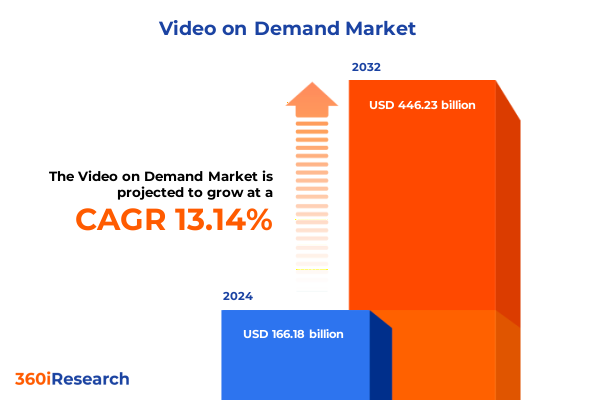

The Video on Demand Market size was estimated at USD 188.49 billion in 2025 and expected to reach USD 210.30 billion in 2026, at a CAGR of 13.10% to reach USD 446.23 billion by 2032.

Setting the Stage for Video-on-Demand Evolution by Examining Emerging Consumer Behaviors and Industry Innovations in Digital Entertainment Spaces

The digital entertainment sphere has undergone a seismic transformation as audiences shift away from scheduled programming to on-demand experiences that align with individual lifestyles. Consumers now gravitate toward platforms that deliver high-definition content, lightning-fast start times, and personalized recommendations, accentuating the necessity for seamless user journeys across multiple screens. This migration away from traditional television has been fueled by greater broadband penetration, the proliferation of smart devices, and evolving cultural habits that prioritize convenience and autonomy.

Furthermore, the interplay between technological advances and content innovation has accelerated consumer adoption, giving rise to new behaviors such as binge-watching, interactive storytelling, and social viewing integrations. As viewers engage with a diverse array of genres-from serialized dramas to live sporting events-they demand flexible access models that accommodate subscription tiers, ad-supported experiences, and pay-per-view transactions. This dynamic has compelled service providers to refine their user interfaces, invest in proprietary content, and leverage data-driven insights to anticipate viewer preferences.

Against this backdrop, a comprehensive analysis emerges to illuminate the nuanced forces shaping the video-on-demand landscape. By tracing the evolution of consumer expectations, mapping technological inflections, and spotlighting emerging monetization strategies, stakeholders can acquire a holistic vantage point. This introduction sets the stage for an exploration of transformative shifts, tariff implications, segmentation intelligence, regional nuances, and strategic imperatives that define the current and future state of digital entertainment.

Exploring the Convergence of Advanced Technologies and Changing Consumer Expectations Redefining How Video-on-Demand Services Are Delivered and Consumed

The arrival of artificial intelligence and machine learning has revolutionized how platforms understand and engage audiences. Through sophisticated algorithms, viewers receive tailored suggestions that transcend simple genre classifications, fostering deeper engagement and longer session durations. At the same time, cloud-native infrastructures facilitate elastic scaling, ensuring that content delivery networks optimize bandwidth and maintain crisp playback across geographies. Coupled with the rollout of 5G networks, these technological shifts have reduced latency and elevated mobile streaming to near-desktop quality, broadening the horizons for live event broadcasts and interactive experiences.

Moreover, the landscape has witnessed the emergence of immersive formats that blur the boundaries between traditional video consumption and participatory entertainment. Virtual and augmented reality pilots are testing new narrative frontiers, while cloud gaming integrations introduce interactive storylines where viewers can influence plot outcomes. Parallel to these content experiments, dynamic advertising insertion and addressable commercials refine monetization paradigms by delivering contextually relevant promotions based on real-time viewer data. As a result, the once-passive audience has evolved into an active participant, engaging with content in novel ways that demand agile business models.

Nonetheless, these transformative forces carry attendant challenges that industry stakeholders must navigate. Heightened expectations for seamless, high-fidelity delivery exert pressure on service providers to continually upgrade their networks and invest in next-generation codecs. Privacy concerns and data governance frameworks impose regulatory complexities, while the proliferation of niche services contributes to market fragmentation. In response, agile operators are forging strategic alliances, embracing modular architectures, and prioritizing interoperability to maintain competitive advantage in this swiftly evolving digital entertainment ecosystem.

