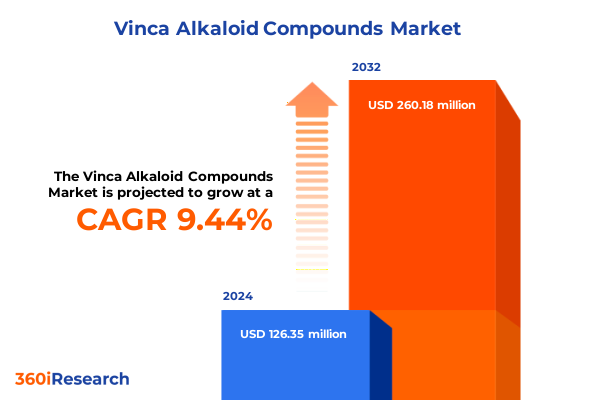

The Vinca Alkaloid Compounds Market size was estimated at USD 138.32 million in 2025 and expected to reach USD 150.49 million in 2026, at a CAGR of 9.44% to reach USD 260.18 million by 2032.

Revisiting the Fundamental Role of Vinca Alkaloid Compounds in Contemporary Oncology: Historical Roots and Modern Therapeutic Relevance Unveiled

The history of Vinca alkaloid compounds spans over half a century, tracing back to pioneering work on vinca rosea in the mid-20th century. These naturally derived molecules have become foundational pillars in oncology, demonstrating potent antimitotic activity that disrupts microtubule formation. Over time, chemists have refined their extraction and purification, yielding derivatives such as vinblastine, vincristine, vindesine, and vinorelbine. From their early laboratory isolations to modern clinical applications, Vinca alkaloids have continually proven their therapeutic relevance, offering vital options for treating a broad spectrum of hematological and solid tumors.

Today, these compounds occupy a critical space within combination regimens, often serving as cornerstones alongside platinum-based chemotherapies and novel targeted agents. Their capacity to interfere with rapid cell division renders them indispensable, particularly in malignancies such as breast cancer, leukemia, lung cancer, and lymphoma. As the oncology field shifts toward precision medicine, Vinca alkaloids are experiencing renewed interest. Researchers are exploring nanoparticle formulations and antibody–drug conjugates to enhance targeted delivery and reduce systemic toxicity. Thus, the introduction of Vinca alkaloid compounds underscores both their enduring legacy and evolving role in contemporary cancer care.

Deciphering the Transformative Shifts in Research, Regulatory Environment, and Technological Advances Reshaping the Vinca Alkaloid Landscape

In recent years, the landscape of Vinca alkaloid development has been transformed by breakthroughs in synthetic chemistry and regulatory reforms. Novel semi-synthetic pathways now enable scalable production of vindesine and vinorelbine, reducing reliance on natural precursors and mitigating environmental concerns associated with plant harvesting. Concurrently, regulatory bodies have introduced accelerated approval pathways for oncology drugs demonstrating significant clinical benefit, expediting access to innovative formulations with improved safety profiles.

Technological advances are fostering a paradigm shift in drug delivery, with microfluidic systems facilitating the design of liposomal carriers that optimize pharmacokinetics and biodistribution. At the same time, academic–industry collaborations are driving combinatorial studies that assess Vinca alkaloids in tandem with immune checkpoint inhibitors, aiming to potentiate antitumor responses through synergistic mechanisms. These research initiatives reflect a broader emphasis on personalized approaches, where genetic biomarkers guide therapeutic selection to maximize efficacy. As a result, stakeholders must stay attuned to these transformative trends, which collectively redefine the competitive and clinical utility of Vinca alkaloid compounds.

Assessing the Deep-Rooted Effects of 2025 United States Tariff Adjustments on Raw Material Sourcing and Supply Chain Dynamics for Vinca Alkaloids

The United States’ implementation of revised tariffs in early 2025 has introduced a new layer of complexity to the supply chain for Vinca alkaloid precursors. Import duties on critical alkaloid intermediates have increased, compelling manufacturers to reassess global sourcing strategies. In response, many organizations are exploring partnerships in regions with favorable trade agreements, while others are accelerating investments in domestic cultivation and semi-synthetic manufacturing capabilities.

Moreover, the cost implications of tariff adjustments have prompted an industry-wide push toward process optimization. Companies are investing in continuous manufacturing platforms to reduce waste and enhance yield efficiencies, thereby dampening the impact of higher input costs. Alongside these operational shifts, stakeholders are engaging in proactive dialogue with policymakers to advocate for tariff exemptions on essential pharmaceutical inputs. Through these collective efforts, the industry is navigating the evolving regulatory terrain and seeking to maintain uninterrupted access to Vinca alkaloid therapies for patients.

Uncovering Critical Insights across Dosage Forms, End Users, Product Variations, and Therapeutic Applications Defining the Vinca Alkaloid Landscape

A nuanced understanding of key segmentation parameters serves as the foundation for tailoring development strategies and commercial approaches in the Vinca alkaloid arena. When considering dosage form, the landscape encompasses both injection and oral formulations, with injectable products offering rapid systemic delivery and oral variants under exploration for improved patient convenience. Among injectable options, distinctions between intravenous bolus and continuous infusion approaches influence clinical decision-making, particularly in settings where toxicity management and dosing schedules demand flexibility.

