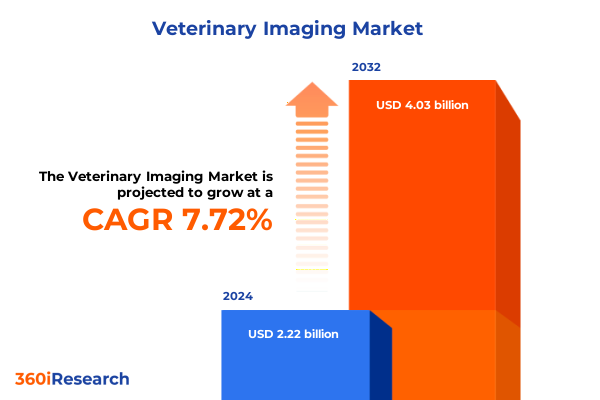

The Veterinary Imaging Market size was estimated at USD 2.33 billion in 2025 and expected to reach USD 2.49 billion in 2026, at a CAGR of 7.28% to reach USD 3.81 billion by 2032.

Exploring the Expanding Role of Advanced Imaging Technologies in Modern Veterinary Practice with Data-Driven Insights Shaping Next-Generation Diagnostics

Modern veterinary practice is increasingly reliant on advanced imaging modalities to enhance diagnostic precision and treatment outcomes. As the complexity of animal health conditions grows, clinicians are turning to cross-sectional imaging techniques that deliver detailed anatomical and functional insights. Computed tomography in particular has revolutionized diagnostic workflows by providing three-dimensional views of musculoskeletal, neurological, and oncological conditions, enabling veterinarians to make more informed clinical decisions and plan targeted interventions with greater confidence.

Simultaneously, the integration of artificial intelligence into image reconstruction and analysis is streamlining interpretation and accelerating time to diagnosis. AI-enhanced algorithms can automatically detect anomalies, quantify lesion volumes, and suggest differential diagnoses, reducing the burden on radiologists and improving consistency in reporting. Portable ultrasound and mobile radiography systems are also democratizing access to imaging by allowing real-time bedside assessments, which fosters early intervention and continuous monitoring of critical cases.

Moreover, emerging technologies like photon-counting CT systems are setting new standards for spatial resolution and radiation dose reduction. Early adopters in academic referral centers have demonstrated sub-millimeter imaging capabilities that optimize soft-tissue contrast for intricate surgical planning. These innovations, coupled with secure cloud-based image management platforms, are forming a robust data ecosystem that supports longitudinal case tracking and collaborative consultations across distributed care networks.

Uncovering the Transformational Shifts in Veterinary Imaging Enabled by AI Innovations and Portable Diagnostic Solutions Driving Clinical Efficiency

The veterinary imaging landscape is undergoing a profound transformation driven by advancements in hardware miniaturization, software intelligence, and workflow optimization. Artificial intelligence has moved from research prototypes to clinical applications, where machine learning models automatically highlight areas of interest on radiographs and cross-sectional scans, freeing clinicians to focus on patient care. This shift elevates diagnostic accuracy, particularly in identifying subtle pathologies that may be easily overlooked during manual review.

At the same time, low-dose X-ray systems equipped with digital detectors are addressing safety concerns by minimizing radiation exposure for both animal patients and veterinary staff. These systems often incorporate AI-driven noise reduction to preserve image clarity at reduced dose levels. Portable ultrasound devices with wireless connectivity are enabling veterinarians to perform immediate abdominal and cardiac scans in field settings, thereby broadening the scope of point-of-care diagnostics and reducing time delays associated with centralized imaging suites.

Photon-counting computed tomography has further raised the bar for image quality, delivering unparalleled contrast resolution that improves lesion characterization in oncology and neurology cases. Early industry deployments have demonstrated significant gains in diagnostic confidence, with detailed visualization of vascular structures and bone microarchitecture. These technological leaps are fostering a more proactive and personalized approach to veterinary care, where early detection and targeted treatment pathways can be pursued with greater speed and precision.

