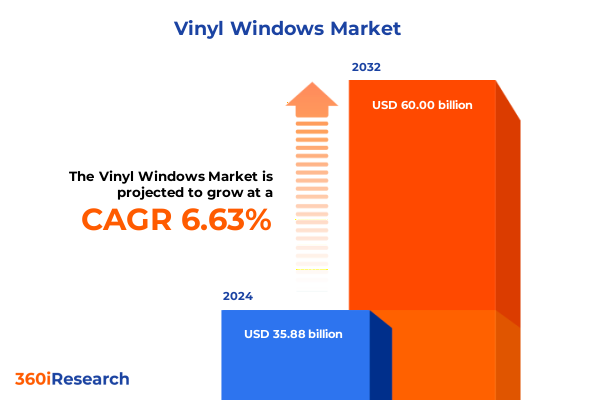

The Vinyl Windows Market size was estimated at USD 38.07 billion in 2025 and expected to reach USD 40.39 billion in 2026, at a CAGR of 6.71% to reach USD 60.00 billion by 2032.

Exploring the Role of Vinyl Windows in Modern Construction and Sustainable Building Practices Across North America’s Residential and Commercial Sectors

Vinyl windows, crafted from polyvinyl chloride (PVC), have become a mainstay in modern construction due to their affordability, low-maintenance profile, and strong performance characteristics. Unlike traditional wood or aluminum frames, vinyl windows resist rot, corrosion, and fading without the need for periodic sealing or painting. The extrusion process enables highly precise channel construction and multi-chamber frame designs, which improve structural stability while minimizing heat transfer. As a result, vinyl windows deliver energy performance that meets or exceeds current building codes, offering homeowners and commercial property owners a blend of durability and thermal efficiency. These attributes have propelled vinyl windows into a dominant position in both residential and light commercial applications, where cost and long-term maintenance are critical considerations.

Advances in Materials Techniques and Regulations Are Transforming How Vinyl Windows Are Designed Manufactured and Integrated into Next Generation Building Solutions

The vinyl window landscape is undergoing a profound transformation driven by advances in materials science, digital manufacturing, and regulatory evolution. Industry leaders are integrating recycled PVC content into extruded profiles, closing the loop on end-of-life windows and reducing carbon footprints. Closed-loop recycling programs enable manufacturers to reclaim post-consumer window frames, reprocess the polymer, and reintroduce high-quality resin into new products-a practice that has cut millions of tons of CO₂ emissions and established a circular approach in Europe and beyond.

Simultaneously, multi-layered frame architectures and optimized thermal breaks are enhancing energy performance without compromising affordability. Triple-pane glazing options paired with argon or krypton fills and advanced low-emissivity coatings are now accessible at price points that were once exclusive to high-end fenestration systems. New polymer blends and bio-attributed PVC compound shells are further reducing reliance on virgin fossil feedstocks, aligning window manufacturing with broader sustainability goals.

On the digital front, the adoption of digital templating, automated fabrication cells, and IoT-enabled quality monitoring is streamlining production processes. These Industry 4.0 initiatives not only increase throughput and reduce scrap but also empower manufacturers to deliver highly customized window units with minimal lead times. In parallel, evolving building codes-such as the latest stretch energy codes in the Northeast-are pushing triple-pane vinyl windows to the forefront of compliance strategies, prompting manufacturers to innovate rapidly to meet more stringent U-Factor and solar heat gain requirements.

Assessing the Far Reaching Effects of New United States Import Tariffs on Vinyl Window Components Glass and Frame Materials Throughout 2025

In April 2025, the United States implemented a universal 10 percent tariff on all imported goods to bolster domestic manufacturing and rebalance trade deficits, eliminating the long-standing de minimis thresholds for products from China and Hong Kong. This measure has elevated input costs for imported window components-including glass packages, hardware, and extruded frame stock-pressuring manufacturers that rely on global supply chains.

