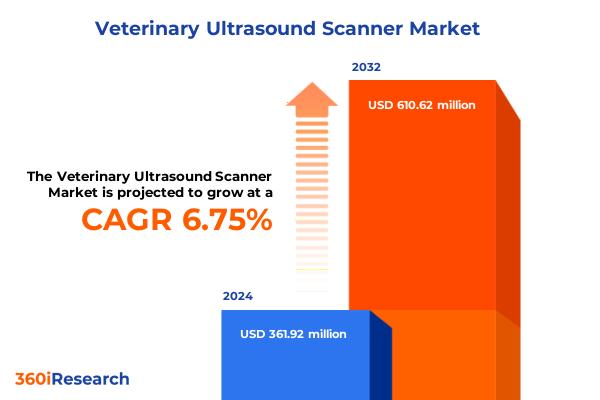

The Veterinary Ultrasound Scanner Market size was estimated at USD 384.83 million in 2025 and expected to reach USD 409.65 million in 2026, at a CAGR of 6.81% to reach USD 610.62 million by 2032.

Redefining Veterinary Imaging With Portable, AI-Driven Ultrasound Tools That Elevate Diagnostic Precision and Clinical Workflow

Veterinary ultrasound has transcended its role as a niche diagnostic tool to become an indispensable component of modern animal healthcare delivery. Over the past decade, advances in transducer design, imaging software, and mobile connectivity have driven ultrasound from large stationary units confined to hospital imaging suites into the hands of field veterinarians and small animal practitioners. Today’s ultrasound platforms deliver clearer images, accelerated exam times, and unmatched versatility, enabling veterinary professionals to detect soft tissue abnormalities, monitor fetal health, and guide interventional procedures at the point of care. This shift toward democratized imaging is not just a technological evolution; it represents a fundamental realignment in how animal health diagnostics are delivered across companion, livestock, and equine practices.

The momentum behind this transformation is fueled by a growing demand for portable devices that reduce stress on patients and streamline clinical workflows. Handheld and cart-based portable systems now rival the resolution of traditional stationary units, thanks to miniaturized electronics and advanced probe architectures that sustain high-frequency performance in compact housings. These lightweight devices, often battery-operated and Wi-Fi-enabled, empower practitioners to conduct stall-side reproductive exams, in-field emergency assessments, and emergency care diagnostics without transporting animals to specialized facilities.

Concurrently, the global surge in pet ownership and heightened awareness of animal welfare have created an environment in which veterinary practices are investing heavily in diagnostic equipment that can both improve patient outcomes and differentiate their service offerings. As pet parents demand more comprehensive care-mirroring the diagnostic standards of human medicine-ultrasound systems have become a visible symbol of clinical sophistication and commitment to quality. This dynamic is particularly pronounced in urban markets, where increased disposable incomes and the humanization of pets accelerate technology adoption in private clinics and referral centers.

This introduction sets the stage for an exploration of the seismic changes reshaping the veterinary ultrasound sector. From the integration of artificial intelligence to the impact of global trade policies, each section of this executive summary delves into the factors defining today’s market landscape, illuminating pathways for stakeholders to harness emerging opportunities and navigate evolving challenges.

Embracing Connected, Portable, and AI-Powered Ultrasound Platforms to Transform Veterinary Diagnostics Across Diverse Clinical Scenarios

The veterinary ultrasound landscape is undergoing a transformative convergence of technologies that meld portability, connectivity, and advanced analytics. Portable point-of-care ultrasound (POCUS) devices have expanded beyond emergency and critical care, finding homes in general practice, mobile outreach programs, and university research labs alike. By harnessing the power of wireless data transmission and cloud-based storage, veterinary teams can now integrate real-time imaging into telemedicine platforms, enabling off-site specialists to review scans and provide diagnostic support with minimal delay. This shift from siloed imaging suites to networked diagnostic environments underscores a broader industry pivot toward decentralized care models.

