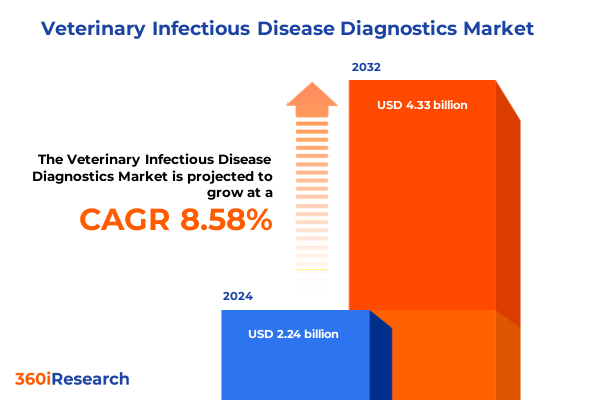

The Veterinary Infectious Disease Diagnostics Market size was estimated at USD 2.42 billion in 2025 and expected to reach USD 2.62 billion in 2026, at a CAGR of 8.65% to reach USD 4.33 billion by 2032.

Understanding the Evolving Landscape of Veterinary Infectious Disease Diagnostics and Its Strategic Importance for Diagnostics Providers and Animal Health Stakeholders

The realm of veterinary infectious disease diagnostics is undergoing a profound transformation driven by the increasing recognition of disease surveillance as a cornerstone of animal health management. Effective diagnostics serve not only to safeguard the welfare of companion animals and livestock, but also to mitigate zoonotic risks that can impact public health. As ecosystems become more interconnected and the movement of animals accelerates globally, the demand for rapid, accurate, and cost-effective diagnostic solutions has intensified. In parallel, regulatory bodies have tightened their scrutiny of diagnostic performance, emphasizing validation protocols and quality assurance measures to ensure reliable detection of bacterial, fungal, parasitic, and viral pathogens.

Moreover, shifts in stakeholder expectations have prompted diagnostic providers to integrate advanced technologies such as molecular assays, immunodiagnostics, and digital data platforms into traditional workflows. Veterinary hospitals and clinics now anticipate streamlined operations that facilitate point-of-care testing, while research laboratories demand high-throughput capabilities that can accommodate expansive studies. This introduction sets the stage for an exploration of how these evolving requirements are reshaping the competitive landscape, driving innovation adoption, and redefining strategic priorities across the diagnostics value chain.

Identifying Key Transformative Shifts Driving Innovation Adoption and Operational Resilience in Veterinary Infectious Disease Diagnostics Sector

In recent years, transformative forces have converged to recalibrate the veterinary infectious disease diagnostics arena, propelling the integration of molecular methodologies and digital intelligence into established platforms. Foremost among these shifts is the ascendancy of real-time polymerase chain reaction and next-generation sequencing technologies, which have elevated sensitivity thresholds and accelerated pathogen identification timelines. Consequently, decision-makers are prioritizing the adoption of assays that combine multiplex capabilities with minimal sample preparation, thereby reducing time to actionable results and enhancing operational throughput.

Simultaneously, the proliferation of cloud-based analytics and artificial intelligence frameworks is enabling predictive modelling of disease outbreaks and customized treatment regimens. By harnessing large datasets from in-house testing facilities and veterinary hospitals, software solutions are delivering deeper insights into epidemiological trends and facilitating remote diagnostics at the point of care. As a result, strategic investments are increasingly funneled toward integrated hardware-software ecosystems that support seamless data exchange and robust cybersecurity protocols.

Finally, decentralization has emerged as a crucial paradigm, driven by demand from pet owners, animal shelters, and rural practitioners for accessible, user-friendly test kits. This shift has spurred partnerships between established instrument manufacturers and reagent specialists to develop portable platforms that maintain laboratory-grade performance. Collectively, these transformative shifts underscore the critical need for agility and collaboration across the diagnostics landscape.

Evaluating the Collective Implications of Recent United States Tariff Policies on Veterinary Infectious Disease Diagnostic Practices and Technology Supply Chains

The cumulative impact of United States tariff policies enacted in 2025 has introduced a new dimension of complexity for stakeholders involved in the procurement and distribution of veterinary infectious disease diagnostics. In particular, increased duties on imported molecular reagents and specialized analyzers have elevated the cost base for clinical chemistry and molecular diagnostic analyzers, prompting supply chain managers to reevaluate vendor partnerships and sourcing strategies. As manufacturers encounter higher input costs, strategic sourcing from domestic suppliers has become a priority to preserve profitability and maintain uninterrupted access to critical consumables.

