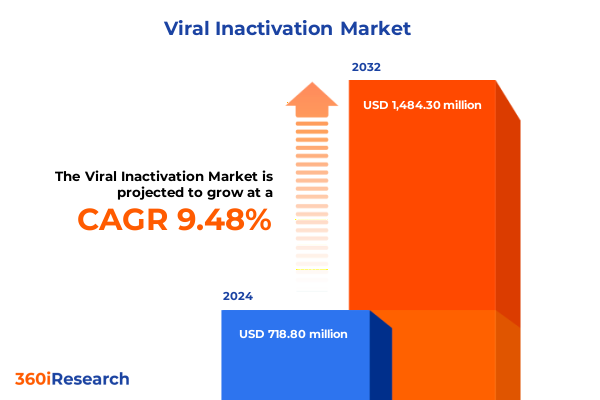

The Viral Inactivation Market size was estimated at USD 786.30 million in 2025 and expected to reach USD 863.85 million in 2026, at a CAGR of 9.50% to reach USD 1,484.30 million by 2032.

Understanding the Critical Role of Viral Inactivation in Ensuring Safe Biopharmaceutical Production Amid Emerging Pathogen Threats Worldwide

Understanding the Critical Role of Viral Inactivation in Ensuring Safe Biopharmaceutical Production Amid Emerging Pathogen Threats Worldwide

Viral inactivation encompasses a suite of chemical, physical, and heat-based methods designed to eliminate or neutralize viral contaminants in biologics, blood products, and environmental matrices. Techniques such as solvent–detergent treatment disrupt lipid envelopes to render enveloped viruses noninfectious, preserving protein integrity while achieving complete kill rates. Meanwhile, ultraviolet irradiation, particularly in the UVC spectrum, and ozone treatments are increasingly used for air and water applications, demonstrating high log reductions against pathogens including norovirus surrogates and influenza.

In recent years, the expanding pipeline of monoclonal antibodies, gene and cell therapies, and vaccines has driven a surge in demand for reliable inactivation processes. Biopharmaceutical manufacturers are balancing stringent regulatory mandates-such as ICH Q5A(R2) for viral safety-with pressure to optimize throughput and sustainability. This has catalyzed the adoption of high-temperature short-time treatments, advanced chemical agents, and continuous processing techniques, complemented by automation and real-time analytics to reduce operator variability and enhance reproducibility.

This executive summary synthesizes the latest market dynamics, regulatory influences, and technological innovations shaping viral inactivation. It offers a structured overview of transformative shifts, tariff impacts, segmentation insights, regional drivers, competitive strategies, and actionable recommendations to guide decision-makers toward robust, compliant, and cost-effective viral safety programs.

Exploring the Technological and Regulatory Transformations Reshaping Viral Inactivation Practices Across Biopharmaceutical and Public Health Sectors

Exploring the Technological and Regulatory Transformations Reshaping Viral Inactivation Practices Across Biopharmaceutical and Public Health Sectors

Over the past decade, viral inactivation has evolved from batch chemical treatments to integrated, automated platforms that align with continuous bioprocessing trends. The shift toward single-use assemblies and closed systems has minimized cross-contamination risks and reduced cleaning validation burdens, while enabling flexible scale-up in response to fluctuating demand for biologics and vaccines. Concurrently, digital process controls and predictive analytics are providing real-time monitoring of critical parameters-such as temperature, UV intensity, and detergent concentrations-to instantly detect deviations and ensure robust viral reduction profiles.

Regulatory agencies worldwide are harmonizing standards to emphasize risk-based approaches, demanding comprehensive viral validation plans and traceability across the supply chain. In the United States, revisions to guidance documents have elevated expectations for viral clearance validation, promoting greener chemistries and reduced reliance on legacy detergents that pose ecological hazards. Similarly, Europe’s focus on environmental impact has spurred the adoption of biodegradable disinfectants and solvent-free process designs, incentivizing collaboration across chemical suppliers, equipment manufacturers, and technology providers.

As viral inactivation moves into the era of smart manufacturing, the convergence of automation, advanced inactivation methods, and unified regulatory frameworks is catalyzing enhanced safety, sustainability, and process economics. These transformative shifts not only mitigate risk but also create new pathways for innovation-paving the way for next-generation viral safety solutions that can keep pace with emergent pathogens and complex biologic modalities.

