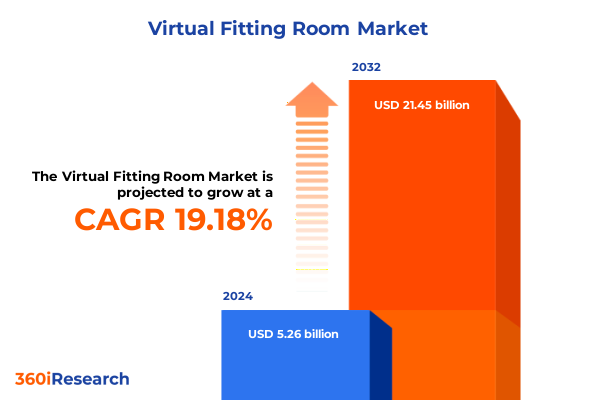

The Virtual Fitting Room Market size was estimated at USD 6.24 billion in 2025 and expected to reach USD 7.42 billion in 2026, at a CAGR of 19.26% to reach USD 21.45 billion by 2032.

Understanding the Dawn of Virtual Fitting Rooms: Redefining Retail Engagement and Consumer Experiences through Cutting-Edge Digital Try-On Technologies

The emergence of virtual fitting rooms represents a watershed moment for retailers and technology providers alike, transforming the traditional in-store try-on experience into a seamless digital journey. As consumer expectations for convenience, personalization, and safety continue to evolve, virtual fitting rooms have transcended novelty status to become a critical component of omnichannel retail strategies. By leveraging advanced imaging, computer vision, and machine learning, brands can now simulate a realistic try-on experience that closely replicates the tactile exploration shoppers expect in physical stores.

In today’s digital-first landscape, virtual fitting rooms not only address the growing consumer demand for contactless shopping but also empower retailers to reduce return rates, optimize inventory, and generate deeper analytics on styling preferences. What began as simple overlays of garments on static images has matured into fully immersive and interactive solutions, capable of adapting in real time to user inputs and environmental variables. This report delves into the technologies, market dynamics, and strategic drivers propelling virtual fitting rooms to the forefront of retail innovation, offering decision-makers the insights they need to navigate this rapidly evolving sector.

Examining the Rapid Evolution of Virtual Fitting Room Technologies and Market Dynamics Shaping Immersive Retail Experiences in an Increasingly Digital Ecosystem

Over the past decade, the virtual fitting room landscape has undergone profound transformations, driven by breakthroughs in artificial intelligence, augmented reality, and cloud computing. Early iterations relied heavily on static image rendering, but advances in depth sensing and neural networks now enable highly accurate body-scanning and garment draping. Consequently, retailers can offer personalized recommendations based on precise measurements and style profiles, increasing shopper confidence and driving higher conversion rates.

Simultaneously, the proliferation of high-speed mobile networks and edge computing has facilitated real-time virtual try-on experiences directly within mobile apps and web browsers, eliminating the need for specialized hardware. This shift has democratized access to digital fitting solutions, allowing even small and mid-sized brands to adopt immersive try-on technologies without significant infrastructure investments. Furthermore, the integration of social commerce features-enabling users to share virtual try-on sessions with friends or influencers-has amplified organic brand reach and engagement, marking a pivotal shift in how consumers interact with products and make purchase decisions.

Analyzing the Economic and Operational Impact of 2025 United States Tariffs on Virtual Fitting Room Solution Providers and Their Global Supply Chains

In 2025, the United States implemented a new wave of tariffs targeting technology components critical to virtual fitting room solutions, including advanced sensors and specialized display modules. These measures have introduced higher costs for hardware manufacturers and software integrators that rely on imported components, compelling many providers to reevaluate their supply chain strategies. As a result, some solution vendors have absorbed these additional expenses to remain competitive, while others have passed costs onto retail clients through tiered pricing models or increased subscription fees.

