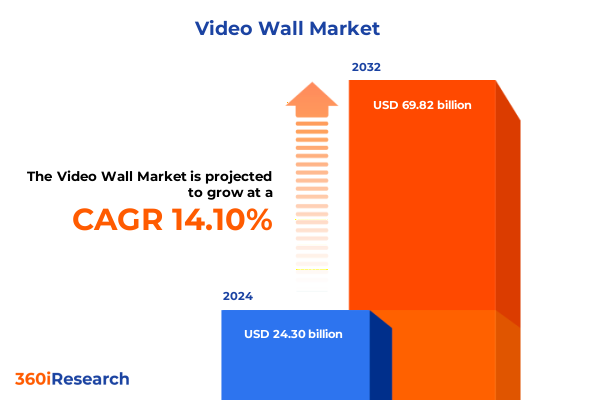

The Video Wall Market size was estimated at USD 27.40 billion in 2025 and expected to reach USD 30.91 billion in 2026, at a CAGR of 14.29% to reach USD 69.82 billion by 2032.

Exploring the Emerging Revolution in Video Wall Technology and Its Strategic Importance for Immersive Interactive Environments and Communication Strategies

The video wall landscape has evolved from a novel display concept into a cornerstone technology for immersive visual communication. Organizations across diverse sectors have integrated large-scale multi-panel displays to captivate audiences, deliver critical information, and elevate brand experiences. As digital transformation accelerates, the demand for high-resolution, scalable, and interactive video walls continues to climb, fueling innovation among solution providers.

Emerging trends in content management, real-time analytics, and seamless connectivity have enhanced the value proposition of video walls beyond static presentations. Today’s leading-edge deployments emphasize centralized control, dynamic content scheduling, and remote monitoring capabilities, allowing operators to adapt messaging swiftly and ensure operational continuity. This convergence of hardware, software, and services has reshaped stakeholder expectations.

Moving forward, market participants will need to navigate shifting customer requirements, evolving regulatory environments, and rapid technological advancements. A comprehensive understanding of the market’s driving forces is essential for decision-makers to identify growth opportunities and mitigate risks. This report offers a strategic foundation for capitalizing on the next generation of video wall solutions.

Analyzing the Key Transformational Forces Reshaping the Global Video Wall Market Landscape and Driving Novel Opportunities for Stakeholders

The video wall sector is experiencing transformative forces that redefine both user experiences and deployment models. Advances in flexible OLED panels and micro LED direct-view architectures are enabling thinner form factors and unparalleled contrast ratios, propelling adoption in control rooms, corporate lobbies, and high-impact entertainment venues. These innovations signal a departure from traditional rigid assemblies toward more adaptable solutions.

Simultaneously, software-driven content orchestration platforms are maturing, offering AI-powered scheduling, audience analytics, and cloud-based management. This trend empowers organizations to deliver personalized, context-aware messaging at scale, while reducing manual oversight. As a result, content strategies have shifted from periodic refresh cycles to continuous, data-driven engagement initiatives.

Another pivotal shift stems from the convergence of digital signage with broader Internet of Things networks. Video walls are no longer isolated displays but integral nodes in interactive ecosystems, connecting with sensors, mobile devices, and enterprise systems to provide real-time insights. This level of integration demands robust cybersecurity measures and interoperability standards, reshaping vendor partnerships and solution roadmaps.

Unraveling the Cumulative Effects of United States Tariffs in 2025 on the Economics and Supply Chains of Video Wall Industry

United States tariff policies in 2025 have imposed notable cost pressures across the video wall supply chain, affecting both components and finished assemblies. Section 301 duties on Chinese-origin semiconductors and related hardware remain at rates up to twenty-five percent, elevating procurement costs for display controllers and integrated media players.

Further, recent reciprocal tariff adjustments under April’s trade measures introduced levies of up to fifty-six percent on imported digital signage devices and subcomponents, including metal enclosures and structural mounts. With professional displays often assembled in North American facilities operating at capacity, manufacturers face limited options for cost mitigation without impacting lead times.

These cumulative effects strain project budgets and may slow the pace of large-scale deployments, particularly in sectors with stringent capital expenditure constraints. Stakeholders are exploring alternate sourcing strategies, such as nearshoring manufacturing or securing tariff exclusions, to preserve competitive pricing. However, the unpredictability of future trade negotiations continues to cast a shadow over procurement planning.

