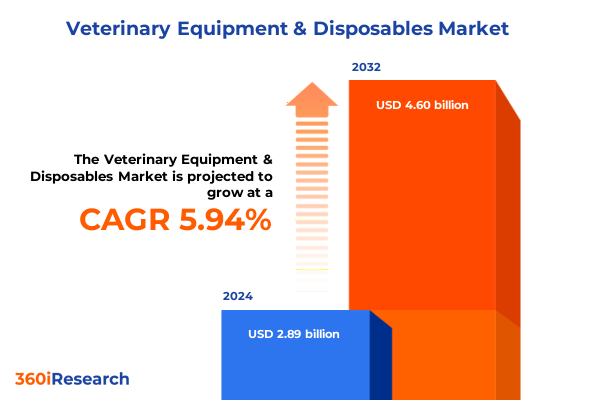

The Veterinary Equipment & Disposables Market size was estimated at USD 3.06 billion in 2025 and expected to reach USD 3.23 billion in 2026, at a CAGR of 5.98% to reach USD 4.60 billion by 2032.

Exploring the Crucial Role of Veterinary Equipment and Disposables in Meeting Rising Demand for Advanced Animal Healthcare Solutions

The veterinary equipment and disposables sector stands at the forefront of an era defined by elevated animal welfare expectations and rapid technological advancement. As pet ownership continues to surge-reaching 94 million U.S. households in 2024-veterinarians face escalating demands for high-quality diagnostic, surgical, and monitoring tools to support both companion and livestock care. Concurrently, rising expenditure in animal health, fueled by the humanization of pets and increasing investment in agricultural efficiency, underscores the critical role of innovative equipment solutions in delivering superior outcomes.

This momentum is further propelled by an expanding range of specialized applications, from neurology and ophthalmology to orthopedic interventions. Veterinarians now require integrated anesthesia systems, advanced imaging modalities, and single-use consumables that not only enhance procedural precision but also streamline workflow and improve infection control. In response, manufacturers and distributors are broadening portfolios to include portable anesthesia machines, AI-enhanced diagnostic platforms, and ergonomic surgical instruments.

The intersection of these factors has reshaped the veterinary landscape into a dynamic marketplace where agility, regulatory compliance, and technological differentiation are paramount. Industry stakeholders are challenged to anticipate evolving clinical protocols, manage supply chain vulnerabilities, and adopt cost-effective innovations to meet the diverse needs of academic institutions, clinics, hospitals, and research centers. Understanding these foundational trends is essential for any organization seeking to thrive in this competitive environment.

Identifying the Transformative Technological Regulatory and Consumer Shifts Revolutionizing Veterinary Equipment and Consumables

Over the past two years, veterinary medicine has undergone transformative shifts driven by pandemic-induced digitization, telehealth proliferation, and heightened emphasis on preventive care. Telemedicine platforms, once a niche service, have become mainstream, prompting the integration of remote monitoring devices and portable diagnostic tools into standard practice. This shift toward virtual consultations has elevated the demand for wireless patient monitors and handheld ultrasound units that support accurate assessments outside traditional clinic settings.

Simultaneously, artificial intelligence and machine learning have revolutionized image interpretation and laboratory diagnostics. AI algorithms now enhance ultrasound imaging resolution, enable rapid pathogen detection in point-of-care testing, and support predictive analytics for chronic disease management in companion animals. These innovations not only accelerate diagnostic workflows but also reduce the risk of human error, improving treatment accuracy.

Sustainability has also emerged as a key driver, with stakeholders actively seeking eco-friendly disposables and recyclable packaging to align with corporate responsibility goals. Manufacturers are investing in biodegradable surgical drapes and green sterilization solutions, reflecting end-user preferences for sustainable options without compromising clinical efficacy. Transitioning to such products can lower environmental footprints while maintaining the high infection-control standards expected in veterinary settings.

