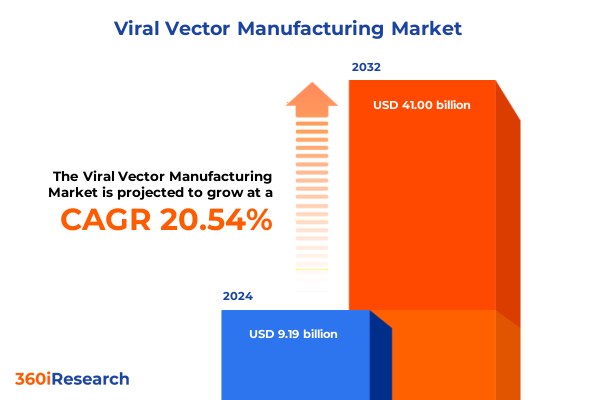

The Viral Vector Manufacturing Market size was estimated at USD 11.00 billion in 2025 and expected to reach USD 13.17 billion in 2026, at a CAGR of 20.67% to reach USD 41.00 billion by 2032.

Exploring the Critical Innovations and Multifaceted Challenges That Are Driving the Rapid Evolution of Viral Vector Manufacturing for Next Generation Advanced Therapies

Viral vector manufacturing has become an indispensable pillar in the development of advanced gene and cell therapies that target rare and complex diseases. Capabilities to produce high-quality, clinical-grade vectors underpin both the efficacy and safety of these transformative treatments, while strict regulatory expectations demand consistent, end-to-end traceability. Demand surges driven by a growing pipeline of clinical candidates are met with the challenge of transitioning from laboratory-scale batches to commercial-scale production, requiring robust process optimization and significant infrastructure investments.

Regulatory scrutiny from agencies such as the U.S. Food and Drug Administration and the European Medicines Agency enforces rigorous quality standards, driving comprehensive quality management systems, technology transfers, and process validations. Manufacturers must align with Good Manufacturing Practice guidelines to secure approvals across diverse markets, necessitating advanced analytical controls and specialized facility designs. This regulatory landscape contributes to extended development timelines and elevated operational costs.

To overcome these barriers, industry stakeholders are forging strategic collaborations and integrating single-use technologies, closed systems, and data-driven process analytics. Modular platforms enhance flexibility, reduce contamination risk, and enable real-time monitoring, laying the groundwork for efficient scale-up. These collaborative ecosystems aim to accelerate vector innovation while maintaining rigorous standards for safety and reproducibility.

Uncovering Transformative Technological and Operational Shifts Reshaping the Landscape of Viral Vector Production and Bioprocessing Strategies

Technological breakthroughs are reshaping viral vector production, with the adoption of single-use equipment and continuous bioprocessing emerging as critical enablers of agile manufacturing. Single-use bioreactors offer swift changeover and contamination control, while continuous flow systems minimize footprint and maximize productivity. These platforms allow manufacturers to adjust production volumes dynamically, responding rapidly to clinical demand fluctuations and supply chain interruptions.

Concurrently, advanced analytical and digital tools are unlocking deeper insights into cell culture dynamics and vector integrity. Real-time monitoring of critical quality attributes, supported by machine learning algorithms, facilitates predictive process control and variability reduction. These data-driven approaches not only accelerate process development but also bolster regulatory compliance by offering comprehensive, traceable data sets.

Another key shift involves the rise of decentralized and hybrid manufacturing models. Organizations are increasingly investing in regional facilities and point-of-care sites to localize production, reduce logistical complexity, and enhance patient access. This trend also fosters resilient supply networks, enabling faster clinical trial support and mitigating risks associated with centralized, single-location manufacturing.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Supply Chains Equipment Costs and Competitiveness in Viral Vector Manufacturing

The cumulative impact of U.S. trade tariffs instituted in 2025 has significantly influenced the economics of viral vector manufacturing. The doubling of Section 232 duties on critical stainless-steel bioprocessing equipment like large-scale vessels and purification columns has elevated capital expenditures, particularly for new and expanding facilities. Manufacturers now face steeper entry costs to establish or upgrade cGMP-compliant suites, prompting many to explore alternative materials or sourcing strategies.

Beyond equipment, tariffs on specialized chemicals and single-use components-ranging from chromatography resins to cell culture media-have increased operational expenses. Many U.S.-based biotech firms, historically reliant on imported inputs, are confronting margin pressures as additional duties are absorbed or passed on. This dynamic is reshaping supplier relationships and triggering contract renegotiations to preserve production timelines.

In response, industry participants are accelerating efforts to cultivate a domestic ecosystem for critical manufacturing inputs. Regional suppliers are scaling capacity to produce bioprocessing materials and ancillary consumables domestically, fostering a more resilient value chain. Simultaneously, some organizations are diversifying geographies for equipment procurement, leveraging competitive pricing from markets with lower trade barriers and favorable currency dynamics.

