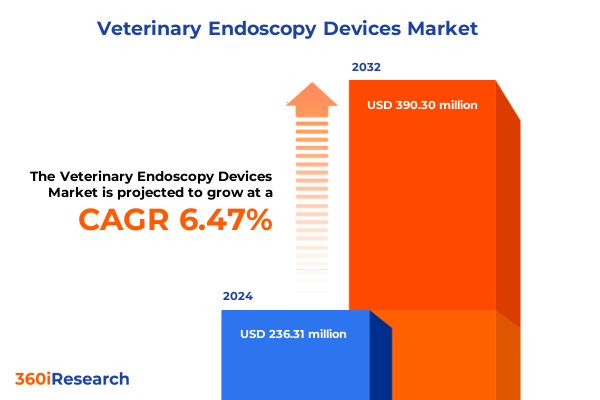

The Veterinary Endoscopy Devices Market size was estimated at USD 250.59 million in 2025 and expected to reach USD 266.05 million in 2026, at a CAGR of 6.53% to reach USD 390.30 million by 2032.

Pioneering Insight into the Evolution of Veterinary Endoscopy Devices Transforming Animal Diagnostics and Therapeutic Interventions in Modern Practice

The field of veterinary endoscopy has undergone a remarkable evolution, driven by advances in imaging, optics, and minimally invasive techniques that enable more precise diagnostics and therapeutic procedures. This surge in innovation has elevated the standard of care for companion animals and livestock alike. As practitioners increasingly favor less invasive alternatives, endoscopy devices have emerged as critical tools to support a wide range of interventions, from gastrointestinal examinations to robotic-assisted surgeries. Consequently, understanding the nuanced progress of these technologies is essential for stakeholders seeking to optimize clinical outcomes.

In recent years, the convergence of fiber optic and digital imaging technologies has yielded systems capable of high-definition visualization within the intricate anatomy of animals. This integration not only enhances diagnostic accuracy but also facilitates more targeted interventions, reducing procedural risks and recovery times. Moreover, the growing utilization of robotic and video-assisted platforms represents a transformative leap, enabling veterinarians to perform complex maneuvers with unprecedented control.

Through this executive summary, readers will gain a comprehensive overview of the market forces, segment-specific trends, regional dynamics, and strategic imperatives shaping the veterinary endoscopy landscape. By synthesizing technological advancements with regulatory influences and supply chain considerations, this analysis provides an essential foundation for informed decision-making in an increasingly competitive environment.

Unprecedented Technological and Procedural Advancements Reshaping the Veterinary Endoscopy Landscape with Enhanced Imaging and Robotic Capabilities

The veterinary endoscopy market has experienced unprecedented momentum as developments in optics, robotics, and digital image processing converge to redefine clinical capabilities. High-definition camera modules and enhanced light sources now deliver unparalleled clarity, facilitating early disease detection and more accurate tissue assessments. These advances are particularly salient in gastrointestinal applications, where refined scopes have improved the identification of lesions and other pathologies.

Furthermore, the introduction of robotic-assisted endoscopy platforms marks a significant shift in procedural precision. These systems provide stable instrumentation and ergonomic controls, enabling veterinarians to conduct intricate maneuvers within confined anatomical regions. This capability has expanded the therapeutic potential of minimally invasive approaches, translating into shorter recovery periods and reduced postoperative complications for animal patients.

Moreover, the broader integration of wireless and portable video endoscopes has unlocked new possibilities for point-of-care diagnostics. These compact systems allow practitioners to deploy flexible imaging equipment in field settings, thereby extending advanced care to rural and mobile clinics. Consequently, the democratization of endoscopy technology is set to accelerate, further catalyzing the adoption curve across diverse veterinary settings.

Assessing the Strategic Ramifications of 2025 United States Tariffs on Veterinary Endoscopy Device Supply Chains, Costs, and Local Manufacturing Dynamics

The implementation of new tariffs on imported medical devices in early 2025 has introduced complex challenges for veterinary endoscopy stakeholders. Devices such as flexible colonoscopes and high-definition video scopes, often manufactured overseas, have faced elevated duties, thereby increasing landed costs. This development has prompted procurement teams to reevaluate sourcing strategies and negotiate more favorable terms with both domestic and international suppliers.

As a result, supply chain resilience has become a strategic imperative. Many distributors are now diversifying their portfolios to include locally manufactured or tariff-exempt equipment, while others are investing in warehousing solutions to mitigate potential disruptions. Furthermore, partnerships between device manufacturers and regional production facilities have gained traction, as firms seek to circumvent duty escalations and maintain stable price points for end users.

Despite these headwinds, the tariff environment has also spurred innovation within domestic manufacturing. In response to cost pressures, several companies have expedited the development of competitive in-house endoscopy platforms, integrating advanced video and robotic functions to appeal to cost-conscious veterinary clinics. Consequently, the tariffs have acted as a catalyst for market diversification, ultimately fostering a more robust ecosystem of device providers.

