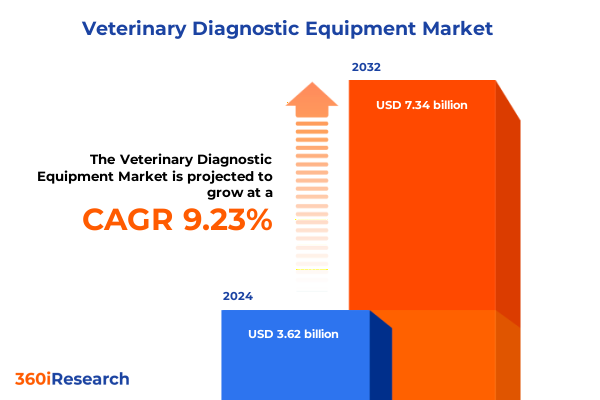

The Veterinary Diagnostic Equipment Market size was estimated at USD 3.94 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 9.28% to reach USD 7.34 billion by 2032.

Charting the Evolution of Veterinary Diagnostic Equipment Market as Emerging Technologies Converge with Shifting Industry Imperatives and Clinical Demands

The veterinary diagnostic equipment market has undergone a profound evolution driven by technological breakthroughs, shifting clinical practices, and heightened expectations for animal health outcomes. Diagnostic tools that were once confined to basic biochemistry and hematology assays have been augmented by advanced molecular platforms, high-throughput immunodiagnostics, and integrated digital solutions. This metamorphosis reflects a broader industry commitment to precision, speed, and connectivity in delivering evidence-based interventions across companion animals, livestock, equine, and poultry settings.

Over recent years, point-of-care testing and remote monitoring solutions have redefined the boundaries of veterinary diagnostics, enabling clinicians to obtain rapid, actionable results directly within clinical and field environments. Simultaneously, laboratory automation and cloud-enabled data management systems have enhanced throughput and operational efficiency for reference laboratories, research institutes, and large-scale farms. These developments underscore a paradigm shift toward decentralized, data-driven workflows that prioritize real-time decision-making and predictive analytics.

Furthermore, growing concerns about zoonotic disease transmission, food safety regulations, and animal welfare standards have amplified the role of sophisticated diagnostic platforms in biosecurity and epidemiological surveillance. In response, manufacturers are accelerating investments in multiplex assays, next generation sequencing, and AI-powered image analysis to broaden diagnostic capabilities and reduce turnaround times.

Looking ahead, the convergence of telehealth services, advanced analytics, and Internet-of-Things connectivity is poised to further revolutionize veterinary diagnostics. Industry participants must therefore adapt to an environment characterized by rapid innovation cycles, dynamic regulatory landscapes, and evolving customer expectations to fully capitalize on the emerging opportunities.

Embracing Disruptive Technological Advancements and Process Innovations Including Digitalization, Artificial Intelligence, and Telehealth Transforming Veterinary Diagnostic Workflows

Veterinary diagnostics is undergoing a transformative renaissance driven by the integration of digitalization, artificial intelligence, and telehealth capabilities into traditional workflows. In routine practice, image recognition algorithms and machine learning models now augment the interpretation of hematology smears and immunofluorescence assays, reducing human error and enabling earlier disease detection. Concurrently, cloud-based platforms facilitate seamless data exchange between field veterinarians, clinical laboratories, and research hubs, fostering collaboration and accelerating translational insights across the value chain.

Process innovations have equally reshaped laboratory operations, from automated sample preparation systems to high-throughput liquid handling robots that enhance reproducibility and lower per-test costs. Moreover, the adoption of mobile diagnostic devices has empowered practitioners in remote and resource-constrained environments to perform rapid antigen tests and point-of-care PCR, broadening access to critical diagnostics for livestock and equine applications.

Telehealth services, supported by wearable biosensors and remote monitoring tools, are emerging as vital enablers of continuous health surveillance, enabling veterinarians to track vital parameters and disease biomarkers in real-time. This shift not only optimizes clinical interventions but also aligns with preventive care models that emphasize early warning systems and ongoing patient management.

As disruptive technologies mature, stakeholders are recalibrating their investment strategies to embrace agile, interoperable solutions that deliver both depth of insight and operational efficiency. This dynamic landscape underscores the imperative for market participants to prioritize scalable, software-driven platforms that seamlessly integrate with existing infrastructures and regulatory frameworks.