Unpacking the Ripple Effects of 2025 United States Tariff Policies on Devices, Content Licensing, and Platform Economics in the Video-on-Demand Sector

The sweeping tariff measures enacted by the United States government in early 2025 have introduced a new layer of complexity into the video-on-demand ecosystem, exerting pressure on both hardware manufacturers and service operators. Levies imposed on the importation of consumer electronics-including smart televisions, streaming media sticks, set-top boxes, and certain smartphone components-have triggered cost escalations that ripple through the supply chain. As a direct result, device makers have experienced margin compression, prompting many to reassess sourcing strategies, negotiate with alternative contract manufacturers in Southeast Asia, or initiate investments in localized assembly facilities to mitigate tariff burdens.

In parallel, these additional import duties have influenced the pricing structures that service providers deploy to attract and retain subscribers. While the cost of digital content delivery remains insulated from the direct impact of hardware tariffs, platforms that bundle proprietary or licensed devices with subscription packages face tougher decisions regarding promotional subsidies and introductory offers. Some companies have opted to absorb a portion of the increased cost to maintain competitive entry pricing, whereas others have introduced incremental surcharges or limited-time device rental programs to preserve long-term profitability. These strategic pivots underscore the delicate balance between consumer value propositions and operational feasibility.

Moreover, the tariff environment has catalyzed renewed discussions around regional content licensing agreements and distribution partnerships. With elevated hardware expenses, platforms are increasingly scrutinizing the economics of exclusive rights and co-production deals. By forging closer alliances with regional studios and independent content creators, some operators aim to offset hardware-related cost pressures with differentiated library offerings that drive subscriber loyalty. Consequently, the cumulative impact of these 2025 tariff policies extends beyond the manufacturing floor, reshaping promotional tactics, partnership models, and the broader competitive dynamics of the video-on-demand sector.

Diving Deep into Service Model, Content Type, and Device Type Segmentations to Reveal Audience Preferences and Monetization Pathways

A nuanced evaluation of segment-level performance reveals distinct consumer behaviors and monetization pathways. Within the service model spectrum, ad-supported video-on-demand continues its ascent among cost-conscious viewers, while subscription video-on-demand offerings in both freemium tiers and premium tiers cultivate subscriber loyalty through exclusive content and ad-free experiences. Meanwhile, transactional video-on-demand options split between download rental and electronic sell-through demonstrate episodic surges aligned with blockbuster release schedules, underscoring the persistent appetite for premium releases outside traditional subscription bundles. Transitional strategies that blend subscription and transactional elements are gaining traction as operators seek balanced revenue diversification.

Similarly, an examination of content type demonstrates that children’s programming and television entertainment serve as foundational engagement drivers for foundational time slots, whereas movies-both catalog titles and new releases-anchor peak streaming periods and drive incremental revenue through on-demand rentals or purchases. Series formats, whether distributed episodically or produced as limited mini series, foster habitual viewing patterns that strengthen platform stickiness. Music and sports content, enhanced by live or near-live streaming capabilities, introduce dynamic engagement windows that complement evergreen content libraries and boost cross-segment consumption.

On the technology front, device type segmentation offers critical insights into user context and session habits. Gaming consoles and personal computers facilitate immersive, prolonged viewing experiences, while set-top boxes and smart televisions dominate traditional living-room scenarios. Smartphones operating on Android and iOS platforms capture on-the-go consumption spikes throughout the day, and tablets bridge the gap between mobility and screen size, serving as versatile secondary displays. This multi-device reality compels service providers to optimize user interfaces and adaptive bitrate streaming across all endpoints to ensure consistent quality and seamless transitions between devices.

This comprehensive research report categorizes the Video on Demand market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Content Type

- Device Type

Analyzing Regional Divergences in Video-on-Demand Adoption across the Americas, EMEA, and Asia-Pacific and Their Strategic Implications

Across the Americas, the video-on-demand sphere exhibits hallmarks of a mature market undergoing iterative refinements in both service offerings and monetization strategies. Advertising-supported tiers have carved out significant share among price-sensitive demographics, while premium subscription experiences continue to attract audiences through high-profile original series and strategic bundling with telecommunications providers. Device penetration is particularly robust, and cross-promotion between over-the-top platforms and traditional cable or satellite services has created hybrid distribution channels that extend audience reach while preserving recurring revenue streams.

In Europe, the Middle East, and Africa, regulatory frameworks and cultural diversity shape a multifaceted landscape. Stringent data protection regulations necessitate rigorous compliance protocols, and varied language requirements incentivize localized content production and regional partnerships. National streaming champions have emerged in key markets, leveraging government incentives and local expertise to compete against global incumbents. Furthermore, the growth of free, ad-supported streaming networks presents a cost-effective entry point for consumers, while emerging broadband infrastructures in selective regions pave the way for enhanced video quality and interactive features.