Building on these broader duties, a targeted 25 percent tariff on European aluminum extrusions and related construction products took effect in April, directly impacting premium vinyl window lines that sourced specialized frame accessories from Germany and Austria. The added levy on extruded aluminum reinforcement bars and co-extruded weatherstrips has elevated landed costs by as much as 20–30 percent for some imported window systems.

Despite temporary reprieves or exemptions under USMCA for qualifying originating goods, supply chain planners are navigating increasing complexity in tariff classifications. Procurement teams are evaluating domestic alternatives for PVC resin and hardware, while actively seeking tariff exclusions or duty drawback strategies to mitigate cost impacts. As a result, many manufacturers have accelerated nearshoring initiatives, investing in regional extrusion capacity and diversifying resin sourcing to steepen supply-chain resilience.

Uncovering How Product Type Installation Application and Distribution Channel Segmentation Drives Strategic Opportunities in the Vinyl Window Market

Different window designs command varying demand and construction timelines. Bay and bow vinyl windows-valued for their architectural appeal-are gaining traction in high-end residential retrofits, while double-hung and sliding units dominate new housing starts due to their streamlined installation and favorable performance-to-cost ratios. Casement and awning windows are also expanding their share in energy-conscious builds, prized for their airtight seals and optimal ventilation characteristics. Specialty profiles, including geometric shapes and oversized picture windows, cater to bespoke commercial projects where light harvesting and design differentiation are paramount.

Installation segments reveal distinct strategic paths. New construction projects often specify window bundles as part of early procurement, allowing for integrated supply agreements between homebuilders and fenestration partners. Conversely, the replacement market continues to outpace new-builds in retrofit volume, driven by full-frame overhauls and pocket-replacement techniques that minimize interior disruption. While full-frame replacements deliver the highest thermal upgrades and curb appeal, pocket replacements offer faster turnaround and lower labor costs, fitting tight renovation budgets.

Application-based segmentation highlights diverging needs across end users. Institutional, office, and retail projects prioritize long-term performance, compliance with commercial glazing standards, and aesthetic cohesion with curtainwall systems. In contrast, residential projects-whether single-family dwellings in suburban developments or multi-family units in urban infill-focus on energy savings, ease of maintenance, and homeowner appeal. Market players are thus tailoring window assemblies, hardware finishes, and warranty packages to each application category to maximize project alignment.

Finally, distribution channels are evolving with omnichannel strategies. E-commerce platforms have emerged as a key access point for specifiers and small contractors seeking quick quotes and streamlined ordering. Home improvement centers continue to attract high-volume replacement business, supported by in-store displays and contractor loyalty programs. Manufacturer-owned showrooms offer premium experiences and design consultations, while specialist contractors drive custom installations and value-added services in niche segments. Each channel demands tailored sales approaches, margin structures, and lead-time commitments.

This comprehensive research report categorizes the Vinyl Windows market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Installation

- Distribution Channel

- Application

Analyzing Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific to Uncover Growth Patterns and Challenges in Vinyl Window Adoption

In the Americas, strong federal tax credits and utility rebate programs for ENERGY STAR certified windows have fueled sustained demand for vinyl upgrades in both residential and light commercial buildings. Incentives under the Low Income Home Energy Assistance Program (LIHEAP) and state-level weatherization drives, coupled with aging housing stock, have propelled replacement volumes in key U.S. and Canadian markets. Canada’s R-2000 program and evolving provincial energy codes further reinforce the economic case for high-performance vinyl windows in colder climates.

Europe, the Middle East, and Africa are characterized by stringent sustainability mandates and circular economy directives. The EU’s Construction Products Regulation (CPR) and the Green Deal’s emphasis on life-cycle assessments have driven manufacturers to increase recycled PVC content and invest in closed-loop recycling facilities. Companies like VEKA and GEALAN have expanded recycling capacities in Germany, France, and the U.K., ensuring compliance with Ecodesign requirements and delivering windows with up to 35 percent recycled cores and bio-attributed PVC shells.

