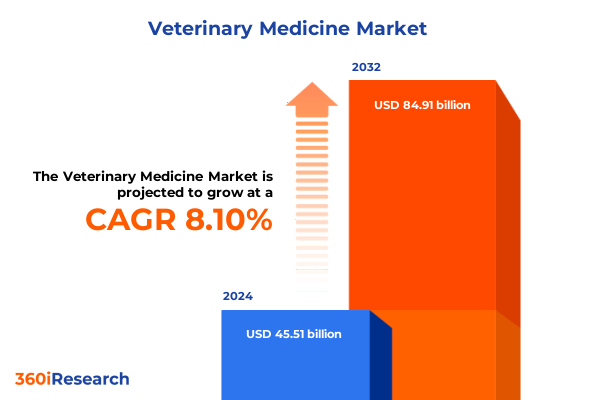

The Veterinary Medicine Market size was estimated at USD 49.10 billion in 2025 and expected to reach USD 52.97 billion in 2026, at a CAGR of 8.13% to reach USD 84.91 billion by 2032.

Exploring the United States veterinary medicine landscape through an executive lens to highlight pivotal trends and strategic imperatives for stakeholders

The veterinary medicine sector in the United States has emerged as a dynamic convergence of science, technology, and compassionate care. As the industry navigates an increasingly complex environment shaped by evolving client expectations, regulatory developments, and supply chain pressures, stakeholders require a distilled, expert analysis to inform critical decisions. This executive summary distills the most consequential developments influencing veterinary practices, animal health product innovation, and service delivery models, offering a strategic vantage point for executives, investors, and practitioners.

In recent years, the integration of telemedicine platforms and artificial intelligence diagnostic tools has accelerated the pace of transformation. Telehealth legislation in select states, such as Michigan’s House Bill 4200, underscores the shift toward virtual consultations for triage and follow-up care under established veterinary relationships. Concurrently, machine learning applications are advancing diagnostic accuracy in imaging and predictive modeling, setting new standards for personalized treatment planning. Against this backdrop, industry leaders must adapt to technological innovations while balancing the relentless drive for efficiency with the highest standards of animal welfare.

Revolutionary shifts redefining veterinary medicine with digital breakthroughs, human-centric care, and emerging technological paradigms driving industry evolution

The veterinary profession is undergoing a profound technological renaissance driven by digital transformation, artificial intelligence, and immersive education tools. Telehealth consultations have quickly evolved from a temporary convenience into a critical service channel, alleviating access constraints caused by practitioner shortages in urban and rural regions alike. Meanwhile, AI-powered diagnostic platforms are enhancing veterinary imaging and scribe automation, allowing clinicians to devote more time to patient care and complex case management. These breakthroughs are redefining the parameters of clinical excellence and operational efficiency.

As pet owners demand more holistic and personalized care, veterinary practices are broadening their service portfolios to include nutrition counseling, behavior therapy, and wellness programs informed by data analytics. Wearable devices and IoT sensors generate continuous streams of health metrics, enabling proactive interventions that reduce chronic disease burden and optimize patient outcomes. Concurrently, the ethical and sustainable operation of clinics is becoming a strategic advantage, with eco-friendly materials and waste reduction initiatives resonating with environmentally conscious clients .

Education and workforce development are also evolving through immersive AR/VR platforms and AI-guided tutoring systems, equipping the next generation of veterinarians with simulated clinical experience and decision support tools before they ever work on live patients. This educational transformation promises to accelerate proficiency while helping address gaps in specialist availability.

Analyzing the ripple effects of recent U.S. tariff policies on veterinary medicine supply chains and operational dynamics across animal health segments

In 2025, the U.S. federal government’s tariff policies have introduced new complexities for veterinary pharmaceutical manufacturers, distributors, and clinical practices. Although finished veterinary drugs are largely exempt from recent tariff lists, the inputs and medical supplies essential to animal health-from raw active pharmaceutical ingredients to syringes and personal protective equipment-face levies as high as 25 percent. This creates cost pressures across the supply chain and necessitates strategic sourcing alternatives.

Distributors operating on thin margins must choose between absorbing incremental costs or passing them through to clinics and pet owners. Even products purchased domestically can carry embedded tariff-related expenses when their ingredients or components were imported before final assembly. Meanwhile, certain raw materials, such as chemical precursors for generic veterinary drugs, remain partially subject to tariffs, underscoring the importance of integrated supply chain visibility and proactive inventory management.

Clinics should anticipate a phased impact. Pre-tariff inventory buffers may delay immediate price adjustments, but as pipelines work through existing stocks, cost increases will materialize. Small practices with limited storage may feel these effects more acutely, while larger corporate chains will have greater capacity to absorb fluctuations. Engaging with suppliers to identify exempt categories and exploring alternative sourcing strategies will be crucial to maintaining stable operations and preserving affordability of patient care.

