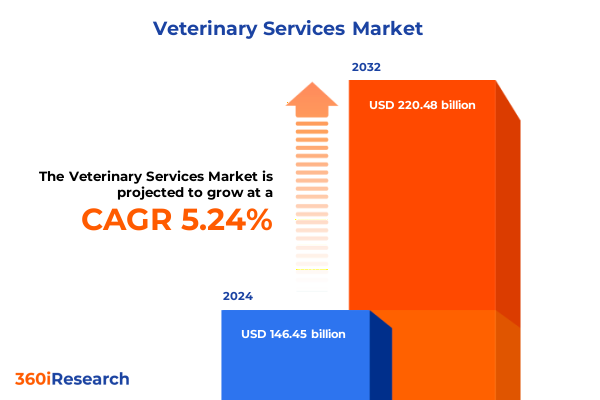

The Veterinary Services Market size was estimated at USD 153.48 billion in 2025 and expected to reach USD 160.85 billion in 2026, at a CAGR of 5.31% to reach USD 220.48 billion by 2032.

Navigating the Evolving Landscape of Veterinary Services and Uncovering Critical Drivers Shaping Industry Dynamics in 2025

The veterinary services sector has undergone a remarkable evolution in recent years, driven by shifting pet ownership trends, heightened consumer expectations, and rapid technological innovation. Rising disposable incomes and broader recognition of pets as integral family members have elevated demand for advanced medical care, preventive wellness programs, and specialized treatments. Furthermore, the proliferation of digital channels has empowered caregivers with greater visibility into service offerings and pricing structures, fostering a more discerning and engaged clientele.

Against this backdrop, regulatory frameworks have also adapted to ensure higher standards of safety and efficacy. At the same time, industry consolidation among practices and service providers has accelerated, reshaping competitive dynamics and resource allocation. These forces have converged to create an environment in which agility, technological adoption, and client-centric offerings stand out as key differentiators. As pet owners seek more holistic care experiences, practices that successfully integrate diagnostics, therapeutics, and wellness solutions are poised to lead.

Transitioning from traditional brick-and-mortar models to hybrid and mobile platforms, veterinary service providers are now exploring telehealth consultations, at-home care visits, and integrated service bundles. This introduction sets the stage for a deeper examination of the transformative shifts redefining the veterinary services landscape in 2025 and beyond.

Exploring Pivotal Technological Innovations and Paradigm Shifts Revolutionizing Veterinary Care Delivery Across Diverse Animal Segments

Beyond demographic shifts and consumer behavior, the veterinary services industry is experiencing transformative currents that promise to redefine care delivery. The emergence of telemedicine platforms has enabled remote consultations and triage, easing access for rural and time-constrained pet owners. In parallel, the adoption of artificial intelligence for diagnostic imaging and predictive analytics is enhancing clinical accuracy and accelerating decision-making. Wearable health monitors now offer real-time data on vital signs, activity levels, and chronic condition flare-ups, empowering both veterinarians and owners to adopt proactive wellness strategies.

Meanwhile, the integration of precision medicine, including genomic sequencing and targeted treatments, is unlocking new avenues for treating hereditary conditions. Supply chain digitization is streamlining inventory management and reducing equipment downtime, while cloud-based practice management solutions facilitate seamless client communication and billing. Furthermore, the emphasis on sustainability has prompted providers to explore eco-friendly sterilization methods, biodegradable supplies, and green facility designs. Together, these innovations are forging a veterinary services ecosystem that is more connected, data-driven, and environmentally responsible.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Policies on the Veterinary Services Supply Chain and Cost Structures

The United States enacted a suite of tariffs in early 2025 targeting animal health products and diagnostic equipment sourced from key trading partners. These measures, intended to protect domestic manufacturing and incentivize local production, have led to immediate cost pressures across veterinary clinics and laboratories. Imported imaging devices such as MRI and CT scanners, previously procured at competitive prices, now carry a premium, directly affecting diagnostic imaging service margins.

Similarly, pharmaceutical tariffs have driven up the cost of specialty drugs required for complex treatments, prompting providers to reassess procurement strategies and explore alternative suppliers. In response, some service operators have accelerated collaborative ventures with domestic equipment manufacturers, fostering joint innovation efforts. At the same time, tariffs have spurred investment in local R&D for veterinary pharmaceuticals, which could yield long-term benefits in supply security and tailored therapeutic solutions.

While the initial impact has stretched operational budgets and influenced pricing strategies, the industry’s adaptive measures reveal pathways to resilience. Practices are renegotiating supply contracts, optimizing inventory turnover, and consolidating purchasing power through group buying organizations. As the tariff landscape continues to evolve, veterinary service providers that proactively reconfigure their supply chains and partner ecosystems will mitigate cost volatility and maintain high standards of care.

