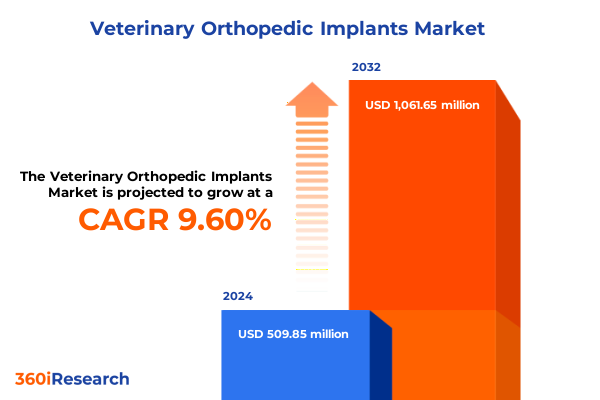

The Veterinary Orthopedic Implants Market size was estimated at USD 559.88 million in 2025 and expected to reach USD 618.32 million in 2026, at a CAGR of 12.30% to reach USD 1,261.65 million by 2032.

Uncovering the Dynamic Intersection of Innovation and Demand Shaping the Veterinary Orthopedic Implants Market Landscape Worldwide

The veterinary orthopedic implant landscape has entered a phase of remarkable dynamism, driven by converging forces of rising animal healthcare expenditure, technological breakthroughs, and evolving clinician preferences. Amid growing demand for advanced surgical solutions, practitioners and manufacturers alike are seeking deeper clarity on market nuances to guide resource allocation and product development. This introduction sets the stage by framing the critical interplay of demographic shifts-such as the increasing companion animal population and expanding interest in exotic and large animal care-with the innovative technologies poised to redefine treatment protocols. As veterinarians pursue minimally invasive techniques and customized implant designs, the imperative for thorough market intelligence has never been stronger.

In this evolving environment, supply chain resilience and regulatory alignment are key themes that underpin strategic decisions. Stakeholders must contend with complex procurement processes, variable reimbursement landscapes, and regional disparities in adoption rates. Against this backdrop, the introduction explores how insights into raw material sourcing, clinical trial outcomes, and end-user requirements converge to inform a robust understanding of market dynamics. This perspective highlights why comprehensive research is essential for harnessing growth opportunities and driving value across the veterinary orthopedic implant ecosystem.

Exploring the Pivotal Technological and Clinical Shifts Driving Unprecedented Transformation in Veterinary Orthopedic Implant Innovations

The past few years have witnessed transformative shifts that are reshaping the contours of veterinary orthopedic implant innovation. Leading this charge is the integration of additive manufacturing platforms, which enable rapid prototyping and patient-specific implant geometry for more precise anatomical fit. Simultaneously, breakthroughs in bioactive coatings and advanced polymers have expanded the realm of osteointegration and infection control, bolstering long-term clinical outcomes.

In parallel, the rise of image-guided surgical navigation and robotic assistance is redefining procedural accuracy and reducing operative times. These technological advances are complemented by a growing emphasis on regenerative strategies, where biomaterial scaffolds facilitate tissue repair and encourage endogenous healing. Together, these developments are not only elevating the standards of care but also catalyzing novel product pipelines, as companies vie to deliver next-generation solutions that meet the dual imperatives of efficacy and cost efficiency.

Analyzing the Compound Effects of 2025 United States Tariff Policies on Cost Structures and Supply Chain Dynamics in Veterinary Orthopedics

The cumulative impact of the United States’ 2025 tariff realignment has introduced new complexities into cost structures and supply chain dynamics for veterinary orthopedic implants. Heightened duties on imported titanium, stainless steel, and specialty polymer precursors have elevated production expenses, compelling manufacturers to reassess sourcing strategies and consider near-shoring or alternative materials. These increased input costs are being passed through to end users, prompting careful evaluation of pricing models by veterinary clinics and hospitals.

Moreover, the reconfiguration of logistical routes due to tariff restrictions has extended lead times, underscoring the critical need for flexible inventory management and robust supplier partnerships. Simultaneously, stakeholders are exploring vertical integration and strategic alliances to mitigate exposure to tariff volatility. This convergence of policy-driven cost pressures and operational constraints is reshaping competitive positioning, with agility and local manufacturing capabilities emerging as key differentiators.

