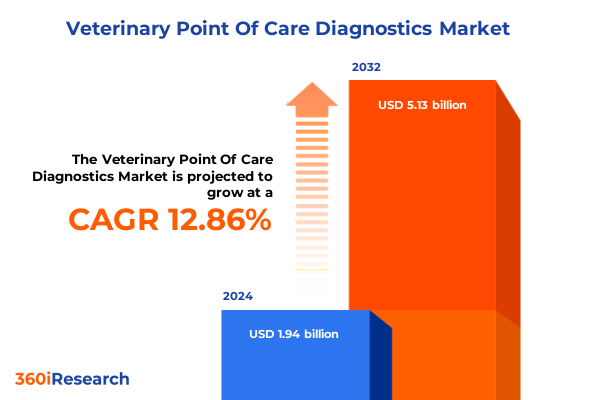

The Veterinary Point Of Care Diagnostics Market size was estimated at USD 2.19 billion in 2025 and expected to reach USD 2.47 billion in 2026, at a CAGR of 12.87% to reach USD 5.13 billion by 2032.

Unveiling the Rising Demand and Cutting-Edge Technological Innovations Driving Transformative Growth in Veterinary Point Of Care Diagnostics Worldwide

Rapid advances in veterinary medicine and the growing demand for timely, accurate diagnostic results have fundamentally reshaped the point of care landscape. Driven by expanding pet ownership, heightened awareness of animal welfare, and the critical need for efficient disease management in livestock, diagnostic testing is increasingly moving from centralized laboratories into clinics and farms. Practitioners now expect portable, user-friendly instruments capable of delivering reliable data within minutes rather than days. In response, manufacturers have accelerated investments in compact analyzers and smart assays that integrate seamlessly into existing workflows.

Moreover, the advent of digital connectivity and data analytics has propelled this transformation, enabling real-time decision-making and improved patient outcomes. Veterinarians can now leverage cloud-based platforms to track trends, benchmark performance, and collaborate with diagnostic specialists regardless of geographic location. This shift toward decentralized testing not only enhances clinical efficiency but also supports proactive herd health management and early disease detection in companion animals.

Amid these changes, regulatory bodies are evolving guidelines to ensure the safety and efficacy of at‐the‐point diagnostics without stifling innovation. Harmonized standards and streamlined approval pathways are fostering a conducive environment for novel technologies. Furthermore, partnerships between diagnostic providers and software firms are bridging gaps in data interoperability, setting the stage for an era in which smart, connected diagnostics become an indispensable component of veterinary practice.

Disruptive Technological Advances and Evolving Clinical Workflows That Are Reshaping the Veterinary Point Of Care Diagnostics Landscape in 2025

In recent years, the confluence of miniaturized hardware and sophisticated bioassays has disrupted traditional veterinary diagnostics. Portable biochemistry analyzers, once relegated to large laboratories, now deliver multiparametric results directly in the clinic. Concurrently, high‐sensitivity immunoassays are detecting biomarkers of infectious and metabolic diseases at lower thresholds, enabling earlier intervention. These advances are rapidly reshaping clinical workflows: routine checkups now often include point of care panels that inform immediate treatment decisions.

Artificial intelligence and machine learning algorithms have emerged as pivotal enablers, interpreting complex data patterns from multiple assays to guide differential diagnoses. This layer of analytics reduces reliance on specialized personnel, democratizing advanced testing capabilities across diverse practice settings. Meanwhile, the integration of molecular diagnostics into handheld platforms has broadened the range of detectable pathogens, offering real-time surveillance of zoonotic outbreaks.

These transformative shifts extend beyond technology alone. Telemedicine services are increasingly paired with point of care tools, allowing remote specialists to review in‐clinic results and recommend treatment protocols within hours. Field veterinarians leverage portable readers in rural and resource‐limited areas, bridging gaps in animal health monitoring. As connectivity improves, the veterinary ecosystem is converging on a model of continuous, data‐driven care that promises to elevate both clinical outcomes and practice efficiency.

