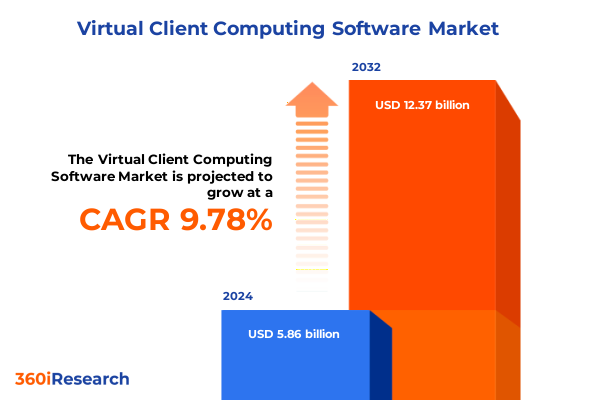

The Virtual Client Computing Software Market size was estimated at USD 6.37 billion in 2025 and expected to reach USD 6.93 billion in 2026, at a CAGR of 9.94% to reach USD 12.37 billion by 2032.

Unlocking New Horizons in Virtual Client Computing With Cutting-Edge Solutions That Empower Secure, Efficient, and Scalable Digital Workspaces

Virtual client computing has emerged as a cornerstone of modern digital transformation strategies by enabling secure, centralized management of user workspaces across diverse environments. Organizations increasingly recognize the value of delivering consistent performance and robust security to end users, whether they work from headquarters, remote offices, or public networks. This paradigm shift reduces dependency on traditional physical desktops while creating flexible, resilient infrastructures that respond swiftly to evolving business demands.

As enterprises embrace hybrid and remote work models, virtual client computing solutions are playing a pivotal role in ensuring seamless access to enterprise applications and data. Advanced virtualization platforms extend beyond basic desktop streaming to incorporate comprehensive management frameworks, dynamic resource allocation, and integrated security controls. By consolidating client workloads in centralized data centers or cloud environments, IT teams gain unparalleled visibility and operational efficiency, ultimately driving productivity and reducing total cost of ownership

Navigating the Rapid Transformation Landscape in Virtual Client Computing Through Innovations in Cloud Integration, AI-Driven Automation, and Enhanced Security Protocols

The virtual client computing landscape has transformed dramatically under the influence of cloud-native architectures and AI-driven capabilities. Integration with public and private cloud services enables dynamic provisioning of virtual desktops, allowing organizations to instantly scale resources in response to fluctuating user demands. Furthermore, automation powered by machine learning optimizes resource utilization and performance, reducing manual intervention and accelerating time to value for new deployments.

Simultaneously, security protocols have advanced to address growing cyber threats and compliance mandates. Zero-trust frameworks and micro-segmentation techniques now safeguard virtual sessions end to end, while real-time threat intelligence integration enhances resilience against modern attacks. These innovations, combined with edge computing initiatives that bring processing closer to end users, underscore the industry’s relentless focus on delivering low-latency, highly secure digital workspaces across diverse connectivity scenarios

Assessing the Cumulative Impact of Recent United States Tariffs on Virtual Client Computing Supply Chains, Cost Structures, and Competitive Dynamics Across the Industry

United States tariffs enacted in early 2025 have introduced new cost pressures throughout the virtual client computing ecosystem, especially for hardware components such as thin clients, servers, and specialized graphics accelerators. These levies have increased procurement expenses, compelling solution providers to renegotiate supply contracts and explore alternative sourcing from non-tariffed regions. As a result, many organizations have restructured procurement strategies to secure favorable pricing while maintaining performance standards.

