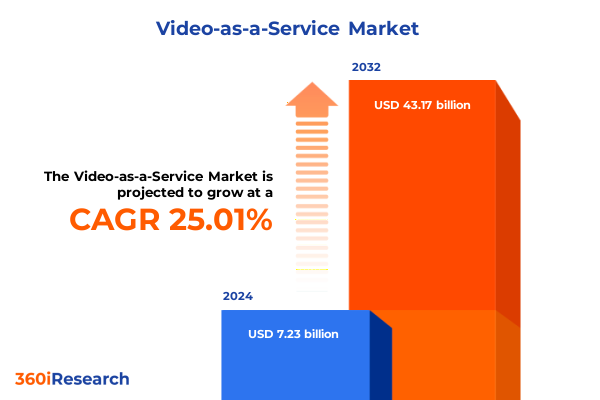

The Video-as-a-Service Market size was estimated at USD 9.03 billion in 2025 and expected to reach USD 11.27 billion in 2026, at a CAGR of 25.04% to reach USD 43.17 billion by 2032.

Unlocking the Transformative Potential of Video-as-a-Service Ecosystems for Enhanced Connectivity and Operational Agility

The rapid proliferation of digital communication channels has propelled Video-as-a-Service to the forefront of enterprise and consumer engagement strategies. In an era defined by remote work, virtual collaboration, and on-demand content consumption, organizations are increasingly leveraging cloud-based video solutions to bridge geographical divides and foster dynamic user experiences. As a transformative enabler, Video-as-a-Service integrates real-time conferencing, intelligent analytics, and scalable streaming capabilities into unified platforms that cater to diverse operational needs. By abstracting infrastructure complexity and delivering end-to-end video workflows, VaaS has emerged as a catalyst for streamlined collaboration, heightened security protocols, and cost-efficient deployment models that adapt to fluctuating demand.

Against a backdrop of accelerating network upgrades and AI-driven automation, the VaaS landscape is evolving faster than traditional on-premise video implementations. Market participants must navigate an intersection of emerging technologies-such as edge computing, 5G connectivity, and smart video analytics-while aligning with regulatory frameworks and shifting end-user preferences. This executive summary introduces the key drivers, transformative shifts, and actionable insights that define the current market dynamic, equipping decision makers with a concise yet comprehensive overview of strategic imperatives. As the ecosystem matures, organizations that proactively embrace innovation and leverage holistic video-centric architectures will gain a sustainable competitive edge.

Embracing Next Generation Video-as-a-Service Innovations Driven by AI, Edge Computing, 5G and Hybrid Delivery Models

Entering the second decade of Video-as-a-Service evolution, industry dynamics are being reshaped by an array of technological and operational shifts. First and foremost, the integration of artificial intelligence and machine learning into video platforms has accelerated the adoption of advanced analytics, enabling enterprises to extract actionable insights from visual data. This convergence of AI with real-time video streaming is empowering use cases ranging from automated quality control in manufacturing to sentiment analysis in customer engagement scenarios. Furthermore, the rollout of 5G networks is enhancing bandwidth and reducing latency, unlocking new possibilities for immersive experiences such as augmented reality training sessions and ultra high-definition live events.

Concurrently, the proliferation of edge computing architectures is decentralizing video processing, enabling critical workloads to be executed closer to data sources. This transition mitigates network bottlenecks and bolsters data sovereignty compliance by localizing sensitive video analytics. In parallel, hybrid delivery models that seamlessly orchestrate workloads across public, private, and on-premise environments are gaining traction, offering a balanced approach to performance, security, and cost management. Through these transformative shifts, Video-as-a-Service is transitioning from a simple connectivity tool to a foundational element of digital strategy, underpinning next-generation workflows that demand both agility and robustness.

Assessing the Far Reaching Effects of United States 2025 Tariff Policies on Video-as-a-Service Infrastructure and Supply Chains

In 2025, sweeping tariff revisions enacted by the United States government have introduced new complexities to the Video-as-a-Service supply chain, especially in hardware acquisition and peripheral sourcing. Components such as video codecs, specialized processors, and high-resolution camera modules have been subject to increased import duties, elevating the total cost of ownership for integrated VaaS deployments. These levies have compelled providers and end users alike to reevaluate procurement strategies, exploring opportunities to diversify supplier portfolios and negotiate localized manufacturing partnerships in non-tariff jurisdictions.