Assessing the Broad Economic and Strategic Consequences of 2025 United States Tariff Policies on the Veterinary Point Of Care Diagnostics Sector

In 2025, the imposition of new tariffs on imported diagnostic instruments and reagents in the United States has introduced both challenges and strategic opportunities. By increasing duties on key components sourced from leading manufacturing hubs, procurement costs have risen, exerting pressure on margins across the value chain. Veterinary practices and labs now face higher equipment acquisition expenses, while device manufacturers experience escalated production outlays.

Consequently, several stakeholders have reevaluated sourcing strategies, forging closer partnerships with domestic suppliers and exploring alternative manufacturing locations to mitigate tariff impacts. Some diagnostic firms have initiated localized assembly operations to circumvent duties, thereby fostering regional job creation and supply chain resilience. Others are investing in reverse logistics and inventory management solutions to optimize import schedules and reduce tariff-related surcharges.

At the practice level, veterinarians are adapting by consolidating orders and negotiating value‐based contracts that include service bundles and reagent discounts. These arrangements not only soften the immediate financial burden but also promote predictive restocking, reducing downtime associated with equipment maintenance and calibration. Looking ahead, this tariff environment may incentivize greater collaboration among industry participants, ultimately driving a more diversified, locally integrated supply ecosystem for veterinary point of care diagnostics.

Uncovering How Animal Type Test Type End User Technology Application and Sample Type Segments Drive Distinct Trends within Veterinary Point Of Care Diagnostics

In examining how segment dynamics influence veterinary point of care diagnostics, animal type remains a primary driver of technology adoption and service design. Clinics focused on feline and canine health often prioritize compact analyzers optimized for small sample volumes, whereas livestock applications demand high‐throughput capabilities and ruggedized equipment suited to cattle, swine, poultry, and equine environments. This distinction shapes instrument feature sets, consumable requirements, and service models across the market spectrum.

Test type segmentation further delineates growth pathways. Biochemistry platforms, encompassing both electrolyte and chemistry analyzers, address core metabolic and organ function assessments, while hematology systems like cell counters and hemoglobin analyzers support routine wellness visits. Immunoassay offerings, including ELISA and lateral flow formats, facilitate on‐the‐spot detection of infectious agents and hormone levels. Molecular diagnostics have become indispensable for pathogen identification, particularly in herds susceptible to rapid‐spread diseases. The interplay of these modalities informs portfolio development and cross‐platform integration strategies.

End users drive demand patterns based on operational scale and complexity. Diagnostic laboratories often adopt high‐throughput systems to serve multiple clinics, whereas hospitals and clinics require versatile point of care devices for same‐visit decision-making. Research institutes contribute to early validation of novel assays, influencing product roadmaps. Technology choices-from reader‐based systems to readerless assays-dictate ease of use, cost structures, and connectivity potential. Application areas such as cardiac monitoring, critical care, infectious disease surveillance, and metabolic screening determine workflow prioritization. Finally, the diversity of sample types, spanning blood, urine, milk, saliva, and feces, necessitates configurable platforms capable of handling varying viscosities and matrix complexities. Together, these segment insights guide targeted innovation efforts and strategic investment decisions.

This comprehensive research report categorizes the Veterinary Point Of Care Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Test Type

- Technology

- Sample Type

- Application

- End User

Comparative Regional Analysis Highlighting Unique Drivers Challenges and Adoption Patterns across Americas EMEA and Asia Pacific Veterinary Diagnostics

Regional dynamics profoundly shape the adoption and evolution of point of care diagnostics in veterinary medicine. In the Americas, a well‐established veterinary infrastructure and favorable reimbursement policies have accelerated uptake of advanced portable analyzers and smart assay systems. The United States leads in integrating digital platforms for data management and teleconsulting, while Latin American markets present emerging opportunities driven by efforts to modernize livestock monitoring and improve disease traceability.

In Europe, Middle East & Africa, market fragmentation presents both challenges and opportunities. The European Union’s harmonized regulatory framework streamlines product approvals, yet varying levels of veterinary spending across member states influence device adoption rates. In the Middle East, investments in biosecurity and animal husbandry are elevating demand for rapid infectious disease testing, whereas African regions are focused on cost‐effective solutions to address endemic diseases in cattle and poultry. SMEs in these regions are exploring readerless assay formats to reduce capital outlay while maintaining diagnostic accuracy.