Uncovering nuanced segmentation layers in veterinary medicine to deepen understanding of market dynamics across species, channels, and therapeutic domains

Veterinary market segmentation offers a multifaceted lens into customer needs and competitive differentiation. Considering animal species, companion animals such as cats and dogs drive high-margin diagnostics and therapeutics, whereas livestock operations prioritize mass-scale production, cost-effective medicated feed additives, and vaccine programs tailored to cattle, poultry, and swine. Equine health, while smaller in volume, demands specialized biologics and premium pharmaceuticals that support both wellness and performance management.

Within product categories, imaging and infectious disease diagnostics are gaining traction alongside rapid in-clinic tests, while pharmaceuticals span a spectrum from generic drugs to prescription-only innovations. Vaccines comprise inactivated, live attenuated, and recombinant platforms, each offering unique immunogenicity profiles for companion, equine, and livestock applications. Medicated feed additives continue to serve as a cornerstone for preventive herd health, balancing regulatory scrutiny with industry demand.

Distribution channels are evolving to meet omnichannel expectations: veterinary clinics remain the primary site for complex procedures and vaccinations, pharmacies extend reach for over-the-counter therapeutics, and online platforms deliver convenience for preventive products and wellness supplements. Therapeutic areas such as anti-infectives, anti-inflammatories, cardiovascular agents, and parasiticides represent core categories, with antibiotics, antifungals, and antivirals addressing acute needs, and ectoparasiticides and endectocides serving preventive protocols. Route-of-administration preferences further refine strategies, as injectable biologics and oral formulations dominate acute interventions, while topical and inhalation routes gain importance in chronic management and respiratory care.

This comprehensive research report categorizes the Veterinary Medicine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Therapeutic Area

- Route Of Administration

- Distribution Channel

Illuminating regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific that influence veterinary care delivery, regulatory frameworks, and growth trajectories

In the Americas, the veterinary sector benefits from robust pet ownership trends and resilient expenditure patterns. With 94 million households owning at least one pet and U.S. industry spending reaching $152 billion in 2024, demand for advanced clinical services and wellness products is sustained by strong emotional bonds, multi-pet households, and generational shifts toward holistic care models. Pet insurance adoption remains nascent at under 4 percent, highlighting a growth opportunity for risk mitigation solutions in companion animal care.

Europe, the Middle East, and Africa are shaped by the European Union’s Veterinary Medicinal Products Regulation (EU 2019/6), embedding antimicrobial stewardship and One Health principles into product development and prescribing practices. This regulatory framework mandates a 50 percent reduction in antimicrobial sales for farmed animals by 2030 and enforces stricter controls on preventive antibiotic use, thereby influencing product pipelines and clinical protocols across member states and aligning with the broader One Health strategy for AMR mitigation.

Across Asia-Pacific, middle-income countries are spearheading livestock production growth, accounting for 54 percent of global agricultural output expansion through 2034. Rising incomes and population dynamics are accelerating protein demand, while governments invest in biosecurity, vaccine innovation, and integrated disease surveillance systems. Companion animal segments are also scaling rapidly in urban centers, driven by rising disposable incomes, digital access, and shifting cultural norms that elevate pet companionship and preventive care.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Medicine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading animal health players to reveal strategic positioning, innovation initiatives, and competitive responses shaping the evolving veterinary medicine market landscape

Leading animal health companies are reshaping the industry through diversified portfolios, targeted R&D investments, and strategic acquisitions. Zoetis, a global pioneer in companion and livestock pharmaceuticals, achieved full-year 2024 revenue of $9.3 billion-driven by 14 percent operational growth in companion animal care and 5 percent in livestock-while guiding for 6–8 percent organic revenue growth in 2025 amid enacted tariffs and foreign exchange headwinds. 高-impact launches such as Librela and Simparica Trio underscore Zoetis’s innovation pipeline strength.

Merck Animal Health posted 5 percent global sales growth to $1.6 billion in Q1 2025, outpacing foreign exchange impacts, and continues to integrate the July 2024 Elanco aquaculture acquisition. The company absorbed an estimated $200 million in tariff costs for the full year, reflecting deliberate supply chain localization and domestic manufacturing investments to mitigate future trade policy volatility.

Elanco leverages a balanced portfolio across pet health and farm animal segments, delivering 4 percent organic constant currency growth in Q1 2025 and raising full-year guidance to $4.51–$4.58 billion while managing a $16–$20 million anticipated net tariff impact on EBITDA. Strategic asset monetization and disciplined leverage reduction complement its innovation focus on products like Credelio Quattro and Bovaer.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Medicine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- Biogenesis Bago SA

- Biopharm company

- Biowet Puławy sp. z o.o.