In addition to direct hardware cost hikes, the tariffs have triggered broader supply chain diversification efforts. Vendors now leverage multi-regional manufacturing footprints and regional distribution centers to mitigate tariff exposure. Although these strategies enhance resilience, they also introduce complexity in logistics and inventory management. Consequently, client computing initiatives must account for potential lead-time fluctuations and associated carrying costs. Despite these challenges, industry leaders continue to invest in virtualization platforms, confident that long-term gains in operational agility counterbalance short-term tariff impacts

Illuminating Critical Segmentation Insights Across Components, Cloud Models, Enterprise Sizes, and End-Use Verticals Shaping Virtual Client Computing Adoption

In dissecting the virtual client computing software market by component, management software emerges as the command center for orchestrating virtual desktops, while security software provides critical layers of data protection and threat mitigation. Virtualization software further divides into application virtualization for streamlined application delivery, remote desktop session hosts for multi-user environments, and virtual desktop infrastructure that offers dedicated workspaces for each user. This varied component landscape underscores the importance of selecting solutions that align with specific workload requirements and security postures.

Cloud-based delivery models further shape market dynamics, as private cloud deployments deliver enhanced control and compliance assurances, especially for regulated industries, while public cloud offerings enable rapid elasticity and reduced upfront capital expenditures. Enterprise size plays a pivotal role in technology adoption, with large enterprises favoring comprehensive, feature-rich platforms to support complex, global user bases, and small and medium-sized organizations prioritizing cost-effective, easy-to-deploy solutions that minimize IT overhead.

End-use verticals shape demand through unique performance and compliance requirements. Banking, financial services, and insurance sectors emphasize rigorous security and data privacy, while government entities focus on stringent regulatory adherence and citizen service continuity. Healthcare organizations demand robust encryption and patient data safeguards, IT and telecom firms drive innovation in user experience and network optimization, and media and entertainment companies require high-performance graphics virtualization to support creative workflows

This comprehensive research report categorizes the Virtual Client Computing Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Cloud

- Enterprise Size

- End Use

Examining Regional Market Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific to Reveal Unique Drivers and Challenges in Virtual Client Computing Deployment

Regional dynamics in the Americas highlight strong uptake driven by mature cloud infrastructures and progressive regulatory frameworks that champion data sovereignty. Market leaders in this region leverage advanced analytics and integrated platform services to deliver personalized, high-performance virtual workspaces. Continuous investments in backbone connectivity and data center expansion further position the Americas as a bellwether for emerging virtualization trends.

In Europe, the Middle East, and Africa, a mosaic of regulatory environments and digital maturity levels drives differentiated adoption patterns. Strict data protection regulations, such as GDPR, necessitate federation and encryption capabilities within virtual client computing solutions. Concurrently, digital transformation initiatives across government and private sectors propel demand for scalable, cost-efficient virtual desktop offerings that address both urban and remote connectivity challenges.

Asia-Pacific markets are characterized by rapid digitalization and a growing emphasis on hybrid cloud architectures. Regional enterprises, from manufacturing to education, pursue virtualization to optimize IT spend and support distributed workforces. Price sensitivity compels solution providers to tailor offerings with flexible licensing models and localized support services, reinforcing the region’s reputation as a high-growth frontier for virtual client computing technologies

This comprehensive research report examines key regions that drive the evolution of the Virtual Client Computing Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Profiles and Innovations From Leading Virtual Client Computing Providers Driving Market Leadership and Technological Advancements

Leading providers in the virtual client computing space have distinguished themselves through relentless innovation and strategic partnerships. Some focus on integrating end-to-end management platforms that unify storage, networking, and desktop services under a single pane of glass. Others concentrate on embedding advanced security controls, such as behavior analytics and zero-trust access, directly into virtualization stacks to deliver turnkey protection for dispersed workforces.

Strategic alliances between virtualization vendors and cloud hyperscalers accelerate the rollout of hybrid cloud solutions, enabling customers to seamlessly shift workloads between on-premises data centers and public clouds. Additionally, specialized entrants target niche requirements-offering high-performance graphics virtualization for creative industries or ultra-lightweight clients optimized for mobile work scenarios. Collectively, these approaches drive competitive differentiation and expand the value proposition of virtual client computing solutions

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Client Computing Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Fujitsu Limited

- Google LLC

- IGEL Technology GmbH

- Microsoft Corporation

- Nutanix, Inc.

- Parallels International GmbH

- VMware, Inc.