Uncovering Strategic Insights from Segmentation Analysis to Tailor Video Wall Solutions Across Technologies, Applications, and User Needs

Insights derived from segmentation analysis reveal nuanced dynamics across multiple dimensions of the video wall market. Solutions built on LCD technology, including both direct-lit and edge-lit variants, maintain strong appeal in environments prioritizing cost efficiency and energy consumption. Conversely, direct-view and micro LED options demonstrate compelling benefits for use cases demanding exceptional brightness and durability, while flexible and rigid OLED panels attract creative applications seeking seamless, curved installations.

When evaluating application contexts, control rooms and corporate environments often emphasize reliability and continuous operation, fostering demand for redundant systems and robust maintenance services. In contrast, educational venues such as classrooms and lecture halls focus on ease of content distribution and interactive touch capabilities, whereas stadiums and theaters require expansive, high-luminosity displays capable of engaging large audiences. Retail flagship stores seek premium visual appeal to reinforce brand identity, while in-store deployments balance impactful messaging with cost-effective modularity. Transportation hubs-from airports to bus terminals and railways-prioritize real-time wayfinding integration and resilience to environmental factors.

End users spanning BFSI institutions like banking and insurance firms depend on compliance-focused security and centralized control, while schools and universities look for flexible scheduling across campuses. Government applications in defense and public safety demand hardened performance, and clinics and hospitals require displays that facilitate critical information delivery. Data centers and network operations centers leverage advanced analytics integration, whereas broadcasting and streaming services drive the adoption of cutting-edge video processing capabilities.

Component-level exploration highlights the interplay between display panels, media players, and mounting systems, supplemented by software solutions for content management and control, alongside installation, integration, and maintenance services. Finally, deployment considerations underscore indoor environments-both fixed and modular systems-and outdoor scenarios, where fixed structures and rental solutions must withstand variable weather conditions and regulatory constraints.

This comprehensive research report categorizes the Video Wall market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Display Technology

- Component

- Deployment

- Application

- End User

Highlighting Regional Dynamics and Growth Drivers across Americas, EMEA and Asia-Pacific Markets Shaping the Video Wall Ecosystem

Regional market dynamics reveal distinctive growth catalysts and challenges across the Americas, EMEA, and Asia-Pacific. In the Americas, demand is driven by digital retail transformation and investment in enterprise communication platforms, supported by robust infrastructure and favorable technology financing. This region benefits from proximity to major manufacturing hubs in Mexico, which offset some tariff impacts, yet remains sensitive to cross-border logistics volatility.

Across Europe, the Middle East, and Africa, stringent energy efficiency regulations and a strong public sector focus on security command the design parameters for control room and defense installations. Western European markets prioritize sustainability certifications, encouraging suppliers to optimize power consumption. Meanwhile, rapid infrastructure development in Gulf countries and urban modernization programs in Africa create pockets of opportunity for large-scale outdoor and command-center deployments.

In the Asia-Pacific region, dynamic economic growth in Southeast Asia and investment in smart city initiatives fuel demand for transportation signage solutions, while mature markets in East Asia continue to push the envelope on micro LED and flexible OLED showcases. Manufacturers in this region leverage advanced production capacity and government incentives for high-tech exports, although geopolitical tensions and shifting trade agreements pose ongoing uncertainty.

This comprehensive research report examines key regions that drive the evolution of the Video Wall market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Industry Players and Their Innovative Competitive Strategies Shaping the Evolution of the Video Wall Market's Future

Leading companies in the video wall sector distinguish themselves through strategic investments in research and development, expanded global footprints, and comprehensive service portfolios. Key players differentiate with proprietary display technologies that enhance brightness, color accuracy, and panel longevity. Simultaneously, firms that integrate end-to-end solutions-from hardware supply to cloud-based content orchestration-capture larger wallet share by simplifying procurement and operation for clients.

Several market incumbents also pursue vertical integration, establishing manufacturing facilities in tariff advantageous locations while forging partnerships with software innovators to deepen platform capabilities. This dual approach helps firms manage cost pressures and deliver unified offerings that address evolving customer requirements. Additionally, collaborative alliances with system integrators and channel partners extend service reach, ensuring responsive support for complex deployments.

Competitive dynamics increasingly hinge on the ability to deliver scalable solutions that align with industry-specific compliance standards. Companies that leverage predictive maintenance analytics and AI-driven content adaptation further solidify their leadership, showcasing the strategic value of marrying hardware excellence with intelligent software.

This comprehensive research report delivers an in-depth overview of the principal market players in the Video Wall market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absen Optoelectronic Co. Ltd.

- Acer Inc.

- AUO Corporation

- Barco NV

- Christie Digital Systems USA, Inc.