- Brovapharma

- C H Boehringer Sohn AG & Co KG

- Ceva Sante Animale

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Evonik Industries AG

- Hester Biosciences Limited

- Indian Immunologicals Ltd.

- Intracin Pharmaceutical Private Limited

- JoinHub Pharma

- Merck & Co Inc.

- Nam Pharma Sdn Bhd

- NAPHAVET Co., Ltd.

- Neogen Corporation

- Nutreco NV

- Phibro Animal Health Corporation

- Sykes Vet International Pty Ltd.

- TRAVETCO

- Vetoquinol SA

- Vetpharma Animal Health S.L.

- Vetsintez LLC

- Virbac SA

- Weefsel Pharma

- Zoetis Inc.

Presenting targeted strategic recommendations for veterinary industry leaders to navigate emerging challenges and capitalize on defined growth opportunities with actionable insights

Industry leaders should prioritize diversified supply chains by partnering with multiple API and component suppliers to mitigate tariff risks and ensure continuity of critical medications. Implementing integrated inventory management systems and leveraging predictive analytics will allow practices and distributors to anticipate cost fluctuations and optimize procurement cycles.

Investments in digital platforms and telemedicine infrastructure can enhance access while addressing workforce limitations. By embedding AI-driven diagnostic and decision support tools into clinical workflows, practices can increase throughput without compromising care quality. Concurrently, expanding value-added services-such as behavior consultation, nutritional wellness programs, and preventive care packages-can deepen client engagement and unlock new revenue streams.

Collaborating with regulatory bodies and professional associations to shape policy frameworks will be essential to safeguard antimicrobial stewardship and One Health objectives. Companies should also accelerate sustainable product innovations-biodegradable packaging, eco-friendly clinic certifications, and carbon-offset partnerships-to resonate with environmentally conscious stakeholders and differentiate their brands.

Detailing the robust research methodology that underpins comprehensive and credible analysis of veterinary medicine trends, ensuring reliability and actionable depth

This analysis integrates both primary and secondary research methodologies to ensure robust, evidence-based insights. Primary research comprised in-depth interviews with leading veterinarians, industry executives, and distribution channel leaders, alongside quantitative surveys administered to over 200 U.S. veterinary practices and laboratories. These engagements provided real-time perspectives on clinical adoption rates, supply chain resiliency, and client service evolution.

Secondary research utilized a comprehensive review of regulatory filings, trade association publications, patent databases, and financial statements of key animal health companies. Publicly available data from government sources, peer-reviewed journals, and international organizations such as the OECD and FAO were synthesized to contextualize regional dynamics and policy impacts.

Rigorous data triangulation was conducted to cross-verify findings, while qualitative thematic analysis distilled actionable themes across technology adoption, regulatory compliance, and market segmentation. All insights were peer-reviewed by subject matter experts to validate accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Medicine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Medicine Market, by Product Type

- Veterinary Medicine Market, by Animal Type

- Veterinary Medicine Market, by Therapeutic Area

- Veterinary Medicine Market, by Route Of Administration

- Veterinary Medicine Market, by Distribution Channel

- Veterinary Medicine Market, by Region

- Veterinary Medicine Market, by Group

- Veterinary Medicine Market, by Country

- United States Veterinary Medicine Market

- China Veterinary Medicine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Synthesizing critical insights to underscore strategic imperatives and chart a forward-looking roadmap for decision-makers in veterinary medicine

The United States veterinary medicine landscape is at an inflection point, shaped by technological innovation, regulatory reform, and evolving client expectations. Stakeholders must navigate supply chain uncertainties driven by tariff policies, capitalize on segmentation insights that reveal nuanced opportunities across species and channels, and tailor strategies to regional market dynamics.

Leading companies have demonstrated resilience and adaptability through targeted investments in domestic manufacturing, strategic acquisitions, and scalable digital platforms. Practices embracing telehealth, AI-assisted diagnostics, and sustainable operations are well positioned to deliver differentiated care and maintain competitive advantage.

Moving forward, industry players should adopt a proactive, data-driven approach, leveraging real-time market intelligence and fostering collaborative partnerships across the value chain. By aligning strategic priorities with emerging trends-One Health stewardship, omnichannel distribution, and personalized animal care-leaders can secure sustainable growth and elevate patient outcomes.

Engage Ketan Rohom at 360iResearch to access the full in-depth veterinary medicine market research report and unlock tailored strategic intelligence for your organization

We invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our detailed veterinary medicine analysis can be customized to meet your organization’s specific intelligence needs. Ketan’s expertise and dedication to client success ensure that your team will receive not only comprehensive data but also strategic guidance tailored to your unique market challenges and goals. Don’t miss the opportunity to leverage this critical resource and gain a competitive edge-reach out today to discuss a personalized engagement and take the next step toward informed decision-making.

- How big is the Veterinary Medicine Market?

- What is the Veterinary Medicine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?