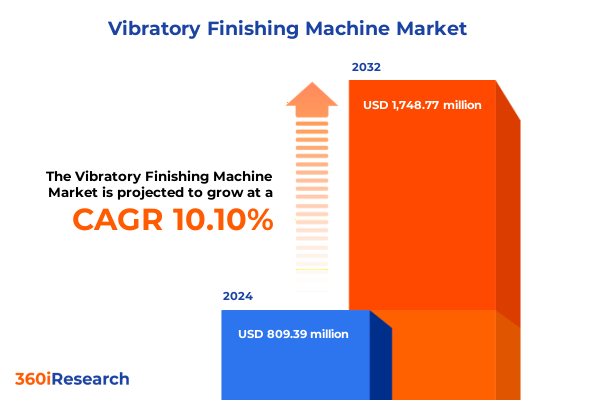

The Vibratory Finishing Machine Market size was estimated at USD 134.11 billion in 2025 and expected to reach USD 150.80 billion in 2026, at a CAGR of 14.59% to reach USD 348.03 billion by 2032.

Exploring the Fundamentals of Vibratory Finishing Machines and Their Critical Role in Precision Surface Processing Across Key Industrial Sectors

Vibratory finishing machines represent a cornerstone of modern mass finishing practices, leveraging controlled mechanical vibrations and engineered media to execute deburring, cleaning, descaling, and polishing in a unified process. These machines operate by inducing rapid, elliptical movements within a specially designed work bowl or tub, prompting abrasive media-such as ceramic, plastic, or steel pellets-to gently abrade workpiece surfaces. As the media circulates, it delivers consistent energy across complex geometries, enabling uniform surface quality without the risk of tearing or warping that can accompany more forceful finishing techniques. The result is an efficient, reliable method for achieving precise edge radiusing, surface smoothing, and cosmetic enhancement across bulk batches of components.

Over time, vibratory finishing equipment has emerged as an indispensable asset for manufacturers seeking to optimize throughput and maintain tight tolerances. Its relatively quiet operation and configurable process variables-such as vibration frequency, amplitude, media composition, and cycle duration-permit fine-tuning to meet stringent requirements in aerospace, automotive, medical, and general engineering sectors. By combining robust mechanical design with adaptable process parameters, vibratory finishers deliver repeatable results while minimizing labor and energy costs, thereby cementing their role in lean manufacturing and Industry 4.0 initiatives.

Assessing Technological Advancements and Sustainability Drivers Reshaping the Vibratory Finishing Machine Landscape for Future Competitive Advantage

The adoption of Industry 4.0 technologies has catalyzed a profound transformation in vibratory finishing, with digital monitoring and artificial intelligence reshaping process control and maintenance paradigms. Machine builders are integrating IoT-enabled sensors to continuously track bearing temperatures, motor currents, and vibration signatures. Advanced analytics platforms apply machine learning algorithms to these data streams, facilitating predictive maintenance that flags potential wear or imbalance before unplanned downtime occurs. Such AI-driven IoT solutions not only extend equipment lifespan but also enhance process consistency by ensuring operations remain within optimal vibration parameters at all times.

Concurrently, sustainability has become a key performance indicator for both equipment manufacturers and end users. Closed-loop finishing systems, which recycle process water and media, are reducing fresh water consumption and minimizing chemical discharge. High-density ceramic media formulations and bio-based compound alternatives are gaining traction for their lower ecological footprint, meeting increasingly stringent environmental regulations and corporate net-zero commitments. In parallel, noise-dampening enclosures and energy-efficient motors contribute to workplace safety and operational cost savings, reflecting a holistic shift toward resource-optimized finishing operations.

Finally, growing demand for customized and automated finishing solutions has elevated modular and robotic integrations to the forefront of industry development. Manufacturers are launching multi-mode vibratory finishing systems that combine circular, disc, and tub configurations within a single line, enabling seamless transitions between cleaning, deburring, descaling, and polishing stages. Robotic part handling systems are synchronizing with finishing cycles to automate loading, orientation adjustment, and unloading, thereby increasing throughput and reducing manual handling risks. This fusion of modular machine design with intelligent automation sets the stage for next-generation vibratory finishing workflows that deliver both high precision and operational flexibility.