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Viral Inactivation Equipment and Consumables Supply Chains

Assessing the Cumulative Impact of United States Tariffs Implemented in 2025 on Viral Inactivation Equipment and Consumables Supply Chains

In 2025, new tariff structures on key reagents, filtration media, and irradiation components significantly altered the cost dynamics for U.S.-based viral inactivation operations. Import duties on chemical kits and UV lamp assemblies rose, driving procurement teams to diversify sourcing strategies and secure long-term agreements with domestic manufacturers. This pivot mitigated immediate cost spikes but introduced complexity in qualifying new suppliers to meet stringent viral safety standards and regulatory requirements.

Equipment providers have responded by localizing production of irradiation modules, single-use bags, and sterilization skids, thereby shortening lead times and reducing import dependency. In parallel, service-based models have gained traction as CDMOs and laboratories opt to outsource specialized inactivation processes rather than invest in high-tariff-sensitive capital equipment. This trend underscores the growing appeal of flexible service networks that can absorb tariff volatility while maintaining compliance with ICH and FDA guidelines.

Looking ahead, stakeholders who proactively engaged in tariff impact analyses and secured diversified supply chains have maintained pricing stability and accelerated project timelines. By forging strategic partnerships with regional suppliers and leveraging tariff-free trade agreements where possible, industry leaders can continue to strengthen resilience and competitiveness in the face of evolving U.S. trade policies.

Deriving Key Insights from Product, Method, Application, and End User Segmentations to Inform Viral Inactivation Market Strategies

Deriving Key Insights from Product, Method, Application, and End User Segmentations to Inform Viral Inactivation Market Strategies

The viral inactivation landscape can be navigated through a multi-dimensional segmentation lens that illuminates where innovation and demand converge. When considering product categories, consumables span chemical kits, disinfectant solutions, and UV lamps-each tailored to deliver targeted inactivation effects-while equipment offerings are distributed among filtration, irradiation, and sterilization platforms. This dichotomy highlights the opportunity for integrated solutions that bundle consumables with compatible hardware to streamline validation and ensure consistency under regulatory scrutiny.

Method-based segmentation reveals that chemical treatments-particularly chlorine dioxide, ethylene oxide, and hydrogen peroxide-remain foundational, but are increasingly complemented by heat treatments (both dry and moist heat) and physical approaches such as electron beam, gamma radiation, and various ultraviolet modalities. Within the ultraviolet subset, low-pressure mercury lamps and pulsed xenon systems are gaining favor for their proven efficacy, though emerging UVC-LED technologies promise enhanced energy efficiency and lower environmental impact once cost and performance hurdles are addressed.

Across applications-ranging from air purification in HVAC systems and portable purifiers to the sterilization of beverage, dairy, and meat processing lines; from pharmaceutical manufacturing of APIs, biologics, and vaccines to drinking and wastewater treatment-tailored inactivation protocols are essential to meet diverse safety and product integrity requirements. End-user segmentation further delineates demand among biotechnology firms (diagnostic and therapeutics developers), food and beverage processors (beverage, dairy, and meat plants), healthcare facilities (clinics and hospitals), and laboratories (clinical and research). By aligning product innovation with the unique needs of each segment, suppliers can refine their value propositions and drive adoption across the viral inactivation continuum.

This comprehensive research report categorizes the Viral Inactivation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Method

- Application

- End User

Highlighting Critical Regional Dynamics Influencing Viral Inactivation Adoption Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Highlighting Critical Regional Dynamics Influencing Viral Inactivation Adoption Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Regional considerations play a pivotal role in shaping viral inactivation strategies. In the Americas, robust biopharmaceutical infrastructure and well-established regulatory bodies drive demand for advanced inactivation technologies and high-throughput equipment. Market participants here benefit from proximity to leading research institutions and a streamlined approval landscape, enabling rapid integration of novel solutions into production workflows.