Delving into Core Market Segments Spanning Vector Types Workflows Delivery Modes Technologies Disease Indications Applications and End Users

In the ever-expanding viral vector manufacturing landscape, multiple facets define the market’s contours. Producers of adenoviral, lentiviral, retroviral, herpes simplex, baculoviral, and plasmid DNA vectors each navigate distinct process intricacies, from host cell optimization to vector purification. Meanwhile, upstream and downstream processes-from bioreactor design and cell culture engineering to formulation strategies and chromatographic purification-demand tailored solutions that ensure yield and purity targets. Delivery modalities bifurcate between in vivo direct injection, intravenous administration, or oral routes and ex vivo cell transduction and reinfusion techniques, each influencing vector characteristics and manufacturing parameters. Purification approaches hinge on chromatography or ultrafiltration methods, while transfection relies on chemical reagents or electroporation devices.

Disease-specific applications span cardiovascular conditions, genetic disorders, infectious outbreaks, and metabolic dysfunctions, commanding bespoke vector constructs and quality benchmarks. In gene therapy, oncological research, and vaccinology, subsegments focus on inherited disease correction, oncolytic virotherapy, cancer vaccine development, and zoonotic outbreak prevention. End users range from established pharmaceutical enterprises and large biomanufacturers to nimble biotechnology start-ups and academic research institutions, each equipped with varying scale, expertise, and regulatory acumen. Together, this intricate segmentation illustrates the sector’s diversity and the necessity for specialized, end-to-end manufacturing strategies to address unique clinical and commercial demands.

This comprehensive research report categorizes the Viral Vector Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vector Type

- Workflow

- Delivery Method

- Technology

- Disease Indication

- Application

- End User

Evaluating Regional Dynamics and Competitive Advantages Across the Americas Europe Middle East Africa and Asia Pacific Viral Vector Markets

The Americas maintain a dominant position in viral vector manufacturing, supported by substantial R&D investment, regulatory harmonization, and an ecosystem of leading biopharma companies. North America’s advanced infrastructure and established CDMO networks accelerate process innovation, while regional incentives drive capacity buildout and technology adoption.

Europe, the Middle East, and Africa exhibit a dynamic mix of mature markets and emerging hubs. Western Europe’s stringent regulatory environment fosters rigorous quality standards and early adoption of cutting-edge manufacturing practices. Simultaneously, select Middle Eastern and African centers are positioning themselves as cost-effective manufacturing corridors, leveraging free-trade zones and strategic partnerships to attract contract manufacturing activity.

In Asia-Pacific, rapid market growth is underpinned by government-backed biomanufacturing initiatives, abundant skilled labor, and aggressive capacity expansion. Countries such as China, Japan, and South Korea are investing heavily in localized production facilities and technology platforms, aiming to capture both regional demand and global export opportunities. This landscape offers a compelling blend of cost advantages and innovation potential.

This comprehensive research report examines key regions that drive the evolution of the Viral Vector Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players Shaping the Viral Vector Manufacturing Ecosystem Through Capacity Expansions Partnerships and Technological Advancements

A cadre of key industry players is driving advancements in viral vector manufacturing. Global CDMOs are expanding capacity through strategic acquisitions and facility modernizations, integrating single-use systems and digital control platforms to enhance scalability. Established life sciences conglomerates are leveraging proprietary cell line technologies, advanced analytics, and integrated fill–finish capabilities to deliver turnkey solutions that span from process development to commercial supply.

Partnerships between biopharma innovators and specialized technology providers are catalyzing the adoption of next-generation manufacturing tools. Collaborations focused on continuous processing technologies, high-throughput analytics, and end-to-end automation demonstrate a collective push toward leaner, more agile production models. At the same time, emerging biotech entrants and academic spin-outs are pioneering novel vector constructs and innovative transfection techniques, enriching the ecosystem with disruptive R&D pipelines.

This collaborative constellation of CDMOs, technology platforms, and clinical developers underscores a trend toward vertically integrated offerings. Such integration reduces time to clinic, mitigates tech-transfer risks, and aligns end-to-end quality management under unified governance, positioning these organizations at the forefront of industry growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Viral Vector Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABL Inc.

- Batavia Biosciences B.V. by CJ Cheiljedang

- Biovian Oy

- Charles River Laboratories International, Inc.

- Creative Biogene

- Danaher Corporation

- FinVector Oy

- FUJIFILM Diosynth Biotechnologies U.S.A., Inc.

- GE HealthCare Technologies, Inc.

- Genezen Laboratories, Inc.