Exploring the Aggregate Effects of United States Tariff Measures Introduced Through 2025 on Import Dynamics and Production Costs in Vibratory Finishing

In early 2025, the United States reinstated a comprehensive 25 percent tariff on steel and aluminum imports under Section 232 of the Trade Expansion Act, closing exemptions and expanding coverage to include downstream articles. This measure took effect on February 11, 2025, marking a return to uniform duties intended to support domestic metal producers by curtailing undervalued imports. Barely four months later, on June 4, 2025, the administration increased these Section 232 tariffs to 50 percent for the steel and aluminum content of imported products, intensifying input cost pressures on industries reliant on metal media and machine components. Small to midsize machine shops and contract finishers, in particular, have reported a noticeable uptick in procurement times and unit costs as suppliers have struggled to secure tariff-compliant raw materials.

Layered atop metal duties, Section 301 tariffs on Chinese-origin machinery and components-initially imposed at rates up to 25 percent beginning in 2018-remain in force through 2025, affecting specialized finishing equipment and replacement parts. Although importers could request temporary exclusions for certain manufacturing machinery, the narrow scope and short duration of those relief processes have left many end users exposed to sustained tariff burdens. The combination of high duties on metal inputs and equipment imports has driven manufacturers to explore near-sourcing, negotiate longer-term supply contracts, and in some cases substitute alternative media materials or retrofit existing equipment to maintain process continuity. As a result, procurement lead times have extended, inventory levels have climbed, and cost management has emerged as a critical operational focus for finishing service providers and OEMs alike.

These cumulative tariff actions have underscored the vulnerability of global supply chains in capital-intensive sectors. Firms have responded by diversifying supplier networks, increasing engagement with domestic media and equipment manufacturers, and leveraging strategic inventory buffers to mitigate potential disruptions. While these adaptations drive resilience, they also require significant capital allocation toward working capital and operational planning, reshaping competitive dynamics across the vibratory finishing ecosystem.

Unveiling Critical Market Segmentation Patterns by Industry Application, Machine Configuration, Media Material, Process Type, and Automation Level

A deep dive into end-use segmentation reveals that diverse application requirements drive distinct equipment and media configurations. In aerospace, where surface integrity and precision are paramount, finishing operations favor vibratory tub systems paired with fine ceramic media to achieve isotropic superfinishes and tight surface roughness tolerances. Automotive applications split between commercial vehicles and passenger cars exhibit divergent throughput and durability needs; heavy commercial components often undergo aggressive deburring in large vibratory bowls with steel media, whereas high-volume passenger car parts require rapid cycle polishing in disc vibrators using plastic or ceramic formulations. Electrical and electronics manufacturers deploy vibratory disc machines supplemented by soft plastic media to delicately clean intricate consumer-grade assemblies, while industrial electronics segments leverage medium-density steel media for robust descaling and polishing tasks. General engineering sectors utilize a balance of bowl, disc, and tub configurations to address versatile component portfolios, and medical device producers emphasize fully automatic lines with stringent cleaning and polishing protocols to meet regulatory sterilization standards.

Machine type influences process optimization: vibratory bowls are preferred for bulk deburring and high throughput, vibratory discs excel in flat part finishing and shine enhancement, and vibratory tubs deliver precise action on complex or sensitive parts. Media selection-ceramic for fast cutting and long media life, plastic for delicate finishing, steel for heavy deburring-aligns with the desired material removal rate and surface finish quality. Process insights further segment across cleaning, deburring, descaling, and polishing operations, each demanding tailored media-compound-machine combinations and cycle parameters. Automation level spans manual operations for low-volume or specialized tasks, semi-automatic systems for mid-scale production with mixed operator oversight, and fully automatic solutions for high-volume, standardized workflows requiring minimal human intervention.

By understanding how end-use industries, machine configurations, media materials, process types, and automation tiers interrelate, stakeholders can precisely match finishing solutions to customer demands, optimize equipment utilization, and anticipate maintenance and operational support needs.

This comprehensive research report categorizes the Vibratory Finishing Machine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Machine Type

- Media Material

- Process

- Automation Level

- End Use Industry

Analyzing Regional Dynamics in Americas, EMEA, and Asia-Pacific to Reveal Growth Drivers, Regulatory Environment, and Infrastructure Support

In the Americas, manufacturers are capitalizing on nearshoring trends and robust domestic metal supply capabilities to mitigate tariff impacts. The United States and Canada, in particular, are witnessing heightened investments in advanced finishing lines equipped with digital monitoring and closed-loop water systems. Environmental regulations and sustainability initiatives in North America are also driving adoption of eco-friendly media and energy-efficient motors, enhancing regional competitiveness in aerospace and automotive finishing. Meanwhile, regional trade agreements under the United States-Mexico-Canada Agreement (USMCA) offer preferential input sourcing that supports integrated supply chains with reduced cross-border tariffs.