- Daktronics

- Delphi Display Systems, Inc. by Toast, Inc.

- Delta Electronics, Inc.

- Koninklijke Philips N.V.

- Leyard Group

- LG Electronics Inc.

- Lighthouse Technologies Limited

- Mitsubishi Electric Corporation

- Navori SA

- NEC Corporation

- Panasonic Holdings Corporation

- Primeview Global

- Prysm Systems, Inc.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Shenzhen CLT Electronic Co.,Ltd.

- Sony Group Corporation

- Toshiba Corporation

- Unilumin Group Co., Ltd.

- ViewSonic Corporation

Presenting Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends and Strengthen Market Position

Industry leaders must prioritize agility in adapting to rapid technology shifts and tariff-induced cost fluctuations. By fostering flexible supply chain models, they can pivot between multiple production centers and secure alternative component sources to mitigate trade uncertainties. Embracing modular system architectures allows for incremental upgrades, extending product lifecycles and preserving capital efficiency.

Moreover, investing in advanced analytics and AI-driven management tools will empower operators to fine-tune content delivery and proactively address performance bottlenecks. Collaboration with software partners to integrate security features and interoperability standards can drive adoption in highly regulated sectors, reinforcing the value proposition of comprehensive solutions.

Finally, forging strategic alliances with regional integrators, resellers, and infrastructure providers will broaden market access and enable tailored offerings that meet localized requirements. Proactive engagement with policymakers to advocate for technology-friendly regulations and tariff relief measures can further support sustainable growth trajectories.

Detailing the Robust Research Methodology Employed to Generate Comprehensive Strategic Insights for the Video Wall Market Study

This market analysis employed a multi-faceted research methodology to ensure comprehensive and accurate insights. Primary data collection encompassed in-depth interviews with industry executives, system integrators, and end users across key sectors. This qualitative intelligence was supplemented by extensive secondary research, drawing on industry publications, regulatory filings, and scholarly journals to validate emerging trends.

Quantitative analysis involved assessing historical adoption rates, pricing trajectories, and procurement patterns, ensuring a balanced view of performance drivers. Segmentation frameworks were systematically applied across display technology, application domains, end-user verticals, component categories, and deployment scenarios to uncover granular insights. Regional assessments leveraged macroeconomic indicators and infrastructure investment data to contextualize growth potential.

To maintain objectivity, cross-validation techniques compared findings from independent sources and reconciled any discrepancies through follow-up discussions with subject matter experts. The resulting data set was synthesized into strategic models that underpin the report’s conclusions and recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Video Wall market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Video Wall Market, by Display Technology

- Video Wall Market, by Component

- Video Wall Market, by Deployment

- Video Wall Market, by Application

- Video Wall Market, by End User

- Video Wall Market, by Region

- Video Wall Market, by Group

- Video Wall Market, by Country

- United States Video Wall Market

- China Video Wall Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3816 ]

Synthesizing Core Findings and Strategic Implications to Provide a Cohesive Conclusion on the Video Wall Market Trajectory

The analysis underscores a market poised for continuous innovation, driven by advances in display materials, content orchestration, and system integration. While tariff fluctuations present short-term cost challenges, strategic supply chain adaptations and nearshoring efforts can mitigate risk. Adoption is strongest in environments where immersive communication and real-time data visualization deliver clear business outcomes.

Segmentation insights reveal that diverse applications-from control rooms to retail flagships-demand tailored solutions, reinforcing the importance of flexible technology platforms. Regional pillars exhibit distinct drivers: infrastructure modernization in developed economies, regulatory emphasis on energy efficiency, and smart city investments in emerging markets. Leading players differentiate through integrated offerings, local manufacturing footprints, and AI-enabled services.

By synthesizing these findings, stakeholders can chart a clear path forward-prioritizing modular architectures, collaborative partnerships, and proactive policy engagement. This holistic perspective provides a roadmap for navigating market complexities and capturing emerging opportunities.

Engage with Ketan Rohom to Unlock Exclusive Market Research Insights and Secure Your Tailored Video Wall Industry Report Today

To delve deeper into strategic insights and gain tailored guidance on leveraging video wall innovations for your business, reach out directly to Ketan Rohom. As Associate Director of Sales & Marketing, he offers personalized consultations to help you align your goals with the comprehensive market research findings. By partnering with Ketan, you unlock access to exclusive data, bespoke analysis, and actionable roadmaps designed to maximize your market impact. Start a conversation now to secure your copy of the full industry report and transform your strategic planning with expert support.

- How big is the Video Wall Market?

- What is the Video Wall Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?