Analyzing the Comprehensive Impact of United States Tariffs on Veterinary Imaging Equipment Supply Chains and Cost Structures in 2025

The legacy of U.S. tariff policies continues to reverberate through the veterinary imaging industry, affecting equipment pricing, procurement strategies, and supply chain architecture. Tariffs imposed on imported imaging components have increased the landed cost of key hardware elements, including superconducting magnets for MRI and detectors for CT systems. Industry reports highlight cost escalations of up to 25% on certain components, prompting many veterinary hospitals to defer system upgrades or explore alternative suppliers outside traditional sourcing corridors.

In addition, tariff rates ranging as high as 65% on specialty electronics sourced from Asia and Europe have further pressured manufacturers to relocate production or reconfigure supply chains. These disruptions manifested in extended lead times-often exceeding 52 weeks for critical hardware-and have made forecasting capital expenditures more challenging for veterinary practices balancing tight budgets and evolving clinical needs.

Amid these headwinds, stakeholders are increasingly adopting strategies to mitigate cost inflation and logistical bottlenecks. Collaborative vendor financing programs, strategic stockpiling of consumables, and negotiated multi-year purchase agreements are emerging as practical approaches to stabilize equipment availability and manage total cost of ownership. These adaptations underscore the industry’s resilience and ongoing commitment to maintaining diagnostic standards despite macroeconomic uncertainties.

Revealing Key Segmentation Insights Across Imaging Modalities Animal Types End Users Product Types and Sales Channels Informing Market Opportunities

Dissecting the market through the lens of segmentation reveals nuanced dynamics that inform strategic decision-making. When examining imaging modalities, computed tomography stands out for its rapid adoption in specialty clinics, with multi-slice systems favored for complex orthopedic and neurological applications, while single-slice units are leveraged for routine screenings and mobile services. Endoscopy is bifurcated between flexible instruments-preferred for minimally invasive gastrointestinal procedures-and rigid systems that offer superior image stability in arthroscopic interventions.

Animal type segmentation highlights divergent demand patterns across species. Small animal practices, particularly those focusing on canine and feline care, account for the bulk of imaging utilization due to higher clinic visit frequencies and established reimbursement frameworks. Meanwhile, specialty centers serving equine patients invest in large-format CT gantries for detailed limb imaging, and exotic animal facilities increasingly rely on high-field MRI to navigate the unique anatomical challenges of avian and reptile patients.

End users span diagnostic laboratories seeking high-throughput batch processing of radiographs to research institutes employing advanced MRI for translational studies. Veterinary hospitals and clinics invest in modular hardware-software bundles that balance capital outlay with clinical utility. Product type segmentation further differentiates demand between hardware-such as CT, MRI, ultrasound, and radiography systems-and software solutions encompassing three-dimensional reconstruction tools, picture archiving and communication systems, and workflow management platforms. Finally, sales channels across direct vendor engagements and distributor networks shape purchasing experiences, with global distributors enabling multinational chains to maintain consistency and local distributors offering tailored support to regional practices.

This comprehensive research report categorizes the Veterinary Imaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Imaging Modality

- Animal Type

- Component

- End User

- Sales Channel

- Clinical Application

Illuminating Regional Dynamics in Veterinary Imaging Across the Americas EMEA and Asia-Pacific Highlighting Diverse Market Drivers and Adoption Trends

Regional markets display distinct characteristics driven by regulatory environments, clinical infrastructure, and animal healthcare priorities. In the Americas, robust private veterinary sectors and mature pet insurance ecosystems support widespread adoption of both fixed and portable imaging equipment. The United States, in particular, remains the epicenter of innovation, hosting leading technology developers and referral centers that pilot novel modalities and AI-enabled platforms.

Across Europe, the Middle East, and Africa, diverse healthcare systems and varied pet ownership densities create a complex tapestry of demand. Western Europe demonstrates high penetration of advanced imaging modalities in specialized clinics, while emerging markets in Eastern Europe and the Gulf Cooperation Council are experiencing rapid growth fueled by rising disposable incomes and increased investments in veterinary infrastructure. Regulatory harmonization efforts across the European Union have also streamlined device approvals, facilitating cross-border expansion of imaging service providers.

