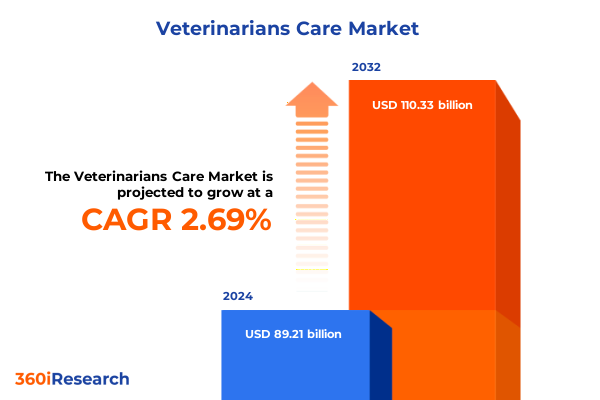

The Veterinarians Care Market size was estimated at USD 91.58 billion in 2025 and expected to reach USD 94.01 billion in 2026, at a CAGR of 2.69% to reach USD 110.33 billion by 2032.

Understanding the Evolving Role of Veterinary Services in Modern Animal Healthcare and the Strategic Imperatives Shaping Market Dynamics

In an era marked by rapid evolution in animal health care, veterinary services have transitioned from foundational preventative care to comprehensive, multi-disciplinary models that address the full spectrum of patient needs. Contemporary pet owners demand cutting-edge diagnostic capabilities, seamless digital engagement, and holistic wellness programs that mirror human health experiences. Simultaneously, advancements in therapeutics and surgical techniques have expanded the boundaries of care, enabling treatment protocols formerly reserved for human medicine to benefit companion animals, livestock, and exotic species alike. These dynamics underscore the necessity for veterinary providers to continually realign operational priorities, invest in staff training, and embrace new modalities of care delivery aimed at enhancing treatment outcomes and client satisfaction.

As care expectations intensify, service providers are under mounting pressure to integrate sophisticated technologies ranging from telemedicine platforms to artificial intelligence-assisted diagnostic imaging. In parallel, evolving regulatory frameworks governing pharmaceutical approvals and practice standards continue to shape market entry requirements and quality benchmarks. Against this backdrop, the veterinary sector faces a pivotal juncture: embracing innovation to maintain competitive advantage while ensuring cost-effective delivery across diverse patient populations. As demand for specialized services proliferates, providers that adeptly navigate these intersecting forces will be well positioned to deliver superior care and capture emerging opportunities within a dynamic market landscape.

Assessing the Technological and Consumer-Driven Transformations Reshaping Veterinary Practices and Driving New Standards of Care Across Species

The veterinary industry is undergoing a profound transformation driven by technological advancements and shifting consumer expectations. Digital health solutions have emerged as a cornerstone of today’s practice models, empowering pet owners with remote monitoring tools, real-time analytics, and interactive teleconsultations. This shift toward virtual engagement enhances practice efficiency, optimizes appointment scheduling, and fosters greater adherence to preventive protocols. Moreover, the integration of artificial intelligence and machine learning into diagnostic imaging workflows is revolutionizing the speed and accuracy of disease detection, enabling earlier interventions and improved prognoses across species.

Concurrently, consumer preferences are evolving in response to broader wellness trends. Pet owners increasingly view their animals as family members and demand personalized care experiences that align with their own health values. This humanization of pets has catalyzed growth in specialized services such as advanced dental care, regenerative medicine, and behavioral health interventions. Alongside these care enhancements, sustainability considerations have become integral to practice operations, prompting providers to reevaluate procurement strategies, reduce waste, and implement eco-friendly facility designs. Navigating these transformative shifts requires a strategic balance between technology adoption, workforce development, and sustainable business practices.

Furthermore, the global talent shortage in veterinary medicine has underscored the need for practices to implement robust recruitment and retention initiatives. Innovative staffing models, including mobile units and telemedicine collaborations, are emerging as viable solutions to address workforce constraints while expanding service reach. By anticipating and adapting to these concurrent shifts, forward-looking practices will set new standards for quality, accessibility, and client engagement.