Unveiling Critical Segmentation Insights to Clarify Veterinary Service Requirements Across Animal Types Service Categories Practice Settings and Client Types

A nuanced segmentation framework yields invaluable insights into the heterogeneous needs of the veterinary services market. When categorized by animal type, care priorities vary significantly among cats, dogs, equine, exotic pets, and livestock. Within the equine category, breeding stock demand specialized reproductive support and genetic counseling, while pleasure horses require routine preventive care and rehabilitation services. Sport horses, by contrast, necessitate advanced orthopedic interventions and high-performance conditioning programs. Exotic pets, spanning amphibians, birds, reptiles, and small mammals, drive demand for species-specific diagnostic protocols and nutritional regimens. Meanwhile, livestock services bifurcate into avian, bovine, caprine, ovine, and porcine segments, each with regulatory compliance, herd health management, and large-scale vaccination campaigns.

Service type segmentation further refines market understanding. Dental services encompass cleaning and polishing, radiographic imaging, and extractions tailored to species-appropriate oral anatomy. Diagnostic imaging expands across MRI and CT, conventional radiography, and ultrasonography, serving both routine and complex cases. Emergency and critical care includes poison management, trauma care, and intensive monitoring. Preventive care integrates nutritional counseling, parasite control, vaccine administration, and wellness examinations to forestall chronic conditions. Surgical procedures range from minimally invasive endoscopies to reconstructive orthopedic operations and soft tissue interventions.

Practice setting segmentation reveals distinct operational models. Large animal practices often operate on a farm-visit basis, supporting herd vaccination and reproductive services, whereas mixed animal clinics must balance small pet care with occasional equine or livestock consultations. Mobile clinics bring preventive and routine services directly to client locations, reducing stress on animals. Small animal clinics provide comprehensive wellness and specialty services, and specialty referral centers focus on tertiary-level diagnostics and surgeries. Client type segmentation distinguishes commercial livestock producers seeking cost-efficient herd solutions, equine owners prioritizing performance outcomes, exotic pet owners requiring niche expertise, individual pet owners valuing personalized care, and research institutions demanding rigorous protocols for experimental animals. This layered segmentation approach illuminates the varied service requirements and strategic priorities that providers must address.

This comprehensive research report categorizes the Veterinary Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Animal Type

- Service Type

- Practice Setting

- Client Type

Providing Comprehensive Regional Analysis Highlighting Unique Growth Drivers and Challenges Shaping Veterinary Services Markets Across Key Global Territories

Regional analysis reveals divergent growth drivers and market characteristics that shape veterinary services across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, elevated pet ownership rates and well-established healthcare infrastructures underpin a robust demand for comprehensive clinical offerings. The United States leads adoption of advanced imaging and telehealth solutions, while Canada’s rural communities increasingly rely on mobile clinics and mixed practice models to bridge geographic gaps.

Across Europe, the Middle East & Africa, regulatory harmonization initiatives in the European Union drive standardization in preventive care and pharmaceutical use, fostering cross-border collaboration among providers. In the Middle East, rising investments in animal welfare and burgeoning equine sport sectors fuel specialized service development, whereas sub-Saharan Africa contends with infrastructure constraints, prioritizing scalable herd health programs and government-backed vaccination initiatives.

In Asia-Pacific, shifting dietary preferences and expanding livestock operations in China and India amplify demand for large-scale veterinary solutions. Urbanization trends in Japan and Australia support growth in pet insurance uptake and high-end specialty clinics. Telemedicine adoption accelerates in emerging markets where mobile penetration outpaces traditional healthcare access, enabling remote diagnostics and digital consultation platforms. Collectively, these regional distinctions emphasize the necessity for service providers to tailor offerings to local regulatory environments, cultural preferences, and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Strategies and Market Positioning of Leading Veterinary Service Providers Driving Innovation and Competitive Advantage in the Industry

The competitive landscape in veterinary services is shaped by several leading providers whose strategic initiatives set industry benchmarks. A major corporate consolidator has expanded its network of animal hospitals, investing heavily in integrated digital platforms that streamline appointment scheduling, electronic medical records, and telehealth consultations. Another global animal health company has leveraged its pharmaceutical expertise to bundle therapeutics and laboratory diagnostics, creating comprehensive care packages for companion animals and livestock alike.

Key equipment distributors have pursued partnerships with diagnostic imaging specialists to launch co-branded centers of excellence, positioning themselves at the forefront of advanced imaging services. Meanwhile, innovative startups have carved niches in wearable health monitors and AI-driven diagnostic tools, attracting significant venture capital and forging pilot programs with established veterinary groups. Multi-practice management organizations continue to consolidate independent clinics, standardizing protocols and negotiating volume discounts with suppliers to drive cost efficiencies.

In parallel, specialty referral centers have differentiated through tertiary-level services in oncology, cardiology, and orthopedic surgery, reinforcing their roles as critical referral hubs. Collaborative research agreements between university-affiliated teaching hospitals and private practices have also emerged, accelerating clinical trials and knowledge transfer. These diverse strategic approaches illustrate the multifaceted competitive dynamics that market participants must navigate to secure sustainable growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CVS Group plc

- Ethos Veterinary Health, LLC

- Greencross Limited

- Linnaeus Holding Limited

- Mars, Incorporated

- Modern Animal

- National Veterinary Associates, LP

- Pathway Vet Alliance, Inc.