In Asia-Pacific, rapid urbanization and a burgeoning middle-class housing market are shaping window demand. Cost sensitivity leads to higher volumes of basic double-hung and sliding vinyl units in emerging markets, while advanced economies such as Australia, Japan, and South Korea embrace multi-chamber frames and double- or triple-pane assemblies to meet tightening energy regulations. Local manufacturing hubs and regional resin suppliers play a pivotal role in keeping costs competitive, even as global polymer prices fluctuate.

This comprehensive research report examines key regions that drive the evolution of the Vinyl Windows market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Vinyl Window Manufacturers Innovations Sustainability Efforts and Market Positioning Driving Competitive Leadership in 2025

Andersen Corporation has solidified its leadership through relentless innovation and sustainability commitments. Recognized as an ENERGY STAR Partner of the Year for ten consecutive years, Andersen’s product portfolio now includes triple-pane options for its flagship 400 Series, designed to meet Stretch Code performance requirements in the Northeast. The company’s Ventures+ arm strategically invests in advanced materials and AI-driven manufacturing, accelerating breakthroughs that enhance energy efficiency and product customization. Andersen’s dedication to circularity is evident in its nationwide vinyl and glass recycling programs, which diverted over 23 million pounds of production waste from landfills in 2024.

JELD-WEN is expanding its sustainability credentials through Cradle to Cradle™ product certifications across European markets, earning Bronze-level distinctions for multiple door and window lines in 2025. This achievement underscores JELD-WEN’s holistic approach to responsible sourcing, material health, and social fairness. The company has also been recognized by USA TODAY’s Climate Leaders list for significant reductions in greenhouse gas emission intensity, reinforcing its net-zero ambitions by 2050.

Pella Corporation has carved a niche in product innovation with its award-winning Hidden Screen solution, which integrates retractable screens into vinyl sash for unobstructed views and enhanced natural light, earning top honors at Architizer’s 2024 A+Product Awards. The introduction of the Pella 350 Series vinyl line, featuring up to 18 insulating chambers and triple-pane InsulShield® glass, has set new benchmarks for energy performance in the mid-tier premium segment. Pella’s emphasis on recycled sawdust and glass in its product cores further exemplifies its commitment to sustainable design.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vinyl Windows market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alside Inc.

- aluplast GmbH

- Andersen Corporation

- Cascade Windows, Inc.

- Encraft Systems Pvt. Ltd.

- Fenesta Building Systems Pvt. Ltd.

- JELD-WEN, Inc.

- Marvin Windows and Doors, LLC

- Milgard Manufacturing, Inc.

- Pella Corporation

- PGT Innovations, Inc.

- Ply Gem Industries, Inc.

- ProVia Holdings, LLC

- Simonton Windows & Doors, Inc.

- Stanek Windows & Doors, Inc.

- VEKA AG

- VELUX America LLC

- YKK AP America Inc.

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Vinyl Window Technologies Markets and Regulatory Shifts in the United States

Industry leaders should prioritize closed-loop recycling partnerships to boost recycled PVC content and secure long-term material supply. By investing in regional recycling infrastructure and forging alliances with waste management firms, manufacturers can reduce raw material costs and bolster environmental credentials. This approach not only insulates producers from resin price volatility but also aligns with tightening sustainability regulations.

Manufacturers and distributors must capitalize on evolving digital channels by enhancing e-commerce platforms and integrating real-time inventory visibility with quoting tools. Providing contractors and specifiers with seamless digital ordering experiences can shorten lead times and improve on-site efficiency. Additionally, mobile-enabled product configurators and AR visualizers will empower end users to make informed choices, reducing change orders and returns.