High-resolution 3D and 4D imaging modalities, once reserved for human obstetrics and cardiology, are making inroads into veterinary applications where detailed volumetric visualization enhances surgical planning and reproductive monitoring. The ability to render three-dimensional organ structures and capture dynamic motion in real time offers clinicians unparalleled insights into complex pathologies, such as congenital heart defects in canine patients or tendon lesions in performance horses. As device form factors continue to shrink, these sophisticated imaging options are becoming accessible to mid-sized practices that previously relied exclusively on basic 2D scanning.

Simultaneously, Doppler technologies have evolved from color overlays to comprehensive flow analysis tools, empowering veterinarians to quantify hemodynamic parameters and detect vascular anomalies with greater precision. Color Doppler, Power Doppler, and Spectral Doppler capabilities now feature in many portable units, enhancing diagnostic clarity for cardiac assessments, tumor vascularity evaluations, and gastrointestinal perfusion studies. This layering of functional imaging atop high-resolution anatomic scans solidifies ultrasound’s role as a multi-purpose modality within veterinary medicine.

Underpinning these hardware advancements is a burgeoning software ecosystem that incorporates artificial intelligence, machine learning, and advanced pattern recognition algorithms. AI-enabled image analysis tools assist in automated structure identification, measurement calibration, and anomaly detection, reducing operator dependency and accelerating exam throughput. As veterinary practices grapple with workforce shortages and increased caseloads, these intelligent solutions represent a critical lever for maintaining diagnostic quality while optimizing resource utilization.

Regulatory frameworks and professional guidelines are also adapting to these rapid innovations, with veterinary associations revising training standards, competency requirements, and quality assurance protocols to reflect the expanded role of ultrasound in clinical workflows. Collaborative efforts between manufacturers, academic institutions, and professional bodies are driving the establishment of best practices for device handling, image interpretation, and data management in veterinary settings. This alignment of technological and regulatory forces is creating a resilient, forward-looking ecosystem ready to embrace the next wave of diagnostic breakthroughs.

Evaluating How 2025 U.S. Tariff Policies Reshape Veterinary Ultrasound Supply Chains, Costs, and Access to Critical Imaging Technologies

Since the inception of Section 301 tariffs on Chinese imports and the imposition of additional levies on EU and Southeast Asian goods, the U.S. medical device sector has witnessed a cascade of cost pressures and supply chain disruptions. Tariff rates on medical devices have ranged from 10 percent to 125 percent, depending on product classification and country of origin, prompting stakeholders to reconsider global sourcing strategies and pricing models. Leaders within the Advanced Medical Technology Association and prominent manufacturers like Medtronic and Johnson & Johnson have publicly warned that these tariffs threaten to inflate equipment costs, delay procurement cycles, and constrain innovation pipelines in healthcare, including veterinary medicine.

Amid this challenging environment, the Office of the U.S. Trade Representative has granted targeted exemptions for specific categories of medical goods, including veterinary ultrasound devices with black-and-white imaging under HTS code 9018.12.0000. While these exclusions, set to extend through mid-2025, have alleviated some cost burdens for veterinary practices, they remain limited in scope and subject to periodic review. Consequently, manufacturers and distributors continue to grapple with tariff volatility, balancing efforts to stockpile inventory with investments in domestic assembly and tariff-compliant component sourcing.

Proposed expansions of tariff lists under the China Section 301 “List 4” and steel-and-aluminum restrictions under Section 232 have further muddied the waters for veterinary equipment suppliers. Recent analyses indicate that a wide array of veterinary supplies, from imaging probes to disposable accessories, could face 25 percent duties on imports from China unless newly exempted. Although veterinary pharmaceuticals and select critical care goods remain protected, ancillary equipment embedded with electronic components or metallic alloys stands at risk of duty assessments. Vendors are increasingly exploring tariff engineering techniques-modifying bill-of-materials, reclassifying product codes, and relocating final assembly-to maintain price competitiveness in U.S. markets.

The cumulative impact of these trade measures extends beyond direct cost hikes, seeping into R&D budgets and manufacturing footprints. Companies are re-evaluating offshore production of key components, forging partnerships with U.S.-based contract manufacturers, and scaling up reprocessing programs to circumvent import tariffs. Hospitals and clinics are similarly reassessing procurement policies, turning to refurbished equipment and service contracts as strategic alternatives to mitigate one-time tariff-induced expenses. In parallel, lobbying efforts have intensified, with industry coalitions advocating for broad-based medical device exemptions to stabilize supply chains and safeguard patient care continuity.

