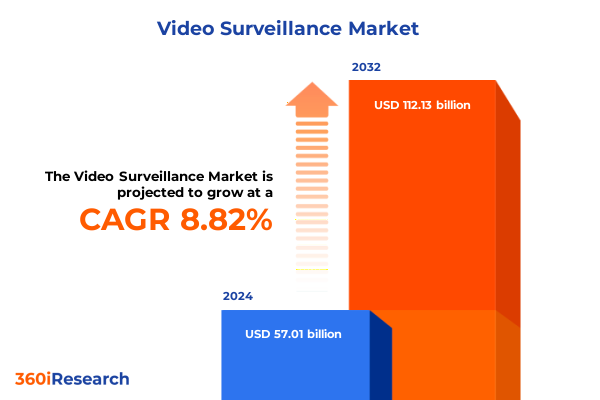

The Video Surveillance Market size was estimated at USD 61.70 billion in 2025 and expected to reach USD 66.89 billion in 2026, at a CAGR of 8.90% to reach USD 112.13 billion by 2032.

Emerging Dynamics and Catalysts Shaping the Next Wave of Innovation and Resilience in the Global Video Surveillance Landscape

In an era defined by digital transformation and heightened security imperatives, video surveillance has transcended its traditional role as a passive recording mechanism to become a proactive, intelligence-driven asset. Advancements in high-definition imaging, network infrastructures, and real-time analytics are converging to empower organizations with unparalleled situational awareness. This evolution is underpinned by an ever-expanding ecosystem of devices, software, and services that are integrating seamlessly into broader security and operational workflows.

Organizations across critical infrastructure, commercial enterprises, and residential environments are now recognizing video surveillance as more than a security measure-it is a strategic enabler of business continuity, risk mitigation, and operational efficiency. By capturing and analyzing vast volumes of visual data, enterprises can detect anomalies, automate response protocols, and derive actionable insights that fuel informed decision-making. Moreover, regulatory compliance and evolving privacy standards are driving greater transparency and accountability, compelling technology providers to innovate in areas such as data encryption, secure storage, and access management.

Against this backdrop, the market is witnessing a paradigm shift from siloed, analog systems to interconnected, AI-enabled platforms capable of delivering real-time intelligence. This introductory section delineates the key drivers propelling this transformation, highlights the critical role of video surveillance in contemporary security and operational strategies, and sets the stage for an in-depth examination of the shifts, impacts, and actionable insights that follow.

Rapid Technological Convergence and Regulatory Evolution Driving a Fundamental Transformation in Video Surveillance Systems and Service Architectures Worldwide

The video surveillance ecosystem is undergoing a profound transformation driven by rapid technological convergence and stringent regulatory evolution. Artificial intelligence and machine learning are now deeply embedded in analytics engines, enabling systems to perform facial recognition, object detection, and behavioral analysis with remarkable accuracy. Meanwhile, edge computing architectures are decentralized, pushing processing capabilities closer to the source to reduce latency and bandwidth consumption. As a result, security operations centers and remote monitoring hubs are experiencing enhanced situational responsiveness and reduced reliance on centralized data centers.

Concurrently, the proliferation of cloud-based Video Surveillance-as-a-Service (VSaaS) offerings is redefining deployment models. Organizations can scale infrastructure dynamically, adjust service tiers on-demand, and benefit from subscription-based cost structures. This shift is complemented by the integration of 5G networks, which promise ubiquitous connectivity and support high-resolution streams without the constraints of legacy wired infrastructure. Furthermore, global privacy regulations-ranging from the California Consumer Privacy Act (CCPA) to the European Union’s General Data Protection Regulation (GDPR)-are compelling providers to embed robust data protection, transparent consent mechanisms, and audit trails into their platforms.

Moreover, cybersecurity has ascended to a critical focal point in video surveillance, as camera endpoints and network devices present potential vectors for malicious intrusion. Enhanced security protocols, firmware hardening, and zero-trust architectures are emerging as industry norms. In tandem, open API frameworks and interoperability standards are gaining traction, allowing for seamless integration with access control systems, alarm platforms, and building management solutions. Collectively, these transformative shifts are setting the stage for a new generation of intelligent, resilient, and scalable video surveillance architectures.