Assessing the Widespread Implications of 2025 United States Tariff Policies on Veterinary Equipment and Disposables Supply Chains

In 2025, U.S. tariff policies have introduced significant headwinds to the veterinary equipment and disposables market, disrupting established supply chains and inflating costs for key inputs. The April 2 trade emergency declaration elevated average tariff rates from 2.5% to approximately 27%, the highest level since 1903, applying to a broad array of imported medical goods, including syringes, needles, and active pharmaceutical ingredients that are essential to veterinary practice. Further compounding the challenge, Section 301 tariffs on Chinese imports have imposed duties of 100% on syringes and needles since September 27, 2024, and will raise tariffs on rubber gloves to 50% in 2025 and 100% in 2026, directly affecting disposable supply costs.

Meanwhile, medical device tariffs on electronics and imaging equipment from China and other major suppliers have reached up to 145%, threatening access to portable ultrasound machines and patient monitors that rely on globally sourced components. Stakeholders report that budget uncertainties are causing delays in procurement and hesitancy toward equipment upgrades, particularly in smaller clinics operating on narrow margins. While certain life-saving vaccines and finished pharmaceuticals remain exempt, most ancillary supplies and diagnostic instrumentation lack similar protections.

These tariff-induced pressures have prompted industry calls for targeted exemptions and supply chain diversification. Leading manufacturers are exploring nearshoring strategies and domestic partnerships to mitigate cost escalations. Nonetheless, until policy adjustments occur, veterinary professionals must navigate a landscape characterized by fluctuating import duties, higher overheads, and potential supply shortages that could constrain service delivery and compromise patient care.

Revealing Key Market Segmentation Trends Shaping Growth Trajectories Across Animal Types Products Applications and Distribution Channels

Analysis of market segmentation reveals critical insights into where growth and resilience are emerging across the veterinary ecosystem. When examining animal types, companion animals continue to account for the majority of equipment utilization, driven by high per-procedure spending in specialty clinics, while livestock applications rely more heavily on rugged, high-throughput devices suited to farm environments. In the product landscape, anesthesia machines, whether integrated or portable, have seen upticks in demand parallel to procedural volume increases, whereas disposables like single-use surgical drapes and advanced wound care products provide stable, recurring revenue streams.

Within clinical realms, application-specific trends underscore the rising use of imaging and monitoring equipment in neurology and ophthalmology, reflecting the growing sophistication of specialized veterinary services. Similarly, orthopedic procedures now routinely employ high-precision surgical hand instruments and patient-specific implants, elevating the importance of durable, reusable equipment alongside consumables such as specialized sutures. End-user segmentation highlights that veterinary hospitals and research centers invest heavily in capital-intensive modalities, academic institutions prioritize multi-platform diagnostic systems for training, and clinics of varying sizes balance cost with functionality when selecting fluid therapy management devices.

Distribution channels further modulate these trends, as offline store-based vendors remain vital for emergency and immediate procurement, yet online store-based models are rapidly gaining traction for routine consumable replenishment, providing competitive pricing and just-in-time delivery options. The interplay of these segmentation dimensions informs strategic decisions about inventory management, product development, and go-to-market approaches in a sector where adaptability drives long-term success.

This comprehensive research report categorizes the Veterinary Equipment & Disposables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Product

- Application

- End Users

- Distribution Channel

Highlighting Regional Market Dynamics Influencing Veterinary Equipment and Disposables Adoption Across the Americas EMEA and Asia-Pacific

Regional dynamics exert significant influence on the adoption and diffusion of veterinary equipment and disposables. In the Americas, robust animal health expenditure and high veterinary service penetration underpin strong demand for cutting-edge diagnostic and surgical technologies, particularly in the United States and Canada. Latin American markets are characterized by growing livestock mechanization and rising pet care investments, fostering opportunities for mid-range and cost-effective product lines.

