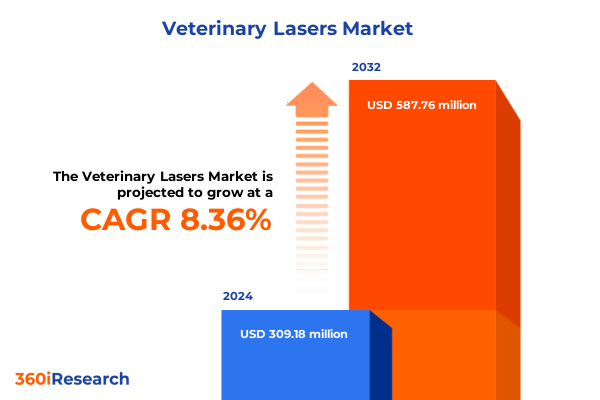

The Veterinary Lasers Market size was estimated at USD 333.75 million in 2025 and expected to reach USD 361.99 million in 2026, at a CAGR of 8.42% to reach USD 587.76 million by 2032.

Innovative Veterinary Laser Technologies Are Redefining Animal Healthcare through Enhanced Precision, Noninvasive Procedures, and Therapeutic Efficacy

Veterinary laser technology has emerged as a pivotal innovation within animal healthcare, reshaping how practitioners approach diagnostics, therapies, and surgical interventions. Over recent years, continuous advancements in both hardware engineering and software integration have escalated the capabilities of laser-based treatments. Clinics and hospitals now leverage enhanced precision to target specific tissues, minimizing collateral damage and accelerating recovery trajectories for companion, equine, and livestock animals alike. Moreover, the noninvasive nature of certain low-power laser therapies has catalyzed broader acceptance among both veterinarians and pet owners, as these treatments offer pain relief, improved wound healing, and reduced reliance on pharmaceuticals.

As the industry moves forward, pulsed lasers and continuous wave systems each contribute unique advantages. Pulsed lasers deliver high-intensity bursts ideal for coagulation and tumor ablation, whereas continuous wave devices support applications such as soft tissue surgery and chronic pain management. This technological duality provides a nuanced toolkit for veterinary professionals aiming to customize patient care. Furthermore, advancements in user interfaces and portable system design have enhanced usability in field settings and mobile clinics, enabling practitioners to extend services into remote locations. Consequently, veterinary laser technology is not just an incremental improvement but a transformative force redefining standards of care across diverse animal types.

Emerging Trends and Transformative Shifts in Veterinary Laser Applications Driving Breakthroughs Across Treatment Modalities and Clinical Outcomes

The veterinary laser landscape is undergoing sweeping transformations driven by innovation, regulatory evolution, and shifting clinical priorities. First, the integration of artificial intelligence and imaging modalities has elevated diagnostic precision, enabling practitioners to delineate treatment zones with unprecedented accuracy. As a result, procedures that once required extensive surgical intervention can now be accomplished with minimal incisions or in a completely noninvasive manner. Furthermore, the advent of tunable wavelength lasers permits customization across dermatological, oncological, and orthopedic therapies, allowing clinicians to calibrate parameters to individual patients’ physiological needs.

Concurrently, the rise of telemedicine and remote monitoring solutions has extended the reach of laser-based treatments. Platforms that transmit real-time data on patient responses not only optimize dosage protocols but also foster collaborative care models. These developments coincide with a growing emphasis on regenerative veterinary medicine, where low-level laser therapy (LLLT) is being investigated for its potential to stimulate cell proliferation and tissue regeneration. Additionally, manufacturers are prioritizing ergonomic design and modular architectures, facilitating scalability and component upgrades. Taken together, these shifts underscore a move toward precision-driven, data-centric, and patient-focused veterinary care that leverages lasers as a cornerstone technology.