Evaluating the Far-Reaching Effects of Recent United States Tariff Measures on Veterinary Supply Chains and Operational Costs in 2025

Recent policy actions in the United States have introduced a series of tariff measures aimed at protecting domestic manufacturing sectors. In 2025, new duties on imported pharmaceuticals, specialized medical devices, and consumables have imposed additional cost burdens on veterinary supply chains. These tariffs, applied across key categories of injectables, surgical instruments, and diagnostic reagents, have prompted service providers to absorb higher procurement expenses or pass costs along to clients. The resulting margin pressures are magnified by concurrent inflationary trends in labor and facility overhead, intensifying the challenge of maintaining profitable operations without compromising care quality.

In response, many veterinary practices have accelerated initiatives to diversify sourcing strategies and cultivate relationships with domestic manufacturers. By localizing aspects of the supply chain, providers aim to mitigate exposure to tariff-related disruptions and foster more resilient logistics networks. Some forward-thinking companies have also explored joint ventures with regional distributors, facilitating technology transfers that support the development of domestically produced veterinary pharmaceuticals and consumables. These collaborations not only buffer against future policy shifts but also contribute to the long-term sustainability of the broader animal health ecosystem.

While cost containment remains a critical focus, these supply chain realignments are unlocking ancillary benefits such as shorter lead times, reduced dependence on global shipping routes, and enhanced quality oversight. As the industry adjusts to the cumulative impact of the 2025 tariff landscape, stakeholders that proactively optimize procurement practices and invest in local innovation platforms will be better equipped to preserve service excellence and maintain competitive agility.

Illuminating Critical Market Segmentation Across Diverse Animal Types, Service Modalities, and Practice Delivery Models to Uncover Actionable Insights

A nuanced examination of the veterinary services marketplace reveals distinct patterns of demand and resource allocation when viewed through the lens of animal type, service specialization, and practice format. In terms of patient species, care for companion animals-encompassing cats, dogs, and small mammals-continues to drive a substantial portion of procedural volume, with rising incidence of chronic conditions necessitating ongoing therapeutic engagement. Parallel to this trend, equine medicine focusing on performance breeds such as quarter horses and thoroughbreds is experiencing steady investment in sports-medicine protocols and regenerative therapies. Meanwhile, exotic pet care for birds, reptiles, and select small mammals is carving out specialized practice niches, often requiring bespoke facility adaptations and staff with advanced biological training. Large animal services remain integral to agricultural health, with targeted programs for cattle, goats, sheep, and swine underscoring the essential role of veterinary expertise in herd management and biosecurity.

Service type segmentation further delineates areas of rapid expansion and resource intensity. Preventive care protocols, driven by vaccination programs and comprehensive wellness exams, represent the first line of defense against disease outbreaks and support long-term health outcomes. In the realm of diagnostics, imaging services-from ultrasound to advanced CT scanning-are pivotal in accelerating disease detection and guiding treatment pathways. Emergency and critical care capabilities are likewise on the rise, reflecting heightened expectations for round-the-clock intervention. Surgical service offerings span orthopedic and soft tissue procedures, with many facilities bolstering their capabilities through strategic acquisitions of specialized instrumentation and continuous skill development for veterinary surgeons.

Practice type segmentation underscores the diversification of delivery models. Traditional brick-and-mortar clinics, both general and specialized, remain foundational, yet veterinary hospitals are increasingly differentiating on advanced case complexity and inpatient care services. In contrast, mobile units are expanding access to care in rural and underserved areas, utilizing portable diagnostic equipment and teleconsultation interfaces. Telemedicine platforms complement these efforts by facilitating remote triage, follow-up consultations, and interprofessional collaboration. This spectrum of practice formats allows providers to tailor service portfolios to regional demand patterns and capitalize on consumer preferences for convenience and digital engagement.

This comprehensive research report categorizes the Veterinarians Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Service Type

- Practice Type

- End User

- Channel Type

Exploring Regional Variations in Veterinary Service Adoption, Innovation Initiatives, and Regulatory Environments Across the Americas, EMEA, and Asia-Pacific

Geographic distinctions play a pivotal role in shaping veterinary service uptake, regulatory compliance, and innovation trajectories. In the Americas, robust pet ownership rates and advanced agricultural sectors drive simultaneous growth in companion care and livestock services. Markets in North America are characterized by high investment in digital health platforms and the rapid adoption of advanced imaging technologies, while Latin American regions are witnessing incremental enhancements in preventive care infrastructure and veterinary education standards.