The Europe, Middle East & Africa region presents a heterogeneous landscape: Western Europe leads in advanced imaging and critical care equipment driven by stringent animal welfare regulations, whereas emerging markets in Eastern Europe and the Middle East focus on basic diagnostic tools and consumables. Africa remains underpenetrated but shows potential for growth in livestock health solutions as agribusiness modernization initiatives gain momentum.

Asia-Pacific stands out as a high-growth arena, propelled by increasing pet ownership in urban centers, burgeoning veterinary infrastructure in China and India, and government incentives supporting livestock disease surveillance. Demand for portable and point-of-care devices is particularly pronounced, with manufacturers tailoring products to the region’s unique power stability and connectivity constraints. Overall, these regional insights underscore the need for tailored market entry strategies and localized distribution partnerships to optimize reach and impact.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Equipment & Disposables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Competitive Strategies Driving Innovation in Veterinary Equipment and Disposable Products Worldwide

The competitive landscape is defined by a blend of specialized veterinary diagnostics leaders and diversified medical device conglomerates. IDEXX Laboratories remains at the forefront, with its SNAP and Catalyst platforms widely adopted for point-of-care testing and core chemistry analysis, even as the company navigates fluctuating clinic visit trends and anticipates a rebound in demand. Zoetis continues to deliver resilient performance, reporting 9% organic operational revenue growth in the first quarter of 2025 despite tariff headwinds, and adjusting full-year guidance to reflect enacted duties on key imports.

Heska Corporation, now integrated into Mars Petcare’s diagnostics portfolio, distinguishes itself through AI-enabled hematology analyzers and flexible leasing models that appeal to mid-sized clinics seeking capital efficiency. Major life sciences companies like Thermo Fisher Scientific extend their reach into veterinary laboratories with advanced analyzers and rapid test kits, while medical device manufacturers such as Mindray Medical and Carestream Health leverage global networks to offer imaging solutions tailored to veterinary settings. Additionally, distribution specialists Covetrus and Midmark play pivotal roles in linking end users to an extensive range of equipment and consumables, supported by value-added services including training and maintenance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Equipment & Disposables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvaCare Pharma

- B. Braun SE

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux S.A.

- Canon Inc.

- Cardinal Health, Inc.

- Dextronix, Inc.

- Digicare Biomedical Technology

- Dispomed Ltd.

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies, Inc.

- Grady Medical

- Henke Sass Wolf GmbH

- ICU Medical, Inc.

- IDEXX Laboratories, Inc.

- IMV Technologies Group

- Johnson & Johnson Services, Inc.

- Karl Storz SE & Co. KG

- Lepu Medical Technology (Beijing) Co., Ltd.

- Medtronic PLC

- Midmark Corporation

- MinXray, Inc.

- Neogen Corporation

- Nonin Medical, Inc.

- Qalibra

- RWD Life Science Co.,LTD

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers AG

- SOMNI Scientific

- Terumo Corporation

- Thermo Fisher Scientific Inc.

- Zoetis Inc.

Outlining Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Mitigate Tariff-Related Risks

To navigate the complexities of a tariff-impacted environment and capitalize on evolving sector trends, industry leaders should prioritize supply chain resilience by forging partnerships with domestic manufacturers and qualifying alternative international suppliers under favorable trade treaties. Simultaneously, investing in modular, portable equipment platforms will enhance flexibility, allowing clinics and hospitals to adapt swiftly to fluctuating procedural demands and remote care models.

Furthermore, aligning product development roadmaps with emerging clinical specialties-such as neurology, ophthalmology, and orthopedics-can unlock new revenue streams, particularly when complemented by integrated data management systems and AI-driven analytics that deliver actionable insights. Embracing sustainability by transitioning to biodegradable disposables and optimizing packaging logistics will not only address environmental mandates but also resonate with a growing segment of eco-conscious end users.