Comprehensive Analysis of How United States Tariff Policies in 2025 Are Altering the Cost Structures and Supply Chains for Veterinary Laser Equipment

In 2025, a significant recalibration of United States tariff policies has introduced new cost dynamics for veterinary laser manufacturers and end users. Under revised tariff schedules, certain laser equipment and optical components imported from key manufacturing hubs now incur additional duties, reshaping supply chain decisions and prompting strategic sourcing adjustments. Consequently, some vendors have explored nearshoring select production stages to mitigate exposure to import levies and preserve price competitiveness. These cost pressures have rippled through distribution channels, influencing equipment selection criteria among veterinary hospitals, clinics, and academic research institutes.

Moreover, the tariff environment has driven innovation in domestic manufacturing capabilities. Companies have accelerated investments in local production of optical coatings, diode assemblies, and control electronics to circumvent elevated duties. This localization trend has benefitted end users by shortening lead times and reinforcing quality assurance processes, albeit at the expense of initial capital expenditures. At the same time, service providers have had to revisit maintenance agreements and spare part inventories, adjusting service-level commitments to account for extended replacement timelines. The collective impact underscores an industry in flux, where trade policy not only dictates cost structures but also catalyzes operational realignment and resilience strategies.

Critical Segmentation Insights Revealing How Distinct Technological and Application-Based Categories Drive Diverse Veterinary Laser Market Dynamics

A nuanced understanding of veterinary laser market segmentation reveals how diverse technological attributes and end use cases shape adoption patterns. Based on technology, continuous wave lasers deliver a steady beam ideally suited for soft tissue surgery and thermal decomposition, whereas pulsed lasers provide high-intensity bursts optimal for coagulation and targeted oncological interventions. Shifting to power range, high power Class 4 systems dominate surgical suites where deep tissue access is required, while low power Class 1 and 2 lasers find favor in pain management and wound healing applications; medium power Class 3 devices bridge these use cases, offering sufficient energy for more complex treatment without the infrastructure demands of higher-power equipment.

Delving deeper, treatment type segmentation underscores distinct clinical priorities. Dermatological procedures leverage specific wavelengths for lesion removal and skin rejuvenation. Oncological applications bifurcate into cancer therapy protocols, which combine lasers with photodynamic agents, and tumor removal treatments that prioritize precision ablation. Orthopedic applications, meanwhile, focus on musculoskeletal rehabilitation, addressing inflammation and joint recovery. Distribution channel dynamics further influence market reach, with offline channels maintaining strong clinical penetration through direct sales and service contracts, while online channels cater to smaller practices and remote providers seeking flexible procurement options. Application-based segmentation highlights key functions, from pain alleviation and soft tissue surgery to thermal decomposition processes and enhanced wound healing. When viewing the ecosystem through an end user lens, academic and research institutes drive early-stage innovation and protocol validation, clinics prioritize cost-effective, versatile systems for routine interventions, and veterinary hospitals demand high-throughput solutions with robust service networks. Finally, animal type segmentation illustrates tailored system requirements: companion animal clinicians address diverse species such as birds, cats, and dogs with portable, user-friendly lasers; equine specialists require devices capable of penetrating substantial tissue depths; and livestock animal operations, including cattle, goats, pigs, and sheep, balance throughput with efficacy to support herd health management. Together, these segmentation insights inform strategic decisions around product development, marketing focus, and service alignment within the veterinary laser arena.

This comprehensive research report categorizes the Veterinary Lasers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Power Range

- Treatment Type

- Distribution Channel

- Application

- End User

- Animal Type

Strategic Regional Insights Highlighting How Geographic Variations Shape Adoption, Regulatory Environments, and Growth Trajectories in Veterinary Laser Usage

Geographic factors play a pivotal role in shaping veterinary laser adoption, as each region exhibits unique regulatory landscapes, clinical paradigms, and economic considerations. In the Americas, established veterinary infrastructure in North America supports widespread integration of advanced laser systems, underpinned by favorable reimbursement frameworks and a high prevalence of companion animals. Clinics and hospitals in the region benefit from mature distribution networks that facilitate training, maintenance, and rapid deployment of new technologies. Transitioning to Latin America, growth is driven by expanding pet ownership and increasing investment in animal health, although economic variability and import regulations can moderate equipment acquisition timelines.

