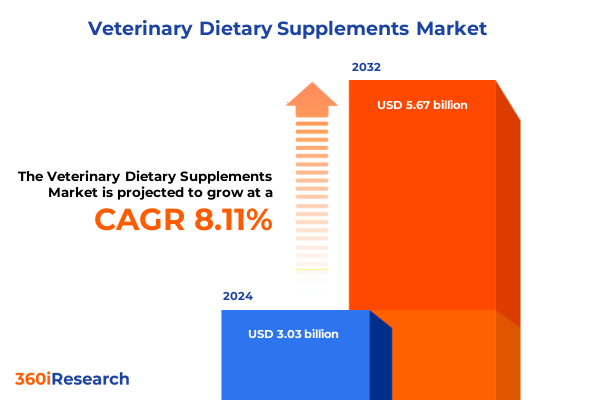

The Veterinary Dietary Supplements Market size was estimated at USD 3.28 billion in 2025 and expected to reach USD 3.55 billion in 2026, at a CAGR of 8.13% to reach USD 5.67 billion by 2032.

Unveiling the Rising Importance of Veterinary Dietary Supplements in Enhancing Animal Health and Owner Engagement

The growing emphasis on animal wellbeing has elevated veterinary dietary supplements from niche offerings to mainstream components of comprehensive pet healthcare. As pets take on increasingly meaningful roles within family units, owners are seeking advanced nutritional solutions to support preventive care, disease management, and overall vitality. This shift has been particularly pronounced in North America, where between thirty and fifty percent of pet owners now incorporate supplements into daily regimens and nearly ninety percent of veterinarians recommend complementary nutrition as part of treatment plans.

Consumer perception now firmly positions proper nutrition and supplements as pivotal to animal health, with eighty-five percent of pet owners viewing these products as equally important for their companion’s wellbeing as they are for humans. This widespread acceptance is reshaping traditional veterinary practices, as clinics integrate nutraceutical guidance alongside diagnostics and therapeutics. The convergence of veterinary expertise and nutritional science is enabling holistic care pathways that address joint mobility, digestive balance, immune support, and stress relief.

Alongside growing professional endorsement, digital adoption is transforming purchase behaviors. Over thirty percent of supplement purchases now occur through online platforms, reflecting the convenience of e-commerce and an appetite for educational resources that guide formulations and dosing. Moreover, emerging smart devices and data-driven health trackers are empowering owners to monitor intake compliance and correlate nutritional interventions with measurable health outcomes, underscoring a new era of connected pet care.

Exploring Transformative Shifts Shaping the Future Veterinary Nutrition Landscape Through Innovation and Personalized Pet Care

The veterinary nutrition landscape is undergoing rapid transformation as stakeholders respond to evolving consumer expectations and scientific breakthroughs. Wellness, personalization, and sustainability now serve as interdependent pillars guiding new product development and strategic priorities. Balanced formulations aimed at supporting foundational health, proactive customization based on breed and life stage, and environmentally conscious sourcing are driving the next wave of innovation in the sector.

Precision nutrition, once a concept limited to human health, is now gaining traction for companion animals. Advances in genomics and data analytics are enabling breed-specific diets and targeted supplement regimens tailored to genetic predispositions and metabolic profiles. By analyzing individual health risk factors and leveraging predictive algorithms, companies and veterinary centers are creating bespoke interventions that optimize outcomes and mitigate chronic conditions effectively.

At the same time, sustainability has emerged as a core strategic consideration. Pet owners are increasingly demanding ethically sourced, cruelty-free ingredients produced under transparent supply chain standards. This trend is fueling collaboration between supplement manufacturers and suppliers committed to regenerative agriculture and responsible harvesting practices. By embedding environmental stewardship into their value propositions, leading brands are strengthening consumer trust and differentiating offerings in a crowded market.

Furthermore, the integration of e-commerce with veterinary consultation services and rich digital content delivery is reshaping distribution models. Omnichannel approaches that marry online convenience with professional expertise are enhancing accessibility to specialized supplements, reinforcing the perception of these products as integral components of veterinary treatment protocols.