The Asia-Pacific region is characterized by rapid expansion and heterogeneity. Developed markets such as Japan and Australia exhibit strong demand for sophisticated molecular and immunoassay platforms, augmented by digital integration. Conversely, emerging economies in Southeast Asia and India prioritize affordability and simplicity, driving growth of low-cost lateral flow assays and electrolyte analyzers. Large livestock populations and recurring zoonotic concerns underscore the need for scalable point of care solutions, and local manufacturing initiatives are gaining momentum to meet regional needs.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Point Of Care Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strengths Strategies and Innovation Portfolios of Leading Players Shaping Veterinary Point Of Care Diagnostics in 2025

Competitive positioning in veterinary point of care diagnostics is marked by a blend of established corporations and nimble innovators. Leading players have fortified their portfolios through strategic acquisitions, expanding from core biochemistry and hematology offerings into advanced immunoassay and molecular diagnostics. Partnerships with software developers have enabled the rollout of cloud‐based data platforms, enhancing device interoperability and remote monitoring capabilities.

Several companies have differentiated themselves through proprietary assay chemistries that offer improved sensitivity and specificity for key veterinary biomarkers. Others emphasize modular hardware architectures, allowing end users to customize test menus and upgrade capabilities without overhauling existing systems. Startups are carving niches in readerless lateral flow formats, targeting resource‐limited settings and those seeking cost‐effective rapid screening tools. Meanwhile, established firms leverage their global distribution networks to accelerate market entry in underserved regions.

Innovation in sample processing and digital readouts is driving a competitive arms race, with firms investing heavily in R&D to reduce assay runtimes and enhance automation. At the same time, service and maintenance agreements have emerged as critical revenue drivers, with warranty extensions and reagent subscription models cultivating stronger customer loyalty. Together, these strategic initiatives underscore the intensity of competition and the imperative for differentiation in a maturing yet dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Point Of Care Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agrolabo Spa

- B. Braun SE

- Biogal Galed Labs

- BioMérieux SA

- BioNote, Inc.

- Chembio Diagnostic Systems, Inc. by Biosynex

- Dispomed Ltd.

- Esaote SpA

- Fassisi GmbH

- FUJIFILM Holdings Corporation

- Heska Corporation by Mars Inc.

- IDEXX Laboratories, Inc.

- Medtronic PLC

- Mindray Medical International Limited

- Neogen Corporation

- Nova Biomedical Corporation

- Precision Biosensor Inc.

- Randox Laboratories Ltd.

- Shenzhen Mindray Animal Medical Technology Co., Ltd.

- Thermo Fisher Scientific Inc.

- Vimian Group AB

- Virbac Corporation

- Woodley Equipment Company Inc.

- Zoetis Inc.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks within Veterinary Point Of Care Diagnostics

Industry leaders should prioritize the integration of digital connectivity with diagnostic hardware to create end‐to‐end solutions that streamline data collection and analysis. Investing in cloud‐based platforms that offer real-time analytics will not only enhance clinical decision‐making but also facilitate predictive maintenance and remote support. Furthermore, developing multiplex assay capabilities that combine biochemistry, immunoassay, and molecular testing on a single platform can provide practitioners with comprehensive diagnostic insights in one visit.

To navigate the ongoing tariff environment, organizations must diversify their supply chains by establishing regional assembly hubs and forging partnerships with local reagent manufacturers. This approach mitigates the risk of cost escalations and ensures continuity of supply. Simultaneously, companies should explore value‐based contracting models that align pricing with clinical outcomes, fostering deeper collaboration with veterinary practices and strengthening market access.

Penetrating emerging markets requires tailored product strategies that balance affordability with performance. Readerless and lateral flow formats can address the needs of resource‐constrained environments, while scalable service packages will support sustainable adoption. Finally, investing in end‐user training programs and technical support infrastructure will drive higher utilization rates and reinforce brand loyalty, turning diagnostic tools into indispensable components of veterinary care.