Moreover, the cumulative impact of tariff adjustments has underscored the strategic importance of software-centric solutions and subscription-based models. As hardware costs have escalated, organizations have accelerated their migration to cloud-native video platforms that demand minimal on-premise infrastructure investment. This shift has catalyzed collaborations between service providers and regional data center operators to pool resources and mitigate the financial burden imposed by sustained tariff pressures. Consequently, market participants that demonstrate supply chain resilience and adaptability to regulatory changes are emerging as preferred partners for enterprises seeking uninterrupted video services amid an increasingly protectionist trade environment.

In Depth Exploration of Video-as-a-Service Market Segmentation Revealing Deployment Models, Components, Organizational Sizes, Service Types, and Industry Verticals

Delving into the multifaceted segmentation of the Video-as-a-Service market reveals distinct growth trajectories and adoption patterns across deployment, component, organizational scale, service type, and vertical dimensions. Deployment strategies range from fully cloud-based implementations-further differentiated by hybrid, private, and public cloud variants-to traditional on-premise installations. Each model presents unique value propositions, whether it’s the agility and scalability of public cloud platforms, the enhanced control offered by private cloud configurations, or the balanced performance and compliance attributes of hybrid environments.

At the component level, services and solutions form the dual pillars of market offerings, with managed and professional services driving customization, integration, and lifecycle management. Organizational requirements diverge between large enterprises, which demand complex, high-performance systems, and small and medium enterprises that prioritize cost-effectiveness and rapid deployment. When evaluating service types, video analytics segments into post-event and real-time analytics, video conferencing encompasses telepresence and web conferencing, video streaming bifurcates into live and on-demand streaming, and video surveillance differentiates between cloud-native and on-premise surveillance infrastructures. Lastly, adoption across industry verticals-from banking and financial services to education, government, healthcare, media and entertainment, retail, and telecom-highlights tailored use cases, compliance drivers, and innovation priorities that collectively shape the market’s heterogeneous nature.

This comprehensive research report categorizes the Video-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Component

- Deployment Model

- Organization Size

- Industry Vertical

Comparative Regional Dynamics Shaping Video-as-a-Service Adoption Trends Across Americas, Europe Middle East Africa, and Asia Pacific Markets

Regional dynamics are critically shaping Video-as-a-Service growth as enterprises tailor their strategies to local infrastructure maturity, regulatory landscapes, and customer expectations. In the Americas, the proliferation of 5G networks and extensive cloud service portfolios have accelerated adoption, particularly among technology, banking, and retail sectors. North American early adopters are amplifying investments in AI-powered analytics and immersive conferencing solutions, while Latin American markets are gradually unlocking remote learning and telehealth opportunities through cost-optimized video platforms.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing data protection and privacy-exemplified by GDPR within the European Union-have prompted a steady shift toward private and hybrid cloud deployments. Public sector entities and healthcare institutions within this region are prioritizing compliance-ready surveillance and secure streaming channels to meet stringent governance requirements. Meanwhile, Asia-Pacific markets are characterized by rapid digital transformation initiatives, with governments and enterprises leveraging Video-as-a-Service to support smart city projects, e-commerce livestreaming, and large-scale distance education. As infrastructure investments intensify, the region is poised to become a major growth engine for VaaS deployments worldwide.

This comprehensive research report examines key regions that drive the evolution of the Video-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positioning of Leading Video-as-a-Service Providers and Their Competitive Advances in Technology and Service Offerings

Leading providers in the Video-as-a-Service arena are differentiating through strategic investments in platform interoperability, security frameworks, and vertical solution suites. Technology incumbents with extensive cloud infrastructure portfolios are integrating advanced analytics modules and edge orchestration tools to deliver low-latency, high-availability experiences. Meanwhile, specialized VaaS vendors are carving out niches by offering tailored surveillance, compliance, and user-experience enhancements, cementing relationships with industry-specific clients.

Partnerships and ecosystem alliances further amplify competitive positioning as companies collaborate with telecom operators, system integrators, and hardware manufacturers to present end-to-end value propositions. These cooperative arrangements facilitate bundled offerings-combining network services, video management software, and professional services-designed to streamline deployment and accelerate time to value. In parallel, continuous innovation in security protocols, codec efficiency, and user-centric interfaces is fueling market differentiation, underscoring the importance of sustained research and development investments for organizations seeking to maintain a leadership stance in the rapidly evolving VaaS domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Video-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Amazon Web Services, Inc.

- Avaya LLC

- Brightcove Inc.

- Cisco Systems, Inc.