Assessing the Far-Reaching Effects of Newly Implemented 2025 United States Tariff Policies on International Supply Chains and Cost Structures within Veterinary Diagnostic Equipment Market

In 2025, the imposition of new United States tariffs on key components of veterinary diagnostic equipment has triggered significant recalibrations within global supply chains and cost structures. Specifically, higher duties on imported reagents, consumables, and analyzers have elevated landed costs, compelling manufacturers and end users alike to absorb or mitigate increased expenses. This environment of tariff-induced price pressure has underscored the vulnerability of traditional sourcing strategies disproportionately reliant on select offshore suppliers.

In response, industry players have accelerated supply chain diversification efforts, exploring partnerships with domestic manufacturers and near-shore assembly facilities to reduce exposure to unpredictable trade barriers. At the same time, inventory management practices have evolved toward strategic stockpiling of critical reagents and consumables to buffer short-term disruptions. Collaboration agreements with local distributors have also gained traction, ensuring expedited access to key diagnostic kits and technical support amid fluctuating import lead times.

Importantly, margin compression resulting from tariff-driven cost increases has spurred innovation in reagent formulations and assay efficiencies, as producers seek to optimize yield per test and offset pricing pressures. Concurrently, economic incentives offered by federal and state authorities to bolster domestic production have catalyzed investments in facility upgrades and pre-commercial validation of home-grown reagent pipelines.

Looking forward, the legacy of the 2025 tariffs will likely influence long-term procurement strategies, compelling stakeholders to balance cost considerations with supply resilience, regulatory compliance, and evolving biosafety requirements. Consequently, organizations that proactively adapt to this new trade framework will be best positioned to deliver uninterrupted diagnostic services and maintain competitive pricing structures.

Deriving Strategic Insights from a Multifaceted Segmentation Framework Spanning Test Types, Animal Categories, End Users, Product Portfolios, Technologies, and Distribution Channels

A multifaceted segmentation framework provides a panoramic view of the veterinary diagnostic equipment market, illuminating distinct growth drivers and competitive dynamics across test types, animal categories, end users, product portfolios, technologies, and distribution channels. Within test types, immunodiagnostics has emerged as a growth engine, driven by the proliferation of chemiluminescence immunoassays and lateral flow formats that facilitate rapid pathogen detection at the point of care. Molecular diagnostics, particularly digital PCR and multiplex assays, also command premium positioning due to their high sensitivity and applications in early disease detection.

When viewed through the lens of animal type, companion animals sustain robust demand for advanced diagnostic platforms owing to elevated pet health expenditure and preventative care trends. Simultaneously, livestock diagnostics, especially within bovine and swine sectors, have scaled rapidly to address production efficiency and biosecurity imperatives, while equine diagnostics remain a niche segment focused on elite race and work horse wellness protocols.

Analysis by end user underscores veterinary hospitals and clinics as the largest adopters of benchtop analyzers and data management software, whereas animal husbandry farms leverage portable testing kits and remote monitoring systems to ensure herd health continuity. Reference laboratories continue to invest in high-capacity culture systems and rapid identification platforms, and research institutes allocate resources across pharma research and university laboratory networks to advance translational studies.

The product type perspective reveals a balanced demand for analyzers, reagents, and software solutions, with consumables representing recurring revenue streams. Technological segmentation highlights the convergence of immunoassay, PCR, and next generation sequencing capabilities within unified platforms. Lastly, distribution channel analysis illustrates an increasing shift toward online procurement for reagent orders, while direct sales and third party distributors remain vital for sophisticated equipment installations and localized support.

This comprehensive research report categorizes the Veterinary Diagnostic Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Test Type

- Animal Type

- Product Type

- Technology

- End User

- Distribution Channel

Unpacking Critical Regional Dynamics Driving Growth in Americas, Europe Middle East & Africa, and Asia-Pacific Veterinary Diagnostic Equipment Markets Amid Distinct Industry Trends

Regional landscapes within veterinary diagnostic equipment markets exhibit diverse trends and strategic imperatives that reflect local regulatory environments, economic maturity, and disease prevalence patterns. The Americas continue to lead in technology adoption, buoyed by significant investments in next generation sequencing platforms and point-of-care immunodiagnostics across the United States and Canada. Latin American markets are progressively expanding testing capabilities, driven by government initiatives to strengthen animal health surveillance and biosecurity measures.

In Europe, Middle East & Africa, stringent regulatory frameworks and harmonized veterinary directives have elevated the standards for assay validation and quality controls. Western Europe’s well-established laboratory networks have prioritized automation and digital connectivity, while emerging markets in Eastern Europe and the Middle East are accelerating infrastructure development and forging public-private partnerships to enhance diagnostic capacity.

