.

- Qorvo Inc.

- Santec Holdings Corporation

- Sony Group Corporation

- STMicroelectronics N.V.

- Sumitomo Electric Industries, Ltd.

- TRUMPF Group

Actionable Recommendations for Vertical Cavity Surface Emitting Laser Stakeholders to Navigate Market Disruptions and Seize Growth Opportunities Globally

Industry leaders should prioritize diversifying their supply chains by qualifying multiple wafer suppliers and assembly partners to mitigate tariff exposures and maintain production agility. They must also accelerate investments in domestic fabrication and packaging capabilities, ensuring proximity to end markets and reducing transit risks. Collaboration with academic institutions and consortia can unlock next-generation VCSEL architectures-such as heterogeneous integration on silicon photonics platforms-and speed commercialization.

Moreover, companies should deepen customer engagements by co-developing application-specific VCSEL solutions, aligning product roadmaps with emerging standards in automotive safety, data center optics, and medical diagnostics. Strategic M&A activity can further consolidate capabilities in epitaxial growth and advanced testing, while targeted R&D funding should focus on enhancing emitter reliability and reducing thermal load. By adopting a proactive, integrated approach to technology development, supply-chain resilience, and customer partnerships, stakeholders will be better positioned to capitalize on the rapidly expanding VCSEL ecosystem.

Outlining a Robust Research Methodology Leveraging Primary Interviews and Secondary Data to Ensure Rigorous Analysis of Vertical Cavity Surface Emitting Laser Markets

This analysis draws upon a comprehensive research methodology combining primary and secondary data sources to ensure robust, objective insights. Primary research included in-depth interviews with photonics engineers, strategic buyers, and product managers across leading semiconductor firms and end-user organizations. Secondary research involved a thorough review of technical papers, trade publications, regulatory filings, and publicly available patent databases to map technological trajectories and identify competitive benchmarks.

Market segmentation was validated through data triangulation, comparing supplier shipment records, trade data on HTS-classified components, and reported capacity expansions by major foundries. Qualitative inputs from advisory panels supplemented quantitative metrics, aiding in scenario modeling for tariff scenarios and regional demand shifts. Throughout the study, rigorous cross-verification and quality checks were conducted to minimize bias and enhance traceability, ensuring that findings accurately reflect the current VCSEL landscape and inform future strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vertical Cavity Surface Emitting Laser market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vertical Cavity Surface Emitting Laser Market, by Wavelength

- Vertical Cavity Surface Emitting Laser Market, by Power Output

- Vertical Cavity Surface Emitting Laser Market, by Emitter Type

- Vertical Cavity Surface Emitting Laser Market, by Packaging Type

- Vertical Cavity Surface Emitting Laser Market, by Application

- Vertical Cavity Surface Emitting Laser Market, by Region

- Vertical Cavity Surface Emitting Laser Market, by Group

- Vertical Cavity Surface Emitting Laser Market, by Country

- United States Vertical Cavity Surface Emitting Laser Market

- China Vertical Cavity Surface Emitting Laser Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Drawing Conclusions on Market Trends Technological Evolution and Strategic Imperatives for Vertical Cavity Surface Emitting Laser Adoption Across Industries

The ascent of VCSEL technology underscores its versatility as both a high-bandwidth optical source and a precision sensing element. From consumer devices embedding facial recognition to industrial lasers enabling intricate manufacturing operations, VCSELs have demonstrated their capacity to meet the divergent demands of modern applications. Regional and trade policy factors continue to reshape the supply dynamics, urging stakeholders to adapt through supply-chain diversification and targeted investments in domestic capabilities.

Looking forward, the integration of VCSELs onto silicon photonics platforms, coupled with advancements in packaging and thermal management, is set to unlock new frontiers in system efficiency and miniaturization. By aligning strategic priorities with evolving application requirements-such as automotive safety standards and data center energy constraints-organizations can harness VCSEL innovations to drive product differentiation and long-term growth. Ultimately, the convergence of technology, policy, and customer collaboration will define the next chapter of the VCSEL market.

Take the Next Step Engage with Our Associate Director to Access Comprehensive Vertical Cavity Surface Emitting Laser Research and Unlock Strategic Insights

To ensure you stay ahead of emerging opportunities and challenges in the Vertical Cavity Surface Emitting Laser segment, engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Our comprehensive market research report delivers the in-depth technical, commercial, and strategic insights required to inform your next critical investments and partnerships in photonics. Reach out today to secure your copy and unlock tailored, actionable intelligence that empowers you to make confident, data-driven decisions in one of the most dynamic sectors of optical technology.

- How big is the Vertical Cavity Surface Emitting Laser Market?

- What is the Vertical Cavity Surface Emitting Laser Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?