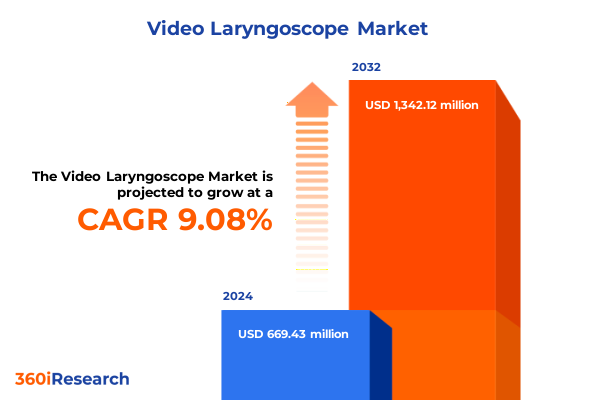

The Video Laryngoscope Market size was estimated at USD 723.34 million in 2025 and expected to reach USD 785.78 million in 2026, at a CAGR of 9.23% to reach USD 1,342.12 million by 2032.

Understanding the Rising Demand for Video Laryngoscopes and Their Critical Role in Modern Airway Management Across Healthcare Settings

Video laryngoscopes have emerged as indispensable tools in modern airway management, offering clinicians enhanced visualization and greater success rates in intubation procedures. Their high-resolution imaging capabilities and ergonomic designs enable anesthesiologists, emergency physicians, and critical care teams to navigate complex airways with improved precision and safety. As minimally invasive techniques and patient safety standards continue to evolve, video laryngoscopes are increasingly adopted across healthcare facilities worldwide, replacing traditional direct laryngoscopy methods and setting new benchmarks for clinical outcomes.

Against this backdrop, a thorough understanding of market dynamics, technological advancements, and regulatory influences is crucial for decision-makers seeking to optimize procurement strategies and streamline clinical protocols. This report provides an executive summary of the prominent factors shaping the video laryngoscope sector, offering a concise yet comprehensive overview of transformational trends, tariff-driven supply chain considerations, segmentation insights, regional developments, competitive landscapes, and actionable recommendations.

Exploring How Technological Innovations, Training Protocols, and Integration of AI Are Revolutionizing the Video Laryngoscope Market

Innovations in optical technology, device miniaturization, and digital integration are revolutionizing the video laryngoscope market, enabling clinicians to perform complex intubations with greater ease and consistency. End users now benefit from features such as anti-fog lenses, disposable blades, and wireless connectivity, which enhance sterilization workflows and facilitate real-time consultations during emergency scenarios. Furthermore, the incorporation of artificial intelligence algorithms for image recognition and predictive analytics is poised to support training modules and decision support tools, fostering continuous improvements in clinician proficiency.

Simultaneously, evolving clinical protocols and heightened emphasis on patient safety have driven the integration of video laryngoscopes into standard airway management guidelines. Professional societies are encouraging structured training programs, which underscores the need for intuitive interfaces and comprehensive user education. By addressing these transformative shifts, device manufacturers and healthcare providers can collaborate to optimize procedural efficiency, reduce complication rates, and ultimately elevate standards of care.

Evaluating the Far-Reaching Effects of 2025 United States Tariffs on Video Laryngoscope Import Dynamics and Supply Chain Resilience

The introduction of new United States tariffs in 2025 has reshaped import dynamics for video laryngoscope components and finished devices, prompting manufacturers to reassess sourcing strategies. With increased duties on key materials and modules, supply chain resilience has become a strategic priority. Consequently, many companies are exploring alternative suppliers in diversified geographies while simultaneously increasing investments in domestic manufacturing capabilities to mitigate cost pressures and potential disruptions.

Moreover, the tariff landscape has influenced inventory management practices, leading distributors and hospitals to adjust stocking levels and negotiate long-term agreements with local partners. Increasing lead times for imported components have accelerated the push toward vertical integration, with larger players acquiring specialized component suppliers. As a result, stakeholders must maintain a proactive stance on regulatory updates to ensure seamless access to critical airway management tools and uphold continuity of patient care.