Asia-Pacific presents a heterogeneous tapestry of opportunity, underscored by rapid modernization in China, Japan, and Australia and nascent adoption curves in Southeast Asian and South Asian nations. Demand for multiplex PCR systems and high throughput analyzers is ascending in major Asia-Pacific economies, catalyzed by expanding livestock operations and growing companion animal populations. Concurrently, local manufacturing hubs are emerging to serve regional demand, supported by favorable government incentives and investments in R&D clusters.

Overall, recognizing these regional nuances is essential for stakeholders aiming to tailor product offerings, channel strategies, and partnership models that align with distinct market requirements and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Diagnostic Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Leading Players Shaping the Veterinary Diagnostic Equipment Market through Product Innovation, Strategic Partnerships, Geographic Expansion, and Value-Added Services

Leading veterinary diagnostic equipment manufacturers and service providers are leveraging innovation, strategic partnerships, and geographic expansions to consolidate market positions and capture emerging growth opportunities. Tier-one companies are advancing next generation sequencing and digital PCR capabilities through targeted R&D collaborations and acquisitions of niche technology specialists. Concurrently, mid-tier players are focusing on cost-effective point-of-care solutions and expanding their reagent portfolios to foster recurring revenue streams.

Partnerships between global diagnostic firms and regional distributors have intensified, enabling seamless integration of localized technical support, training programs, and maintenance services. This collaborative model enhances end-user satisfaction by ensuring rapid response times and reducing equipment downtime. Additionally, several companies are investing in cloud-based data management platforms and AI-driven analytics, creating value-added services that extend beyond traditional hardware sales.

Meanwhile, key market participants are forging alliances with academic research centers and biotech startups to co-develop multiplex assay panels and automated workflows tailored to specific animal health challenges. These joint ventures not only accelerate product development timelines but also facilitate entry into previously underpenetrated segments.

As competitive intensity rises, companies that balance robust product pipelines with agile go-to-market strategies, fortified by strategic mergers and operational scale-ups, will reinforce their leadership status and drive sustained growth in the veterinary diagnostic equipment space.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Diagnostic Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert N.V.

- Agrolabo S.p.A.

- BioChek B.V.

- Biomerieux SA

- Carestream Health Inc

- Covetrus, Inc.

- Diagnostic Imaging Systems, Inc.

- Heska Corporation

- IDEXX Laboratories, Inc.

- IM3 Inc.

- IMV Technologies group

- INDICAL Bioscience GmbH

- Innovative Diagnostics SAS

- Merck & Co., Inc.

- Mindray Medical International Ltd.

- MinXray, Inc.

- Neogen Corporation

- Randox Laboratories, Ltd.

- Thermo Fisher Scientific, Inc.

- Virbac, Inc.

- Zoetis, Inc.

Delivering Actionable Recommendations for Industry Leaders to Navigate Regulatory Headwinds, Harness Technological Innovations, and Optimize Market Penetration Strategies

To thrive in a rapidly evolving environment, industry leaders should prioritize diversification of supply chains by establishing relationships with multiple reagent and component manufacturers, including domestic and near-shore partners, to mitigate tariff and logistics risks. Investing in modular, upgradable platforms can enable organizations to adapt swiftly to technological advancements without incurring prohibitive capital expenditures. Embracing digital ecosystems through cloud-native data management, AI-powered diagnostics, and telehealth integration will position companies to meet growing demand for real-time insights and remote care solutions.

Strategic collaborations with academic institutions, biotech innovators, and regulatory bodies can expedite the development and validation of novel assays, while co-marketing arrangements with veterinary associations can enhance market penetration and brand credibility. Furthermore, a customer-centric approach that couples comprehensive training programs with responsive technical support services will differentiate providers in an increasingly competitive landscape.

Pricing strategies that incorporate value-based models, subscription offerings for reagents and software, and performance-based service agreements can drive recurring revenue streams and foster long-term customer loyalty. Simultaneously, market participants must remain vigilant to emerging regulatory trends, aligning product development roadmaps with evolving biosafety standards and animal welfare mandates.

By executing these actionable strategies, stakeholders can optimize operational resilience, unlock new revenue opportunities, and solidify their competitive positioning in the next wave of veterinary diagnostic innovation.

Outlining a Rigorous Research Methodology Incorporating Comprehensive Primary Interviews, Secondary Data Analysis, Statistical Validation, and Data Triangulation for Enhanced Market Insights

This study’s methodology integrates both primary and secondary research to ensure comprehensive coverage and robust validation of insights. Primary research involved structured interviews with senior executives at leading diagnostic equipment manufacturers, end users across veterinary hospitals, large farms, reference laboratories, and research institutes. Additionally, expert panel discussions with academic and industry thought leaders provided qualitative perspectives on emerging trends and pain points.