Delving into Five Critical Segmentation Dimensions to Illuminate Market Opportunities and Nuanced Demand Drivers in Veterinary Orthopedic Implants

A nuanced examination of market segmentation reveals layers of demand that inform targeted growth strategies. By animal type, small animal applications, driven by the popularity of companion cats and dogs, represent a substantial portion of clinical procedures. Within this category, advances in implant design for canine and feline orthopedic disorders continue to expand treatment options. Large animal segments, encompassing bovine, equine, and porcine care, present specialized requirements for load-bearing implants and robust fixation systems. Exotic animal care, with birds and reptiles at the forefront, is an emerging niche requiring bespoke solutions that balance size constraints with biomechanical performance.

Implant type segmentation further clarifies opportunity spaces, as external fixators-particularly ring fixators used in fracture correction-gain traction for their adjustability, while interlocking and intramedullary nails offer streamlined approaches for load sharing. Plates and screws remain foundational, though the shift toward locking plates underscores demand for enhanced stability. Material type analysis highlights stainless steel and titanium as longstanding mainstays given their strength and biocompatibility, yet bioabsorbable polymers and ceramic coatings are forging new pathways in gradual load transfer and reduced revision rates. End-user segmentation examines the roles of veterinary hospitals, clinics, ambulatory surgical centers, and academic research institutions, each with distinct procurement patterns, regulatory compliance standards, and procedural volumes. Application insights show fracture fixation as the principal use case, while joint reconstruction, ligament repair, and osteotomy applications reflect growing sophistication in surgical offerings.

This comprehensive research report categorizes the Veterinary Orthopedic Implants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Implant Type

- Material Type

- Application

- End User

Mapping Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Decipher Growth Trajectories in Veterinary Orthopedics

Regional dynamics underscore how jurisdictional factors drive both demand and supply considerations. Within the Americas, a mature network of veterinary hospitals and clinics, coupled with high pet ownership rates, sustains stable demand for advanced orthopedic implants. Innovation hubs in North America facilitate rapid adoption of next-generation materials and digital surgical platforms, whereas Latin American markets are exhibiting gradual expansion spurred by rising disposable income and increased access to veterinary care.

Across the Europe, Middle East and Africa region, regulatory harmonization and pan-regional reimbursement frameworks influence procurement cycles. Western European countries lead in adopting minimally invasive techniques, while Middle Eastern and African markets show targeted growth where investments in animal health infrastructure are on the rise. In the Asia-Pacific region, burgeoning pet populations in markets such as China and India, alongside government incentives for livestock health in countries like Australia, are creating divergent but complementary growth trajectories. Stakeholders in each region are tailoring distribution models and educational initiatives to align with local clinical practices and regulatory requirements.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Orthopedic Implants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Strategic Moves and Collaborative Initiatives by Prominent Firms Shaping the Veterinary Orthopedic Implants Industry

A review of leading corporate strategies highlights the competitive interplay shaping the veterinary orthopedic arena. Global medical device conglomerates are leveraging their extensive R&D capabilities and distribution networks to introduce specialized implant lines tailored for veterinary applications. Simultaneously, mid-sized orthopedic specialists are focusing on strategic acquisitions of innovators in 3D printing and bioresorbable materials to enhance their technological portfolios.

Meanwhile, collaborative initiatives between established players and academic research centers are accelerating the validation of novel implant geometries and surface treatments through preclinical trials. Joint ventures with regional distributors are streamlining market entry into underpenetrated geographies, and co-development agreements are ensuring that product pipelines are aligned with veterinarian preferences. Across the board, companies are emphasizing digital integration-ranging from preoperative planning software to outcome tracking platforms-to provide holistic solutions that differentiate their offerings in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Orthopedic Implants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arthrex, Inc.

- B. Braun Melsungen AG

- BioMedtrix, Inc.

- DePuy Synthes, Inc.

- IMEX Veterinary Inc.

- Kyon AG

- Orthomed, Inc.