To mitigate tariff pressure, procurement teams should diversify resin and hardware sources across multiple geographies and explore bonded warehouse strategies to delay duties. Engaging trade advisors on exclusion requests and duty-drawback programs can yield significant savings. Concurrently, nearshoring critical components to North America and Europe will enhance supply-chain agility and minimize transport-related emissions.

R&D efforts must focus on next-generation coatings and dynamic glazing integrations, such as electrochromic films and low-iron substrates, to meet emerging green building certifications and electrification targets. Collaborations with smart glass pioneers can unlock new value propositions in commercial and high-end residential segments. Leveraging government incentives-like the Investment Tax Credit for dynamic glazing-will accelerate market adoption and deliver competitive advantages.

Transparent Overview of Research Methods Primary Interviews Secondary Data and Triangulation Strategies Underpinning This Vinyl Window Market Analysis

This analysis combines primary interviews with executives and technical specialists from leading fenestration companies, in addition to insights from policy advisors and trade associations. Secondary research draws on publicly available data from the U.S. Department of Energy, EPA’s ENERGY STAR program, and regulatory publications covering tariff changes and sustainability directives.

Company disclosures, press releases, and credible newswire reports-such as PR Newswire and Manufacturer journals-have been systematically reviewed to verify product launches, certification achievements, and strategic initiatives. Regional dynamics leverage government incentive databases and local building code archives to ensure accuracy in incentive and compliance reporting.

Data triangulation and peer review by independent market analysts have been employed to resolve any discrepancies and to validate the coherence of trends across segments, applications, and regions. All quantitative insights are corroborated by multiple sources to maintain the highest standard of factual integrity and analytical rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vinyl Windows market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vinyl Windows Market, by Product Type

- Vinyl Windows Market, by Installation

- Vinyl Windows Market, by Distribution Channel

- Vinyl Windows Market, by Application

- Vinyl Windows Market, by Region

- Vinyl Windows Market, by Group

- Vinyl Windows Market, by Country

- United States Vinyl Windows Market

- China Vinyl Windows Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Discoveries Impact Drivers and Strategic Insights to Navigate the Evolving Landscape of Vinyl Windows in Modern Construction

The vinyl window sector stands at a pivotal juncture where sustainability, advanced materials, and digital transformation converge. Closed-loop recycling and bio-attributed compounds have redefined the environmental footprint of PVC fenestration, while triple-pane glazing and dynamic coatings answer the demands of stricter energy and green building standards. Tariff-induced cost pressures have catalyzed supply-chain diversification, nearshoring investments, and duty mitigation strategies that will reshape sourcing paradigms.

Market segmentation underscores the nuanced opportunities across product types, installation modes, and applications-from architecturally driven bay windows in premium homes to rapid pocket replacements in urban retrofits. Regional disparities in incentives, regulations, and urbanization trajectories further influence product preferences and distribution channel strategies. Leading manufacturers have responded by embedding circular practices, securing sustainability certifications, and deploying digital engagement models that elevate the customer experience.

Looking ahead, the race for market leadership will favor organizations that seamlessly integrate recycled materials, optimize digital platforms, and harness regulatory and tariff landscapes to their advantage. By aligning innovation roadmaps with dynamic building codes, incentive frameworks, and sustainability mandates, vinyl window stakeholders can navigate complexities and drive value for both end users and investors.

Connect with Ketan Rohom Associate Director Sales and Marketing to Secure the Comprehensive Vinyl Window Market Research Report and Inform Your Strategic Decisions

To obtain the comprehensive vinyl window market research report and unlock data-driven insights tailored to your strategic priorities, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can guide you through the report’s in-depth analysis and help you select the research solutions that best fit your organization’s needs. Engage with an expert who understands the complexities of the fenestration industry and ensure your next investment is backed by rigorous research, actionable intelligence, and a clear roadmap for growth. Contact Ketan today to secure your copy of the report and stay ahead in the rapidly evolving vinyl window market.

- How big is the Vinyl Windows Market?

- What is the Vinyl Windows Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?