Europe, Middle East, and Africa (EMEA) present a heterogeneous regulatory and demand landscape. In Western Europe, stringent environmental directives and noise-emission limits have pushed manufacturers to install sound-deadening enclosures and solvent-free compounds, while governments incentivize modernization of legacy equipment through tax credits and grants. Central and Eastern European countries are emerging as cost-effective manufacturing hubs, attracting finishing service providers seeking labor arbitrage alongside improved infrastructure. In the Middle East and Africa, burgeoning construction and energy sectors are generating demand for heavy-duty descaling and surface enhancement services, though infrastructure bottlenecks and import controls can impede timely equipment delivery.

Asia-Pacific remains the largest regional contributor to vibratory finishing activity, driven by expansive industrial bases in China, India, Japan, and South Korea. The region’s diverse maturity spectrum ranges from highly automated automotive and electronics facilities in Japan and South Korea to emerging contract finishers in India focusing on manual and semi-automatic systems. China continues to dominate manufacturing volumes yet faces increasing pressure to transition toward quality-driven finishing solutions to serve premium export markets. Across APAC, growing urbanization and infrastructure projects are also fueling demand for surface treatment of construction and heavy-equipment components, with a parallel push toward digitalized process control to enhance productivity and traceability.

This comprehensive research report examines key regions that drive the evolution of the Vibratory Finishing Machine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Manufacturers and Innovative Market Players Driving Technological Excellence and Competitive Differentiation in Vibratory Finishing Field

Leading equipment manufacturers and process material suppliers are intensifying R&D to differentiate through technological innovation and service excellence. Walther Trowal, a pioneer in circular and multivibratory finisher design, offers a versatile portfolio ranging from entry-level vibratory bowls to premium multivibratory systems that secure complex parts for fine polishing. Its global test lab services enable customers to fine-tune process recipes and verify finish quality prior to capital commitment, reinforcing its reputation for precision and support.

Rösler Oberflächentechnik stands out for its holistic integration of machine, media, and process equipment manufacturing. With over 15,000 compound and media formulations produced in-house, Rösler sets benchmarks for sustainable media innovation, including a patented low-dust ceramic grinding body and closed-loop process solutions. Its multi-spectrum approach, encompassing shot blast, automation, and digital process control, underscores its position as an end-to-end finishing partner.

Among specialized service providers, Engineered Finishing Inc. and its affiliates deliver custom job-shop capabilities, leveraging Keramo polishing and ultrasonics to meet demanding aerospace and medical device standards. These firms differentiate through ISO-certified processes, rapid turnarounds, and expert compound selection, addressing niche finishing requirements. Shot blasting and shot peening specialists such as Engineered Abrasives complement the vibratory market by offering automated peening systems and high-precision nozzles, broadening end-to-end surface engineering portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vibratory Finishing Machine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3R MASSFIN Equipments Pvt Ltd

- ActOn Finishing Ltd.

- Almco, Inc.

- Bel Air Finishing Supply, LLC

- BV Products Australia Pty Ltd

- Giant Finishing, Inc.

- Inovatec Machinery Co., Ltd.

- Kramer Industries, Inc.

- Mass Finishing, Inc.

- OTEC Präzisionsfinish GmbH

- Richwood Industries, Inc.

- Rösler Oberflächentechnik GmbH

- Sharmic Engineering Ltd.

- Shuanglin Hengxing Co., Ltd.

- Tipton Corporation

- Vibra Finish Company

- Vibratory Finishing Technologies, Inc.

- Vibro Equipments Private Limited

- Walther Trowal GmbH & Co. KG

- Zhejiang Humo Polishing Grinder Manufacture Co., Ltd.

Implementing Strategic Imperatives and Best Practices to Enhance Efficiency, Sustainability, and Technological Adoption in Vibratory Finishing Operations

To thrive in an evolving landscape, industry leaders should prioritize the integration of digital process monitoring and predictive maintenance systems. By deploying IoT sensors and analytics platforms, companies can transition from reactive upkeep to condition-based interventions, reducing unscheduled downtime and optimizing component life cycles.