Uncovering Critical Market Segmentation Insights From End Users to Portability and Price Tiers Driving Video Laryngoscope Adoption Patterns

Market segmentation reveals distinct adoption patterns across diverse end users, applications, and product characteristics. Hospitals and ambulatory surgery centers represent the primary purchasers of video laryngoscopes. Within the hospital sector, private institutions, including multi-specialty medical centers and specialist facilities, typically allocate greater budgets for advanced airway management technologies, striving to differentiate through superior clinical outcomes. Public hospitals, while cost-sensitive, are gradually increasing procurement as they update emergency and critical care units.

In terms of clinical application, anesthesia departments account for the bulk of device utilization, driven by routine surgical intubations. However, critical care units and emergency medicine teams are rapidly expanding their video laryngoscope inventories to manage trauma and high-acuity cases where direct line-of-sight is compromised. The choice between reusable and single-use devices further reflects institutional priorities: reusable systems appeal to organizations with centralized sterilization capabilities, whereas single-use options reduce cross-contamination risks in high-turnover environments.

Price sensitivity remains a key determinant, with economy range models enabling cost-conscious facilities to gain basic imaging functionality, midrange systems delivering improved optics and blade compatibility, and premium offerings providing cutting-edge features such as integrated recording and network connectivity. Portability also influences procurement, as nonportable tabletop units suit fixed operating suites, while lightweight, battery-powered systems support rapid deployment across emergency departments and field settings. Finally, purchasing channels vary between traditional distributor sales, direct hospital agreements, and emerging online platforms, each offering distinct lead times, service models, and contract structures.

This comprehensive research report categorizes the Video Laryngoscope market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Portability

- Disposable Status

- End User

- Application

Assessing Regional Dynamics in the Video Laryngoscope Sector Across the Americas, Europe Middle East & Africa, and Asia Pacific Markets

Geographic trends underscore varying levels of market maturation and growth prospects across major regions. In the Americas, established healthcare infrastructures in the United States and Canada drive consistent demand for advanced video laryngoscope systems, supported by well-defined regulatory pathways and reimbursement frameworks. Latin American markets, meanwhile, are in the nascent stage of adoption, focusing on basic models to equip expanding surgical and emergency care facilities.

Europe, the Middle East, and Africa present a heterogeneous landscape. Western European nations prioritize high-end features and integration with electronic health record systems, reflecting their emphasis on connectivity and data-driven care. In contrast, several Middle Eastern healthcare hubs are investing heavily in modernizing hospital infrastructure, creating fertile ground for premium video laryngoscope solutions. Sub-Saharan African markets, while constrained by budgetary limitations, are increasingly leveraging portable and single-use devices to address urgent airway management challenges in resource-limited settings.

The Asia-Pacific region exhibits robust growth potential, driven by government initiatives to upgrade healthcare facilities, a rising focus on medical tourism, and expanding training programs for airway management. Markets such as China, India, and Southeast Asia are witnessing accelerated procurement of cost-efficient and portable systems, reflecting a blend of urban hospital demand and rural outreach programs.

This comprehensive research report examines key regions that drive the evolution of the Video Laryngoscope market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Partnerships, Product Innovations, and Competitive Strengths in Video Laryngoscopes

Leading players in the video laryngoscope market have differentiated themselves through targeted product innovation, strategic partnerships, and expansive service networks. Established medical device manufacturers have reinforced their portfolios by acquiring niche optics developers and blade component specialists, ensuring seamless integration of advanced imaging technologies. Collaborations with academic institutions and emergency response organizations have further facilitated the refinement of device ergonomics and training modules.

Meanwhile, emerging companies have carved out competitive advantages by focusing on cost-optimized solutions and digital connectivity. They frequently leverage direct-to-hospital sales models and online platforms to accelerate market penetration, particularly in underserved regions. Strategic alliances with sterilization providers and telemedicine vendors are enabling these firms to offer bundled solutions that address infection control and remote procedural support. Through concerted investments in research and development, as well as selective mergers and acquisitions, these industry players are poised to capture new growth opportunities and enhance their global footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Video Laryngoscope market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ambu A/S

- B. Braun Melsungen AG

- Clarus Medical LLC

- Drägerwerk AG & Co. KGaA

- HOYA Corporation

- ICU Medical, Inc.

