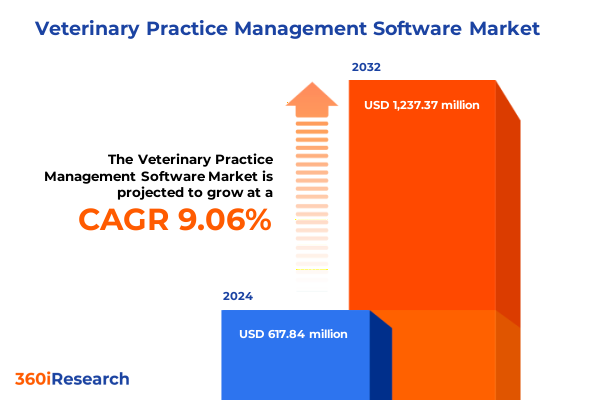

The Veterinary Practice Management Software Market size was estimated at USD 663.38 million in 2025 and expected to reach USD 718.10 million in 2026, at a CAGR of 9.31% to reach USD 1,237.37 million by 2032.

Unlocking the Future of Veterinary Practice Management Software with Innovative Digital Solutions Driving Operational Excellence and Pet Care Advancement

Veterinary practice management software has emerged as the cornerstone of modern animal healthcare operations, driving efficiency and enhancing patient care across diverse clinical settings. Practices that once relied on manual scheduling, paper-based record keeping, and siloed communications are rapidly transitioning to integrated digital ecosystems that streamline workflows, optimize resource utilization, and improve client satisfaction. This shift is underpinned by growing demand for seamless appointment coordination, real-time access to patient histories, and automated billing processes that reduce administrative burdens.

As practices of all sizes grapple with rising operational costs and evolving client expectations, the adoption of sophisticated software solutions has become a strategic imperative. Cloud-based platforms offer scalability and remote accessibility, while on-premise deployments continue to appeal to organizations prioritizing data sovereignty. This confluence of market forces and technological innovation sets the stage for an era of unprecedented transformation in veterinary care delivery, where digital tools not only support clinical excellence but also foster sustainable growth and competitive differentiation.

How Rapid Digital Evolution and Emerging Technologies Are Redefining Veterinary Practice Management and Elevating Standards of Animal Care Delivery

The landscape of veterinary practice management is undergoing radical shifts driven by digital transformation and the integration of emergent technologies. Artificial intelligence–enabled diagnostic imaging tools and automated appointment reminders are eliminating manual bottlenecks, while telemedicine capabilities are expanding access to care beyond the traditional clinic setting. Concurrently, mobile applications and client portals are reshaping the pet owner experience, empowering animal caregivers to schedule services, view treatment plans, and communicate with veterinarians at any time.

Moreover, the proliferation of cloud architectures-spanning private, public, and hybrid models-has democratized software deployment, allowing small practices to leverage enterprise-grade features without prohibitive infrastructure investments. Workflow automation and interoperability standards are fostering cohesive data flows between electronic medical records, inventory management systems, and billing engines. In turn, these transformative shifts are raising the bar for practice efficiency and clinical accuracy, ushering in a new paradigm of data-driven decision making that optimizes both patient outcomes and business performance.

Examining the Far-Reaching Consequences of 2025 United States Tariff Policies on the Cost Structure and Supply Dynamics of Veterinary Software Solutions

The United States’ tariff adjustments in 2025 have exerted a pervasive influence on the cost structures and supply chains underpinning veterinary software ecosystems. Hardware components essential for telemedicine devices and remote monitoring tools have experienced escalated import duties, translating into higher capital expenditures for clinics seeking to integrate advanced diagnostic platforms. Software vendors, in turn, are recalibrating subscription pricing to accommodate increased logistics and compliance overheads, ultimately passing a portion of these costs onto end users.

Beyond direct pricing implications, tariff volatility has spurred heightened emphasis on local sourcing and strategic partnerships with domestic technology providers. Practices are increasingly evaluating on-premise deployments to mitigate exposure to cross-border regulatory fluctuations, even as cloud-based solutions navigate these headwinds through regional data center expansions. As a result, the cumulative impact of tariffs in 2025 has catalyzed a dual focus on cost containment and resilience planning, prompting both veterinary practitioners and software developers to reassess their supply chain strategies and value propositions.

