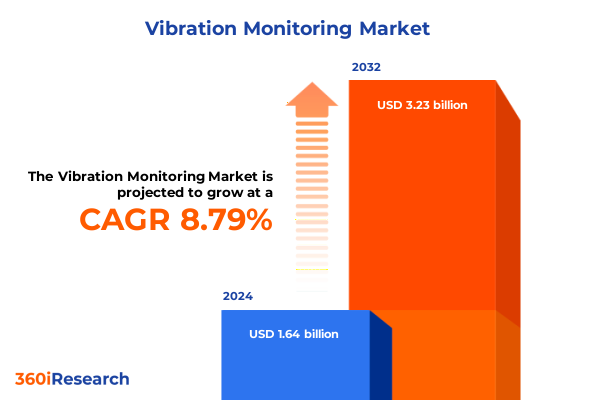

The Vibration Monitoring Market size was estimated at USD 1.78 billion in 2025 and expected to reach USD 1.94 billion in 2026, at a CAGR of 8.84% to reach USD 3.23 billion by 2032.

Setting the Stage for Unmatched Asset Reliability Through Next-Generation Vibration Monitoring Systems Integrated with Predictive Analytics and IoT for Proactive Maintenance

Modern industrial operators are increasingly prioritizing reliability and uptime as core business imperatives, which has elevated vibration monitoring from a specialized maintenance tool to a strategic asset. As facilities embrace digital transformation, the integration of high-fidelity sensors with Internet of Things platforms enables continuous tracking of mechanical health across rotating equipment. Concurrently, advances in predictive analytics are shifting maintenance philosophies from reactive and calendar-based routines to proactive, condition-driven interventions. This paradigm shift underscores the emergence of vibration monitoring as a cornerstone of robust asset management strategies, where real-time diagnostics and early fault detection safeguard against unexpected failures and costly downtime.

Across sectors ranging from energy generation to complex manufacturing, the demand for seamless visibility into machine performance is driving investments in scalable, intelligent monitoring architectures. Edge computing capabilities embedded within wireless accelerometers and proximity probes now facilitate on-site preprocessing of vibration signatures, reducing data transmission loads and improving response times. Meanwhile, cloud-based software platforms aggregate multisite vibration data, offering maintenance teams and decision-makers a comprehensive view of equipment trends and lifecycle health. As a result, organizations are better positioned to align maintenance planning with production schedules, optimize resource allocation, and enhance return on invested capital.

Accelerating Operational Excellence with Transformative Shifts in Intelligent Vibration Monitoring Enabled by AI-Driven Analytics and Digitalized Maintenance Ecosystems

The vibration monitoring landscape is experiencing fundamental transformation fueled by converging technological and operational forces. Artificial intelligence and machine learning algorithms are now capable of parsing complex spectral and time-series vibration data to identify subtle degradation patterns that defy traditional threshold-based alerts. This evolution empowers maintenance teams with context-aware diagnostics that factor in load conditions, ambient variables, and asset history, accelerating root cause analysis and reducing false alarms.

At the same time, the proliferation of wireless sensor networks has unlocked unprecedented flexibility, allowing rapid deployment of accelerometers, velocity sensors, and transmitters in previously inaccessible or high-risk environments. These sensors, often powered by energy harvesting or long-life batteries, feed continuous data streams into edge gateways that execute initial feature extraction and anomaly detection, ensuring instant alerting while preserving network bandwidth. This decentralized intelligence supports hierarchical monitoring architectures in which local edge nodes deliver first-tier diagnostics, while centralized cloud platforms provide deep-dive analytics and fleet-wide benchmarking.

Moreover, services-centric business models are reshaping vendor–customer dynamics. Managed vibration monitoring offerings, combining professional consulting, system integration, and ongoing health assessments, reduce upfront complexity for end-users and accelerate time to value. Simultaneously, diagnostic software suites equipped with low-code configuration interfaces extend monitoring program ownership to cross-functional teams in operations and reliability engineering, fostering a culture of continuous improvement. Collectively, these transformative shifts are redefining how organizations harness vibration data to drive operational excellence, cost efficiency, and sustainable growth.