Asia-Pacific presents a dynamic growth frontier, underpinned by expanding livestock operations in China and India and burgeoning companion animal markets in Australia and Southeast Asia. Governmental initiatives directed at rural disease surveillance and livestock health management, supported by funding for portable X-ray units and point-of-care ultrasound, are broadening access to diagnostic imaging in previously underserved regions.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Imaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Movements of Leading Companies in Veterinary Imaging Through Partnerships Innovations and Competitive Positioning

Leading companies in the veterinary imaging sphere are deploying multifaceted strategies to fortify their market positions and capture emerging opportunities. IDEXX Laboratories has expanded its portfolio through targeted acquisitions and strategic alliances that integrate digital radiography solutions with cloud-based case management platforms. GE HealthCare leverages its global manufacturing scale to introduce modular CT and MRI systems optimized for veterinary workflows, while Fujifilm has invested heavily in AI-driven software modules that enhance image reconstruction and lesion detection.

Specialized suppliers such as Hallmarq Veterinary Imaging and Esaote are focusing on high-field MRI and dedicated equine CT systems, catering to referral hospitals with demanding imaging requirements. Mindray and Canon Medical Systems are capitalizing on the cost-performance sweet spot by delivering portable ultrasound and digital radiography devices that meet the needs of small-animal clinics and mobile service providers. Collaborations between hardware manufacturers and software innovators are also on the rise, exemplified by joint ventures that embed workflow software into next-generation imaging suites, thereby streamlining data management and remote consultation capabilities.

Mergers, joint research initiatives, and co-development agreements are further shaping competitive dynamics as companies seek to differentiate through integrated ecosystems that combine hardware, software, and diagnostics services. This strategic realignment underscores a broader industry trend toward end-to-end solutions designed to deliver clinical value, operational efficiency, and sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Imaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- IDEXX Laboratories, Inc.

- GE Healthcare

- Canon Inc.

- Fujifilm Holdings Corporation

- Siemens Healthineers

- Esaote S.p.A.

- Carestream Health, Inc.

- Shimadzu Corporation

- Agfa-Gevaert Group

- BioChek B.V.

- BMV MEDTECH GROUP CO., LTD.

- Chison Medical Technologies Co., Ltd.

- Clarius Mobile Health Corp.

- Covetrus, Inc.

- DRAMIŃSKI S. A.

- E.I. Medical Imaging

- Edan Instruments, Inc.

- Epica Medical Innovations Inc.

- Hallmarq Veterinary Imaging

- Heska Corporation by Mars, Incorporated

- IM3 Inc.

- IMV Imaging (UK) Ltd.

- Interson Corporation

- Leltek Inc.

- Lepu Medical Technology (Beijing) Co., Ltd.

- Merck KGaA

- MinXray, Inc.

- Narang Medical Limited

- Probo Medical

- Promed Technology Co., Ltd.

- ReproScan

- Samsung Electronics Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- SonoScape Medical Corp.

- Thermo Fisher Scientific, Inc.

- Vet Rocket, Inc.

- Zoetis, Inc.

Providing Actionable Recommendations for Industry Leaders to Capitalize on Technological Advances Supply Chain Resilience and Emerging Market Opportunities

To remain agile and competitive, industry leaders should prioritize investments in AI-centric research and development, accelerating the translation of machine learning models into validated clinical tools. Establishing dedicated centers of excellence for AI-driven radiology can foster closer collaboration between engineering teams and veterinary specialists, enabling rapid iteration and deployment of advanced diagnostic algorithms.

Simultaneously, diversifying supply chains by qualifying alternate component suppliers and regional manufacturing partners will mitigate the impact of tariff volatility and semiconductor shortages. Developing strategic inventory management frameworks and multi-tiered procurement agreements can help stabilize lead times and control capital expenditures amid shifting trade policies.

