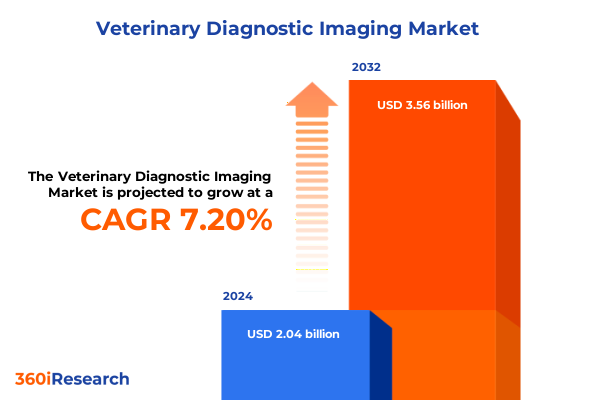

The Veterinary Diagnostic Imaging Market size was estimated at USD 2.18 billion in 2025 and expected to reach USD 2.33 billion in 2026, at a CAGR of 7.24% to reach USD 3.56 billion by 2032.

Unveiling Critical Forces Shaping the Veterinary Diagnostic Imaging Market’s Evolution in a Rapidly Advancing Animal Healthcare Ecosystem

In recent years, the veterinary diagnostic imaging sector has emerged as a critical pillar supporting advanced animal healthcare, propelled by a sustained rise in pet ownership and the expanding footprint of clinical practices. With the dog population in the United States reaching nearly 90 million and cat ownership climbing toward 75 million, the demand for sophisticated imaging solutions has intensified, reflecting pet owners’ growing willingness to seek early and precise diagnoses for their animal companions. Concurrently, the number of practicing veterinarians surged by nearly 19% between 2018 and 2023, bolstering the capacity of clinics and hospitals to integrate high-performance imaging modalities into routine care delivery.

As veterinary professionals strive to meet evolving clinical challenges-from detecting subtle orthopedic abnormalities in aging dogs to monitoring complex cardiac conditions in feline patients-the role of imaging technologies has expanded beyond mere diagnostic support to become an integral component of treatment planning and outcome optimization. Moreover, the shifting expectations of pet owners, who increasingly regard companion animals as family members deserving of the highest standard of care, have catalyzed investments in advanced imaging infrastructure. Therefore, this introduction sets the stage for an executive summary that delves into the transformative forces, regulatory considerations, and strategic drivers defining the future of veterinary diagnostic imaging.

Emerging Breakthroughs and Technological Revolutions Redefining Precision and Accessibility in Veterinary Diagnostic Imaging

The veterinary imaging landscape is undergoing an unprecedented metamorphosis driven by a convergence of technological breakthroughs and evolving care paradigms. The transition from analog to digital imaging systems has accelerated, enabling veterinarians to capture, process, and interpret high-resolution radiographic and ultrasound images with unparalleled clarity and speed. This digital shift has streamlined workflows, facilitated electronic patient record integration, and fostered opportunities for remote consultation, thereby enhancing clinical decision-making and operational efficiency.

Simultaneously, the advent of portable, point-of-care imaging devices has redefined accessibility, allowing practitioners to perform on-site diagnostics within ambulatory settings, equine facilities, and agricultural environments. Compact ultrasound units and handheld radiography tools are increasingly deployed in rural clinics and large animal practices, improving response times in emergency and field interventions.

Complementing these hardware innovations, cloud-based imaging platforms are gaining traction by offering secure storage, instantaneous sharing, and collaborative review of diagnostic studies. This infrastructure underpins telemedicine services, extending specialist expertise to underserved regions and supporting remote second opinions in complex cases. Moreover, the integration of machine learning algorithms into imaging software is enhancing pattern recognition, automating lesion detection, and delivering decision support that augments clinician accuracy and confidence. Finally, the rise of three-dimensional reconstruction techniques for CT and MRI studies is empowering surgical planning and non-invasive intervention strategies, heralding a new era of precision veterinary medicine.