Assessing How United States Tariff Policies Have Transformed Supply Chains and Pricing Dynamics Within Veterinary Dietary Supplements

Since the initial imposition of Section 301 tariffs on imports from China in 2018 and 2019, the United States has maintained a complex tariff regime affecting numerous dietary supplement ingredients. In May 2024, the U.S. Trade Representative extended exclusions on select Chinese imports, including animal‐feeding machinery and related equipment, through June 2025 to support sourcing transitions and mitigate supply disruptions. This policy afforded temporary relief but underscored the broader necessity for supply chain resilience in an environment of reciprocal trade measures.

In April 2025, the White House further revised its tariff framework by exempting essential nutrition inputs-such as key vitamins, amino acids, coenzyme Q10, and multiple trace minerals-from reciprocal tariff lists. This exemption initiative aimed to stabilize pricing and availability for manufacturers within the animal health and functional food sectors. By alleviating inflationary pressures on these foundational ingredients, this policy shift supported market continuity, even as broader trade tensions persisted.

Despite these carve‐outs, significant duties remain on several critical compounds sourced predominantly from China. The ad valorem tariff on vitamin K imports reached twenty‐point‐five percent, inositol tariffs climbed to thirty percent, and duties on vitamins D3 and B12 each stand at ten percent under Section 301 measures. Consequently, companies report annual cost increases ranging from hundreds of thousands to millions of dollars, prompting efforts to secure alternative suppliers and accelerate domestic production initiatives. Additionally, botanicals outside exemption lists face steep duties upward of one hundred forty‐five percent, intensifying challenges for natural product formulations.

Gaining Deep Insights From Segmentation Strategies to Navigate Product, Form, Ingredient and Consumer Variations in Veterinary Nutrition

A nuanced understanding of the veterinary dietary supplements market emerges when analyzed through multiple segmentation lenses. By animal type, the market spans companion categories-cats, dogs, and horses-as well as livestock, which encompasses cattle, poultry, and swine. Each segment presents distinct nutritional requirements and regulatory considerations, driving targeted formulation strategies that address species‐specific metabolic and physiological needs.

Examining product type segmentation reveals focused demand across digestive health supplements, joint health support, multivitamins, probiotics, skin and coat formulations, and foundational vitamins and minerals. Such diversification reflects an industry shift toward condition‐specific nutraceuticals, with R&D investments concentrated on therapeutic efficacy and palatability to ensure compliance and measurable health benefits.

The form in which supplements are delivered-capsules, chewables, gels, liquids, powders, and tablets-further defines consumer preferences, influenced by ease of administration, dosage accuracy, and perceived value. Meanwhile, ingredient sourcing strategies bifurcate between natural and synthetic origins, with natural ingredients prized for clean‐label appeal and synthetic compounds favored for cost efficiencies and supply stability.

Application segmentation captures a broad spectrum of health objectives, from cardiovascular and dental support to immune enhancement, performance optimization, reproductive health, skin and coat maintenance, urinary care, and weight management. Distribution channels range from offline retail-pet specialty outlets, pharmacies, and veterinary clinics-to burgeoning online platforms, while end user segmentation distinguishes purchasing behaviors of individual pet owners versus institutional veterinary hospitals.

This comprehensive research report categorizes the Veterinary Dietary Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product Type

- Form

- Ingredient Source

- Application

- Distribution Channel

- End User

Unveiling Regional Dynamics and Growth Opportunities Across the Americas Europe Middle East Africa and Asia Pacific Veterinary Supplement Markets

Regional dynamics in veterinary dietary supplements demonstrate pronounced contrasts in market maturity, regulatory landscapes, and growth trajectories. In the Americas, a well-established pet nutrition ecosystem thrives on strong integration between veterinary practitioners and supplement providers. This synergy fosters robust clinical endorsement of specialized nutraceuticals, with omnichannel distribution models bridging brick-and-mortar veterinary clinics and sophisticated e-commerce platforms. Consumer willingness to invest in premium formulations underpins steady category expansion, buttressed by extensive veterinary education initiatives.

In Europe, the Middle East, and Africa, regulatory rigor and safety standards shape product development and market access. European authorities maintain stringent guidelines on health claims and ingredient provenance, compelling manufacturers to validate therapeutic assertions through scientific evidence and clinical studies. At the same time, growing demand for environmentally conscious and ethically sourced supplements has propelled the adoption of plant-based and sustainably harvested ingredients. Cross-regional collaborations on harmonizing regulatory pathways are gradually reducing market entry barriers and promoting innovation across the EMEA territory.