- Google LLC

- International Business Machines Corporation

- JW Player Corporation

- Kaltura Inc.

- Microsoft Corporation

- Poly Inc.

- RingCentral, Inc.

- Vidyard Inc.

- Vimeo, Inc.

- Zoom Communications, Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Video-as-a-Service Opportunities and Mitigate Emerging Challenges

Industry leaders should prioritize a modular, API-driven architecture to accommodate evolving feature sets and third-party integrations while minimizing vendor lock-in. By adopting open standards and fostering developer ecosystems, organizations can expedite customization and accelerate go-to-market timelines. Furthermore, embedding AI-powered analytics directly within video workflows will unlock new insights and operational efficiencies, enabling predictive maintenance, automated quality assurance, and personalized user experiences.

To mitigate the financial impact of ongoing tariff fluctuations, enterprises are advised to explore localized edge deployments and hybrid licensing models that decouple hardware procurement from software subscriptions. Strategic partnerships with regional data center operators and system integrators can enhance supply chain resilience and ensure consistent service availability. Lastly, cultivating a cross-functional governance framework-uniting IT, security, legal, and business stakeholders-will be essential to align compliance, performance, and user experience objectives, thereby fostering a cohesive and sustainable Video-as-a-Service strategy.

Comprehensive Research Methodology Underpinning the Video-as-a-Service Market Analysis Incorporating Data Collection, Validation, and Analytical Frameworks

This analysis is grounded in a robust research methodology combining primary and secondary data sources to ensure comprehensive market coverage and factual accuracy. Extensive interviews with industry executives, technology innovators, and end users provided qualitative insights into adoption drivers, pain points, and future requirements. Concurrently, secondary research encompassed white papers, regulatory filings, and financial disclosures, meticulously cross-referenced to validate emerging trends and competitive landscapes.

Quantitative analyses leveraged proprietary data aggregation tools to track deployment scales, service adoption rates, and regional growth differentials. The study also incorporated scenario modeling to assess the implications of regulatory changes and tariff policies on cost structures and vendor strategies. Finally, rigorous data validation processes-spanning triangulation, outlier analysis, and peer review-ensured the reliability and relevance of all findings, furnishing stakeholders with a solid foundation for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Video-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Video-as-a-Service Market, by Service Type

- Video-as-a-Service Market, by Component

- Video-as-a-Service Market, by Deployment Model

- Video-as-a-Service Market, by Organization Size

- Video-as-a-Service Market, by Industry Vertical

- Video-as-a-Service Market, by Region

- Video-as-a-Service Market, by Group

- Video-as-a-Service Market, by Country

- United States Video-as-a-Service Market

- China Video-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Conclusive Insights Highlighting the Strategic Imperatives and Future Trajectories for Stakeholders in the Video-as-a-Service Ecosystem

As enterprises and service providers navigate a landscape defined by rapid technological advancement and evolving regulatory frameworks, Video-as-a-Service stands out as a pivotal enabler of digital transformation. The convergence of AI-driven analytics, edge computing, and hybrid cloud architectures offers unparalleled opportunities for enhanced security, immersive collaboration, and data-driven decision making. At the same time, tariffs and supply chain considerations demand strategic agility and diversified sourcing models to maintain cost-effective operations.

Looking ahead, organizations that embrace open architectures, invest in intelligent automation, and cultivate ecosystem partnerships will be best positioned to capture the full potential of video-centric workflows. With demand surging across verticals from finance to healthcare and geographies spanning mature and emerging markets, the imperative for actionable insights and adaptive strategies has never been greater. Ultimately, the insights presented in this summary equip stakeholders to chart a path toward resilient, scalable, and innovation-driven Video-as-a-Service implementations.

Engage with Ketan Rohom to Secure the Comprehensive Video-as-a-Service Market Research Report and Empower Strategic Decision Making

For professionals seeking to pioneer market leadership and optimize strategic investments in video technology, the comprehensive Video-as-a-Service market research report delivers the critical insights required to drive informed decision making. Complementing robust data analysis with practical guidance, this report ensures stakeholders can swiftly identify high-value growth vectors, anticipate emerging challenges, and adapt marketing and sales strategies to evolving customer expectations. To access this indispensable resource and collaborate on tailored solutions that align with your organization’s objectives, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who will facilitate a seamless engagement and equip you with the actionable intelligence necessary to outperform competitors and capture tomorrow’s opportunities.

- How big is the Video-as-a-Service Market?

- What is the Video-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?