- PetVet Care Centers, Inc.

- Veterinary Emergency Group, LLC

- Veterinary Service Inc.

- VetPartners Limited

Offering Targeted Strategic Recommendations to Empower Veterinary Industry Leaders to Capitalize on Emerging Trends and Strengthen Operational Resilience

In light of evolving market dynamics, providers should prioritize the deployment of telehealth infrastructure to expand geographic reach and enhance client engagement. Integrating artificial intelligence into diagnostic workflows can not only improve accuracy but also optimize clinician workload and reduce turnaround times. Cultivating partnerships with domestic manufacturers will mitigate tariff-induced supply disruptions, while collaborative procurement agreements can bolster negotiating power and stabilize costs.

Furthermore, practices should diversify revenue streams by developing preventive care subscription models and wellness plans tailored to specific animal segments. Investing in staff training on species-specific procedures and advanced technologies will elevate care quality and foster brand loyalty. Sustainability initiatives, such as adopting eco-friendly sterilization processes and reducing single-use plastics, will resonate with environmentally conscious clients and align with broader regulatory trends.

Finally, market leaders must remain vigilant of regional nuances, customizing service portfolios to local infrastructure and cultural expectations. By leveraging data analytics to refine service mix and client outreach, organizations will uncover new growth pockets and enhance operational resilience. These targeted strategies will empower veterinary service providers to thrive in an increasingly complex and competitive environment.

Detailing a Rigorous Multi-Method Research Design Combining Primary Insights and Secondary Intelligence to Illuminate Veterinary Services Market Dynamics

This research employs a blended methodology, integrating primary data collection and comprehensive secondary intelligence. Primary research encompassed structured interviews with veterinary practice owners, service executives, and industry experts, capturing qualitative insights on technology adoption, regulatory impacts, and evolving client preferences. Concurrently, online surveys gathered quantitative feedback from a broad cross-section of veterinary professionals and animal owners, validating thematic findings and measuring service adoption trends.

Secondary research involved an exhaustive review of industry publications, scientific journals, regulatory filings, and company annual reports. Publicly available databases provided macroeconomic indicators, trade statistics, and tariff schedules to assess policy impacts. Proprietary analytics tools were deployed to map competitive landscapes and track M&A activities. To ensure robustness, all data points underwent triangulation across multiple sources, with anomalies subjected to follow-up clarification.

Analytical frameworks, including SWOT and PESTEL analyses, were applied to synthesize internal capabilities and external pressures. Segmentation modeling techniques delineated distinct service requirements across animal types, practice settings, and client profiles. This multi-method approach underpins the rigor and credibility of the insights presented, laying a solid foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Services Market, by Animal Type

- Veterinary Services Market, by Service Type

- Veterinary Services Market, by Practice Setting

- Veterinary Services Market, by Client Type

- Veterinary Services Market, by Region

- Veterinary Services Market, by Group

- Veterinary Services Market, by Country

- United States Veterinary Services Market

- China Veterinary Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Findings to Highlight the Strategic Imperatives and Future Outlook for the Veterinary Services Industry in a Rapidly Changing Environment

The synthesis of data and expert perspectives underscores several strategic imperatives for the veterinary services industry. First, the integration of digital health solutions and AI-enabled diagnostics will serve as critical levers for enhancing clinical outcomes and operational efficiency. Second, the evolving tariff environment has illuminated the importance of resilient supply chains and strategic sourcing partnerships to mitigate cost volatility. Third, the nuanced segmentation of animal types, service categories, and client profiles highlights the necessity for tailored care models and specialized service bundles.

Regional disparities in regulatory frameworks, infrastructure maturity, and consumer expectations demand localized strategies, from scaling mobile clinics in underserved areas to launching high-end specialty centers in mature markets. Competitive dynamics are increasingly driven by consolidation, strategic alliances, and technology partnerships, emphasizing the role of collaborative innovation. Above all, proactive investment in preventive care and wellness programs will cultivate long-term client relationships and support sustainable growth.

Looking ahead, veterinary service providers that embrace agile business models, leverage data-driven insights, and foster a culture of continuous innovation will be best positioned to navigate future challenges. This executive summary serves as a roadmap for decision-makers seeking to align organizational priorities with emerging market realities.

Seize Exclusive Access to Comprehensive Veterinary Services Market Research by Reaching Out to Ketan Rohom for Customized Insights and Purchasing Information

To secure a comprehensive understanding of the veterinary services landscape, reach out to Ketan Rohom at your earliest convenience. He will guide you through a tailored presentation of the market research findings, ensuring that you extract maximum strategic value from our in-depth analysis. By collaborating with him, you will gain access to exclusive data sets, customized benchmarking, and ongoing support designed to help your organization navigate evolving industry challenges. Act now to align your decision-making with the most current insights and drive sustainable competitive advantage in a rapidly transforming market.

- How big is the Veterinary Services Market?

- What is the Veterinary Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?