Navigating the Complex Ripple Effects of New 2025 United States Tariffs on Global Vibration Monitoring Equipment and Supply Chains

In early 2025, sweeping adjustments to the United States tariff framework have introduced a universal baseline levy on industrial equipment imports, intensifying cost pressures across the vibration monitoring value chain. Accelerometers, diagnostic software modules, and specialized transmitters sourced from major trading partners now carry surcharges well above historical levels, prompting many vendors to reevaluate component sourcing and production footprints. These heightened duties complicate procurement strategies, potentially delaying deployment timelines as contract negotiations incorporate tariff contingencies and pass-through costs.

At the same time, companies that traditionally relied on competitively priced imports are grappling with margin erosion and supply chain disruptions. In response, some market leaders are accelerating domestic manufacturing initiatives, establishing localized assembly lines for hardware components to mitigate tariff exposure. Others are diversifying through nearshoring partnerships with low-tariff countries, blending regional content aggregation with cross-border logistics solutions. These strategic adaptations, while aimed at insulating operational performance, require significant capital deployment and carry execution risk as global trading agreements continue to fluctuate.

Beyond direct cost impacts, tariff-induced pricing volatility has triggered recalibrations in long-term service contracts. Organizations are increasingly embedding flexible escalation clauses that account for future adjustments to trade policy, thereby safeguarding their maintenance budgets from unforeseen spikes. In aggregate, the new United States tariffs for 2025 are accelerating the reshaping of global vibration monitoring supply chains, driving innovation in localized production and contract structuring while underscoring the critical role of agility in an evolving regulatory environment.

Unlocking Comprehensive Market Perspectives through Multi-Dimensional Segmentation Insights Spanning Components Processes Functionalities Deployments Verticals and Applications

An in-depth examination of market segments reveals nuanced opportunities and challenges across the vibration monitoring ecosystem. Within the hardware domain, accelerometers continue to command significant attention for their precision in capturing high-frequency signatures, while proximity probes and velocity sensors retain essential roles in monitoring slow-speed machinery. This hardware-centric growth is complemented by expanding software capabilities, where data integration suites unify multi-sensor inputs and diagnostic platforms enrich actionable insights. Concurrently, managed services are gaining traction as organizations outsource specialist analysis and health reporting to partners capable of delivering turn-key monitoring programs.

Process orientation further differentiates the market, as offline portable systems enable spot checks during planned outages, while online fixed installations ensure uninterrupted asset surveillance. In tandem with these deployment models, functionality-based innovations are evident in the rising adoption of predictive maintenance modules that pre-empt failures, backed by fault detection and diagnostics algorithms tuned to specific asset classes. These software layers dovetail with cloud-native and on-premises deployment options, allowing end-users to balance concerns around cybersecurity, latency, and data sovereignty.

Diverse industry verticals-from aerospace and automotive to energy and power-are tailoring vibration monitoring applications to distinct operational profiles. In sectors such as oil and gas and chemical processing, robust meter and transmitter solutions must withstand corrosive environments and extreme temperatures, whereas food and beverage or pharmaceutical settings mandate hygienic, non-intrusive sensor designs. Across these verticals, bearings, motors, pumps, and turbines emerge as focal points for condition-based monitoring initiatives, reflecting their criticality in ensuring continuous throughput. Taken together, this multi-dimensional segmentation landscape underscores the importance of customized monitoring strategies aligned with both technical requirements and strategic maintenance objectives.

This comprehensive research report categorizes the Vibration Monitoring market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Monitoring Process

- Functionality

- Connectivity Type

- Industry Vertical

- Application

Decoding Regional Dynamics and Growth Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific Vibration Monitoring Markets

Regional dynamics in the vibration monitoring domain are shaped by distinct economic drivers, industrial maturity, and regulatory frameworks. In the Americas, robust investments in predictive maintenance across manufacturing, energy, and infrastructure bolster demand for integrated monitoring systems, particularly in North American markets where digital transformation initiatives are well established. Meanwhile, Latin American operators are increasingly adopting wireless sensor networks to extend coverage in remote facilities, supported by public–private partnerships aimed at modernizing critical utilities.