- Kaneka Eurogentec S.A.

- Lonza Group Ltd.

- MaxCyte, Inc.

- Merck KGaA

- Miltenyi Biotec GmbH

- Novartis AG

- Oxford Biomedica PLC

- Sanofi SA

- Sirion-Biotech GmbH

- Spark Therapeutics, Inc. by F. Hoffmann-La Roche Ltd.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

- uniQure N.V.

- VGXI, Inc. by GeneOne Life Science

- Waisman Biomanufacturing

- Wuxi AppTec Co., Ltd.

Strategic Action Plans and Best Practices for Industry Leaders to Optimize Viral Vector Production Resilience and Market Agility

Industry leaders should prioritize the deployment of flexible, modular manufacturing platforms that can adapt swiftly to evolving clinical demands and material constraints. By investing in single-use and continuous processing technologies, organizations can reduce changeover times, enhance contamination control, and align capacity with fluctuating pipeline requirements.

Diversifying supplier networks and strategically reshoring critical input production will mitigate the risks posed by trade barriers and supply chain disruptions. Establishing regional partnerships for equipment, consumables, and media formulations ensures redundancy and negotiating leverage, while localized sourcing reduces exposure to tariff volatility.

Integrating advanced process analytical technologies and digital twins into production workflows will drive data-informed decision-making and predictive maintenance. Real-time monitoring and model-based controls elevate process consistency, expedite regulatory filings, and optimize resource utilization. Concurrently, forging cross-sector alliances with technology innovators and academic centers will accelerate R&D pipelines and foster shared best practices.

Detailing a Rigorous Research Framework Incorporating Primary Interviews Secondary Sources and Data Triangulation for Market Insight Generation

This research framework synthesizes a dual-pronged approach combining qualitative expert interviews with primary stakeholders and quantitative data from validated secondary sources. Key opinion leaders across biopharma, CDMOs, regulatory bodies, and technology providers were engaged to capture emerging trends, operational pain points, and strategic priorities.

Secondary research integrated peer-reviewed journals, industry white papers, and public regulatory filings to ensure factual accuracy and comprehensive coverage. Data triangulation techniques were applied to reconcile disparate inputs, refine segmentation boundaries, and validate thematic findings. The methodology also incorporated cross-market analyses, benchmarking against best-in-class manufacturing practices and historical case studies to contextualize current developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Viral Vector Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Viral Vector Manufacturing Market, by Vector Type

- Viral Vector Manufacturing Market, by Workflow

- Viral Vector Manufacturing Market, by Delivery Method

- Viral Vector Manufacturing Market, by Technology

- Viral Vector Manufacturing Market, by Disease Indication

- Viral Vector Manufacturing Market, by Application

- Viral Vector Manufacturing Market, by End User

- Viral Vector Manufacturing Market, by Region

- Viral Vector Manufacturing Market, by Group

- Viral Vector Manufacturing Market, by Country

- United States Viral Vector Manufacturing Market

- China Viral Vector Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3180 ]

Synthesizing Critical Findings to Highlight Opportunities Challenges and Strategic Imperatives in the Viral Vector Manufacturing Landscape

The viral vector manufacturing landscape stands at the intersection of unprecedented therapeutic promise and operational complexity. Technological innovations, from single-use systems to decentralized production, are unlocking new pathways to scale, while shifting regulatory expectations and trade policies introduce fresh challenges and opportunities.

Navigating the multifaceted segmentation-from vector types and workflow stages to end-user applications-requires tailored strategies that balance agility with compliance. Regional dynamics further influence competitive positioning, with each geography offering unique strengths in infrastructure, incentives, and market access.

By aligning strategic investments in modular technologies, supplier diversification, and digital transformation, industry leaders can mitigate tariff-driven risks, accelerate time to clinic, and sustain long-term growth. The synthesis of rigorous research and actionable recommendations presented herein equips stakeholders to chart a resilient and innovative course through the evolving viral vector manufacturing ecosystem.

Engage with Ketan Rohom to Acquire In-Depth Viral Vector Manufacturing Market Research and Drive Strategic Decisions for Advanced Therapies

If you wish to leverage comprehensive insights and strategic guidance on the viral vector manufacturing sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise can help your organization navigate evolving regulatory frameworks, optimize supply chains amidst tariff fluctuations, and harness transformative technological shifts. By partnering with Ketan, decision-makers can access an actionable roadmap, tailored data analysis, and personalized support to accelerate manufacturing capabilities and capitalize on emerging opportunities. Connect today to secure your copy of the full-market research report and unlock critical intelligence that will inform your growth strategies in the advanced therapies landscape.

- How big is the Viral Vector Manufacturing Market?

- What is the Viral Vector Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?