Comprehensive Analysis of Veterinary Endoscopy Market Segmentation by Product Type, Technology, Application, Animal Type, and End-User Perspectives

A thorough examination of the veterinary endoscopy domain reveals distinct product categories with unique growth trajectories. Flexible endoscopes, which encompass colonoscopes, duodenoscopes, and gastroscopes, have become the preferred choice for gastrointestinal diagnostics due to their adaptability and superior maneuverability. Conversely, rigid endoscopes such as arthroscopes, bronchoscopes, cystoscopes, and laparoscopes retain a pivotal role in surgical interventions where stability and direct visualization are paramount.

The technological segmentation further underscores the rise of fiber optic systems alongside next-generation video endoscopes and emerging robotic platforms. While fiber optic configurations continue to offer cost-effective solutions for basic imaging, video endoscopes equipped with digital sensors provide higher-resolution outputs that facilitate early detection of subtle lesions. Robotic endoscopes are increasingly adopted for their fine motor control, supporting complex surgical procedures with greater precision.

Applications span diagnostic scopes to therapeutic and surgical procedures, reflecting the sector’s broad clinical utility. Device usage in therapeutic contexts is expanding as manufacturers integrate channels for instrument passage, enabling interventions such as tissue biopsies and localized drug delivery. Additionally, the analysis of animal type segmentation shows that companion animals, including canines and felines, drive device utilization in private clinics, whereas livestock applications emphasize durability and cost efficiency. End-user perspectives vary from research laboratories, which prioritize specialized imaging capabilities, to veterinary clinics and hospitals, which value comprehensive service packages and post-sale support.

This comprehensive research report categorizes the Veterinary Endoscopy Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- Animal Type

- End-User

Comparative Regional Dynamics in the Veterinary Endoscopy Sector Spanning the Americas, Europe Middle East and Africa, and the Asia Pacific Markets

Regional dynamics in the veterinary endoscopy sector reveal contrasting adoption patterns and regulatory landscapes. In the Americas, the United States leads with robust investment in high-definition video endoscopes and robotic-assisted platforms, driven by rising demand for precision procedures in companion animal care. Canada’s veterinary community similarly emphasizes advanced imaging solutions, although smaller clinic networks often favor portable endoscope systems for diversified service offerings.

Across Europe, Middle East and Africa, regulatory frameworks and reimbursement guidelines vary significantly, shaping market entry strategies. Western European countries benefit from established veterinary networks and standardized approval processes that support the introduction of premium endoscopy devices. In contrast, emerging markets in Eastern Europe and the Middle East prioritize cost-effective fiber optic and video endoscopes to meet growing but budget-sensitive demand.

The Asia Pacific region exhibits accelerated growth due to rapid urbanization and increasing pet ownership in countries such as China, Japan, and Australia. Here, local manufacturing initiatives have expanded, reducing dependency on imports and mitigating recent tariff impacts. Furthermore, collaborations between domestic companies and global technology providers have fueled the deployment of next-generation endoscopy solutions in both companion animal clinics and livestock health operations, underscoring the region’s pivotal role in the market’s future trajectory.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Endoscopy Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Veterinary Endoscopy Device Innovators Driving Market Growth through Technological Differentiation and Collaborative Partnerships

Leading innovators in the veterinary endoscopy landscape have distinguished themselves through continuous technological differentiation and strategic collaborations. Global medical device companies with established endoscopy portfolios have adapted their human-focused platforms for animal-specific applications, tailoring features such as scope diameter and insertion tube flexibility to the unique anatomical considerations of various species.

Smaller specialized firms have also gained traction by focusing on niche applications, developing compact, portable systems that cater to field veterinarians and mobile clinics. These providers emphasize modular designs and simplified interfaces to streamline training and maintenance, thereby lowering the barrier to adoption in resource-constrained environments. Additionally, alliances between device manufacturers and software developers have resulted in integrated diagnostic suites, featuring image analysis algorithms that enhance lesion detection and procedural documentation.

In parallel, service-oriented companies offering comprehensive training and technical support have become indispensable partners for veterinary practices. Their programs cover both fundamental endoscopic techniques and advanced robotic-assisted procedures, ensuring that clinical teams can fully exploit the capabilities of cutting-edge platforms. This combined hardware, software, and service model is emerging as a key differentiator among industry participants, reinforcing customer loyalty and driving long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Endoscopy Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adeor Medical AG

- Aohua Endoscopy Co., Ltd.

- B. Braun Vet Care GmbH

- Biovision Veterinary Endoscopy, LLC

- Dr. Fritz Endoscopes GmbH

- Eickemeyer – Medizintechnik für Tierärzte KG

- ESS, Inc.