Analyzing the Far-Reaching Implications of New United States Trade Tariffs on Veterinary Diagnostic Imaging Supply Chains and Service Delivery

Despite the promise of innovation, the veterinary diagnostic imaging sector is contending with mounting challenges stemming from United States trade policy, particularly the cumulative impact of newly enacted tariffs. Non-Chinese medical device imports are now subject to a uniform 10% levy, while goods originating from China face punitive duties that have escalated to as much as 145% under successive Section 301 actions. This layered tariff regime threatens to inflate procurement costs for critical imaging systems, including CT scanners, MRI units, and X-ray tables, as well as consumable components such as digital sensors and contrast media.

Industry stakeholders warn that these heightened duties could disrupt long-established global supply chains, delaying equipment deliveries and complicating service agreements. Veterinary practices-particularly smaller clinics operating under fixed reimbursement schedules-may confront narrower margins and deferred technology upgrades if tariff-driven price increases are passed along by manufacturers. Moreover, the interdependence of imaging hardware and specialized software amplifies vulnerability, as licensing fees and maintenance contracts may also be subject to import duties, further eroding affordability.

In response, professional associations and equipment suppliers are advocating for targeted tariff exemptions for essential medical technology, citing the critical role of diagnostic imaging in animal welfare and public health. At the same time, veterinary institutions are exploring local sourcing alternatives, strategic inventory buffering, and collaborative purchasing arrangements to mitigate cost escalation and maintain uninterrupted access to lifesaving imaging services.

Decoding Core Market Segmentation Dynamics to Reveal Nuanced Opportunities Across Product, Animal Type, Modality, End User, Application, and Distribution Channels

Understanding the nuanced contours of the veterinary imaging market requires a detailed examination of its primary segmentation pillars, each of which reveals distinct demand drivers and channel dynamics. By product type, imaging systems-from computed tomography and magnetic resonance setups to X-ray suites and advanced video endoscopy units-constitute the core investment focus for large hospitals, while accessories and consumables, alongside software platforms, underpin ongoing operational requirements. This diversification underscores the need for vendors to tailor solutions that bridge capital procurement with lifecycle cost efficiency.

Animal type segmentation further differentiates the market into large and small animal cohorts, reflecting the divergent clinical protocols, equipment form factors, and procedural volumes inherent to equine or bovine diagnostics versus companion pet care. Portable modalities resonate particularly with large animal specialists who require mobile imaging capabilities, whereas stationary, high-resolution systems are indispensable in small animal referral centers that manage complex oncologic or neurologic cases.

Modality considerations distinguish between portable and stationary instruments, each offering trade-offs in terms of mobility, image fidelity, and environmental resilience. End-user segmentation spans academic and research institutions-where experimental imaging workflows and validation studies abound-through veterinary clinics and hospitals that prioritize throughput, ease of use, and service reliability. Application segmentation highlights critical clinical domains, such as cardiology, neurology, oncology, and orthopedic trauma, where modality selection and software integration directly influence diagnostic yield.

Finally, distribution channels bifurcate into direct sales relationships, enabling closer technical collaboration and custom configuration, and networked distributor and dealer models, which extend reach and localized support. These segmentation lenses collectively guide strategic resource allocation, product innovation roadmaps, and go-to-market prioritization efforts.

This comprehensive research report categorizes the Veterinary Diagnostic Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Modality

- End-User

- Application

- Distribution Channel

Delineating Regional Nuances in Veterinary Diagnostic Imaging Adoption Trends and Growth Drivers Across the Americas, EMEA, and Asia-Pacific

Regional dynamics exert a profound influence on veterinary diagnostic imaging adoption, with each geography presenting distinct growth trajectories and regulatory considerations. In the Americas, robust pet ownership rates, advanced veterinary infrastructure, and favorable reimbursement landscapes fuel ongoing investments in cutting-edge imaging platforms, while an expanding network of specialty referral centers drives demand for high-end modalities.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts-such as the EU Medical Device Regulation-are elevating quality benchmarks and catalyzing cross-border trade, even as economic disparities shape technology diffusion. In key European markets, stringent clinical accreditation standards encourage the adoption of digital radiography and cloud-based image management systems, whereas emerging markets within the EMEA region are beginning to integrate portable ultrasound and tele-consultation services to address gaps in veterinary specialist availability.