End users represent a diverse ecosystem, spanning ambulatory care centers, specialized cancer research institutes, and hospitals, each with its own procurement protocols and treatment workflows. Within hospital environments, private institutions may exhibit distinct formulary preferences and budgetary constraints compared to public hospitals, shaping how Vinca alkaloid therapies are integrated into standard regimens. Product type further delineates the competitive landscape, with classic molecules such as vinblastine and vincristine coexisting alongside newer derivatives like vindesine and vinorelbine, each offering unique pharmacological profiles.

Therapeutic area segmentation underscores the breadth of clinical applications for these compounds, with clinical evidence supporting their use across breast cancer, leukemia, lung cancer, and lymphoma indications. By aligning development pipelines, pricing strategies, and patient support initiatives with these four pillars of segmentation, organizations can optimize resource allocation and enhance patient-centric outcomes.

This comprehensive research report categorizes the Vinca Alkaloid Compounds market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Dosage Form

- Product Type

- Therapeutic Area

- End User

Analyzing Regional Performance Trends and Strategic Opportunities across the Americas, Europe, Middle East & Africa, and Asia-Pacific in Vinca Alkaloid Utilization

Geographic considerations profoundly influence how healthcare infrastructures adopt and integrate Vinca alkaloid therapies. In the Americas, advanced regulatory environments and reimbursement frameworks facilitate the introduction of generic and novel formulations, while robust clinical networks drive broad utilization across oncology centers. Shifts toward value-based care are encouraging stakeholders to evaluate total cost of therapy and patient-reported outcomes, shaping procurement decisions accordingly.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts within the European Union contrast with more variable approval pathways in emerging markets. In Western Europe, established pharmacovigilance systems and centralized evaluations streamline market access, whereas in parts of the Middle East and Africa, localized clinical trials and adaptive regulatory policies are key to demonstrating safety and efficacy in region-specific patient populations. Reimbursement negotiations often hinge on real-world evidence, prompting manufacturers to invest in regionally relevant observational studies.

In the Asia-Pacific, growing cancer incidence and expanding healthcare budgets are fueling demand for established oncology therapies, including Vinca alkaloids. Countries such as China, India, and Japan exhibit distinct market dynamics: China’s emphasis on domestic innovation encourages joint ventures, while India’s generics manufacturing capacity supports cost-effective supply, and Japan’s stringent regulatory standards drive high-quality clinical validation. Understanding these regional nuances is essential for aligning commercialization strategies and ensuring broad patient access.

This comprehensive research report examines key regions that drive the evolution of the Vinca Alkaloid Compounds market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Biopharmaceutical Innovators and Manufacturers Driving Development, Commercialization, and Strategic Alliances in the Vinca Alkaloid Sector

The competitive terrain in the Vinca alkaloid sector is characterized by a blend of legacy biopharmaceutical giants and emerging specialty players. Established pharmaceutical companies with robust oncology portfolios are leveraging decades of clinical trial expertise to reinforce the positioning of vinblastine and vincristine within combination therapies. At the same time, generic manufacturers are capitalizing on patent expirations to introduce cost-competitive formulations, intensifying price competition in mature markets.

Meanwhile, innovative biotech firms are pursuing differentiated development avenues, exploring next-generation formulations such as liposomal and nanoparticle-bound Vinca alkaloids to enhance therapeutic index and mitigate adverse effects. Strategic alliances between research institutes and contract development organizations are accelerating proof-of-concept studies, facilitating rapid translation from bench to bedside. Additionally, cross-border licensing agreements with regional pharmaceutical companies are enabling localized manufacturing and distribution, thereby improving supply resilience and market penetration.

Patent landscapes are continually evolving, with key exclusivities expiring and new patents filed for drug delivery innovations. These shifts are prompting M&A activity, as larger entities seek to augment their product pipelines and smaller players aim to secure capital and market reach. By closely monitoring patent trajectories and alliance networks, stakeholders can identify competitive gaps and partnership opportunities to strengthen their foothold in the Vinca alkaloid arena.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vinca Alkaloid Compounds market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alkaloids Corporation

- BOC Sciences

- Carbosynth Ltd.

- Cayman Chemical Company

- Chengdu Biopurify Phytochemicals Ltd.

- Fresenius Kabi AG

- Hikma Pharmaceuticals PLC

- Indena S.p.A.

- LKT Laboratories, Inc.

- MedChemExpress LLC

- Minakem

- Pfizer Inc.

- Phytex Australia Pty Ltd

- Pierre Fabre SA

- Samarth Life Sciences Pvt. Ltd.

- Teva Pharmaceutical Industries Ltd.

- Toronto Research Chemicals Inc.