Moving to Europe, Middle East, and Africa, regulatory harmonization under European Union directives has standardized safety certifications, enabling smoother product approvals across member states. As a result, manufacturers leverage this unified framework to introduce innovative laser models with minimal lead time. In the Middle East, government-backed veterinary initiatives and rising equine sports sectors bolster demand for therapeutic and surgical lasers, while in Africa, localized solutions that address livestock health challenges are gaining traction despite infrastructure constraints. Lastly, Asia-Pacific represents a high-growth environment fueled by surging demand for livestock productivity, rising companion animal care standards, and strong import dependency for precision medical devices. Countries such as China, Japan, and Australia exhibit robust research collaborations and conference activities that accelerate knowledge transfer and technology adoption. Collectively, these regional dynamics emphasize the need for tailored market entry strategies, localized service models, and regulatory engagement to ensure success across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Lasers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

In-Depth Company Profiles and Vendor Analyses Unveiling the Leading Innovators and Strategic Partnerships Driving Veterinary Laser Technology Advancements

Within the veterinary laser sector, leading companies distinguish themselves through a blend of research-driven innovation, strategic collaborations, and comprehensive support services. Aesculight, known for its versatile continuous wave laser platforms, has expanded its portfolio to include ergonomic handpieces and integrated imaging modules that streamline surgical workflows. LiteCure has garnered attention for its expertise in low-level laser therapy, deploying scientifically validated protocols that address musculoskeletal conditions and chronic pain, backed by partnerships with academic institutions to refine treatment algorithms.

Summus Medical Laser has targeted oncological use cases, developing pulsed systems with precision beam control and user-friendly interfaces, while Multi Radiance Medical emphasizes portable devices designed for field use, capitalizing on modular power supplies and plug-and-play configurations. El.En Group leverages its global manufacturing footprint to optimize production of diode assemblies and scanning heads, reducing lead times for clinical installations. K-Laser integrates software enhancements that facilitate remote monitoring and data analytics, positioning its platforms at the convergence of telemedicine and point-of-care solutions. BTL Industries has broadened its reach by offering bundled training programs and service subscriptions, ensuring end users maintain high operational uptime. These vendors collectively shape competitive dynamics by balancing product differentiation with scalable support infrastructures, guiding the evolution of veterinary laser offerings worldwide.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Lasers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aesculight LLC

- ASALaser S.r.l.

- Aspen Laser Systems LLC

- Companion Animal Health, Inc.

- Cutting Edge Laser Technologies, Inc.

- Dimed Laser Technology Co., Ltd.

- Eltech K-Laser srl

- Erchonia Corporation

- Excel Lasers Limited

- GIGAAMEDICAL

- Multi Radiance Medical

- OmniLase, Inc.

- Respond Systems, Inc.

- RWD Life Science Co.,LTD

- Shanghai Wonderful Opto-Electrics Co., Ltd.

- SpectraVET Inc.

- Summus Medical Laser LLC

- Sunny Optoelectronic Technology Co., Ltd.

- Swiss & Wegman AG

- Ugo Basile S.p.A.

- VBS Direct Limited

- Wuhan Pioon Technology Co., Ltd.

Actionable Strategic Recommendations Offering Clear Roadmaps for Industry Leaders to Capitalize on Opportunities within the Evolving Veterinary Laser Landscape

Industry leaders seeking to harness the full potential of veterinary laser technologies must adopt a multifaceted strategic approach. First, investing in research and development collaborations with academic and clinical partners will accelerate the validation of new treatment protocols, particularly in emerging areas such as photobiomodulation and regenerative therapies. By forging alliances with veterinary teaching hospitals and research institutes, equipment providers can refine device specifications, demonstrate clinical efficacy, and build a robust evidence base that supports premium positioning.