Sustainability imperatives demand investment in closed-loop finishing lines and eco-friendly media compounds to lower water consumption and chemical usage. Equipment upgrades that support media recycling and wastewater treatment not only ensure regulatory compliance but also deliver long-term cost savings and bolster corporate environmental credentials.

On the procurement front, establishing strategic partnerships with domestic steel and equipment suppliers can mitigate tariff-induced cost volatility. Participating in USTR exclusion processes for specific machinery and proactively documenting domestic sourcing efforts helps secure temporary relief from Section 301 duties, alleviating immediate capital expenditure pressures.

Finally, embracing modular system architectures and robotic part-handling integration allows for rapid adaptation to shifting production mixes. By standardizing interfaces and control protocols across machine types, organizations gain the flexibility to reconfigure lines as end-use demands evolve, enhancing responsiveness and reducing equipment obsolescence risk.

Outlining Robust Research Design and Methodological Framework Ensuring Accurate Data Collection, Validation, and Analytical Rigor for Industry Insights

This research employed a multi-tiered methodology to ensure the integrity and relevance of the insights presented. Secondary research included analysis of governmental trade publications, regulatory fact sheets, industry white papers, and credible news outlets to map tariff developments and technology trends. Publicly available company disclosures, product brochures, and patent filings were examined to identify leading players and innovation pathways.

Complementing desk research, primary insights were gathered through structured interviews with OEM product managers, equipment end users, and process engineering experts. These discussions offered qualitative depth on operational challenges, equipment performance, and evolving buyer criteria. Additional quantitative validation was achieved via surveys distributed to finishing service providers, capturing real-world data on cycle times, media wear rates, and adoption barriers.

All data points and thematic findings underwent cross-verification through triangulation, ensuring alignment across independent sources. Expert review sessions with domain advisors provided an additional layer of field-tested perspective, reinforcing the analysis’s robustness and applicability for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vibratory Finishing Machine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vibratory Finishing Machine Market, by Machine Type

- Vibratory Finishing Machine Market, by Media Material

- Vibratory Finishing Machine Market, by Process

- Vibratory Finishing Machine Market, by Automation Level

- Vibratory Finishing Machine Market, by End Use Industry

- Vibratory Finishing Machine Market, by Region

- Vibratory Finishing Machine Market, by Group

- Vibratory Finishing Machine Market, by Country

- United States Vibratory Finishing Machine Market

- China Vibratory Finishing Machine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Future Outlook to Empower Stakeholders with Strategic Perspectives on Vibratory Finishing Machine Market Evolution

The landscape of vibratory finishing continues to be reshaped by digital integration, sustainability mandates, and evolving trade policies. Artificial intelligence, IoT monitoring, and modular automation are redefining machine capabilities while closed-loop processes and eco-friendly media address environmental and cost concerns. Tariff dynamics under Section 232 and Section 301 have underscored the critical importance of supply chain resilience and strategic sourcing, prompting nearshoring and alternative procurement pathways.

Segmentation analysis reveals that each industry vertical demands tailored machine and media combinations, from heavy deburring in automotive to precision polishing in aerospace and medical devices. Regional nuances-such as nearshore advantages in the Americas, compliance-driven upgrades in EMEA, and volume-led growth in APAC-further inform deployment strategies and investment priorities.

Leading manufacturers differentiate through end-to-end solutions that span equipment, media, automation, and service, while actionable recommendations stress digital maintenance, sustainable operations, and tariff mitigation tactics. Stakeholders armed with these insights can navigate complexity, optimize process efficiency, and secure competitive advantage as the vibratory finishing market matures into its next phase of innovation.

Connect with Ketan Rohom to Access In-Depth Vibratory Finishing Device Market Intelligence and Propel Your Organization’s Competitive Edge in Surface Treatment

To capitalize on the comprehensive insights and tailored intelligence presented in this executive summary, reach out to Ketan Rohom, the Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep industry expertise and a nuanced understanding of surface finishing markets, ensuring that your organization receives personalized guidance on vibratory finishing machine strategy and adoption. Whether you seek to explore advanced process optimization, mitigate tariff impacts, or integrate cutting-edge automation and sustainability practices, Ketan can connect you with the full market research report and strategic advisory support.

- How big is the Vibratory Finishing Machine Market?

- What is the Vibratory Finishing Machine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?