- Vinca Alkaloid Company

- Vinkem Labs

Actionable Recommendations for Industry Stakeholders to Navigate Competitive Pressures and Accelerate Innovation within the Vinca Alkaloid Ecosystem

To navigate intensifying competition and evolving regulatory demands, industry leaders should prioritize building resilient supply chains through diversified sourcing strategies and investments in continuous manufacturing technologies that reduce reliance on single suppliers. Embracing advanced drug delivery platforms-such as targeted nanoparticles and conjugated monoclonal antibodies-can differentiate product offerings and potentially unlock new therapeutic indications.

Furthermore, establishing collaborative frameworks with payers and healthcare providers will be critical for demonstrating real-world value. Generating robust pharmacoeconomic data and patient-reported outcomes will strengthen reimbursement propositions in both mature and emerging markets. At the same time, engaging in proactive regulatory dialogue, including early scientific advice consultations, can mitigate approval delays and ensure alignment with evolving guidelines.

Finally, fostering a data-driven culture by integrating real-world evidence systems and predictive analytics will improve clinical trial design and post-market surveillance. By operationalizing these recommendations, organizations can stay ahead of tariff-induced cost pressures, seize opportunities in key therapeutic areas, and ultimately deliver improved patient outcomes.

Outlining a Robust, Multi-Modal Research Methodology Leveraging Primary Interviews, Secondary Data Analysis, and Expert Peer Review in Oncology Studies

This analysis integrates a multi-tiered research methodology designed to deliver rigorous and actionable insights. Primary research was conducted through in-depth interviews with oncologists, pharmacologists, supply chain experts, and key decision-makers at leading academic medical centers and specialty clinics. These direct engagements provided context on clinical practices, procurement criteria, and emerging therapeutic paradigms.

Secondary data collection involved a thorough review of peer-reviewed literature, clinical trial registries, regulatory filings, and public financial disclosures. Information from specialized oncology journals and government health agency reports enriched understanding of safety profiles, pharmacoeconomic considerations, and policy impacts. Complementing these efforts, proprietary databases were analyzed to identify patent expiration timelines, alliance patterns, and manufacturing footprints.

Finally, an expert peer-review process was employed, in which findings were vetted by an advisory board comprising senior researchers, regulatory consultants, and industry veterans. This validation step ensured accuracy, mitigated bias, and aligned conclusions with current best practices. The convergence of qualitative and quantitative approaches in this methodology underpins the credibility and strategic relevance of the report’s insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vinca Alkaloid Compounds market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vinca Alkaloid Compounds Market, by Dosage Form

- Vinca Alkaloid Compounds Market, by Product Type

- Vinca Alkaloid Compounds Market, by Therapeutic Area

- Vinca Alkaloid Compounds Market, by End User

- Vinca Alkaloid Compounds Market, by Region

- Vinca Alkaloid Compounds Market, by Group

- Vinca Alkaloid Compounds Market, by Country

- United States Vinca Alkaloid Compounds Market

- China Vinca Alkaloid Compounds Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Perspectives on Vinca Alkaloid Therapeutics Emphasizing Strategic Positioning and Future Directions in Oncology Treatment Paradigms

In summary, Vinca alkaloid compounds continue to occupy a pivotal position in oncology, underpinned by decades of clinical validation and ongoing innovation in formulation and delivery. The landscape is being reshaped by advances in synthetic methodologies, regulatory reforms, and the expanding role of precision medicine. Simultaneously, supply chain dynamics have grown more complex, influenced by tariff adjustments and the imperative for manufacturing resilience.

Key segmentation insights across dosage forms, end-user settings, product variations, and therapeutic applications highlight the need for tailored strategies that align with clinical and institutional requirements. Regional insights reveal diverse adoption curves, regulatory frameworks, and partnership models across the Americas, EMEA, and Asia-Pacific, underscoring the importance of localized expertise. Competitive analyses indicate that both established pharmaceutical leaders and agile biotech firms are driving development through strategic alliances, advanced drug delivery research, and portfolio diversification.

Looking ahead, organizations that embrace collaborative innovation, invest in differentiated formulations, and leverage comprehensive real-world evidence will be best positioned to capitalize on emerging opportunities. By internalizing the actionable recommendations outlined in this report, stakeholders can enhance their strategic positioning and contribute to more effective cancer therapies.

Unlock Exclusive Access to Vinca Alkaloid Market Intelligence by Engaging with Ketan Rohom to Propel Your Strategic Decision Making

To explore the comprehensive findings of this report, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored package that aligns with your strategic priorities. Ketan brings deep expertise in oncology market intelligence and can guide you through the report’s in-depth analyses of competitive positioning, supply chain considerations, regulatory impacts, and segmentation insights. His team is prepared to customize deliverables, ensuring you receive the most relevant data slices, executive briefing materials, and interactive dashboards designed to inform high-stakes decisions.

Engaging with Ketan Rohom ensures you capitalize on the actionable recommendations and nuanced perspectives that this report provides, enabling your organization to fortify its position in the evolving Vinca alkaloid landscape. Don’t miss the opportunity to leverage this definitive resource and turn intelligence into a competitive edge-reach out to Ketan today to discuss package options and pricing structures tailored to your organization’s unique requirements.

- How big is the Vinca Alkaloid Compounds Market?

- What is the Vinca Alkaloid Compounds Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?