The Europe, Middle East and Africa region presents a diverse set of challenges and opportunities. Western Europe’s mature pharmaceutical hubs emphasize sustainability and greener chemistries, catalyzing adoption of biodegradable disinfectants and closed-loop filtration systems. Meanwhile, emerging markets in the Middle East and Africa are investing in modular facilities and capacity-building partnerships to address public health imperatives, creating new avenues for innovative inactivation services and localized manufacturing collaborations.

In the Asia-Pacific, rapid expansion of CDMO services, coupled with regulatory alignment toward global standards, has sparked significant growth in demand for both consumables and equipment. Regional suppliers are scaling up production to meet domestic and international biomanufacturing needs, while global players forge alliances to establish training centers and application labs. Navigating these regional nuances is critical for organizations seeking to optimize supply chains, accelerate market entry, and tailor solutions to local regulatory and operational contexts.

This comprehensive research report examines key regions that drive the evolution of the Viral Inactivation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Competitive Strategies and Innovations Driving Leading Viral Inactivation Companies to Spearhead Market Advancement in Safety Solutions

Unveiling Competitive Strategies and Innovations Driving Leading Viral Inactivation Companies to Spearhead Market Advancement in Safety Solutions

The competitive landscape in viral inactivation is characterized by strategic acquisitions, integrated technology platforms, and a focus on sustainability. Major players are consolidating upstream and downstream capabilities-combining filtration modules with real-time monitoring software and environmentally friendly reagents-to offer end-to-end viral safety platforms. This integrated approach not only simplifies validation but also strengthens customer loyalty by delivering comprehensive, single-vendor solutions.

Innovative entrants are challenging incumbents by introducing next-generation inactivation methods such as high-hydrostatic-pressure, photochemical, and enzymatic treatments, particularly suited for fragile cell and gene therapy products. Meanwhile, the rise of UVC-LED technology is prompting collaborations between semiconductor developers and bioprocess equipment manufacturers to overcome cost and performance barriers. These alliances underscore the industry’s pivot toward greener, more energy-efficient inactivation paradigms.

Service providers are also differentiating through value-added offerings-such as rapid multi-virus clearance assays, reservoir optimization, and on-site validation support-to address the increasing outsourcing trend among biopharma firms. By aligning their portfolios with pressing customer needs around turnaround time, regulatory compliance, and sustainability, leading companies are solidifying their positions as trusted partners in the ever-evolving viral inactivation ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Viral Inactivation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asahi Kasei Medical

- Charles River Laboratories International, Inc.

- Clean Cells Inc.

- Cytiva

- Danaher Corporation

- Eurofins Scientific SE

- Kedrion

- Lonza Group AG

- Merck KGaA

- Pall Corporation

- Parker Hannifin Corporation

- Rad Source Technologies, Inc.

- Sartorius AG

- Texcell SA

- Thermo Fisher Scientific Inc.

- Vironova AB

- WuXi AppTec

- WuXi Biologics

Empowering Industry Leaders with Actionable Recommendations to Accelerate Innovation, Compliance, and Operational Excellence in Viral Inactivation

Empowering Industry Leaders with Actionable Recommendations to Accelerate Innovation, Compliance, and Operational Excellence in Viral Inactivation

To seize competitive advantage, organizations should prioritize the integration of automation and digital monitoring into their viral inactivation workflows, thereby reducing human error and ensuring reproducible outcomes. Early adoption of UVC-LED systems, complemented by pilot-scale validation, can position firms at the forefront of sustainable inactivation technologies once performance metrics align with traditional UV sources.

Robust supplier diversification strategies are essential to mitigate the effects of tariff fluctuations and geopolitical disruptions. Establishing multiple qualified sources for critical reagents and equipment, and adopting service-based models where feasible, will bolster supply chain resilience and protect project timelines. Equally important is maintaining active dialogue with regulatory agencies to anticipate and adapt to evolving requirements, ensuring that validation protocols and environmental compliance measures remain current.

Finally, fostering cross-functional collaboration between R&D, quality assurance, and operations teams will streamline technology transfer and accelerate time-to-market. By aligning investment decisions with well-defined segmentation insights-tailoring inactivation approaches to specific product, method, application, and end-user needs-industry leaders can optimize resource allocation and enhance the overall efficacy of viral safety programs.