Unveiling Critical Insights from Deployment, Application, Animal Type, Practice Model, and Organization Size Dimensions Shaping Market Dynamics

The market’s deployment mode segmentation reveals a clear trajectory toward cloud-based architectures, with hybrid cloud options bridging the gap between private infrastructure for sensitive patient records and public cloud scalability for nonclinical functions. Many practices are gravitating toward fully managed software-as-a-service models that eliminate the need for in-house server maintenance, while a contingent of institutions continues to adopt on-premise installations for maximum control over data residency and compliance.

Application-driven segmentation highlights the diverse toolkit modern veterinary clinics require. Appointment scheduling enhancements, from calendar integration to automated reminders, have become indispensable for reducing no-shows and optimizing staff utilization. Billing and invoicing modules, reinforced by claims management and payment processing functionalities, are streamlining revenue cycles. Electronic medical records platforms are advancing with diagnostic imaging integration and workflow automation, while inventory management systems ensure timely tracking of pharmaceuticals and supplies. Simultaneously, patient communication channels spanning email notifications, in-app messaging, and SMS notifications foster stronger client relationships. Telemedicine features, from video consultations to remote monitoring, are expanding the reach and responsiveness of care.

Animal type segmentation underscores differentiated use cases and software preferences. Equine practices often demand breed-specific record-keeping tailored to Arabian, Quarter Horse, or Thoroughbred management. Large animal settings focus on livestock applications for cattle, sheep, and swine. Mixed animal clinics require versatility for cats, dogs, and broader livestock, while small animal practices concentrate on companion species management. Practice type segmentation draws attention to corporate entities, franchised multiunit operations, and independent single-entity clinics, each with unique governance, standardization, and customization requirements. Lastly, organization size segmentation illuminates the operational scale spectrum, from small practices with fewer than five vets to medium clinics employing five to fifteen professionals, and large institutions hosting more than fifteen veterinarians.

This comprehensive research report categorizes the Veterinary Practice Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Application

- Animal Type

- Practice Type

- Organization Size

Mapping Regional Market Nuances across the Americas, Europe Middle East & Africa, and Asia-Pacific to Illuminate Local Opportunities and Challenges

Regional dynamics in the Americas are heavily influenced by North American ecosystems, where robust IT infrastructure and progressive regulatory frameworks support rapid adoption of cloud-native veterinary platforms. Latin American markets, while exhibiting strong growth potential, often prioritize cost-effective, mobile-centric solutions to address bandwidth limitations and infrastructure variability. Europe, Middle East & Africa present a heterogeneous landscape characterized by stringent data privacy regulations in the EU, evolving digital health mandates in the Middle East, and diverse economic conditions across Africa that influence software affordability and localization requirements.

In Asia-Pacific, a spectrum of advanced economies and emerging markets drives wide-ranging adoption patterns. Australia and Japan lead in telehealth integration and advanced analytics, leveraging high internet penetration and established electronic medical record standards. Southeast Asian countries balance the need for multilingual interfaces and mesh network compatibility in rural zones. Across these regions, local partnerships and region-specific compliance features serve as critical differentiators for vendors seeking to capture market share and address nuanced operational challenges.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Practice Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovations of Leading Veterinary Software Providers Transforming Practice Management Ecosystems

Leading software providers are distinguishing themselves through innovative feature development and strategic alliances with diagnostic hardware manufacturers. Several market frontrunners emphasize end-to-end solutions that seamlessly integrate practice management modules with advanced imaging workflows and laboratory interfaces. Some vendors focus on niche vertical expertise, delivering tailored platforms for equine or large animal practices, while others pursue horizontal scale by creating modular suites adaptable to multispecies and multi-location networks.

Competitive strategies also encompass differentiated pricing models, from tiered subscription plans catering to small practices to enterprise licensing agreements that support complex, multiunit franchise operations. Partnerships with telecommunications firms and regional data center operators are strengthening cloud resilience and data sovereignty, thereby alleviating tariff-driven uncertainties. Furthermore, a growing cohort of companies is investing in artificial intelligence and predictive analytics, enabling proactive inventory replenishment, clinical decision support, and client engagement optimizations that reinforce customer retention and lifetime value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Practice Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Animal Intelligence Software, Inc.

- Carestream Health, Inc.

- ClienTrax Software

- Covetrus, Inc.

