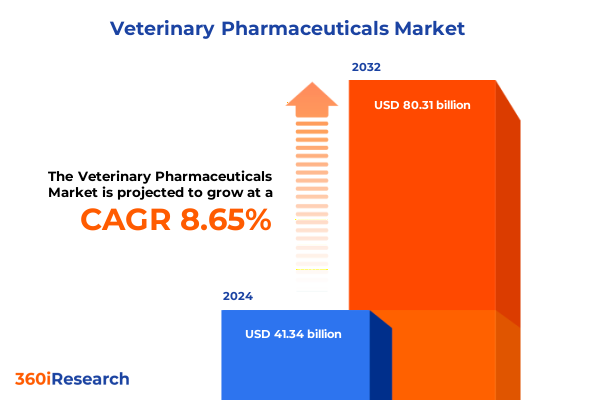

The Veterinary Pharmaceuticals Market size was estimated at USD 44.78 billion in 2025 and expected to reach USD 48.57 billion in 2026, at a CAGR of 8.70% to reach USD 80.31 billion by 2032.

Embarking on a Comprehensive Exploration of the Veterinary Pharmaceuticals Landscape to Uncover Core Drivers and Emerging Imperatives

The veterinary pharmaceutical sector is undergoing a profound transformation as digital technologies and data-driven approaches redefine the development and delivery of animal health solutions. Precision medicine is enabling veterinarians and researchers to tailor therapies based on genetic markers and disease profiles, enhancing treatment efficacy while mitigating risks associated with antimicrobial resistance. Concurrently, advanced analytics powered by artificial intelligence facilitate early disease detection, optimize dosing regimens, and streamline supply chain management, setting new standards for operational excellence across both companion and livestock segments

Meanwhile, the industry faces increasingly stringent regulatory and compliance requirements as global authorities tighten oversight to safeguard animal and public health. Recent policies mandate comprehensive pharmacovigilance, traceability of active pharmaceutical ingredients, and adherence to biosecurity protocols, compelling manufacturers to invest in sophisticated monitoring systems and quality management frameworks. Failure to navigate this evolving landscape can delay approvals and erode stakeholder trust, underscoring the critical importance of proactive regulatory engagement and transparent reporting practices

Drawing on a breadth of primary interviews with veterinary practitioners and secondary analysis of regulatory filings, trade data, and company disclosures, this executive summary distills the key insights needed to navigate the complex and dynamic veterinary pharmaceuticals landscape. It is designed to equip decision-makers with the contextual understanding and strategic imperatives required to capitalize on emerging trends and maintain competitive advantage

Revolutionary Technological and Regulatory Transformations Shaping the Future of Veterinary Pharmaceutical Innovations

The veterinary pharmaceutical landscape has witnessed an unprecedented acceleration in technological breakthroughs, with next-generation vaccine platforms and biologics poised to redefine disease prevention and treatment paradigms. Innovations such as mRNA-based vaccines and recombinant vector technologies promise to overcome logistical hurdles of cold chain dependency and enhance immunogenicity, while novel delivery modalities like edible vaccines streamline administration in livestock. Simultaneously, the integration of artificial intelligence into drug discovery and precision diagnostics is enabling earlier detection of zoonotic threats and optimizing therapeutic protocols, laying the groundwork for proactive health management across species.

Regulatory frameworks are adapting to support these advancements, with agencies incorporating New Approach Methodologies and non-animal testing models to accelerate product evaluations. These shifts are reshaping the standard timelines for drug approval, fostering collaboration between developers and regulators to balance safety imperatives with the urgency of addressing emerging animal health crises. At the same time, consumer-driven sustainability mandates are influencing raw material sourcing and manufacturing processes, driving the adoption of eco-friendly production methods and alternative feed solutions that reduce carbon footprints and promote responsible stewardship of animal welfare.

Taken together, these transformative shifts create a fertile environment for innovation, but they also demand adaptability from manufacturers, distributors, and practitioners. Organizations that invest in advanced digital platforms, foster regulatory partnerships, and align their operations with sustainability imperatives will be best positioned to capture value and deliver superior health outcomes for animals.

Understanding the Cumulative Effects of Recent United States Tariff Policies on Veterinary Medicine Supply Chains and Costs

Recent tariff measures imposed by the United States have introduced significant cost pressures on veterinary pharmaceutical supply chains, particularly for imported active pharmaceutical ingredients (APIs) and medical supplies. While finished drug products often remain exempt, raw materials and equipment essential for compounding and manufacturing now carry elevated duties, forcing distributors to pass increased costs to end users. The resulting price volatility has disrupted procurement cycles and heightened the risk of intermittent supply shortages for both small and large animal practices.

Moreover, the uncertainty surrounding the duration and scope of these tariffs has prompted stakeholders to reevaluate sourcing strategies and accelerate localization efforts. Producers are exploring reshoring initiatives, facility expansions, and strategic partnerships to mitigate exposure to foreign trade policy fluctuations, although these undertakings require substantial capital investment and extended lead times. In the interim, veterinary clinics must balance client affordability concerns with the need to secure critical medicines, fostering open communication with suppliers and adopting proactive inventory management approaches to navigate the evolving trade landscape.