Assessment of the Comprehensive Effects of 2025 United States Tariffs on Supply Chain Dynamics Pricing Pressures and Strategic Sourcing in Video Surveillance

Since the inception of tariff measures targeting technology imports, the cumulative impact on video surveillance components has been significant. The 2025 escalation of duties on imaging sensors, semiconductors, and storage devices has amplified input costs, compelling manufacturers to reassess pricing strategies and supply chain configurations. Importers are grappling with elevated landed costs, which are increasingly being passed through to end-users, triggering budgetary pressures for both public sector entities and private enterprises.

In response to these headwinds, OEMs and system integrators are pursuing dual strategies of nearshoring manufacturing and diversifying vendor portfolios. Component assembly lines are relocating to cost-effective regions within the Americas, leveraging regional trade agreements to mitigate duty burdens. At the same time, procurement teams are sourcing alternative suppliers in markets less affected by the tariff regime. This diversification is fostering greater resilience but also introducing complexity in quality control and logistics management.

Looking ahead, the sustained influence of tariff policies is catalyzing innovation in product design and component optimization. Manufacturers are investing in higher-efficiency imaging modules and consolidated circuit architectures to reduce reliance on tariffed parts. Furthermore, evolving trade dialogues and prospective exemptions are shaping the strategic roadmap for participants across the value chain. Ultimately, stakeholders who proactively adapt their sourcing, manufacturing, and pricing frameworks will be best positioned to navigate the cost pressures and maintain competitive differentiation.

In-Depth Exploration of System Offering and Vertical Segmentation Revealing Critical Insights into Diverse Use Cases and Technology Preferences

A nuanced understanding of system-level segmentation reveals distinct value propositions across analog, hybrid, and IP architectures. Analog Video Surveillance Systems continue to serve legacy deployments, offering cost-effective coverage for basic monitoring needs, while Hybrid Video Surveillance Systems bridge the gap by integrating digital recording with existing analog infrastructure to enhance image quality and storage management. IP Video Surveillance Systems represent the forefront of innovation, delivering high-definition streams, advanced analytics, and network-centric scalability for mission-critical environments.

Delving deeper into solution offerings, hardware components encompass critical elements such as accessories, cameras, and storage devices. Camera portfolios range from wired cameras, preferred for stable power and connectivity, to wireless cameras that deliver rapid deployment flexibility. Storage solutions span digital video recorders to network-attached storage devices, each optimized for capacity, redundancy, and retrieval speeds. Concurrently, services are bifurcated into installation and maintenance support as well as subscription-based Video Surveillance-as-a-Service models, enabling organizations to leverage turnkey capabilities without heavy upfront investments. Software complements hardware with video analytics platforms that automate threat detection and video management suites that orchestrate device interoperability and user access controls.

Vertical segmentation underscores the breadth of applications, spanning commercial environments such as banking, finance buildings, and retail centers; industrial settings that prioritize process safety and asset protection; and infrastructure deployments in city surveillance, transportation hubs, and public utilities. Military and defense use cases extend to border and coastal surveillance, offering multi-sensor fusion and rapid response coordination. Finally, residential markets are embracing smart home integration, leveraging compact cameras and cloud-based storage for personalized security. These layered segments illustrate evolving customer requirements and highlight areas where tailored solutions can deliver maximum impact.

This comprehensive research report categorizes the Video Surveillance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- System

- Offering

- Vertical

Comparative Regional Dynamics Unveiling Market Drivers Constraints and Innovation Hotspots across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics in the Americas are characterized by a mature adoption curve, with market participants prioritizing compliance with privacy regulations and the modernization of legacy analog networks. Energy-efficient IP camera rollouts, coupled with integrated analytics for retail loss prevention and enterprise security, underscore the region’s technology-forward orientation. Meanwhile, government-led smart city initiatives in Latin America are accelerating demand for scalable video infrastructures, often supported by public–private partnerships and international financing mechanisms.