Moreover, tariff-induced price pressures have incentivized equipment leasing and service-based arrangements, allowing veterinary hospitals and research laboratories to mitigate upfront capital expenditures. Regulatory authorities and industry associations have responded by streamlining approval pathways for domestically produced reagents, accelerating market access and fostering a more resilient local manufacturing ecosystem. Consequently, stakeholders are navigating a dual imperative: balancing the benefits of global innovation with the imperative to bolster regional production capabilities.

Looking ahead, proactive collaboration among policymakers, trade organizations, and diagnostics providers will be essential to stabilize supply chains, ensure availability of high-performance test kits, and preserve competitive pricing. By aligning procurement policies with strategic investments in domestic production and by leveraging tariff exclusions where feasible, industry participants can offset the adverse effects of these policy shifts and maintain continuity of diagnostic services.

Deriving Actionable Insights from Disease Category Product Offering Animal Type and End Use Segmentation to Inform Strategic Positioning in Diagnostics

A nuanced examination of segmentation reveals critical insights into the drivers of adoption and resource allocation within veterinary infectious disease diagnostics. When analyzed by disease category, demand for viral detection assays often leads the spectrum, owing to the rapid transmissibility and zoonotic potential of many viral pathogens. Equally, bacterial diagnostic platforms retain significance, particularly in the context of antimicrobial stewardship programs aimed at curbing resistance. Fungal and parasitic diagnostics, while representing smaller volumes, command specialized workflows that underscore the need for tailored reagent formulations and instrument calibration.

Turning to the product dimension, consumables-spanning reagents and test kits-continue to be the backbone of diagnostic operations due to their recurring consumption profile. In contrast, instruments and analyzers, such as clinical chemistry and hematology analyzers alongside immunodiagnostic and molecular diagnostic platforms, require higher initial investment but drive long-term differentiation through advanced capabilities. Accordingly, procurement strategies balance capital allocations between high-throughput machinery and consistent consumable supply to optimize both capacity and economic efficiency.

Moreover, the offering segmentation, encompassing hardware, services, and software, highlights the strategic value of integrated solutions. Hardware remains fundamental, yet services such as preventive maintenance and training have risen in prominence, ensuring optimal uptime and user proficiency. Simultaneously, software platforms for data management and remote diagnostics are enabling more seamless laboratory-clinic connectivity, enhancing both workflow transparency and decision support.

Analyzing animal type segmentation underscores a bifurcation between companion and production animals. While companion animals, particularly cats and dogs, represent a robust segment for routine testing applications, livestock diagnostics for cattle, goats, poultry, sheep, and swine prioritize herd health monitoring and early outbreak detection. This dichotomy extends to end-use environments, where veterinary hospitals and clinics dominate diagnostic volume, research laboratories drive innovation, and in-house testing facilities-including animal shelters and pet owners-seek rapid, user-friendly assays for immediate intervention.

This comprehensive research report categorizes the Veterinary Infectious Disease Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Disease Category

- Product

- Offering

- Animal Type

- End Use

Analyzing Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Patterns and Strategic Opportunities

Regional dynamics in veterinary infectious disease diagnostics are shaped by distinct factors across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, established animal health infrastructures, coupled with widespread veterinary clinic networks and comprehensive research initiatives, underpin high adoption rates for advanced diagnostic platforms. The prevalence of point-of-care testing in companion animals, supported by large-scale adoption of software-enabled data analytics, exemplifies the region’s inclination toward technology-driven solutions.

In the Europe Middle East & Africa region, regulatory harmonization efforts and coordinated disease surveillance programs have fostered cross-border collaboration and standardized diagnostic protocols. Public health agencies and industry consortia are working in concert to address emerging threats, driving demand for multiplex assays and integrated laboratory information management systems. At the same time, capacity constraints in certain markets within the region underscore the need for scalable, cost-effective offerings that can be deployed in both urban veterinary centers and rural diagnostic outposts.