- Firefly Global

- FUJIFILM Holdings Corporation

- Jørgen KRUUSE A/S

- Karl Storz SE & Co. KG

- MDS Incorporated

- Medtronic PLC

- Olympus Corporation

- Richard Wolf GmbH

- SonoScape Medical Corp.

- Steris Corporation

- Stryker Corporation

- SyncVision Technology Corporation

- VetOvation LLC

- Vimex Sp. z o.o.

Proven Strategic Initiatives for Industry Leaders to Optimize Research Development, Supply Chain Resilience, and Clinical Adoption within Veterinary Endoscopy

To navigate the evolving veterinary endoscopy landscape, industry leaders should prioritize strategic investments in research and development that address both current clinical needs and emerging procedural applications. By focusing on ergonomic scope designs and enhanced imaging modalities, device manufacturers can deliver solutions that resonate with end users seeking greater operational efficiency and diagnostic precision.

In addition, cultivating robust partnerships across the supply chain will bolster resilience against external pressures such as tariffs and logistical disruptions. Collaborations with domestic production facilities and local distributors can shorten lead times and stabilize pricing, thereby preserving end-user affordability. Concurrently, establishing technical training alliances with veterinary education institutions will facilitate skill proliferation and reinforce device adoption rates.

Finally, integrating advanced analytics and digital connectivity into endoscopy platforms offers a pathway to new service offerings. By enabling remote procedure monitoring and post-procedural outcome tracking, companies can differentiate their solutions through value-added insights. This data-driven approach not only enhances clinical decision-making but also fosters long-term relationships with veterinary practices seeking comprehensive support.

Rigorous Multi-Tiered Research Methodology Combining Primary Stakeholder Interviews, Secondary Data Analysis, and Qualitative Triangulation for Veterinary Endoscopy Insights

This analysis is underpinned by a rigorous, multi-tiered research approach designed to ensure comprehensive coverage and qualitative depth. Primary research was conducted through in-depth interviews with veterinary surgeons, clinic administrators, and procurement specialists, yielding firsthand perspectives on device performance and adoption barriers. These insights provided a practical foundation for interpreting market dynamics and technological requirements.

Secondary research involved the systematic review of industry publications, peer-reviewed scientific studies, conference proceedings, and regulatory filings. This process enabled cross-validation of primary findings and offered a broader context for emerging trends in imaging technologies, robotics integration, and procedural innovations. Additionally, competitor landscape assessment was performed to identify strategic positioning and partnership models among leading device manufacturers.

Qualitative data triangulation ensured the robustness of conclusions by reconciling contradictory information and highlighting areas of consensus. Throughout the analysis, emphasis was placed on tracking regulatory developments, tariff modifications, and regional policy shifts that could materially impact device availability and pricing. The resulting methodology offers a transparent audit trail for the insights presented within this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Endoscopy Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Endoscopy Devices Market, by Product Type

- Veterinary Endoscopy Devices Market, by Technology

- Veterinary Endoscopy Devices Market, by Application

- Veterinary Endoscopy Devices Market, by Animal Type

- Veterinary Endoscopy Devices Market, by End-User

- Veterinary Endoscopy Devices Market, by Region

- Veterinary Endoscopy Devices Market, by Group

- Veterinary Endoscopy Devices Market, by Country

- United States Veterinary Endoscopy Devices Market

- China Veterinary Endoscopy Devices Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Highlighting Core Opportunities and Challenges Guiding the Future Trajectory of Veterinary Endoscopy Device Adoption and Innovation

In summary, the veterinary endoscopy sector stands at a pivotal juncture where technological innovation, shifting regulatory landscapes, and strategic supply chain adjustments converge to shape its future trajectory. High-definition imaging, robotic-assisted platforms, and portable endoscope systems each contribute to expanded clinical capabilities and improved animal welfare outcomes. Meanwhile, external pressures such as tariffs have catalyzed domestic manufacturing and reinforced the importance of diversified sourcing.

Looking ahead, stakeholders who proactively engage with evolving technology trends, cultivate resilient partnerships, and leverage data-driven service offerings will be best positioned to capture emerging opportunities. By aligning product development, market access strategies, and end-user training initiatives, industry participants can foster sustainable growth and accelerate the adoption of minimally invasive veterinary procedures. Ultimately, the insights contained herein serve as a comprehensive guide for decision-makers seeking to navigate this dynamic landscape with confidence.

Engage with Ketan Rohom to Secure Comprehensive Veterinary Endoscopy Market Insights and Propel Strategic Decision-Making with Expert Guidance Today

To explore the full depth of our findings and leverage unparalleled strategic insights, contact Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). His expertise will guide you through the detailed market dynamics, empowering your organization with actionable intelligence for sustainable growth in the veterinary endoscopy sector.

- How big is the Veterinary Endoscopy Devices Market?

- What is the Veterinary Endoscopy Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?