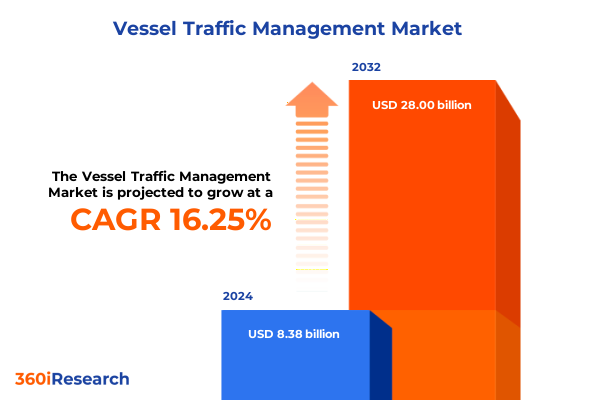

The Vessel Traffic Management Market size was estimated at USD 9.74 billion in 2025 and expected to reach USD 11.32 billion in 2026, at a CAGR of 16.27% to reach USD 28.00 billion by 2032.

Navigating the Future of Vessel Traffic Management through Regulatory Evolution, Environmental Pressures, and Cutting-Edge Innovations Driving Maritime Safety

The vessel traffic management domain represents a critical intersection of maritime safety, environmental stewardship, and logistical efficiency. In an era marked by increasing vessel traffic density, heightened security concerns, and stringent environmental mandates, the role of advanced traffic management systems has never been more pronounced. These systems serve as the central nervous system of port operations and open-sea transit corridors, orchestrating the safe and orderly flow of vessels while mitigating collision risks and minimizing environmental impacts.

Against this backdrop, stakeholders-from port authorities and shipping lines to naval defense organizations-are seeking clarity on the converging forces shaping the market. This executive summary distills the most salient developments, from legislative drivers and technological breakthroughs to emerging competitive strategies. Through an analytical lens, readers will gain an overview of how evolving regulatory frameworks and digital innovations are redefining traffic surveillance, predictive analytics, and decision-support tools. Transitioning from traditional radar-centric approaches, the industry is embracing a converged architecture that integrates satellite AIS, terrestrial sensors, and artificial intelligence, enabling real-time situational awareness at unprecedented scales.

As we navigate through this summary, decision-makers will be equipped with a strategic compass to understand the underlying drivers, risks, and opportunities. The subsequent sections explore transformative shifts, tariff impacts, segmentation dynamics, regional nuances, leading company strategies, pragmatic recommendations, and the robust methodology underpinning these insights-all culminating in actionable intelligence for informed investment and policy decisions.

How Digital Transformation, Artificial Intelligence Integration, and Autonomous Vessel Coordination Are Fundamentally Reshaping the Global Vessel Traffic Management Landscape

Digitalization is redefining the vessel traffic management landscape, ushering in an era where data fusion and real-time analytics empower unprecedented levels of operational precision. The emergence of satellite-based AIS platforms complements shore-based radar installations, extending coverage to remote sea lanes and enhancing redundancy in surveillance networks. Concurrently, cloud-native architectures and edge computing devices are enabling seamless data exchange between vessels and control centers, reducing latency and bolstering decision-support capabilities.

Artificial intelligence and machine learning algorithms are now integral to predictive traffic control, anomaly detection, and route optimization. Advanced neural networks analyze historical vessel movement patterns alongside dynamic environmental inputs-such as currents, winds, and tidal fluctuations-to forecast potential congestion or risk hotspots days in advance. This predictive orchestration not only improves berth allocation and transit times but also supports greener operations by minimizing fuel-intensive idling and deviation maneuvers.

Autonomous vessel trials and collaborative sea-surface unmanned systems have further amplified the value of integrated traffic management. By providing a standardized digital interface, modern platforms facilitate interoperability between manned and autonomous vessels, ensuring cohesive traffic flow and safety protocols. Enhanced cybersecurity measures, including blockchain-based identity frameworks and encrypted data tunnels, safeguard these converged networks against increasingly sophisticated threats. Together, these transformative shifts herald a new chapter in maritime traffic control-one defined by resilience, scalability, and sustainability.