The Asia-Pacific region exhibits the most dynamic growth potential, driven by rising urbanization, increasing disposable incomes, and deepening pet ownership trends. Notably, Asia-Pacific expenditures on pet healthcare and nutrition have outpaced global averages, fueled by shifts in consumer attitudes toward preventive care and personalized wellbeing. Rapid e-commerce adoption and digital pet health platforms are creating novel entry points for both international and indigenous supplement brands, positioning the region as a pivotal driver of future market expansion.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Dietary Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Competitive Landscapes and Strategic Moves by Leading Veterinary Dietary Supplement Companies Driving Market Evolution

Major players in the veterinary dietary supplements arena are leveraging their global footprint and R&D capabilities to secure competitive advantages. One of the sector leaders has strategically invested in condition-specific formulation science, collaborating with academic institutions to validate joint health and digestive support solutions through controlled clinical trials. This approach not only strengthens product efficacy claims but also enhances brand credibility among veterinary professionals and pet owners.

Another key industry participant has centered its growth strategy on innovation in delivery formats and palatability, introducing soft chew multivitamins designed for easy administration in dogs and cats. This product line, developed following comprehensive taste-preference studies, has gained traction in North American markets and is now being adapted for equine and livestock applications to address broader animal nutrition needs.

Global agribusiness and animal health conglomerates have expanded their portfolios through targeted acquisitions of specialized supplement manufacturers, integrating botanical extract capabilities and clinical trial infrastructure. Concurrently, leading names in veterinary pharmaceuticals are entering the supplement space by leveraging existing distribution networks and forging alliances with veterinary hospitals to cross-promote therapeutic diets and nutraceutical additives.

Additionally, several emerging organizations are differentiating through digital direct-to-consumer platforms that offer subscription models, personalized health assessments, and teleconsultation services. By harnessing data analytics and predictive modeling, these new entrants are refining product recommendations and dosage regimens, thereby enhancing customer loyalty and compliance rates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Dietary Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adisseo Co., Ltd.

- Alltech, Inc.

- Archer Daniels Midland Company

- Cargill, Incorporated

- DSM-Firmenich AG

- Elanco Animal Health Incorporated

- Evonik Industries AG

- Kemin Industries, Inc.

- Mars, Incorporated

- Novus International, Inc.

- Nutreco N.V.

- Virbac S.A.

- Zoetis Inc.

Empowering Industry Leaders With Actionable Strategies to Enhance Supply Chains Innovation and Regulatory Engagement in Pet Nutrition

Industry leaders must prioritize holistic supply chain resilience to navigate ongoing trade uncertainties and tariff fluctuations. Establishing diversified supplier networks and nearshoring critical ingredient production can mitigate exposure to abrupt policy shifts and escalating duties. Simultaneously, forging strategic partnerships with raw material producers that adhere to sustainable and ethical sourcing standards will bolster both supply continuity and consumer trust.

Innovation investments should target personalized nutrition platforms and evidence-based formulation. By leveraging genomic and microbiome research, companies can develop next-generation supplements that offer tailored health interventions. Collaborations with veterinary academic centers and third-party laboratories to conduct clinical efficacy studies will not only validate product claims but also accelerate regulatory approvals and professional endorsement.

Moreover, stakeholders should advocate for clearer regulatory frameworks and continued tariff relief for essential nutraceutical ingredients. Engaging with trade associations and government bodies during policy consultations can drive balanced outcomes that support domestic manufacturing growth and global market integration. Concurrently, enhancing transparency through comprehensive digital traceability systems will position brands favorably among increasingly discerning consumers.

To capitalize on evolving distribution paradigms, firms must refine omnichannel strategies that seamlessly integrate retail, e-commerce, and veterinary clinic touchpoints. Implementing data-driven marketing initiatives and telehealth services will enhance customer engagement and adherence to supplementation regimens, ultimately translating into improved animal health outcomes and sustained business performance.