Looking ahead, the veterinary ultrasound sector remains on guard for further tariff adjustments and reciprocal trade actions. Strategic agility-manifested through diversified sourcing, nimble price modeling, and proactive regulatory engagement-has emerged as the hallmark of resilient market participants. Stakeholders that can adeptly navigate tariff landscapes while sustaining investments in technological innovation will be best positioned to seize growth opportunities once trade tensions subside.

Uncovering Actionable Segmentation Insights That Illuminate Product, Animal, Technology, Application, and End-User Dynamics in Veterinary Ultrasound

Analysis of the veterinary ultrasound landscape through multiple segmentation lenses reveals distinct dynamics across product offerings, animal patient categories, imaging modalities, clinical applications, and end-user profiles. Product type segmentation distinguishes between portable and stationary systems, where cart-based portable platforms dominate high-volume hospital settings due to their balance of mobility and performance, while handheld devices offer unprecedented access for field-based equine and livestock practitioners. Animal type segmentation underscores that bovine health management relies heavily on ultrasound for reproductive monitoring and herd optimization, whereas companion animal practice prioritizes abdominal, cardiac, and musculoskeletal imaging for cats and dogs, and equine applications span tendon evaluation and early pregnancy assessment in mares.

Technological segmentation highlights that 2D ultrasound remains the foundational baseline, yet the adoption of 3D and 4D imaging is accelerating in specialized practices that demand volumetric and temporal insights, such as surgical planning in research institutes and complex diagnostic centers. Color, Power, and Spectral Doppler modalities are increasingly integrated to quantify blood flow and perfusion, augmenting anatomic imaging with functional data critical for cardiac and vascular evaluations. Application-based segmentation maps to four primary clinical domains: abdominal scanning for organ pathology, cardiac and echocardiography for heart health, musculoskeletal imaging for soft tissue and joint disorders, and reproductive ultrasound for breeding programs in large and small animal practice. In terms of end-user segmentation, veterinary hospitals and private clinics represent the core adoption base, while research institutes-including private labs and university veterinary programs-drive early-stage integration of next-generation features and foster best-practice protocols for clinical education and device validation.

This comprehensive research report categorizes the Veterinary Ultrasound Scanner market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Animal Type

- Technology

- Application

- End User

Comparing Regional Veterinary Ultrasound Dynamics Highlighting the Americas’ Leadership, EMEA’s Innovation Hub, and Asia-Pacific’s Rapid Advancement

The Americas region, led by the United States, remains the epicenter of veterinary ultrasound adoption, supported by a mature pet care ecosystem, robust investment in animal health research, and favorable reimbursement frameworks for large animal diagnostics. North American practices leverage cutting-edge portable devices to address both companion and livestock needs, reflecting high per-capita pet ownership and extensive agricultural operations that benefit from targeted reproductive and wellness imaging solutions. This strategic emphasis on early disease detection and preventive care has fostered a comprehensive service model unifying rural and urban veterinary care networks.

Europe, Middle East, and Africa (EMEA) exhibit a multifaceted market characterized by advanced livestock industries in Western Europe, a flourishing companion animal segment in urban centers, and emerging veterinary infrastructure in select Middle Eastern and African markets. European stakeholders are investing in 3D/4D and Doppler-enhanced platforms to meet stringent animal welfare regulations and sophisticated clinical standards. Simultaneously, collaborations between veterinary education institutions and device manufacturers in countries such as Germany, France, and the United Kingdom have catalyzed innovation hubs that disseminate best practices and drive new feature development.