Assessing the Ripple Effects of 2025 United States Tariffs on Vessel Traffic Management Technologies Supply Chains and Operational Cost Structures

Effective March 12, 2025, the United States government enacted a 25% tariff on all steel and aluminum imports, extending duties to derivative products unless fully manufactured domestically and mandating granular reporting of material origin and content during customs clearance. This measure, originally conceived to bolster domestic metal industries, has rippled across vessel traffic management supply chains, given the heavy reliance on steel for radar towers, sensor mounts, and shore-side infrastructure. Hardware producers have experienced immediate cost escalations, prompting price adjustments and contract renegotiations with port authorities and integrators.

Tariffs on electronic components and semiconductors, although not uniformly levied, have also surfaced as a significant challenge. Many VTM platforms embed high-performance chips sourced from Asia, and preliminary estimates suggest a 15% hike in electronic subsystem costs, driven by extended duty investigations and compliance processes. Equipment manufacturers are increasingly exploring tariff engineering strategies-such as partial on-shore assembly or reclassification of intermediate goods-to mitigate duty burdens. Nonetheless, complexity in customs classification systems has introduced bureaucratic delays, slowing down deliveries of critical hardware to major port projects in North America.

The automotive sector’s 2025 tariff impact offers a cautionary parallel: S&P Global projected that new duties could stall one-third of vehicle production in North America within days of enforcement due to parts shortages and border gridlock. Similarly, port equipment integrators are reevaluating their supply agreements, with several pursuing diversification into tariff-exempt regions or nearshoring electronics assembly to Mexico and select Southeast Asian hubs. In response, service providers are emphasizing modular upgrade paths and software-centric offerings, shifting value propositions toward maintenance, analytics, and consulting services that remain insulated from raw materials volatility.

Deep Insights into Component Innovation Application Expansion End-User Adoption and Dual Deployment Models That Define the Vessel Traffic Management Market’s Diversity and Specialization

Insights into component dynamics reveal a clear trend toward modular hardware paired with advanced software ecosystems. Within the hardware domain, the integration of AIS transceivers, high-resolution camera systems, and solid-state radar units is converging onto unified sensor platforms, enabling more accurate vessel detection and tracking in adverse weather or congested waterways. Consulting, installation, and comprehensive maintenance services are increasingly packaged as seamless managed-service agreements, ensuring continuous uptime and end-to-end system calibration. Meanwhile, analytics, surveillance, and traffic management software suites are being architected with open APIs, fostering interoperability with external data sources such as meteorological feeds and port community systems.

Application-driven insights emphasize collision avoidance and navigation support as the foundational use cases, with port management functionalities gaining traction in high-density harbor environments. Security management applications-spanning automated identity verification and restricted-zone enforcement-are layering onto core VTM platforms, reflecting broader maritime security imperatives. Traffic monitoring modules offer real-time heat-map visualizations, allowing operators to proactively reroute vessels and optimize berth scheduling based on congestion forecasts.

From an end-user standpoint, commercial ports and harbor authorities remain the principal adopters, deploying integrated systems to enhance cargo throughput and regulatory compliance. Military and offshore platform operators are selectively leveraging traffic coordination tools to secure strategic maritime corridors and support subsea infrastructure deployments. Deployment strategies bifurcate between shore-based installations-offering centralized oversight of multiple traffic zones-and vessel-based configurations that deliver onboard alerts and advisory services to bridge teams. This dual deployment philosophy ensures comprehensive coverage, harmonizing macro-level coordination with vessel-level autonomy.

This comprehensive research report categorizes the Vessel Traffic Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Application

- End User

Unveiling Regional Trajectories of Vessel Traffic Management Adoption across Americas Europe Middle East & Africa and Asia-Pacific Markets

The Americas region continues to lead with robust investments in port modernization and inland waterway surveillance, driven by trade growth along the U.S. Gulf and Pacific coasts. Regulatory mandates from national agencies have accelerated the adoption of digital VTM solutions, while public-private partnerships fund cutting-edge pilot programs integrating unmanned surface vessels into traffic management workflows. Environmental initiatives targeting reduced carbon emissions have further incentivized smart scheduling algorithms and shore-power coordination services.