Building Research Foundations Through Robust Methodologies and Stakeholder Insights in Veterinary Supplement Market Analysis

The research underpinning this analysis adhered to a rigorous mixed-methodology framework, combining primary qualitative interviews with veterinary professionals, supplement manufacturers, and industry associations. These in-depth conversations provided vital context on formulation challenges, clinical adoption barriers, and emerging consumer preferences. Supplementing this, quantitative surveys of pet owners and veterinary practitioners delivered statistically robust insights into purchasing patterns, product feature priorities, and service channel expectations.

Secondary research entailed comprehensive desk studies of regulatory filings, tariff schedules, patent databases, and scientific publications. Key data sources included government trade publications, industry white papers, and peer-reviewed journals detailing advances in animal nutrition and pharmacology. Market intelligence was further enriched by attending relevant industry conferences and symposiums, enabling direct observation of evolving product launches and technological demonstrations.

Data triangulation ensured reliability and validity of findings by cross-verifying insights from multiple sources. Where discrepancies arose, follow-up consultations clarified divergent perspectives. All data collection and analysis protocols complied with ethical guidelines, preserving respondent confidentiality and ensuring objective interpretation. This multi-pronged approach yielded an integrated perspective on market dynamics, competitive positioning, and strategic imperatives within the veterinary dietary supplements sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Dietary Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Dietary Supplements Market, by Animal Type

- Veterinary Dietary Supplements Market, by Product Type

- Veterinary Dietary Supplements Market, by Form

- Veterinary Dietary Supplements Market, by Ingredient Source

- Veterinary Dietary Supplements Market, by Application

- Veterinary Dietary Supplements Market, by Distribution Channel

- Veterinary Dietary Supplements Market, by End User

- Veterinary Dietary Supplements Market, by Region

- Veterinary Dietary Supplements Market, by Group

- Veterinary Dietary Supplements Market, by Country

- United States Veterinary Dietary Supplements Market

- China Veterinary Dietary Supplements Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Synthesizing Key Takeaways and Strategic Imperatives to Drive Future Growth in Veterinary Dietary Supplement Initiatives

The landscape of veterinary dietary supplements is evolving at an unprecedented pace, propelled by humanization of pets, technological advancements, and shifting global trade policies. As stakeholders navigate this dynamic environment, a strategic emphasis on personalization, scientific validation, and regulatory collaboration will be crucial for sustainable growth. Supply chain diversification and nearshore manufacturing can buffer against lingering tariff pressures, while continued advocacy for ingredient exemptions may ease cost burdens and support price stability.

Segmentation analysis underscores the importance of species-specific and condition-focused formulations, delivered in preferred dosage forms. Regional insights reveal distinct growth trajectories, with the Americas maintaining market maturity, EMEA emphasizing regulatory compliance and ethical sourcing, and Asia-Pacific exhibiting rapid expansion driven by digital adoption and rising pet ownership. Companies that align product development with these regional priorities will be well-positioned to capture incremental opportunities.

Competitive intelligence highlights a divergence between established multinational players driving scale through acquisitions and clinical research partnerships, and agile newcomers leveraging digital platforms and subscription models to deepen customer relationships. Industry leaders must reconcile these approaches by embedding data analytics into their innovation pipelines and enhancing omnichannel engagement to cater to both institutional and end-user audiences.

In conclusion, the future of veterinary dietary supplements hinges on an integrated ecosystem that balances scientific rigor, sustainable practices, and responsive distribution strategies. Organizations that embrace these imperatives will cultivate resilient business models capable of delivering measurable health outcomes and long-term shareholder value.

Connect Directly With Ketan Rohom to Secure Your Comprehensive Veterinary Dietary Supplements Market Research Report Today

Ready to gain a strategic edge with comprehensive insights and data-driven analysis tailored to the evolving veterinary dietary supplements market, contact Ketan Rohom, Associate Director of Sales & Marketing. Connect directly to explore how this in-depth research can help you navigate supply chain complexities, anticipate regulatory shifts, and optimize product portfolios for sustained growth in an increasingly competitive landscape. Secure your copy of the complete market research report today to empower your decision-making and drive tangible results.

- How big is the Veterinary Dietary Supplements Market?

- What is the Veterinary Dietary Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?