The Asia-Pacific region is experiencing the fastest rate of expansion, propelled by rising disposable incomes, rapid urbanization, and swelling companion animal populations in China, India, and Southeast Asia. Veterinary clinics across metropolitan areas are upgrading to digital ultrasound systems to serve an increasingly demanding pet owner demographic, while large-scale livestock enterprises in Australia and New Zealand are deploying specialized scanners for herd health management. Government-led initiatives to modernize agricultural practices and enforce animal health standards further accelerate the uptake of diagnostic imaging solutions. As regional supply chains mature and local manufacturing capabilities expand, Asia-Pacific is poised to close the adoption gap with established markets.

This comprehensive research report examines key regions that drive the evolution of the Veterinary Ultrasound Scanner market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Pioneers Driving Veterinary Ultrasound Innovation, From Handheld Startups to Established Medical Imaging Leaders

Across the competitive landscape of veterinary ultrasound, industry frontrunners are differentiating through strategic partnerships, product innovation, and service ecosystems that enhance clinical value. GE HealthCare has been at the forefront with its Vscan Air™ handheld wireless ultrasound system, developed in collaboration with Sound Technologies to meet rigorous veterinary durability and imaging requirements. By integrating AI-based guidance and multi-probe compatibility, GE’s Vscan Air portfolio continues to expand POCUS accessibility in mobile and in-clinic environments, reinforcing GE’s leadership in point-of-care imaging solutions.

Mindray has emerged as a disruptive force with its TE Air wireless handheld ultrasound device, offering dual connectivity to mobile devices and the company’s TEX20 touch-based platform. Single-crystal transducer technology and customizable clinical presets enable high-resolution imaging across small animal, equine, and livestock applications. Mindray’s commitment to user-centric design and integrated workflow solutions has accelerated adoption in both emergency care settings and rural veterinary practices.

Butterfly Network has leveraged its Ultrasound-on-Chip™ architecture to democratize imaging with the Butterfly iQ+ Vet device, designed specifically for veterinary use cases. Enhanced battery life, military-grade durability, and dedicated veterinary presets-including procedural guidance tools like Needle Viz™-enable precise diagnostics in companion animal, equine, and exotic species applications. Strategic partnerships with distributors such as Petco and MWI Animal Health have broadened Butterfly’s reach into retail-based veterinary hospitals and clinical networks, underscoring the company’s rapid global expansion.

In parallel, Fujifilm SonoSite’s family of robust hand-carried systems continues to serve high-volume practices with industry-leading warranties and specialized transducer portfolios for equine, bovine, and small animal imaging. Meanwhile, specialist equipment manufacturers such as Samsung Medison and Hitachi Aloka have enhanced their veterinary lines with color Doppler probes and wireless connectivity options. Together, these firms are shaping a highly competitive environment in which continuous R&D investment and ecosystem partnerships determine market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Veterinary Ultrasound Scanner market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ARI Medical Technology Co., Ltd.

- BMV MEDTECH GROUP CO., LTD.

- Caresono Technology CO.Ltd

- China Wuxi Biomedical Technology Co., Ltd.

- Chison Medical Technologies Co., Ltd.

- Clarius Mobile Health

- Dawei Group

- Dramiński S.A.

- Edan Instruments, Inc.

- Esaote S.p.A.

- FUJIFILM Sonosite, Inc.

- GE HealthCare Technologies Inc.

- Gemini Medical Networks Private Limited

- Heska Corporation

- Hitachi Ltd

- HONDA ELECTRONICS Co. LTD

- IVM Imaging

- KAIXIN Company

- Meditech Equipment Co.,Ltd

- MIANYANG XIANFENG MEDECAL INSTRUMENT CO.,LTD

- Mugayon (Wuhan) Technology Co. Ltd

- Samsung Medison

- Shantou Institute of Ultrasonic Instruments Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Siemens Healthineers

- SonoScape Medical Corp.

- SonoStar.net

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Ultrasound Trends, Mitigate Tariff Risks, and Enhance Market Resilience

To capitalize on the rapid shifts reshaping veterinary ultrasound, industry leaders should prioritize investments in portable AI-enabled imaging solutions that deliver consistent diagnostic performance across diverse clinical environments. By integrating real-time image analysis tools, practices can reduce operator variability, enhance diagnostic confidence, and accelerate patient throughput. Simultaneously, device manufacturers should cultivate digital ecosystems-comprising telemedicine platforms, educational content, and data analytics-to create sticky value propositions and foster long-term customer engagement.