Within Europe, Middle East, and Africa, regulatory frameworks differ widely, influencing market maturation rates. Western Europe’s emphasis on animal welfare and stringent certification processes has elevated the quality of specialized services such as orthopedic surgery and oncology care. In contrast, some EMEA markets are prioritizing capacity building for basic preventive services and livestock disease control programs, supported by public-private partnerships. Across the Middle East, there is increasing demand for luxury pet care services, reflecting shifting cultural attitudes toward companion animals.

Asia-Pacific regions demonstrate a duality of advanced urban centers and emerging rural markets. Countries such as Japan and Australia lead in telemedicine integration and advanced surgical solutions, leveraging strong professional networks and research institutions. Meanwhile, Southeast Asian and South Asian markets are experiencing stepped-up efforts to expand veterinary training programs and enhance supply chain resilience for essential pharmaceuticals and diagnostics. These regional nuances underscore the importance of tailoring service delivery strategies and investment priorities to local market conditions and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Veterinarians Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Veterinary Service Networks, Technology Innovators, and Strategic Collaborators That Are Redefining Competitive Landscapes

A select group of companies is at the forefront of shaping competitive dynamics within the veterinary services ecosystem. These organizations distinguish themselves through robust service networks, advanced technological capabilities, and strategic partnerships that deliver end-to-end solutions for providers. Notable entities drive market consolidation by acquiring smaller clinics and hospitals, thus expanding geographic reach and capabilities in specialized care. Concurrently, technology-oriented firms are gaining traction by offering integrated software suites for practice management, telehealth delivery, and supply chain analytics.

Partnerships between pharmaceutical suppliers and service providers are also reshaping the industry landscape. Collaborative development agreements facilitate accelerated access to novel therapeutics and personalized treatment regimens, particularly in areas such as oncology and regenerative medicine. In parallel, leading diagnostic companies are broadening their product portfolios to include on-site testing kits and mobile imaging solutions, catering to both traditional practices and emerging mobile units. This convergence of capabilities underscores a broader trend toward vertical integration and data-driven decision-making.

Furthermore, a wave of venture-backed start-ups is introducing disruptive innovations, including wearable health monitors for livestock and AI-powered behavioral assessment tools for companion animals. These entrants are expanding the addressable market and intensifying competitive pressures on established players. Collector firms are responding by investing in internal innovation hubs and forging alliances with academic institutions to pilot new service modalities. As consolidation and digital innovation accelerate, stakeholders with agile capital strategies and foresight into emerging consumer demands will likely secure leadership positions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinarians Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale SA

- Covetrus, Inc.

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Greencross Pty Limited

- Heska Corporation

- IDEXX Laboratories, Inc.

- IVC Evidensia (Independent Vetcare Limited)

- Merck & Co., Inc.

- Mission Pet Health

- National Veterinary Associates, Inc.

- Patterson Companies, Inc.

- Pets at Home Group PLC

- Phibro Animal Health Corp

- Vetoquinol SA

- Virbac SA

- Zoetis Inc.

Strategic Recommendations for Veterinary Industry Stakeholders to Accelerate Innovation, Build Resilient Operations, and Sustain Competitive Advantage

Industry leaders must adopt a multi-pronged strategy to capitalize on evolving market dynamics and enhance resilience against operational headwinds. First, investing in digital health infrastructure is critical; practices should prioritize scalable telemedicine platforms and AI-enabled diagnostic tools that improve clinical efficiency and patient outcomes. Similarly, embedding sustainability principles into facility design and procurement policies can drive both cost savings and brand differentiation, addressing growing consumer and regulatory calls for environmental stewardship.

Workforce development also demands strategic emphasis. Leadership teams should collaborate with educational institutions to create tailored training programs that address current skill gaps and anticipate future care requirements. By establishing mentorship and continuous learning initiatives, practices can bolster employee retention and cultivate a pipeline of specialized talent. Concurrently, fostering a culture of cross-functional collaboration between medical, administrative, and supply chain personnel can streamline workflows and reduce overhead.