Delivering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Virtual Client Computing Opportunities and Navigate Emerging Challenges

Industry leaders should prioritize the convergence of virtualization and security by adopting unified platforms that embed endpoint protection, real-time threat detection, and automated remediation workflows. This holistic approach reduces operational complexity and ensures consistent policy enforcement across all virtual sessions. In parallel, integrating AI-driven analytics can optimize resource allocation, predict performance bottlenecks, and proactively address user experience issues before they escalate.

To mitigate supply chain vulnerabilities amplified by tariffs, organizations must diversify sourcing strategies and cultivate relationships with multiple hardware suppliers across different regions. By leveraging hybrid cloud deployment models, companies can dynamically shift workloads to cost-effective environments while preserving the agility to scale. Finally, fostering an ecosystem of certified partners, from managed service providers to independent software vendors, ensures access to specialized skills and accelerates time to delivery for tailored virtual workspace solutions

Outlining a Rigorous, Multi-Source Research Methodology Combining Primary Interviews, Secondary Analysis, and Data Triangulation for Robust Insights

This research synthesizes qualitative insights derived from in-depth interviews with senior IT decision-makers across diverse enterprise sizes and industries. Supplementary quantitative data emerged from comprehensive surveys assessing deployment preferences, technology maturity, and operational priorities. Secondary research included a thorough review of public filings, whitepapers, vendor documentation, and industry conference proceedings to validate emerging trends and technological advancements.

Data triangulation underpins the robustness of this analysis, as findings from primary interviews were cross-referenced with secondary data to ensure validity and consistency. The study adheres to a structured framework encompassing market segmentation, regional dynamics, tariff impact assessment, and competitive profiling. Continuous peer reviews and methodological audits guarantee the accuracy, reliability, and relevance of the insights presented

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Client Computing Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Client Computing Software Market, by Component

- Virtual Client Computing Software Market, by Cloud

- Virtual Client Computing Software Market, by Enterprise Size

- Virtual Client Computing Software Market, by End Use

- Virtual Client Computing Software Market, by Region

- Virtual Client Computing Software Market, by Group

- Virtual Client Computing Software Market, by Country

- United States Virtual Client Computing Software Market

- China Virtual Client Computing Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Highlight the Future Trajectory of Virtual Client Computing and Empower Decision-Makers With Clear Strategic Direction

This executive summary illuminates the evolving dynamics of the virtual client computing landscape, from foundational architectural innovations to the pragmatic challenges posed by new tariffs. It underscores how emerging technologies, regulatory imperatives, and regional nuances collectively shape adoption trajectories. By dissecting segmentation pillars and profiling leading providers, the analysis equips decision-makers with a nuanced understanding of market drivers and potential disruptors.

Looking forward, organizations that embrace security-centric virtualization strategies, diversify their supply chains, and exploit hybrid cloud architectures will gain a decisive advantage. The insights herein lay the groundwork for informed strategic planning, guiding stakeholders to invest in solutions that align with operational objectives, compliance requirements, and future growth imperatives

Empower Your Organization With In-Depth Virtual Client Computing Insights Contact Ketan Rohom Associate Director Sales & Marketing to Secure the Comprehensive Report

Engaging with specialized expertise transforms insight into strategic advantage through a seamless partnership guided by an experienced Associate Director of Sales & Marketing. By collaborating directly with Ketan Rohom, organizations gain personalized support to explore the comprehensive virtual client computing report’s rich analyses and actionable findings. His deep understanding of digital workspace dynamics ensures that each stakeholder receives tailored advice aligned with their unique operational challenges and growth objectives.

Secure your organization’s competitive edge by investing in the full research report. This definitive resource deciphers emerging trends, dissects regional variations, and uncovers pivotal vendor strategies. Immediate access to these insights accelerates informed decision-making, mitigates risk, and reveals untapped opportunities within the evolving virtual client computing landscape. Reach out to begin a conversation that drives measurable outcomes and elevates your digital workspace initiatives to a new standard of excellence

- How big is the Virtual Client Computing Software Market?

- What is the Virtual Client Computing Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?