- Karl Storz SE & Co. KG

- Medtronic plc

- Olympus Corporation

- Teleflex Incorporated

- Verathon Inc.

Delivering Strategic Guidance for Industry Leaders to Capitalize on Emerging Trends, Enhance Operational Excellence, and Drive Market Growth

Industry leaders should invest in modular design platforms that accommodate both reusable and single-use blade systems, thereby catering to diverse clinical environments while optimizing manufacturing costs. In parallel, forging alliances with connectivity solution providers will enable the integration of video laryngoscope outputs into broader digital health ecosystems, facilitating data capture for quality improvement and teleconsultation initiatives.

Moreover, establishing localized assembly or component manufacturing sites can mitigate the impact of import tariffs and logistical delays, strengthening supply chain resilience. To maximize market reach, manufacturers should tailor pricing strategies to reflect regional purchasing power, offering tiered service contracts and training packages that align with end user demands. Finally, proactive engagement in clinician education-through simulation-based training programs and certification workshops-will drive device adoption, reinforce best practices, and position stakeholders as trusted partners in patient safety enhancement.

Detailing the Comprehensive Research Approach, Data Collection Methods, and Analytical Framework Underpinning the Video Laryngoscope Market Study

This study employs a mixed-methods approach combining primary and secondary research. Primary data was collected through structured interviews with key opinion leaders, procurement managers, and clinical directors across major hospital systems and surgery centers. These engagements provided firsthand insights into purchasing decisions, training challenges, and technological requirements. Secondary research drew upon peer-reviewed journals, regulatory filings, and industry white papers to map historical developments and benchmark technological standards.

Analytical frameworks included SWOT and Porter’s Five Forces analyses to assess competitive dynamics, while data triangulation techniques ensured reliability by cross-verifying supplier data, device specifications, and user feedback. The segmentation criteria outlined in the report were applied consistently to enable comparative assessments across regions, applications, and product categories. Quality assurance protocols, including peer reviews and validation workshops with clinical stakeholders, reinforced the credibility of the findings and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Video Laryngoscope market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Video Laryngoscope Market, by Portability

- Video Laryngoscope Market, by Disposable Status

- Video Laryngoscope Market, by End User

- Video Laryngoscope Market, by Application

- Video Laryngoscope Market, by Region

- Video Laryngoscope Market, by Group

- Video Laryngoscope Market, by Country

- United States Video Laryngoscope Market

- China Video Laryngoscope Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Summarizing Key Findings, Industry Implications, and the Path Forward for Stakeholders in the Evolving Video Laryngoscope Ecosystem

In summary, the video laryngoscope landscape is being reshaped by rapid technological advancements, evolving clinical standards, and shifting trade policies. The nuanced insights into segmentation patterns, from end users and clinical applications to product characteristics and purchasing channels, highlight the critical importance of aligning device portfolios with institutional priorities. Regional analyses reveal that while mature markets focus on premium integration and data connectivity, emerging markets are pursuing cost-effective and portable solutions to expand access.

Tariff-related supply chain challenges underscore the value of diversified sourcing strategies and local manufacturing investments. Key players have distinguished themselves through strategic partnerships, targeted acquisitions, and digital innovation, setting the stage for sustained competitive differentiation. By following the actionable recommendations-centered on modular design, connectivity integration, localized production, and clinician education-stakeholders can navigate market complexities and capitalize on growth opportunities. This executive summary provides a strategic roadmap for decision-makers committed to advancing airway management excellence.

Connect With Ketan Rohom to Secure Comprehensive Video Laryngoscope Market Intelligence and Empower Your Strategic Decision Making Today

For tailored insights, strategic guidance, and in-depth market intelligence on video laryngoscopes, please connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in the airway management device landscape ensures you gain the confidence to make well-informed procurement and partnership decisions. Reach out today to secure a comprehensive market research report that will empower your organization to stay ahead of evolving clinical needs and regulatory shifts.

- How big is the Video Laryngoscope Market?

- What is the Video Laryngoscope Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?