Moreover, diversifying supply chains through localized production or regional assembly hubs will mitigate risks associated with trade volatility while optimizing logistics. Leaders should also explore strategic alliances with telemedicine platforms to integrate laser therapy data streams into broader diagnostic ecosystems, enhancing patient monitoring and post-treatment follow-up. In parallel, designing flexible service and financing models will accommodate varying clinic sizes, ensuring that small animal practices and mobile veterinary units can access and maintain cutting-edge laser systems. Finally, implementing comprehensive training curricula, both online and in-person, will empower end users, reduce operator error, and foster brand loyalty through sustained clinical outcomes. By combining these strategic elements, industry leaders will strengthen competitive resilience and pave the way for next-generation veterinary laser applications.

Rigorous Research Methodology and Data Collection Processes Underpinning the Comprehensive Analysis of Veterinary Laser Market Dynamics and Insights

This analysis employs a rigorous research methodology that combines secondary data curation and primary market validation to ensure comprehensive coverage of the veterinary laser domain. Secondary research involved a thorough review of peer-reviewed journals, clinical white papers, government trade policy documents, and published conference proceedings. This foundational work informed the identification of key technological trends, regulatory shifts, and competitive landscapes.

Complementing the desk research, primary interviews were conducted with veterinary surgeons, clinical directors, equipment distributors, and technology developers across multiple regions. Insights from these conversations substantiated product feature priorities, adoption barriers, and service expectations. Data triangulation was performed to reconcile information from diverse sources, enhancing the reliability of qualitative findings. Additionally, segmentation frameworks were refined through iterative consultations with subject matter experts, ensuring that technology type, power classification, treatment modality, distribution channel, application, end user, and animal species dimensions accurately reflect real-world market dynamics. The resulting analysis synthesizes these inputs to deliver an authoritative view of the veterinary laser ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Lasers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Lasers Market, by Technology

- Veterinary Lasers Market, by Power Range

- Veterinary Lasers Market, by Treatment Type

- Veterinary Lasers Market, by Distribution Channel

- Veterinary Lasers Market, by Application

- Veterinary Lasers Market, by End User

- Veterinary Lasers Market, by Animal Type

- Veterinary Lasers Market, by Region

- Veterinary Lasers Market, by Group

- Veterinary Lasers Market, by Country

- United States Veterinary Lasers Market

- China Veterinary Lasers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesis of Key Findings and Strategic Imperatives to Elevate Decision-Making and Foster Innovation within the Veterinary Laser Industry

This executive summary has synthesized pivotal developments, policy impacts, and market structures shaping the veterinary laser landscape. Key findings underscore the transformative role of advanced laser modalities across diagnostic and therapeutic applications, the operational adjustments prompted by tariff policy shifts, and the granular segmentation that informs targeted product strategies. Furthermore, regional insights reveal the interplay between regulatory frameworks and clinical adoption rates, illustrating the necessity of bespoke market engagement approaches.

As the industry continues to evolve, stakeholders must remain vigilant to emerging clinical evidence, supply chain innovations, and competitive maneuvers. By aligning technology roadmaps with practitioner needs and regulatory trends, organizations can maintain relevance and foster sustainable growth. In conclusion, the convergence of precision engineering, data-driven protocols, and strategic collaboration sets the stage for a new era in animal healthcare. Decision-makers equipped with these insights are poised to navigate complexities, unlock efficiencies, and deliver enhanced outcomes for veterinary patients worldwide.

Unlock Exclusive Veterinary Laser Market Intelligence Customized to Your Strategic Objectives Reach Out to Ketan Rohom to Acquire Your In-Depth Research Report

Ready to transform your strategic initiatives with unparalleled market insights, you are invited to engage with Ketan Rohom, Associate Director of Sales & Marketing, whose expertise will ensure you access the precise intelligence you need. By partnering with Ketan Rohom, you unlock tailored guidance focused on translating complex data into actionable strategies. Reach out today to secure personalized support and elevate your understanding of the veterinary laser landscape with a comprehensive report designed for your unique objectives.

- How big is the Veterinary Lasers Market?

- What is the Veterinary Lasers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?