Detailing Rigorous Research Methodology Employed to Ensure Accuracy, Relevance, and Depth in Viral Inactivation Market Analysis

Detailing Rigorous Research Methodology Employed to Ensure Accuracy, Relevance, and Depth in Viral Inactivation Market Analysis

This research initiative combined primary and secondary data collection to build a comprehensive understanding of the viral inactivation landscape. Primary insights were gathered through structured interviews with bioprocess engineers, quality assurance directors, and procurement specialists across biotechnology firms, contract development and manufacturing organizations, and academic institutions. These discussions provided firsthand perspectives on inactivation challenges, technology adoption drivers, and regional regulatory nuances.

Secondary research involved an extensive review of regulatory guidelines, scientific literature, and public health advisories. Authoritative sources-such as the U.S. Food and Drug Administration’s Q5A(R2) guidance, published CMC review guidelines, and peer-reviewed articles on UV and ozone inactivation efficacy-were systematically analyzed to validate market trends and technical milestones. Trade publications and patent filings supplemented this analysis, shedding light on emerging methods and competitive patent landscapes.

Analytical frameworks, including SWOT and Porter’s Five Forces, were applied to segment-level data to identify growth pockets and risk factors. Cross-validation of findings through triangulation techniques ensured data consistency, while expert panel reviews provided further validation of key takeaways. This multi-layered methodology underpins the report’s strategic insights and supports its recommendations for stakeholders across the viral inactivation value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Viral Inactivation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Viral Inactivation Market, by Product

- Viral Inactivation Market, by Method

- Viral Inactivation Market, by Application

- Viral Inactivation Market, by End User

- Viral Inactivation Market, by Region

- Viral Inactivation Market, by Group

- Viral Inactivation Market, by Country

- United States Viral Inactivation Market

- China Viral Inactivation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Summarizing Key Insights and Strategic Imperatives to Guide Future Directions in Viral Inactivation Technologies and Market Adoption

Summarizing Key Insights and Strategic Imperatives to Guide Future Directions in Viral Inactivation Technologies and Market Adoption

The viral inactivation sector is at an inflection point, driven by the convergence of advanced technologies, regulatory harmonization, and evolving supply chain dynamics. Integration of automation and real-time analytics into inactivation protocols is setting new benchmarks for safety and consistency, while alternative chemistries and UVC-LED innovations are charting the course for sustainable, energy-efficient solutions.

Simultaneously, the 2025 tariff landscape underscores the importance of resilient supplier networks and service-based models in safeguarding critical reagent and equipment availability. Regional nuances-spanning the Americas’ established biopharma hubs, the Europe Middle East and Africa region’s sustainability mandates, and the Asia-Pacific’s rapid CDMO expansion-highlight the need for tailored approaches that align with local regulatory and operational environments.

Moving forward, market participants must continue to leverage segmentation insights to drive focused product development, while forging strategic alliances that span consumables, equipment, and validation services. By implementing the actionable recommendations outlined in this summary, stakeholders can enhance operational agility, accelerate compliance, and secure competitive advantage in an increasingly complex viral safety landscape.

Contact Ketan Rohom Associate Director Sales and Marketing to Secure Your Comprehensive Viral Inactivation Market Research Report and Drive Informed Decisions

To obtain an authoritative and comprehensive analysis of the viral inactivation market, reach out directly to Ketan Rohom, Associate Director, Sales and Marketing at 360iResearch, to secure your copy of the full market research report. Engaging with Ketan enables you to benefit from a tailored consultation that highlights the report’s in-depth examination of product and method segmentations, regional dynamics, and competitive landscapes. This dialogue will help you translate the executive summary’s insights into concrete strategies that address supply chain challenges, regulatory shifts, and technological innovations.

Connecting with Ketan also provides early access to supplemental data sets, including detailed tariff impact analyses and actionable recommendations specific to your organization’s needs. By leveraging his expertise, you can ensure your team stays ahead of emerging inactivation methods, aligns procurement with evolving U.S. tariffs for 2025, and maximizes the potential of your current investments in consumables and equipment. Don’t miss the opportunity to fortify your decision-making with robust market intelligence-contact Ketan today and take the first step toward driving innovation and resilience in your viral inactivation operations

- How big is the Viral Inactivation Market?

- What is the Viral Inactivation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?