- Smith & Nephew plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Strategically Tailored Recommendations Enabling Industry Leaders to Capitalize on Emerging Trends and Mitigate Operational Challenges in Veterinary Orthopedics

To thrive amidst competitive intensity and evolving regulatory landscapes, industry leaders must adopt a multi-pronged strategy that balances innovation with operational resilience. First, investing in advanced biomaterial research and additive manufacturing capabilities can accelerate product customization and improve clinical outcomes. Concurrently, diversifying supply chains through regional partnerships and dual-sourcing agreements can buffer against tariff disruptions and logistical uncertainties.

Integrating digital surgical planning tools with implant portfolios fosters closer engagement with veterinary surgeons and supports evidence-based adoption. Strengthening aftermarket support and training programs across all end-user channels enhances loyalty and drives repeat business. Finally, pursuing strategic alliances for co-development and pilot programs in emerging applications-such as ligament repair and osteotomy-enables companies to capture niche segments while sharing development risks. Each of these recommendations is designed to create sustainable competitive advantages and encourage long-term growth.

Detailing a Rigorous Multi-Phase Research Methodology Integrating Primary and Secondary Data to Ensure Robust Insights and Analytical Precision

This research integrates a rigorous, multi-phase methodology designed to deliver robust insights and actionable conclusions. Initial secondary research involved the systematic review of peer-reviewed journals, regulatory filings, and industry white papers to establish a comprehensive baseline of market intelligence. Primary research encompassed structured interviews with veterinary surgeons, procurement managers, and supply chain experts, enabling firsthand perspectives on clinical needs, purchasing drivers, and emerging challenges.

Quantitative data was validated through triangulation techniques, cross-referencing corporate financial disclosures, trade association statistics, and proprietary shipment data. Qualitative insights were enriched by convening expert panels to test hypotheses and refine segmentation frameworks. Advanced analytical tools, including scenario analysis and sensitivity assessments, were employed to evaluate the impact of tariffs and material cost fluctuations. This blended methodological approach ensures that findings are both data–driven and grounded in real-world practice variability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Orthopedic Implants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Orthopedic Implants Market, by Animal Type

- Veterinary Orthopedic Implants Market, by Implant Type

- Veterinary Orthopedic Implants Market, by Material Type

- Veterinary Orthopedic Implants Market, by Application

- Veterinary Orthopedic Implants Market, by End User

- Veterinary Orthopedic Implants Market, by Region

- Veterinary Orthopedic Implants Market, by Group

- Veterinary Orthopedic Implants Market, by Country

- United States Veterinary Orthopedic Implants Market

- China Veterinary Orthopedic Implants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Concluding Strategic Perspectives Emphasizing Key Takeaways and Future Outlook for Stakeholders in the Veterinary Orthopedic Implant Market

In synthesizing the landscape of veterinary orthopedic implants, it is evident that technological innovation, policy dynamics, and nuanced market segmentation are converging to redefine the industry’s trajectory. Stakeholders who align their R&D investments with emerging biomaterial trends and digital surgical solutions will be best positioned to capture value. Meanwhile, companies that proactively navigate tariff implications through supply chain diversification and regional manufacturing footprints can secure cost competitiveness.

The interplay of end-user preferences, regional growth differentials, and collaborative partnerships underscores the importance of an informed, strategic approach. By leveraging granular segmentation insights and taking deliberate, data-backed actions, organizations can address unmet clinical needs, enhance operational agility, and drive sustained growth. The collective insights presented here form a foundation for stakeholders to make confident decisions in a dynamic and opportunity-rich market environment.

Drive Strategic Growth and Market Leadership by Partnering with Ketan Rohom to Secure Comprehensive Veterinary Orthopedic Implant Research and Insights

For organizations poised to elevate their strategic footprint, engaging directly with Ketan Rohom is the pivotal first move towards securing unparalleled market intelligence that drives decision-making. His expertise in translating rigorous research findings into actionable strategies offers stakeholders a clear roadmap to leverage emerging trends, optimize product portfolios, and strengthen competitive positioning. By partnering with Ketan Rohom, decision-makers gain personalized support in aligning their growth ambitions with the in-depth insights captured within the comprehensive veterinary orthopedic implant research. Reach out today to unlock targeted recommendations, secure proprietary data analyses, and fast-track your strategic initiatives.

- How big is the Veterinary Orthopedic Implants Market?

- What is the Veterinary Orthopedic Implants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?