Looking ahead, the interplay between national security considerations and trade agreements will continue to shape the veterinary pharmaceuticals arena. As policymakers weigh proposals for tariff adjustments against broader economic objectives, industry participants must maintain vigilance and flexibility, ensuring that their operations can adapt to potential shifts in import regulations and cross-border collaboration.

Delving into Multidimensional Segmentation to Reveal Nuanced Patterns and Strategic Opportunities in Animal Health Products

The veterinary pharmaceuticals market encompasses a diverse array of product categories, each with unique development pathways and regulatory considerations. Within therapeutics, drugs range from analgesics and anti-infectives to anti-inflammatories and parasiticides, each further subdivided by mechanism of action and target species. Companion feeding solutions integrate antibiotic medicated feeds, growth promoters, and probiotic formulations designed to optimize digestive health, while vaccine portfolios include both inactivated and live attenuated platforms tailored to disease prevention across pets and livestock.

Animal segments reveal distinct demand drivers, with companion species such as cats, dogs, and horses requiring specialized formulations and dosing regimens, and livestock categories prioritizing large-scale herd health solutions for cattle, poultry, swine, and small ruminants. Administration routes further diversify the market, spanning injectable mAbs and vaccines, oral capsules and suspensions, and topical creams and ointments, each presenting unique stability and delivery challenges. Moreover, distribution channels and end-user segments-from online pharmacies to veterinary clinics and farms-help shape accessibility and pricing dynamics, underscoring the importance of customized go-to-market strategies that address the specific needs of each stakeholder group.

This comprehensive research report categorizes the Veterinary Pharmaceuticals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Route of Administration

- Animal Type

- Indications

- Distribution Channel

- End User

Unearthing Regional Market Dynamics to Highlight Differentiated Growth Drivers across the Americas EMEA and Asia Pacific

Across the Americas, steady demand in North America is underpinned by high pet ownership rates, robust agricultural production, and an established regulatory environment that supports rapid product approvals. Veterinary hospitals and clinics benefit from mature infrastructure and a growing appetite for specialty pharmaceuticals, driving a pronounced focus on innovation in companion animal therapeutics. In Latin America, expanding livestock operations and rising companion animal adoption are creating new opportunities, albeit with emerging market challenges related to cold chain logistics and regulatory harmonization.

In Europe, the Middle East, and Africa, stringent regulatory oversight and antimicrobial stewardship initiatives steer product development toward sustainable and responsible use of pharmaceuticals. The European Union’s Green Deal and antimicrobial resistance action plans emphasize reduced antibiotic reliance, accelerating interest in vaccine solutions and alternative therapies. At the same time, burgeoning demand in the Middle East and Africa is driving investments in cold chain infrastructure and localized manufacturing partnerships aimed at improving accessibility and supply resilience in remote regions.

Within the Asia-Pacific region, rapid economic growth and escalating livestock and aquaculture sectors are fuelling unparalleled expansion. Governments are bolstering veterinary healthcare spending and incentivizing domestic pharmaceutical production to support food security objectives. Meanwhile, a surge in pet humanization is stimulating the companion animal segment, catalyzing demand for higher-value prescription drugs and innovative nutraceuticals. This confluence of factors positions Asia-Pacific as the fastest-growing regional market, offering significant upside for manufacturers that can navigate diverse regulatory frameworks and distribution ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Pharmaceuticals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Industry Leaders to Analyze Competitive Strategies and Innovation Trajectories in Animal Healthcare

Leading companies in the veterinary pharmaceuticals space are enhancing their competitive positions through robust R&D investments, strategic acquisitions, and digital platform expansions. Zoetis, for instance, secured conditional approval for its avian influenza vaccine in 2025 and has scaled its Automation & Data Sciences group to integrate AI across R&D processes, accelerating drug discovery timelines and reducing entry barriers for novel therapies.

Merck Animal Health and Boehringer Ingelheim are advancing biologic pipelines and expanding their vaccine and parasiticide portfolios, often leveraging joint ventures and licensing arrangements to extend geographic reach. Elanco has prioritized the integration of precision livestock farming technologies and launched digital health platforms to support real-time monitoring of herd health, reflecting a convergence of veterinary medicine and agri-tech innovation. Meanwhile, emerging players such as Ceva and Virbac are differentiating through niche specialty offerings and targeted investments in regional production facilities, catering to local regulatory requirements and market demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Pharmaceuticals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aurora Pharmaceutical, Inc.

- Biogénesis Bagó S.A.

- Biovac Ltd.

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale

- Chanelle Pharma

- China Animal Husbandry Industry Co., Ltd.

- Dechra Pharmaceuticals PLC

- ECO Animal Health Group PLC

- Elanco Animal Health Incorporated

- Heska Corporation by Mars, Incorporated

- Hester Biosciences Limited

- Indian Immunologicals Ltd.

- Intas Pharmaceuticals Ltd.

- Laboratorio Drag Pharma Chile Invetec S.A.