In Europe, Middle East, and Africa, regulatory diversity is a defining factor. Stricter data protection frameworks in Western Europe contrast with rapidly expanding infrastructure projects across the Middle East, where large-scale stadiums and transportation corridors mandate high-performance video systems. In Africa, initiatives to bolster public safety are driving adoption in urban centers, albeit with budget constraints that favor hybrid and cost-optimized architectures. Throughout the region, interoperability with border control, utilities monitoring, and emergency response systems remains a key priority.

The Asia-Pacific market exhibits the fastest uptake of IP and AI-enabled surveillance, driven by smart city rollouts in China, digital payment security in Southeast Asia, and digital twins in advanced manufacturing hubs. Government investments in border security and defense infrastructures further amplify demand for ruggedized, high-resolution systems. Additionally, regulatory frameworks are evolving to balance national security interests with personal privacy, prompting vendors to integrate privacy masking and secure data handling features as standard offerings.

This comprehensive research report examines key regions that drive the evolution of the Video Surveillance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Competitive Differentiation of Leading Global Video Surveillance Vendors through Technological Partnerships and Portfolio Expansion

The competitive landscape is dominated by global vendors that leverage extensive R&D capabilities, scalable manufacturing, and broad distribution networks. Established multinationals continue to reinforce their market positions through strategic acquisitions and partnerships, integrating software analytics firms to bolster their value propositions. At the same time, regional specialists are gaining traction by offering localized service models, rapid deployment cycles, and deep compliance expertise tailored to specific regulatory regimes.

Leading solution providers are differentiating through modular architectures that facilitate plug-and-play integration with third-party devices and systems. Investments in AI module development have yielded analytics capabilities that encompass crowd counting, thermal detection, and vehicle license plate recognition, enhancing offerings across security and safety applications. Companies are also forging collaborations with cloud platforms and telecom operators to extend VSaaS footprints and deliver managed security services that blend human oversight with automated alerts.

Furthermore, several vendors are emphasizing sustainability by introducing eco-friendly designs, leveraging recyclable materials and low-power components. These initiatives resonate with corporate ESG objectives and emerging procurement guidelines that mandate lifecycle assessments. In parallel, product roadmaps are increasingly aligned with open standards, enabling faster customization and integration with emerging Internet of Things ecosystems. This dual focus on innovation and interoperability is pivotal for maintaining relevance in a dynamic market environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Video Surveillance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADT Inc.

- Alibaba Group Holding Limited

- Canon Inc.

- CP Plus

- Eagle Eye Networks

- ECAMSECURE

- Genetec Inc.

- Grandstream Networks, Inc.

- Hangzhou Hikvision Digital Technology Co., Ltd.

- Hanwha Corporation

- Honeywell International Inc.

- Huawei Investment & Holding Co., Ltd.

- IDIS. Ltd

- Infinova Corporation

- Johnson Controls International PLC

- Motorola Solutions, Inc.

- NEC Corporation

- Nice S.p.A.

- Panasonic Holding Corporation

- Quantum Corporation

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Solink Corporation

- Sony Group Corporation

- Verint Systems Inc.

- VIVOTEK Inc.

- Zhejiang Dahua Technology Co., Ltd.

- Zhejiang Uniview Technologies Co., Ltd.

Actionable Strategic Imperatives for Industry Stakeholders to Capitalize on Emerging Trends Disruptions and Growth Opportunities in Video Surveillance

Industry leaders should prioritize the integration of advanced analytics at the edge to reduce network congestion and accelerate decision-making. By embedding AI inference capabilities within cameras and edge gateways, organizations can achieve real-time threat detection and event correlation without overburdening central servers. Complementarily, deploying software-defined networking and micro-segmentation techniques will strengthen cybersecurity postures and protect distributed camera networks from lateral attacks.