Turning to the Asia-Pacific arena, mobile-first dynamics and an expanding middle class underpin rapid subscriber growth and elevated engagement rates. Homegrown players have proliferated, developing targeted libraries that resonate with regional preferences and leveraging partnerships with telecommunication operators to offer bundled data plans. Despite progress in streaming infrastructure, challenges such as piracy and device affordability persist, prompting strategic investments in content security and flexible pricing models. This region’s high-growth trajectory underscores the critical importance of adaptive service designs and local market intelligence.

This comprehensive research report examines key regions that drive the evolution of the Video on Demand market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Positioning, Strategic Partnerships, and Innovation Trends Among Leading Video-on-Demand Providers Shaping the Market

Industry leaders have adopted divergent strategies to secure market dominance, leveraging unique value propositions and strategic alliances. One prominent global streamer has continued to cement its position through aggressive investment in original programming and the deployment of advanced personalization engines, while another major player leverages its broader e-commerce ecosystem to bundle subscription video services with consumer loyalty programs. Meanwhile, family-oriented content providers have harnessed iconic intellectual properties and franchise expansions to drive multi-platform engagement and subscriber acquisition.

Hybrid models that blend subscription tiers with ad-supported options have gained traction among leading providers seeking to maximize addressable audiences and optimize revenue streams. A notable entertainment conglomerate recently transitioned its flagship streaming service to a unified platform, incorporating live sports and news verticals to diversify engagement drivers. In parallel, a major premium cable operator has expanded its direct-to-consumer offerings through strategic partnerships with telecom carriers and device manufacturers, extending reach into living room ecosystems and enhancing bundled value propositions.

Emerging regional champions and niche specialists contribute further dynamism to the competitive matrix. A prominent Asia-Pacific player has scaled rapidly by aligning content portfolios with local tastes and forging partnerships with regional studios. Smaller innovators in Europe and North America are carving out specialized niches-ranging from indie film curation to interactive fitness and lifestyle programming-challenging larger platforms to continuously refine their content strategies. Collectively, these varied approaches illustrate the multifaceted paths to growth and the imperative for constant innovation in the video-on-demand landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Video on Demand market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- AMC Networks

- Apple Inc.

- Baidu, Inc.

- Comcast Corporation

- Crave

- DAZN

- FuboTV

- Google LLC

- ITV plc

- JioStar

- Mubi Inc.

- Netflix, Inc.

- Paramount Global

- Rakuten Group

- Roku, Inc.

- RTL Group

- Sony Group Corporation

- Starz Entertainment

- Tencent Holdings Ltd.

- The Walt Disney Company

- Viaplay Group

- Warner Bros. Discovery

- Zee Entertainment Enterprises

Offering Actionable Strategic Roadmaps for Industry Leaders to Capitalize on Emerging Trends, Strengthen Competitive Edges, and Future-Proof VOD Operations

To thrive in an increasingly competitive and technologically dynamic environment, industry stakeholders must adopt multifaceted strategies that reinforce both operational agility and consumer relevance. Prioritizing investments in artificial intelligence and machine learning will enable platforms to refine content discovery pathways, deliver hyper-personalized viewing experiences, and optimize advertising yield through precise audience targeting. Simultaneously, embracing hybrid monetization schemes that blend subscription tiers with ad-supported options and transactional offerings can expand market reach while balancing long-term revenue objectives.

Enhancing device-agnostic interoperability and adaptive streaming capabilities is equally critical. Platform developers should allocate resources toward optimizing user interfaces across smart TVs, gaming consoles, mobile devices, and emerging form factors, ensuring seamless transitions and consistent playback quality. Strategic partnerships with telecommunications carriers and hardware vendors can further reinforce distribution pipelines, offering bundled data or subsidized device programs that lower barriers to entry and foster subscriber loyalty.

Moreover, a localized content strategy should be pursued vigorously, with dedicated teams identifying regional storytelling trends and forging co-production alliances with independent studios. This approach will drive cultural resonance and mitigate the impact of global tariff pressures by emphasizing digital delivery over hardware bundling. Finally, instituting robust data governance frameworks and cybersecurity measures will safeguard consumer trust, meet evolving regulatory requirements, and protect proprietary algorithms that underpin differentiated service offerings. By integrating these actionable recommendations, industry leaders can fortify their competitive positioning and unlock sustainable growth in the video-on-demand arena.