In Europe, Middle East & Africa, regulatory harmonization under IMO e-navigation frameworks has catalyzed cross-border data exchange protocols, enabling seamless vessel movement across territorial waters. European ports are pioneering digital twin implementations of navigable waterways, converging S-100 compliant products for route monitoring and underkeel clearance management. In the Middle East, investments by port authorities in AI-driven surveillance and drone-assisted inspections underscore a broader strategic emphasis on maritime security and trade facilitation.

Across Asia-Pacific, rapidly expanding trade corridors in Southeast Asia and Oceania are fueling demand for scalable VTM solutions. National single-window initiatives and interoperability mandates are driving the integration of analytics platforms with customs and border management systems. Offshore resource hubs and island archipelagos are adopting hybrid shore- and vessel-based systems to enhance safety in complex maritime choke points. Collectively, the regional mosaic underscores a global shift toward data-centric, interoperable traffic management ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Vessel Traffic Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning Technological Differentiation and Collaborative Alliances That Propel Leading Vessel Traffic Management Providers to Competitive Advantage

Leading companies are differentiating through strategic alliances and technology partnerships that bolster interoperability and expand service portfolios. Major players offer end-to-end solutions, integrating sensor networks, command-and-control software, and predictive analytics into cohesive platforms. They are increasingly leveraging cloud-native architectures to deliver software-as-a-service models, reducing upfront CapEx burdens for port authorities and vessel operators.

Acquisitions have been a common strategy for market consolidation, enabling firms to augment existing capabilities in cybersecurity, drone surveillance, and digital twin modeling. Joint ventures with satellite AIS providers and telecom operators facilitate global coverage, while collaborations with AI start-ups infuse advanced machine-learning modules for anomaly detection and traffic forecasting. Service-oriented providers are capitalizing on managed-service contracts, delivering turnkey solutions that include continuous system health monitoring and performance benchmarking dashboards.

Innovation roadmaps emphasize modular hardware upgrades and open APIs, catering to evolving e-navigation standards and regional interoperability mandates. Companies are also investing heavily in R&D for autonomous vessel integration, exploring use cases in pilot-assistance, restricted-area enforcement, and automated rerouting. This balanced focus on software-driven intelligence and resilient infrastructure positions them to address both current operational needs and future regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vessel Traffic Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Elbit Systems Ltd.

- Elcome International LLC

- Frequentis AG

- Furuno Electric Co., Ltd.

- Hensoldt AG

- Indra Sistemas, S.A.

- Jacobs Engineering Group Inc.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Marlan Maritime Technologies

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

- Tokyo Keiki Inc.

- Vissim AS

- Wärtsilä Corporation

- Xanatos Marine Ltd.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Vessel Traffic Management Trends and Drive Sustainable Competitive Growth

Industry leaders should prioritize the development of cloud-native, subscription-based platforms that allow seamless scaling across multiple traffic zones and vessel types. This approach not only aligns with evolving procurement preferences but also fosters recurring revenue streams and long-term customer engagement. Embedding advanced machine-learning capabilities focused on congestion forecasting and anomaly detection will further enhance the value proposition, enabling proactive rather than reactive traffic coordination.

Given the ongoing tariff volatility, stakeholders must diversify supply chains by establishing secondary manufacturing hubs in tariff-exempt regions and nearshore locations. Strategic partnerships with local integrators can mitigate duty burdens and logistical bottlenecks, ensuring timely deployment of critical hardware components. Concurrently, expanding service offerings-such as remote monitoring, cybersecurity assurance, and performance analytics-will insulate revenue streams from raw material price fluctuations.