To mitigate tariff-induced cost volatility, stakeholders must develop agile supply chain frameworks that incorporate nearshore manufacturing, multi-sourcing agreements, and strategic inventory buffers. Establishing collaborative relationships with component suppliers can unlock joint investment opportunities in R&D, resulting in cost-effective, purpose-built modules that circumvent tariff constraints. Simultaneously, finance teams should adopt dynamic pricing models that reflect input cost fluctuations and incentivize long-term service contracts to stabilize revenue streams.

In parallel, market participants should deepen engagement with high-value verticals such as critical infrastructure, healthcare, and logistics by co-creating tailored solutions that address regulatory, operational, and environmental requirements. Collaborative pilot programs and proof-of-concept installations can demonstrate value propositions, reduce procurement friction, and generate early reference cases. Further, leveraging open API frameworks will enable integrators to fuse video surveillance with building management, access control, and analytics ecosystems, fostering holistic security and operational platforms.

Finally, investing in talent development and certification programs will ensure that installation teams and support staff possess the advanced skill sets required to implement complex analytics, network security configurations, and cross-platform integrations. Prioritizing continuous training and knowledge-sharing forums will sustain competitive advantage and foster a culture of innovation within organizations.

Rigorous Multi-Source Research Framework Combining Quantitative Data Triangulation and Qualitative Expert Insights to Ensure Comprehensive Market Analysis

This research initiative was underpinned by a multi-source methodology designed to deliver a comprehensive and reliable analysis. Primary data collection included extensive interviews with C-level executives, system integrators, technology suppliers, and end users across key verticals. These qualitative insights were supplemented by in-depth discussions with regulatory authorities and standards bodies to capture evolving compliance requirements and data protection mandates.

On the quantitative side, secondary data was collated from authoritative sources, including government publications, industry whitepapers, and academic journals. Data triangulation techniques were applied to reconcile discrepancies and validate emerging patterns. Advanced statistical tools and scenario analysis were employed to examine the interplay between tariff policies, technological adoption rates, and regional market dynamics. Finally, an expert review panel comprising security consultants, network architects, and procurement specialists scrutinized draft findings to ensure factual accuracy, contextual relevance, and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Video Surveillance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Video Surveillance Market, by System

- Video Surveillance Market, by Offering

- Video Surveillance Market, by Vertical

- Video Surveillance Market, by Region

- Video Surveillance Market, by Group

- Video Surveillance Market, by Country

- United States Video Surveillance Market

- China Video Surveillance Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1908 ]

Synthesis of Key Findings Highlighting Strategic Imperatives Market Complexities and Future Directions for Stakeholders in the Video Surveillance Ecosystem

The confluence of technological innovation, regulatory evolution, and geopolitical considerations is reshaping the video surveillance ecosystem at an unprecedented pace. Stakeholders are confronting new imperatives-from embedding AI-driven analytics at the edge to navigating complex tariff landscapes-while striving to deliver reliable, scalable, and secure solutions. Strategic adaptability, underpinned by robust data and cross-functional collaboration, will be paramount for achieving sustained competitive advantage.

As organizations transition from tactical deployments to integrated security and operations platforms, the ability to anticipate emerging risks and capitalize on digital transformation initiatives will define market leadership. By harnessing the insights presented in this executive summary-spanning system architectures, offering models, regional dynamics, and competitive strategies-decision-makers can chart informed pathways that mitigate uncertainty and unlock new value streams. The journey ahead demands both vision and execution excellence to harness the full potential of next-generation video surveillance.

Engage with Associate Director Sales Marketing Ketan Rohom to Unlock Comprehensive Insights and Accelerate Decision Making with Our Detailed Video Surveillance Market Report

To gain unparalleled visibility into the evolving dynamics of the video surveillance landscape and translate insights into strategic action, connect with Ketan Rohom, Associate Director, Sales & Marketing. By partnering directly, you’ll access a comprehensive market research report packed with granular analysis on technological innovations, competitive strategies, regional trajectories, regulatory impacts, and supply chain considerations-all tailored to inform your next strategic move. Take this opportunity to leverage expert guidance, secure a competitive edge, and elevate your decision-making with data-driven precision by engaging today.

- How big is the Video Surveillance Market?

- What is the Video Surveillance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?