Across Europe, the Middle East and Africa, diverse government mandates around equipment safety and energy efficiency are catalyzing vibration monitoring adoption. Western European manufacturers leverage advanced analytics platforms to comply with stringent reliability standards, while Middle Eastern oil and gas majors deploy customized solutions to monitor offshore assets under harsh climatic conditions. In Africa, mining and water treatment sectors are prioritizing portable monitoring tools to optimize maintenance scheduling and reduce operational risk amid variable resource availability.

The Asia-Pacific region exhibits the fastest pace of innovation, driven by large-scale infrastructure expansions and government incentives for digitalization. In advanced economies such as Japan and South Korea, sophisticated edge-computing architectures integrate seamlessly with factory automation systems, whereas emerging markets in Southeast Asia are investing in hybrid managed services to access expertise while building local technical capabilities. China’s emphasis on self-sufficiency is also spurring domestic software and hardware development, leading to competitive alternatives that resonate across the broader APAC landscape. Collectively, these regional distinctions emphasize the necessity of tailored market approaches that align solution portfolios with localized demand profiles and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Vibration Monitoring market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Market Leaders and Innovators Driving Vibration Monitoring Advancements through Strategic Investments Partnerships and Technological Differentiation

The competitive arena for vibration monitoring is defined by a constellation of established industrial automation leaders, specialized sensor innovators, and emerging software disruptors. Global conglomerates have fortified their portfolios through targeted acquisitions of niche diagnostic software providers and small-scale sensor startups, enabling end-to-end monitoring solutions that span hardware, connectivity, and analytics layers. These integrated offerings often combine best-in-class accelerometers, cloud-based asset health dashboards, and managed service contracts that guarantee defined performance outcomes.

Concurrently, pure-play sensor manufacturers are differentiating through breakthroughs in MEMS accelerometer technology and energy harvesting transmitters, reducing installation complexity and extending maintenance intervals. On the software front, companies with low-code analytics platforms are empowering reliability engineers to configure bespoke fault detection rules without reliance on specialized IT teams. Partnerships between these software vendors and edge device manufacturers are yielding pre-validated system bundles that accelerate deployment cycles and lower total cost of ownership.

A third cohort of agile startups is disrupting traditional models by offering subscription-based access to monitoring-as-a-service, bundling sensor hardware, predictive analytics, and expert-driven anomaly investigations. These models resonate with small and midsized enterprises seeking rapid entry points and minimal capital expenditure. As market convergence intensifies, strategic alliances among hardware suppliers, cloud platform providers, and service integrators are becoming critical to capturing end-to-end solution demand across diverse industry verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vibration Monitoring market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB SKF

- ABB Ltd.

- ALS Limited

- Amphenol Corporation

- Analog Devices, Inc.

- Baker Hughes Company

- Dewesoft d.o.o.

- Emerson Electric Co.

- Fluke Corporation

- General Electric Company

- Honeywell International Inc.

- Hottinger Brüel & Kjaer GmbH

- IVC Technologies

- Jamieson Equipment Co., Inc.

- Kistler Group

- MC MONITORING by Infoteam Informatique Holding SA

- NSK Ltd.

- Parker-Hannifin Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Schaeffler AG

- SCHENCK RoTec GmbH by Durr Group

- SenseGrow Inc.

- Siemens AG

- SPM Instrument AB

- Teledyne Technologies Incorporated

Empowering Industry Leaders with Actionable Strategies to Lead in Vibration Monitoring through Innovation Collaboration and Sustainable Operational Practices

To capitalize on the evolving landscape, industry leaders must adopt a multi-pronged strategy that balances technological investment, partnerships, and operational agility. First, investing in modular, interoperable architectures will enable seamless integration of hardware and software components, reducing vendor lock-in and accelerating system upgrades. By prioritizing open protocols and API-driven data exchange, organizations can future-proof their monitoring infrastructures while fostering ecosystem collaboration.

Second, forging strategic alliances with cloud platform providers and specialized analytics firms will expand analytic capabilities and deliver differentiated insights. Joint development initiatives that embed advanced anomaly detection into edge nodes can reduce latency and support autonomous decision-making in critical applications. Complementing these efforts with managed service offerings ensures that customers derive maximum value from their monitoring investments, driving stickier relationships and recurring revenue streams.