Meanwhile, the Asia-Pacific region stands out for its rapid expansion, underpinned by heightened livestock health imperatives, rising disposable incomes, and a burgeoning companion animal culture in urban centers. Government incentives for agricultural modernization and growing private-sector investment in veterinary education are accelerating the uptake of advanced imaging technologies. However, infrastructure constraints and fragmented distribution networks in some jurisdictions underscore the importance of tailored market entry strategies, localized service models, and strategic alliances with regional partners.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Diagnostic Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Innovators and Strategic Collaborations Driving Competitive Advantage in Veterinary Diagnostic Imaging

The competitive landscape of veterinary diagnostic imaging is shaped by a constellation of global technology leaders and innovative challengers. Major radiology vendors with deep portfolios-such as Siemens Healthineers, Philips Healthcare, and GE HealthCare-continue to leverage established supply chains and research collaborations to deliver state-of-the-art CT and MRI solutions, while also expanding service offerings through cloud-based image management platforms and AI-enabled analytics. In parallel, specialist providers like Esaote and Canon Medical Systems focus on niche ultrasound and digital radiography systems tailored for veterinary applications, enabling responsive support models and modular upgrade paths.

Regional players and emerging manufacturers, particularly across the Asia-Pacific, are gaining traction by offering cost-optimized portable imaging devices and consumables, leveraging domestic production capacities to mitigate tariff exposure. Concurrently, software vendors are differentiating through advanced image-processing algorithms, customizable reporting tools, and integrated telemedicine modules that cater to both academic research settings and high-volume clinical environments.

Strategic partnerships and M&A activities continue to redefine market boundaries, as health technology companies align with veterinary service groups to co-develop bundled care solutions. Recent collaborations between leading imaging firms and veterinary teaching hospitals underscore a trend toward joint innovation initiatives, fostering validation studies for cutting-edge modalities and expanding clinical education pipelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Diagnostic Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agfa-Gevaert Group

- Antech Diagnostics Germany GmbH

- BioChek B.V.

- Canon Medical Systems Corporation

- Carestream Health, Inc.

- Chison Medical Technologies Co., Ltd.

- Epica Medical Innovations Inc.

- Esaote SpA

- Fujifilm Holdings Corporation

- GE Healthcare

- Hallmarq Veterinary Imaging

- Heska Corporation

- IDEXX Laboratories, Inc.

- IM3 Inc.

- Merck KGaA

- MinXray, Inc.

- Narang Medical Limited

- Probo Medical

- Samsung Medison Co., Ltd.

- Shenzhen Mindray Animal Medical Technology Co., LTD.

- Shimadzu Corporation

- Siemens AG

- Thermo Fisher Scientific, Inc.

- Vet Rocket, Inc.

- Zoetis, Inc.

Strategic Blueprint of Actionable Recommendations Empowering Industry Leaders to Harness Innovation, Mitigate Risks, and Accelerate Growth in Veterinary Imaging

To navigate the complex interplay of technological progress and trade uncertainties, industry leaders should adopt a multifaceted strategic approach that prioritizes both innovation and resilience. First, investing in artificial intelligence and machine learning integration can unlock enhanced diagnostic precision and operational efficiencies, anchoring system differentiation in a crowded marketplace. Concurrently, expanding portable and point-of-care imaging product lines enables rapid market penetration in rural and large animal settings, where mobility and ease of deployment are paramount.

Second, proactive supply chain diversification is essential to mitigate tariff-related cost pressures. Establishing secondary manufacturing or assembly hubs outside tariff-vulnerable jurisdictions, forging strategic partnerships with regional distributors, and optimizing inventory buffers will safeguard service continuity and margin stability. Third, engaging with regulatory bodies and professional associations to advocate for targeted tariff exemptions on essential veterinary medical technologies can help preserve affordability for practices and, by extension, animal patients.