Finally, expanding omnichannel distribution strategies that blend offline immediacy with online convenience will strengthen market coverage and customer loyalty. Leveraging digital platforms to offer predictive inventory management and subscription-based consumable replenishment services can create recurring revenue models, mitigate stockouts, and enhance customer satisfaction. By adopting these strategic imperatives, organizations can thrive amid policy uncertainties and accelerate growth in the veterinary equipment and disposables market.

Detailing the Comprehensive Research Methodology Underpinning the Analysis of the Veterinary Equipment and Disposables Market

This analysis is grounded in a rigorous research methodology that combines extensive primary and secondary investigations. Primary research involved structured interviews with veterinary practitioners, equipment procurement managers, and industry experts to validate trends, challenges, and adoption patterns. These qualitative insights were supplemented by quantitative data gathered through surveys conducted across diverse geographies and practice settings, ensuring representativeness and depth.

Secondary research encompassed systematic examination of regulatory filings, trade association publications, corporate annual reports, and authoritative news sources. Wherever possible, data points were cross-verified against publicly available statistics from organizations such as the American Pet Products Association and the U.S. Trade Representative to ensure accuracy and currency. A comprehensive tariff impact assessment was developed using official Federal Register notices and expert commentary from leading legal advisories.

Finally, data triangulation techniques were employed to reconcile information discrepancies, and advanced analytical models facilitated the identification of growth drivers and segmentation insights. This robust approach ensures the credibility of findings and provides stakeholders with a transparent foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Equipment & Disposables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Equipment & Disposables Market, by Animal Type

- Veterinary Equipment & Disposables Market, by Product

- Veterinary Equipment & Disposables Market, by Application

- Veterinary Equipment & Disposables Market, by End Users

- Veterinary Equipment & Disposables Market, by Distribution Channel

- Veterinary Equipment & Disposables Market, by Region

- Veterinary Equipment & Disposables Market, by Group

- Veterinary Equipment & Disposables Market, by Country

- United States Veterinary Equipment & Disposables Market

- China Veterinary Equipment & Disposables Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Summarizing Critical Insights and Implications from the Veterinary Equipment and Consumables Market Executive Summary

The veterinary equipment and disposables market is defined by rapid innovation, shifting regulatory landscapes, and evolving end-user expectations. The sector’s growth is anchored in increasing pet ownership, heightened livestock healthcare needs, and an expanding array of specialized clinical applications. However, 2025 U.S. tariff policies have introduced pronounced supply chain challenges, compelling stakeholders to reassess sourcing strategies and cost structures.

Segmentation insights reveal distinct growth trajectories across animal types, product categories, applications, end users, and distribution channels, offering a roadmap for targeted investment and product development. Regional analysis underscores the importance of customized market approaches to capture opportunities in mature and emerging geographies. In the competitive arena, diagnostic leaders like IDEXX and Zoetis, along with diversified players such as Thermo Fisher and Mindray, set the innovation benchmark, while distributors such as Covetrus and Midmark ensure comprehensive market reach.

By synthesizing these insights and actionable recommendations, organizations are equipped to make informed decisions, optimize operational resilience, and unlock value in a dynamic veterinary landscape. Stakeholders that proactively adapt to technological shifts, regulatory changes, and evolving customer preferences will secure a competitive edge and drive sustainable growth.

Connect with Ketan Rohom to Secure Your Comprehensive Veterinary Equipment and Disposables Market Research Report Today

Ready to transform your veterinary equipment strategy with the most comprehensive market insights available? Ketan Rohom, Associate Director of Sales & Marketing, is here to guide you through the purchase process and ensure you have the data and analysis you need to stay ahead in a rapidly evolving landscape. Engage directly with Ketan to explore tailored package options, exclusive customizations, and bulk pricing discounts designed for your organization’s unique requirements. Contact Ketan today to secure your copy of the Veterinary Equipment & Disposables Market Research Report and gain the actionable intelligence that will empower your strategic decisions.

- How big is the Veterinary Equipment & Disposables Market?

- What is the Veterinary Equipment & Disposables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?