Detailing the Systematic Approach to Data Collection, Analytical Frameworks, and Validation Techniques that Ensure Robust Insights into the Video-on-Demand Landscape

This analysis is built upon a rigorous and transparent research framework that combines extensive secondary research with targeted primary engagements. Initially, public financial disclosures, industry white papers, and technology trend reports are systematically reviewed to establish a foundational understanding of market dynamics and competitive positioning. Proprietary databases supply device usage statistics, while content licensing registries and patent filings offer insights into innovation trajectories and strategic partnerships.

Complementing this secondary research, a series of in-depth interviews are conducted with senior executives, technology architects, and content acquisition specialists across leading platforms to capture firsthand perspectives on emerging challenges and strategic priorities. Additionally, consumer sentiment surveys and focus groups are deployed across diverse demographic segments to assess viewing behaviors, platform preferences, and pricing sensitivities. These qualitative inputs are cross-referenced with anonymized telemetry data from streaming analytics providers, enabling precise calibration of engagement metrics and bandwidth requirements.

Data validation and triangulation underpin the integrity of the findings. Conflicting insights are reconciled through follow-up discussions, and methodological assumptions are stress-tested against historical market movements. All analytical models are documented with explicit parameter definitions, ensuring transparency and reproducibility. A final quality assurance phase involves peer review by subject matter experts in digital media and regulatory compliance. This structured methodology delivers robust, nuanced insights into the video-on-demand landscape and its evolving competitive contours.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Video on Demand market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Video on Demand Market, by Service Model

- Video on Demand Market, by Content Type

- Video on Demand Market, by Device Type

- Video on Demand Market, by Region

- Video on Demand Market, by Group

- Video on Demand Market, by Country

- United States Video on Demand Market

- China Video on Demand Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesizing Key Learnings from Market Developments, Technological Advances, and Strategic Imperatives to Chart the Path Forward for the Video-on-Demand Industry

As the video-on-demand sector continues its rapid maturation, several core themes emerge that will shape its trajectory in the coming years. Technological advancements, including artificial intelligence, cloud-native architectures, and next-generation connectivity, are not only enhancing the quality of content delivery but also redefining consumer expectations around personalization and interactivity. Concurrently, the proliferation of diverse monetization frameworks-from ad-supported tiers to hybrid subscription-transactional models-underscores the necessity for flexible, customer-centric strategies.

Segmentation analysis reveals that viewer preferences vary significantly across service models, content genres, and device contexts, demanding differentiated approaches to engagement and retention. Regional dynamics further complicate the competitive equation, as regulatory environments, infrastructure maturity, and cultural tastes diverge across the Americas, EMEA, and Asia-Pacific markets. In this multifaceted landscape, leading companies demonstrate that sustainable success hinges on the ability to innovate rapidly, forge strategic partnerships, and maintain operational resilience in the face of policy shifts, such as changing tariff regimes.

Ultimately, the path forward for industry stakeholders will depend on striking the optimal balance between global scale and local relevance, technological sophistication and content appeal, as well as experimentation and disciplined execution. Those who embrace a rigorous, data-driven approach to strategy formulation-while remaining attuned to evolving consumer behaviors and regulatory imperatives-will be best positioned to capture value and drive future growth in this vibrant digital entertainment ecosystem.

Engage with Ketan Rohom Today to Secure Exclusive Access to Comprehensive Video-on-Demand Market Research Insights for Strategic Decision-Making

Unlock comprehensive insights and equip your organization with the intelligence required to navigate the complex, ever-evolving video-on-demand industry. This report distills the critical trends-from transformative technological inflections and tariff-induced market shifts to robust segmentation intelligence and regional dynamics-into actionable intelligence. Whether your aims include refining monetization frameworks, optimizing device distribution strategies, or localizing content portfolios, this comprehensive analysis provides the clarity and depth needed to make informed strategic decisions.

To secure immediate access to this indispensable research, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, who is ready to guide you through the report’s key findings and customization options. Engage with a seasoned expert who can tailor deliverables to your organization’s unique objectives and ensure that you derive maximum value from these insights. Elevate your strategic planning and position your team at the forefront of digital entertainment innovation by connecting with Ketan Rohom today.

- How big is the Video on Demand Market?

- What is the Video on Demand Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?