Methodological Framework Employed to Ensure Rigorous Data Collection Analysis and Validation for the Veterinary Point Of Care Diagnostics Market Report

This report’s findings are underpinned by a rigorous research methodology that synthesizes both primary and secondary data sources. Extensive primary research involved in-depth interviews with veterinary practitioners, laboratory directors, industry executives, and academic experts to capture nuanced insights on technology adoption and unmet clinical needs. Surveys were administered to a representative sample of end users across companion animal and livestock segments to validate usage patterns and purchasing criteria.

Secondary research encompassed a comprehensive review of publicly available literature, regulatory filings, technical white papers, and patent databases to map the competitive landscape and track recent technological breakthroughs. Market activity such as mergers and acquisitions, product launches, and strategic partnerships was systematically tracked to inform company profiling. Triangulation of qualitative and quantitative data ensured consistency and minimized bias.

Analytical frameworks, including segmentation matrices and value‐chain mapping, were applied to identify key growth drivers and potential bottlenecks. Findings were subjected to internal validation workshops with subject matter experts to refine assumptions and validate conclusions. The resulting insights reflect a robust, transparent approach designed to deliver actionable intelligence on the veterinary point of care diagnostics market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Point Of Care Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Point Of Care Diagnostics Market, by Animal Type

- Veterinary Point Of Care Diagnostics Market, by Test Type

- Veterinary Point Of Care Diagnostics Market, by Technology

- Veterinary Point Of Care Diagnostics Market, by Sample Type

- Veterinary Point Of Care Diagnostics Market, by Application

- Veterinary Point Of Care Diagnostics Market, by End User

- Veterinary Point Of Care Diagnostics Market, by Region

- Veterinary Point Of Care Diagnostics Market, by Group

- Veterinary Point Of Care Diagnostics Market, by Country

- United States Veterinary Point Of Care Diagnostics Market

- China Veterinary Point Of Care Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesis of Insights Underscoring the Strategic Importance of Veterinary Point Of Care Diagnostics for Enhancing Clinical Outcomes and Business Growth

The convergence of technological innovation, shifting regulatory landscapes, and evolving end‐user expectations has set the stage for a new era in veterinary point of care diagnostics. Compact, integrated platforms are empowering practitioners to make swift, informed decisions that enhance animal welfare and operational efficiency. At the same time, regional nuances-from high‐investment markets in the Americas to cost‐sensitive segments in Asia-Pacific-underscore the need for versatile, adaptable solutions.

Key segmentation insights reveal how animal type, test modality, and end‐user setting collectively shape market dynamics, guiding targeted product development and go-to-market strategies. Competitive analysis highlights the imperative for companies to differentiate through advanced assay chemistries, digital connectivity, and flexible business models that align with clinical outcomes.

By addressing tariff‐related challenges through localized supply chain strategies and value‐based contracting, industry participants can safeguard profitability while fostering broader adoption. Ultimately, the synthesis of these insights underscores the strategic importance of embracing an integrated, data-driven approach to veterinary diagnostics-one that positions stakeholders to capitalize on emerging opportunities and deliver superior care across the spectrum of animal health.

Engage with Ketan Rohom to Unlock In-Depth Veterinary Point Of Care Diagnostics Intelligence and Propel Your Strategic Decision Making to the Next Level

Unlock unparalleled insights into the veterinary point of care diagnostics landscape by securing the comprehensive report tailored for informed decision-making. Engage directly with Ketan Rohom, Associate Director, Sales & Marketing, to explore how this research can align with your organizational objectives, address unique market challenges, and uncover new growth avenues. Whether you seek a deeper understanding of emerging technologies, regional nuances, or competitive strategies, Ketan can provide personalized guidance on the report’s scope, methodologies, and key findings. Reach out today to initiate a discussion about pricing, delivery timelines, and value-added services designed to elevate your strategic planning. Connect now to ensure your team has the actionable intelligence needed to stay ahead in this dynamic sector and confidently navigate the evolving veterinary diagnostics environment.

- How big is the Veterinary Point Of Care Diagnostics Market?

- What is the Veterinary Point Of Care Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?