Given the impacts of recent tariff measures, stakeholders should diversify supply sources and consider forming consortiums to negotiate bulk purchasing agreements. Partnerships with domestic manufacturers can offset import duties while supporting local industry growth. Additionally, practices must refine financial planning processes to accommodate cost fluctuations and maintain transparent pricing models that sustain client trust.

Finally, ongoing monitoring of regulatory developments and consumer sentiment is essential. Establishing dedicated teams to scan policy landscapes and market trends will enable proactive adjustments to service offerings and marketing strategies. By aligning operational execution with real-time intelligence, industry leaders can not only weather the present challenges but also harness emerging opportunities for differentiated growth.

Detailing the Comprehensive Research Methodology Employing Multi-Source Data Integration, Stakeholder Engagement, and Analytical Rigor to Inform Executive Decision-Making

This analysis was underpinned by a rigorous, multi-stage research methodology integrating both primary and secondary data sources. Secondary research included a comprehensive review of trade publications, industry white papers, regulatory filings, and publicly available financial reports to establish macro-level context and historical benchmarks. These insights were synthesized to inform the design of primary research instruments and to ensure compatibility with established analytical frameworks.

Primary research entailed structured interviews with key stakeholders-including practice owners, clinical directors, supply chain executives, and regulatory authorities-across North America, EMEA, and Asia-Pacific. This qualitative approach was complemented by quantitative surveys distributed to a representative sample of veterinarians, support staff, and pet owners, yielding robust data on service utilization, adoption drivers, and operational pain points. The triangulation of these inputs facilitated the validation of emerging themes and the identification of actionable insights.

Analytical rigor was maintained through the application of SWOT and PESTLE analyses, scenario planning exercises, and cross-segment correlation testing. Data integrity protocols, such as consistency checks and outlier screening, were applied throughout the process, ensuring that findings rest on a solid evidentiary foundation. The methodology’s iterative design allowed for the refinement of hypotheses and the continuous refinement of research modules based on evolving stakeholder feedback.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinarians Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinarians Care Market, by Animal Type

- Veterinarians Care Market, by Service Type

- Veterinarians Care Market, by Practice Type

- Veterinarians Care Market, by End User

- Veterinarians Care Market, by Channel Type

- Veterinarians Care Market, by Region

- Veterinarians Care Market, by Group

- Veterinarians Care Market, by Country

- United States Veterinarians Care Market

- China Veterinarians Care Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Synthesizing Core Insights and Strategic Imperatives to Empower Decision-Makers in Navigating the Complex Veterinary Services Landscape

The intersection of advanced clinical capabilities, transformative digital technologies, and shifting regulatory landscapes has set the stage for significant evolution within the veterinary services market. Practices that embrace an integrated approach-balancing investment in telehealth, sustainable operations, and workforce development-will be poised to meet the increasingly sophisticated demands of animal owners and livestock producers. Moreover, strategic supply chain realignments in response to the 2025 tariff landscape can deliver not only cost resilience but also opportunities for domestic innovation collaborations.

Segmentation analysis underscores the importance of tailoring service portfolios to the specific needs of companion, equine, exotic pet, and large animal sub-segments, while regional insights highlight the necessity of localizing strategies to regulatory and cultural contexts. Company profiling reveals that competitive advantage hinges on cohesive partnerships, vertical integration, and a relentless focus on data-driven clinical excellence. Moving forward, the practices and providers that exhibit agility in execution, foresight in investment, and clarity in strategic priorities will define the next frontier of growth and innovation.

Connect Directly with Our Expert to Unlock Customized Veterinary Market Intelligence and Propel Your Strategic Objectives

To explore how these insights translate into customized growth strategies, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in translating complex data into actionable outcomes specifically tailored for your organizational needs. By engaging with Ketan, you will gain early access to in-depth analysis segments customized to your sub-sector, complementary benchmarking data, and bespoke advisory sessions designed to maximize your return on investment. This partnership will empower your team to refine strategic roadmaps, accelerate time-to-market for new service offerings, and strengthen competitive positioning through targeted intelligence. Elevate your strategic planning process and secure a partner committed to driving your sustainable growth trajectory by scheduling your consultation today

- How big is the Veterinarians Care Market?

- What is the Veterinarians Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?