The Asia-Pacific landscape is characterized by rapid expansion driven by rising pet ownership, intensifying livestock production, and governmental initiatives to strengthen food security. Emerging economies are witnessing accelerated investments in diagnostic infrastructure and domestic reagent manufacturing, influenced by prior experiences with zoonotic outbreaks. Consequently, a dual market structure has emerged, with metropolitan areas embracing sophisticated molecular platforms while tier-2 and tier-3 markets adopt portable test kits and point-of-care analyzers to expand diagnostic access.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Infectious Disease Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Organizations Advancing Veterinary Infectious Disease Diagnostics through Innovation Collaboration and Strategic Partnerships

Leading companies in veterinary infectious disease diagnostics are distinguishing themselves through targeted innovation, strategic partnerships, and portfolio expansion. Some have prioritized the development of highly multiplexed molecular assays that can detect a broad spectrum of pathogens within a single workflow, thereby addressing the growing demand for comprehensive panels. Others have forged alliances with data-analytics providers to integrate machine learning algorithms into diagnostic software, offering advanced insights into epidemiological patterns and predictive risk assessments.

Simultaneously, several organizations are expanding their footprint in emerging geographies by establishing local manufacturing facilities and distribution partnerships. These efforts not only mitigate tariff-related cost challenges but also align with regulatory requirements for domestic production and quality control. In addition, a number of diagnostic suppliers have enhanced their service portfolios to include remote installation support, virtual training modules, and subscription-based maintenance offerings, enabling end-users to maximize instrument uptime and proficiency.

Further distinguishing the competitive landscape, select players are investing in research collaborations with academic institutions and veterinary research centers to co-develop next-generation sequencing-based workflows. These partnerships are aimed at accelerating assay validation processes and ensuring broad applicability across both companion animal and livestock testing scenarios. Collectively, these strategic moves underscore the importance of an ecosystem approach-combining cutting-edge reagents, robust instruments, and advanced data tools-to secure leadership in a rapidly evolving diagnostics market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Infectious Disease Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrolabo S.p.A.

- Antech Diagnostics, Inc.

- Bio-Rad Laboratories, Inc.

- Biogal Galed Labs

- BioMérieux S.A.

- BioNote, Inc.

- Demeditec Diagnostics GmbH

- DEXX Laboratories Inc.

- Eurofins Technologies

- Fassisi GmbH

- FUJIFILM Holdings Corporation

- IDEXX Laboratories, Inc.

- IDvet

- Mars, Incorporated

- Merck & Co., Inc.

- Neogen Corporation

- Nisseiken Co., Ltd

- Qiagen N.V.

- Randox Laboratories, Ltd.

- Shenzhen Bioeasy Biotechnology Co., Ltd.

- Shenzhen Mindray Animal Medical Technology Co., Ltd.

- SKYER, Inc.

- Skyla Corporation

- Thermo Fisher Scientific Inc.

- Vimian Group AB

- Virbac S.A.

- Zoetis Inc.

Formulating Actionable Recommendations to Enhance Competitive Advantage and Drive Sustainable Growth in the Veterinary Infectious Disease Diagnostics Industry

To reinforce competitive positioning and capitalize on evolving opportunities, industry leaders should prioritize a suite of strategic initiatives across technology development, operational optimization, and market engagement. First, investing in modular molecular platforms that support seamless expansion of assay portfolios will enable organizations to rapidly respond to emerging pathogens while leveraging existing hardware investments. Enhancing reagent chemistry to boost assay sensitivity and stability will further differentiate offerings and foster customer loyalty.

In parallel, establishing diversified supply chains through dual-sourcing arrangements and localized manufacturing can mitigate tariff impacts and reduce lead times for critical consumables. Cultivating strategic alliances with software developers will also be essential to deliver integrated digital ecosystems that support real-time data analysis, remote diagnostics, and compliance reporting. These partnerships can extend to collaborations with cloud infrastructure providers to ensure robust cybersecurity and scalable storage solutions.

Moreover, organizations should expand their service commitments by deploying virtual training platforms, preventive maintenance agreements, and performance-based contracts that align customer outcomes with service levels. From a market engagement perspective, targeted pilot programs with veterinary hospitals, animal shelters, and research institutions can validate new technologies under real-world conditions and accelerate adoption curves. Finally, forging relationships with regulatory bodies and industry consortia will facilitate early alignment on validation standards and expedite market entry for innovative tests.