Engaging with veterinary professional associations and academic institutions to co-create training programs on new imaging modalities and software platforms will cultivate the end-user expertise necessary for full adoption. Additionally, forging partnerships with pet insurance providers to incorporate imaging procedures into coverage plans can expand the addressable market and promote preventive care adoption. Lastly, evaluating emerging markets through targeted pilot initiatives will uncover high-growth corridors in Asia-Pacific and EMEA, positioning organizations to scale operations as demand accelerates.

Detailing Rigorous Research Methodology Integrating Primary Interviews Secondary Data Validation and Robust Analytical Frameworks for Market Insights

This analysis is underpinned by a comprehensive research framework that integrates both primary and secondary data sources. Primary research involved in-depth interviews with key opinion leaders, including veterinary radiologists, clinic administrators, and technology executives. These conversations provided qualitative insights into adoption barriers, clinical workflows, and investment priorities.

Secondary research encompassed a thorough review of industry publications, regulatory filings, patent databases, and academic journals. Market dynamics were further validated through cross-referencing corporate annual reports, trade association releases, and technology vendor whitepapers. Publicly available data from government agencies was leveraged to understand broader healthcare funding trends and regulatory shifts affecting veterinary diagnostics.

Quantitative data modeling employed a bottom-up approach, aggregating unit shipment data, installed base estimates, and average selling prices across equipment categories. This was complemented by scenario analysis to assess the resilience of supply chains under varying tariff and geopolitical conditions. The segmentation framework was rigorously applied to ensure that modality, animal type, end-user, product type, and sales channel perspectives are fully integrated into the strategic insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Imaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Imaging Market, by Imaging Modality

- Veterinary Imaging Market, by Animal Type

- Veterinary Imaging Market, by Component

- Veterinary Imaging Market, by End User

- Veterinary Imaging Market, by Sales Channel

- Veterinary Imaging Market, by Clinical Application

- Veterinary Imaging Market, by Region

- Veterinary Imaging Market, by Group

- Veterinary Imaging Market, by Country

- United States Veterinary Imaging Market

- China Veterinary Imaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Perspectives on the Future Trajectory of Veterinary Imaging Underpinned by Innovation Collaboration and Evolving Industry Dynamics

The veterinary imaging sector stands at a pivotal juncture where technological innovation, regulatory shifts, and evolving care models converge to redefine diagnostic capabilities. Continued investments in AI and advanced detector materials promise to enhance image quality while minimizing patient exposure, thereby supporting more refined clinical decision-making.

Meanwhile, the strategic responses to tariff pressures and supply chain constraints highlight the industry’s adaptability, as stakeholders pursue diversified sourcing strategies and collaborative procurement models. These developments underscore the importance of resilience in maintaining uninterrupted access to critical diagnostic tools.

Looking ahead, the interplay between emerging market expansion and regional healthcare initiatives will drive new growth vectors, particularly in Asia-Pacific and parts of EMEA. Organizations that proactively align product portfolios with species-specific needs and leverage partnerships to deliver end-to-end solutions will capture disproportionate value. Ultimately, the trajectory of veterinary imaging will be shaped by the collective efforts of technology innovators, clinical practitioners, and policy-makers working in concert to elevate standards of animal care.

Engaging with Associate Director Ketan Rohom to Access Comprehensive Veterinary Imaging Market Research Report and Drive Strategic Growth Initiatives

To embark on a deeper exploration of veterinary imaging trends and secure a strategic advantage, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to procure the full market research report. Engaging with Ketan will grant you unparalleled visibility into emerging technologies, competitive landscapes, and actionable insights tailored to your organization’s priorities.

Ketan will guide you through the report’s comprehensive findings, connect you with expert analysts for any queries, and outline customized solutions to address your unique challenges. By partnering with him, you will gain the intelligence needed to inform product development strategies, optimize go-to-market plans, and strengthen stakeholder confidence.

Take the step today to ensure your organization remains at the forefront of veterinary imaging innovation. Contact Ketan Rohom to request access to the detailed report, clarify your specific requirements, and initiate a dialogue on how these insights can catalyze your growth plans.

- How big is the Veterinary Imaging Market?

- What is the Veterinary Imaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?