- DaySmart Software

- Digitail, Inc.

- ezyVet Limited

- Henry Schein, Inc.

- Hippo Manager, Inc.

- IDEXX Laboratories, Inc.

- IntraVet Holdings, LLC

- NaVetor Veterinary Software

- Nordhealth Oy

- OpenVPMS

- Patterson Companies, Inc.

- PetDesk, Inc.

- Shepherd Veterinary Software

- Timeless Veterinary Systems, Inc.

- VetBlue, LLC

- Vetter Software, Inc.

Crafting Tactical Recommendations for Practice Leaders to Leverage Digital Advancements, Optimize Workflows, and Mitigate Emerging Market Risks

Industry leaders must prioritize seamless integration of telemedicine and diagnostic automation into their existing workflows to stay ahead of client expectations and operational benchmarks. Embracing flexible cloud architectures, including hybrid deployments, will balance the needs for data security and remote accessibility. In parallel, investing in AI-driven modules for workflow automation and predictive maintenance of equipment can unlock new efficiencies and reduce administrative overhead.

Building strategic alliances with domestic hardware suppliers and local cloud operators will mitigate the impact of external tariff pressures while reinforcing supply chain resilience. Firms should also explore tiered pricing frameworks that align value delivered with practice scale, ensuring small clinics can access premium functionality without prohibitive entry costs. Lastly, continuous investment in user training, change management, and client education will guarantee high adoption rates, driving both short-term operational gains and long-term customer loyalty.

Detailing Comprehensive Research Frameworks and Analytical Approaches Underpinning the Rigorous Examination of Veterinary Practice Management Software Trends

The research framework for this study combined extensive primary engagements with veterinary practice executives, IT decision-makers, and software solution architects, alongside rigorous secondary analysis of industry publications, white papers, and regulatory guidelines. Quantitative surveys provided statistical validation for feature adoption rates and deployment preferences, while qualitative interviews offered deep insights into pain points and strategic priorities.

Data triangulation across multiple sources ensured the reliability of observed trends, with iterative validation sessions conducted to refine hypotheses and confirm emerging patterns. Dedicated workshops facilitated scenario planning and stress-testing of tariff impact models, while technology roadmaps were analyzed to anticipate future innovation trajectories. This multifaceted methodology underpins the robust findings and actionable recommendations within the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Practice Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Practice Management Software Market, by Deployment Mode

- Veterinary Practice Management Software Market, by Application

- Veterinary Practice Management Software Market, by Animal Type

- Veterinary Practice Management Software Market, by Practice Type

- Veterinary Practice Management Software Market, by Organization Size

- Veterinary Practice Management Software Market, by Region

- Veterinary Practice Management Software Market, by Group

- Veterinary Practice Management Software Market, by Country

- United States Veterinary Practice Management Software Market

- China Veterinary Practice Management Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Summarizing Core Conclusions Highlighting Market Dynamics, Technology Evolutions, and Strategic Imperatives for Veterinary Practice Management Excellence

In summary, the veterinary practice management software market is being reshaped by digital innovation, evolving deployment preferences, and macroeconomic factors such as tariffs. Practices that harness cloud agility, integrate telemedicine, and leverage AI-driven analytics will secure a competitive edge. Segmentation analysis reveals nuanced requirements across deployment modes, clinical applications, animal types, practice structures, and organization sizes, underscoring the necessity of adaptable, scalable solutions.

Regional insights highlight the importance of localization and compliance in diverse markets, while competitive dynamics spotlight the role of partnerships and modular architectures in capturing market share. By aligning strategic investments in technology with targeted pricing and training initiatives, industry leaders can transform operational efficiency and client satisfaction. These conclusions form the foundation for informed decision-making and strategic planning in a rapidly evolving landscape.

Take action today and partner with Ketan Rohom to secure comprehensive veterinary practice management software intelligence for strategic market advantage

Are you poised to navigate the intricate dynamics of veterinary practice management software and elevate your strategic positioning today? Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure the definitive market research report that delivers actionable insights, comprehensive competitor analyses, and tailored recommendations. Engage with an expert who understands your need for timely intelligence, and transform data into decisive business outcomes by placing your inquiry directly with a seasoned industry specialist ready to support your growth objectives.

- How big is the Veterinary Practice Management Software Market?

- What is the Veterinary Practice Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?