Secondary research encompassed the systematic review of regulatory filings, patent databases, technical whitepapers, and peer-reviewed publications to underpin market dynamics and technology adoption trends. Trade association reports and governmental directives were analyzed to map regulatory frameworks across key geographies. To maintain objectivity, information from multiple independent sources was triangulated, ensuring that quantitative estimates and qualitative narratives reflect consensus views and validated data points.

Quantitative data analysis employed rigorous statistical techniques, including regression modeling and sensitivity analysis, to assess the impact of variables such as tariff changes, adoption rates, and regional demand drivers. Segmentation frameworks were refined through iterative validation with industry stakeholders, ensuring alignment with real-world procurement behaviors and installation patterns.

This structured approach, combining empirical evidence with expert judgment, delivers a nuanced and reliable portrayal of the veterinary diagnostic equipment market, enabling stakeholders to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Diagnostic Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Diagnostic Equipment Market, by Test Type

- Veterinary Diagnostic Equipment Market, by Animal Type

- Veterinary Diagnostic Equipment Market, by Product Type

- Veterinary Diagnostic Equipment Market, by Technology

- Veterinary Diagnostic Equipment Market, by End User

- Veterinary Diagnostic Equipment Market, by Distribution Channel

- Veterinary Diagnostic Equipment Market, by Region

- Veterinary Diagnostic Equipment Market, by Group

- Veterinary Diagnostic Equipment Market, by Country

- United States Veterinary Diagnostic Equipment Market

- China Veterinary Diagnostic Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 4293 ]

Synthesizing Key Findings to Illuminate Strategic Imperatives and Emerging Opportunities That Will Drive Future Growth and Innovation in the Veterinary Diagnostic Equipment Market

The convergence of advanced diagnostic technologies, evolving regulatory environments, and shifting end-user expectations underscores the veterinary diagnostic equipment market’s trajectory toward greater accuracy, speed, and connectivity. Immunodiagnostics and molecular platforms have emerged as core growth segments, while companion animal and livestock applications continue to drive demand for both centralized laboratory systems and decentralized point-of-care solutions. Tariff pressures have spotlighted the importance of supply chain resilience and local manufacturing capabilities, and regional variances highlight the need for tailored strategies that reflect distinct market maturities and regulatory frameworks.

Leading companies have responded with investments in software-driven platforms, strategic partnerships, and agile product portfolios that address emerging animal health challenges. Meanwhile, decision-makers are increasingly valuing value-based pricing models, subscription services for reagents and software, and integrated service offerings that encompass training and technical support.

Looking ahead, the seamless integration of telehealth, AI-enabled analytics, and cloud-native infrastructure will catalyze the next wave of innovation, while ongoing collaboration between industry, academia, and regulatory bodies will accelerate the validation and adoption of novel diagnostics. Collectively, these forces are poised to reshape veterinary care paradigms, enabling more proactive, data-informed interventions and reinforcing the centrality of diagnostic equipment in safeguarding animal and public health.

Seize Actionable Market Intelligence by Engaging with the Associate Director for Tailored Insights and Bespoke Guidance to Secure a Competitive Edge in Veterinary Diagnostics

We invite decision-makers seeking unparalleled depth and actionable market intelligence in the veterinary diagnostics arena to connect with Ketan Rohom, our Associate Director of Sales & Marketing. His extensive experience guiding C-level executives through intricate market landscapes positions him as the ideal partner for aligning strategic objectives with in-depth data. By reaching out to Ketan, stakeholders can gain access to tailored briefings that distill complex findings into concise, operational roadmaps designed to optimize investment priorities and accelerate time-to-value.

Engaging with our Associate Director offers clients opportunities to explore bespoke research deliverables, including customized data tables, deep-dive workshops, and ongoing advisory support. These services ensure that decision-makers remain agile in anticipating regulatory shifts, evolving technological breakthroughs, and competitive pressures. Prospective purchasers will also benefit from a complimentary sample of our executive summary, illustrating how granular segmentation analysis and regional perspectives translate into concrete strategic actions.

To secure a competitive edge and transform market insights into sustainable growth, contact Ketan Rohom today. His dedicated consultation will illuminate the most lucrative pathways and risk mitigation strategies, empowering organizations to capitalize on emerging opportunities within the veterinary diagnostic equipment market.

- How big is the Veterinary Diagnostic Equipment Market?

- What is the Veterinary Diagnostic Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?