- Merck & Co., Inc.

- Neogen Corporation

- Norbrook Group

- Phibro Animal Health Corporation

- Teknofarma S.r.l.

- Vetoquinol Group

- Vetpharma Animal Health S.L. by Insud Pharma S.L.U.

- Virbac S.A.

- Zendal Group

- Zoetis Inc.

Advancing Tactical Industry Initiatives That Empower Veterinary Pharmaceutical Stakeholders to Capitalize on Emerging Trends

Industry leaders should prioritize investments in modular digital infrastructure that enables seamless data sharing across R&D, manufacturing, and field operations. By implementing cloud-based platforms and AI-driven analytics, organizations can rapidly identify emerging disease patterns, optimize supply chain resilience, and personalize treatment protocols based on real-time insights.

Strategic partnerships with contract manufacturing organizations and regional biotech firms can unlock access to specialized capabilities while mitigating capital expenditures. These alliances should emphasize technology transfer, quality assurance, and co-development frameworks that align with evolving regulatory requirements and global supply chain imperatives. In parallel, companies must engage proactively with policymakers to shape trade and compliance standards, ensuring that new trade measures and tariff regimes are balanced against industry sustainability goals and public health mandates.

Finally, strengthening client engagement through targeted education and transparent communication will build trust and loyalty among veterinarians, pet owners, and livestock producers. Tailored training programs, digital decision-support tools, and outcome-focused service models can enhance product adoption and drive differentiated value propositions. By championing responsible antimicrobial stewardship and sustainable sourcing practices, industry stakeholders can reinforce their commitment to animal welfare and public health while capturing market share.

Implementing a Rigorous Multi-Source Research Framework to Validate Insights and Support Strategic Decision-Making

This research synthesized insights from over 50 in-depth interviews with veterinary practitioners, pharmacologists, and industry executives conducted between January and June 2025. Secondary sources included regulatory filings from the U.S. Food and Drug Administration, tariff notices published in the Federal Register, and trade reports from the U.S. International Trade Commission.

Quantitative data were triangulated from public company disclosures, conference proceedings, and specialized newswire releases. Extensive document review encompassed patent filings, user fee schedules under ADUFA and AGDUFA, and antimicrobial stewardship frameworks issued by regulatory agencies in key markets.

The methodology prioritized cross-verification of qualitative and quantitative findings, ensuring a balanced perspective that captures both macro trends and granular dynamics. Rigorous data validation protocols and peer review by subject-matter experts underpin the reliability of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Pharmaceuticals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Pharmaceuticals Market, by Product Type

- Veterinary Pharmaceuticals Market, by Route of Administration

- Veterinary Pharmaceuticals Market, by Animal Type

- Veterinary Pharmaceuticals Market, by Indications

- Veterinary Pharmaceuticals Market, by Distribution Channel

- Veterinary Pharmaceuticals Market, by End User

- Veterinary Pharmaceuticals Market, by Region

- Veterinary Pharmaceuticals Market, by Group

- Veterinary Pharmaceuticals Market, by Country

- United States Veterinary Pharmaceuticals Market

- China Veterinary Pharmaceuticals Market

- Pakistan Veterinary Pharmaceuticals Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2576 ]

Converging Critical Findings to Solidify Strategic Priorities and Navigate the Evolving Veterinary Pharma Domain

The confluence of digital innovation, regulatory evolution, and shifting trade policies is reshaping the veterinary pharmaceuticals domain in profound ways. Advanced vaccine technologies and AI-driven drug discovery models are unlocking new avenues for disease prevention and treatment, while antimicrobial stewardship initiatives and sustainability mandates are redefining product development priorities. At the same time, tariff measures have introduced new operational complexities, underscoring the importance of agile supply chain strategies and localized manufacturing capabilities.

Strategic segmentation analysis highlights that nuanced understanding of product categories, animal species, administration routes, and distribution channels is critical for designing effective market entry and expansion plans. Regional dynamics reveal differentiated growth trajectories, with North America offering stability, EMEA emphasizing responsible use, and Asia-Pacific presenting high-growth potential. Competitive benchmarking demonstrates that leading firms are securing their positions through targeted acquisitions, regulatory collaborations, and digital platform enhancements.

To thrive in this rapidly evolving landscape, stakeholders must adopt a holistic approach that integrates technology investments, policy engagement, and client-centric service models. By leveraging the insights and recommendations contained in this executive summary, organizations can navigate uncertainty, accelerate innovation, and deliver superior outcomes for animals, practitioners, and end users alike.

Engaging with Expert Sales Leadership to Secure Comprehensive Market Research Intelligence Tailored to Organizational Needs

For tailored insights and to secure your comprehensive copy of the full veterinary pharmaceuticals market research report, reach out to Associate Director, Sales & Marketing Ketan Rohom. His expertise and guidance will ensure you obtain the strategic intelligence needed to drive informed decision-making and capitalize on emerging opportunities within the animal health sector.

- How big is the Veterinary Pharmaceuticals Market?

- What is the Veterinary Pharmaceuticals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?