To address rising cybersecurity threats, companies should implement zero-trust architectures and blockchain-based identity frameworks, safeguarding data integrity and ensuring continuous compliance with evolving security standards. Finally, engaging proactively with international regulatory bodies and standards organizations will grant early visibility into upcoming e-navigation mandates, allowing technology roadmaps to remain ahead of mandate cycles. These actionable strategies will empower industry leaders to capitalize on market momentum and achieve sustainable competitive growth.

Comprehensive Primary and Secondary Research Methodology Ensuring Rigorous Data Validation and Insight Generation for Vessel Traffic Management Analysis

Our research framework combines comprehensive primary interviews with port authorities, vessel operators, equipment manufacturers, and regulatory agencies, alongside an exhaustive review of industry publications, technical standards, and proprietary databases. Primary qualitative insights were gathered through structured discussions with senior executives and frontline operators to understand operational pain points and future technology requirements. Quantitative validation involved the triangulation of shipment logs, tenders, and public procurement notices to identify trending investment priorities.

Secondary research encompassed the analysis of regulatory documents from international bodies such as IMO, IHO, and national maritime safety agencies. Technical whitepapers and patent filings were reviewed to track innovation trajectories in radar, optical sensing, and AI-based analytics. We also monitored public announcements, partnership filings, and acquisition activity to assess competitive dynamics. Data integrity was ensured through cross-validation across multiple independent sources.

Our segmentation approach disaggregates the market by component, application, end user, and deployment model, enabling granular visibility into adoption patterns and technology preferences. This multi-stage methodology ensures that our findings are robust, actionable, and reflective of real-world dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vessel Traffic Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vessel Traffic Management Market, by Component

- Vessel Traffic Management Market, by Deployment

- Vessel Traffic Management Market, by Application

- Vessel Traffic Management Market, by End User

- Vessel Traffic Management Market, by Region

- Vessel Traffic Management Market, by Group

- Vessel Traffic Management Market, by Country

- United States Vessel Traffic Management Market

- China Vessel Traffic Management Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Chart a Path Forward for Stakeholders in Vessel Traffic Management

The vessel traffic management sector stands at a transformative junction where regulatory imperatives, environmental pressures, and digital innovations converge. The integration of satellite AIS, terrestrial sensors, and AI-driven analytics is elevating maritime situational awareness, while e-navigation standards and digital twin initiatives pave the way for truly interoperable ecosystems. Tariff fluctuations have injected supply chain complexity, prompting a strategic pivot toward diversified manufacturing and service-centric business models.

Segmentation insights highlight a clear shift toward modular hardware paired with open-architecture software suites, addressing collision avoidance, navigation support, port management, security enforcement, and traffic monitoring needs. Regional nuance underscores differentiated adoption drivers-from the Americas’ port modernization investments to EMA’s harmonized data exchange protocols and Asia-Pacific’s focus on scalable deployments in emerging trade corridors.

Leading vendors are reinforcing their competitive moats through strategic acquisitions, technology partnerships, and managed-service offerings, while industry leaders must pursue cloud-native platforms, diversified supply chains, and advanced cybersecurity strategies. By following these recommendations, stakeholders can navigate the evolving regulatory landscape, capitalize on technological breakthroughs, and secure resilient, efficient, and sustainable maritime traffic ecosystems.

Engage Directly with Ketan Rohom to Secure Cutting-Edge Vessel Traffic Management Insights and Empower Strategic Maritime Decisions

Engaging with our Associate Director of Sales & Marketing, Ketan Rohom, is the next pivotal step to unlocking the full potential of vessel traffic management insights for your organization. With a deep understanding of maritime operational challenges and emerging technological trends, Ketan offers tailored guidance on how this comprehensive report can inform strategic planning, risk mitigation, and investment decisions. By collaborating directly with Ketan Rohom, you will gain exclusive access to in-depth analyses, customizable data extracts, and expert perspectives designed to address your unique requirements. Reach out without delay to secure your copy of the vessel traffic management market research report and embark on a path toward more informed, resilient, and future-ready maritime operations.

- How big is the Vessel Traffic Management Market?

- What is the Vessel Traffic Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?