Finally, cultivating specialized expertise through training programmes and collaborative research with academic institutions will strengthen end-user loyalty and foster a culture of evidence-based practice. By aligning product roadmaps with emerging clinical needs-such as non-invasive oncology imaging and advanced musculoskeletal evaluation-vendors can position themselves as indispensable partners in the evolution of veterinary care.

Transparent Overview of Comprehensive Research Methodology Combining Primary Insights, Secondary Data, and Robust Analytical Frameworks

This report synthesizes insights from an integrated research methodology designed to ensure rigor, reliability, and relevance. Secondary research included a thorough review of peer-reviewed veterinary journals, regulatory databases, and industry publications, complemented by analysis of government trade and import data. Primary research comprised structured interviews with radiology experts, veterinary practice managers, and supply chain executives, alongside a quantitative survey of imaging equipment end users across multiple regions.

Data triangulation techniques were employed to reconcile divergent perspectives, while a proprietary analytical framework facilitated cross-segment comparisons and scenario modelling. Quality control measures, such as multi‐tier data validation and stakeholder review cycles, underpin the robustness of the findings. The methodology’s transparent and collaborative design ensures that strategic implications reflect both macro-level trends and ground-level realities, providing stakeholders with actionable intelligence grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Diagnostic Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Diagnostic Imaging Market, by Product Type

- Veterinary Diagnostic Imaging Market, by Animal Type

- Veterinary Diagnostic Imaging Market, by Modality

- Veterinary Diagnostic Imaging Market, by End-User

- Veterinary Diagnostic Imaging Market, by Application

- Veterinary Diagnostic Imaging Market, by Distribution Channel

- Veterinary Diagnostic Imaging Market, by Region

- Veterinary Diagnostic Imaging Market, by Group

- Veterinary Diagnostic Imaging Market, by Country

- United States Veterinary Diagnostic Imaging Market

- China Veterinary Diagnostic Imaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Market Dynamics and Strategic Imperatives Underscoring the Future Trajectory of Veterinary Diagnostic Imaging

The convergence of surging pet populations, technological innovation, and shifting trade policies is reshaping the veterinary diagnostic imaging landscape. Technological advancements-from portable ultrasound units to AI-driven image analysis-are expanding access, improving diagnostic confidence, and enabling more tailored treatment pathways. At the same time, the imposition of higher tariffs underscores the need for supply chain adaptability and collaborative advocacy to safeguard the affordability of critical imaging tools.

Segmentation analysis highlights varied end-user requirements, from high-throughput small animal referral centers to field-based large animal practices, while regional insights reveal distinct adoption patterns shaped by regulatory environments and infrastructure maturity. Competitive dynamics are intensifying as established global leaders and nimble regional players vie for market share through differentiated offerings, strategic partnerships, and service innovations.

Ultimately, industry resilience will hinge on the ability to innovate responsively, diversify risk, and cultivate deep expertise through research and education. This executive summary underscores the strategic imperatives that will define success in the next phase of veterinary imaging evolution-where precision, speed, and accessibility converge to enhance animal health and welfare.

Engage with Associate Director Ketan Rohom to Unlock In-Depth Market Intelligence and Secure Your Comprehensive Veterinary Diagnostic Imaging Report Today

Ready to elevate your strategic decision-making in the rapidly evolving veterinary diagnostic imaging landscape? Ketan Rohom, Associate Director, Sales & Marketing, is your direct gateway to unparalleled market intelligence, tailored insights, and a comprehensive report designed to empower your next move. Reach out today to secure your copy of the most authoritative analysis on emerging technologies, tariff impacts, segmentation dynamics, and competitive strategies specific to veterinary imaging. Don’t miss the opportunity to leverage in-depth research and actionable recommendations that will guide your investments, partnerships, and innovation roadmap.

- How big is the Veterinary Diagnostic Imaging Market?

- What is the Veterinary Diagnostic Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?