Finally, embedding sustainability and risk management objectives into monitoring programs will underscore vibration monitoring’s role in environmental stewardship and regulatory compliance. By aligning system performance metrics with corporate ESG mandates, maintenance teams can demonstrate reductions in energy consumption, extend asset lifecycles, and minimize waste. Collectively, these actionable imperatives position organizations to lead in vibration monitoring innovation and secure long-term operational resilience.

Ensuring Rigor and Reproducibility through a Robust Multi-Stage Research Methodology Combining Primary Engagements Secondary Intelligence and Analytical Validation

This research embraces a rigorous multi-stage methodology designed to ensure depth, accuracy, and reproducibility. Secondary intelligence gathering commenced with a comprehensive review of public filings, technical whitepapers, and regulatory disclosures related to vibration monitoring technologies and industry standards. These data sources were augmented by an exhaustive examination of patent databases and trade journals to capture emerging innovations and competitive dynamics.

Primary engagements included structured interviews with maintenance leaders, reliability engineers, and technology decision-makers across key industry verticals. These interactions facilitated the validation of secondary insights, the prioritization of pain points, and the elicitation of real-world performance benchmarks. Complementing these qualitative inputs, a global survey of asset-intensive facilities provided quantitative perspectives on technology adoption drivers, budget allocations, and vendor selection criteria.

Data synthesis employed both top-down and bottom-up analytical frameworks. Market segmentation analyses leveraged detailed component, process, and functionality categorizations to map solution demand, while geospatial modeling illuminated regional adoption variances. Analytical validation incorporated cross-referencing among independent data sources, triangulation of interview findings, and stress-testing of segmentation assumptions. The result is a comprehensive, objective portrayal of the vibration monitoring ecosystem rooted in robust evidence and expert consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vibration Monitoring market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vibration Monitoring Market, by Component

- Vibration Monitoring Market, by Monitoring Process

- Vibration Monitoring Market, by Functionality

- Vibration Monitoring Market, by Connectivity Type

- Vibration Monitoring Market, by Industry Vertical

- Vibration Monitoring Market, by Application

- Vibration Monitoring Market, by Region

- Vibration Monitoring Market, by Group

- Vibration Monitoring Market, by Country

- United States Vibration Monitoring Market

- China Vibration Monitoring Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Consolidating Key Findings to Illuminate the Strategic Imperatives Shaping the Future of Vibration Monitoring and Maintenance Excellence

The collective insights from this executive summary illuminate a vibration monitoring market in the midst of profound evolution. Technological advancements in sensor design, edge computing, and AI-driven analytics are empowering maintenance professionals to detect and mitigate equipment anomalies with unprecedented precision. Regulatory shifts and trade policy realignments, notably the 2025 United States tariff adjustments, are catalyzing supply chain resilience and localized manufacturing strategies.

Multi-dimensional segmentation underscores the importance of tailored solution design across hardware, software, and services layers, while regional analyses reveal divergent adoption trajectories driven by economic priorities and regulatory frameworks. Competitive profiling highlights the dynamic interplay between established conglomerates, specialized innovators, and agile disruptors, suggesting that strategic collaborations and subscription-based models will shape future market leadership.

As organizations navigate this complex environment, the integration of open architectures, partnerships with analytics specialists, and alignment with sustainability objectives emerge as critical success factors. By embracing these strategic imperatives, decision-makers can harness vibration monitoring not only as a maintenance tool but as a transformative enabler of operational excellence and competitive differentiation.

Engage with Ketan Rohom to Secure Your Comprehensive Vibration Monitoring Market Intelligence Report and Drive Strategic Maintenance Innovations

Ready to elevate your maintenance strategy with unparalleled market insights and cutting-edge intelligence, Ketan Rohom invites you to take the next step. Leveraging deep expertise in sales and marketing for advanced monitoring solutions, he stands prepared to guide you through the report’s rich findings, customized analyses, and strategic foresight. Connect directly to secure your copy of the comprehensive vibration monitoring market report and unlock the actionable data and recommendations essential for driving operational excellence and competitive differentiation.

- How big is the Vibration Monitoring Market?

- What is the Vibration Monitoring Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?