Outlining Rigorous Methodological Approaches Employed to Ensure Robust Data Integrity and Analytical Transparency in Diagnostic Market Research

A rigorous research methodology underpins the credibility and depth of the analysis presented in this executive summary. Primary data was gathered through structured interviews with veterinary diagnosticians, laboratory directors, and industry executives, ensuring firsthand insights into operational challenges, technology adoption, and procurement strategies. These qualitative inputs were complemented by surveys of end-user segments, spanning animal hospitals, research laboratories, and in-house testing facilities, to capture a broad spectrum of use-case scenarios.

Secondary research formed a foundational layer, encompassing peer-reviewed journals, government publications, and white papers from animal health associations to validate technological trends, regulatory developments, and disease prevalence data. Data triangulation was applied to cross-verify findings, enhancing analytical rigour and minimizing bias. To further bolster reliability, an expert advisory panel provided peer review at key milestones, offering feedback on segmentation frameworks, thematic categorization, and strategic recommendations.

Additionally, stringent data-quality protocols were enforced, including consistency checks, outlier analysis, and methodological audits, in accordance with industry best practices. Ethical considerations were observed throughout, with anonymized treatment of proprietary performance data and adherence to confidentiality agreements. This multi-layered approach ensures that the insights and conclusions drawn are both robust and actionable for decision-makers seeking to navigate the complexities of the veterinary infectious disease diagnostics landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Infectious Disease Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Infectious Disease Diagnostics Market, by Disease Category

- Veterinary Infectious Disease Diagnostics Market, by Product

- Veterinary Infectious Disease Diagnostics Market, by Offering

- Veterinary Infectious Disease Diagnostics Market, by Animal Type

- Veterinary Infectious Disease Diagnostics Market, by End Use

- Veterinary Infectious Disease Diagnostics Market, by Region

- Veterinary Infectious Disease Diagnostics Market, by Group

- Veterinary Infectious Disease Diagnostics Market, by Country

- United States Veterinary Infectious Disease Diagnostics Market

- China Veterinary Infectious Disease Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Observations Emphasizing Strategic Takeaways and Future Considerations for Veterinary Infectious Disease Diagnostics Stakeholders and Investors

In conclusion, the veterinary infectious disease diagnostics field is at an inflection point, characterized by rapid technological advancement, shifting regulatory landscapes, and evolving stakeholder expectations. Strategic agility, underpinned by robust diagnostic platforms and integrated data intelligence, will be paramount for organizations seeking to drive value and enhance animal health outcomes. By leveraging insights from disease category, product, offering, animal type, and end-use segmentation, stakeholders can customize their approaches to meet distinct market needs and operational imperatives.

Moreover, regional nuances-from the advanced infrastructures of the Americas to the harmonized regulatory frameworks of EMEA and the dynamic expansion of Asia-Pacific-demand tailored strategies that balance global innovation with local execution. Companies that embrace collaborative partnerships, prioritize supply chain resilience, and invest in modular, software-connected solutions are best positioned to navigate tariff constraints and seize emerging opportunities.

Ultimately, the synthesis of rigorous research, strategic investment, and operational excellence will define leadership in the veterinary infectious disease diagnostics sector. Organizations that integrate comprehensive diagnostics offerings with scalable services and predictive analytics will not only enhance disease management capabilities but also secure long-term competitive advantage in a rapidly evolving market.

Encouraging Strategic Engagement with Associate Director of Sales and Marketing to Secure Comprehensive Veterinary Diagnostics Insights Report for Informed Decisions

For a deeper exploration of these insights and to access the comprehensive veterinary infectious disease diagnostics report that offers strategic clarity, tailored analysis, and in-depth evaluations, please reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Engaging with this report will equip your organization with actionable intelligence, expert guidance on emerging technologies, and a clear roadmap for navigating market complexities with confidence. Secure your copy today to unlock a wealth of curated data, best-practice frameworks, and personalized support that will empower you to make informed decisions and stay ahead of competitive and regulatory shifts

- How big is the Veterinary Infectious Disease Diagnostics Market?

- What is the Veterinary Infectious Disease Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?