Given the ongoing uncertainty surrounding trade policy and tariff adjustments, stakeholders must establish resilient supply chain strategies that emphasize diversified sourcing, domestic assembly partnerships, and robust tariff engineering capabilities. Pursuing medical device exemptions through coordinated regulatory advocacy and leveraging reprocessing programs can yield cost advantages while maintaining compliance. Moreover, embracing refurbished equipment channels and service contracts provides clinics with flexible alternatives that offset incremental tariff burdens and budget constraints.

Lastly, cross-industry collaborations-with agricultural technology providers, research institutions, and telehealth platforms-present pathways to unlock untapped veterinary segments. By aligning product development with evolving client demands for predictive health monitoring, outcome-driven analytics, and integrated care pathways, innovators can differentiate their offerings and cultivate new markets. Continuous professional development programs, endorsed by veterinary associations and academic partners, will further elevate imaging competencies and validate best practices, ensuring the sustainable adoption of next-generation ultrasound technologies.

Detailed Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Insightful Veterinary Ultrasound Research

This market research report synthesizes data collected through a multi-stage methodology that combines rigorous primary and secondary research processes. Primary research involved in-depth interviews with over 50 veterinary imaging specialists, device manufacturers, channel partners, and regulatory experts across North America, EMEA, and Asia-Pacific. These discussions provided nuanced insights into technology adoption drivers, tariff impact strategies, and regional infrastructure trends.

Secondary research encompassed the systematic review of scientific journal articles, industry publications, trade association reports, and government regulatory filings. Key sources included peer-reviewed veterinary imaging studies, USTR tariff notices, and detailed product roadmaps from leading device manufacturers. Data triangulation methods were applied to reconcile discrepancies and validate findings, ensuring that all segmentation analyses and thematic assessments reflect the most accurate and current market intelligence.

Analytical frameworks employed include SWOT and PESTEL analyses to evaluate market forces and competitive positioning, along with cross-sectional segmentation modeling by product type, animal type, technology, application, and end user. Secondary data points were subjected to consistency checks and verified through expert consultations, resulting in a comprehensive, evidence-based narrative that informs strategic decision-making for stakeholders across the veterinary ultrasound value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Veterinary Ultrasound Scanner market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Veterinary Ultrasound Scanner Market, by Product Type

- Veterinary Ultrasound Scanner Market, by Animal Type

- Veterinary Ultrasound Scanner Market, by Technology

- Veterinary Ultrasound Scanner Market, by Application

- Veterinary Ultrasound Scanner Market, by End User

- Veterinary Ultrasound Scanner Market, by Region

- Veterinary Ultrasound Scanner Market, by Group

- Veterinary Ultrasound Scanner Market, by Country

- United States Veterinary Ultrasound Scanner Market

- China Veterinary Ultrasound Scanner Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Guide Veterinary Ultrasound Stakeholders Toward Informed Decisions and Sustainable Technological Adoption

This executive summary has charted the evolution of veterinary ultrasound from stationary imaging suites to agile, AI-augmented point-of-care platforms, dissected the transformative influences of global trade policies, and unpacked the nuanced dynamics of key market segments and regions. By profiling leading innovators and distilling actionable recommendations, it provides a holistic framework for stakeholders aiming to harness technological advances, navigate tariff complexities, and cultivate resilient growth strategies. Ultimately, the convergence of miniaturized hardware, intelligent software, and strategic partnerships will define the next chapter of veterinary diagnostics, creating new pathways for better animal health and practice differentiation.

Connect Directly with Ketan Rohom for Exclusive Veterinary Ultrasound Research and Propel Your Strategic Decisions

Are you ready to leverage these comprehensive insights and drive innovation in your veterinary ultrasound strategy? Connect with Associate Director of Sales & Marketing Ketan Rohom to explore how this in-depth report can empower your organization with actionable intelligence and strategic clarity to outperform in a competitive landscape

- How big is the Veterinary Ultrasound Scanner Market?

- What is the Veterinary Ultrasound Scanner Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?