Beyond cost implications, the tariffs have catalyzed a broader industry reconsideration of onshore manufacturing and sourcing diversification. Providers are exploring partnerships with domestic electronics assemblers and investing in local R&D facilities to mitigate future trade disruptions. Although these strategic moves require longer lead times and initial capital expenditures, they promise greater supply chain resilience and improved responsiveness to evolving regulatory landscapes. Overall, the 2025 tariffs underscore the importance of proactive risk management for virtual fitting room technology providers operating in a geopolitically complex environment.

Uncovering Critical Segmentation Trends in Virtual Fitting Room Adoption Spanning Artificial Intelligence, Augmented Reality, Cloud Deployment, and Diverse Customer Applications

The virtual fitting room market is dissected across multiple layers of segmentation, each revealing distinct growth trajectories and adoption barriers. From a technology standpoint, AI-powered solutions dominate the early stages of deployment, leveraging sophisticated algorithms to analyze body measurements and predict fit, while augmented reality offerings gain momentum by delivering rich, interactive visualizations through mobile and web interfaces. Meanwhile, pure virtual reality implementations occupy a more specialized niche, appealing primarily to high-end retailers seeking the utmost immersion.

Pricing models further differentiate market participants, with subscription-based offerings providing predictable revenue streams for providers and budget certainty for retailers, whereas pay-per-use arrangements attract newer entrants and smaller brands looking to pilot digital try-on without committing to long-term contracts. Deployment strategies also vary, as cloud-based platforms offer rapid scalability and seamless updates, contrasting with on-premises installations that grant larger enterprises tighter control over data security and system customization. In terms of applications, apparel remains the cornerstone segment-encompassing footwear, clothing, and accessories-yet growth in beauty and cosmetics underscores expanding consumer appetite for virtual makeup trials. Eyewear solutions demand precise facial mapping, and jewelry and watches benefit from high-resolution 3D rendering to convey material quality and craftsmanship. Finally, enterprise solutions continue to outpace individual consumer offerings, as large retail chains integrate virtual fitting capabilities into broader digital transformation initiatives, while direct-to-consumer deployments gain traction among digitally savvy shoppers.

This comprehensive research report categorizes the Virtual Fitting Room market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Pricing Model

- Platform Device

- Deployment

- Application

- Customer Type

Delineating Key Regional Variations Influencing Virtual Fitting Room Adoption Trends Across the Americas, Europe, Middle East & Africa, and the Asia-Pacific Markets

Regional analysis reveals divergent adoption curves and strategic priorities for virtual fitting room technologies. In the Americas, the United States leads the charge, fueled by strong e-commerce infrastructure, high consumer digital engagement, and robust venture funding. Retailers prioritize rapid go-to-market timelines, driving demand for turnkey cloud solutions with minimal integration overhead. Latin American markets, while smaller in scale, show budding interest in virtual try-on as brands seek to differentiate through digital innovation and meet rising internet penetration.

Across Europe, the Middle East, and Africa, adoption is anchored in Europe’s established fashion capitals, where brands harness virtual fitting tools to reduce high return rates and enhance sustainability efforts. Regulatory frameworks around data privacy, particularly in the European Union, shape deployment strategies by emphasizing on-premises or hybrid architectures. In the Middle East and Africa, infrastructure challenges coexist with a youthful, tech-savvy population, creating pockets of rapid growth, especially in the Gulf Cooperation Council states. Meanwhile, the Asia-Pacific region is witnessing rapid uptake, driven by China’s e-commerce giants and Japan’s technological prowess. Mobile-first experiences dominate, and local providers are innovating around AI-driven fit prediction tailored to diverse body types and cultural nuances.

This comprehensive research report examines key regions that drive the evolution of the Virtual Fitting Room market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Initiatives and Competitive Differentiators Among Leading Virtual Fitting Room Technology Providers Driving Innovation and Market Penetration

Competitive intensity within the virtual fitting room landscape is escalating as established technology firms and nimble startups vie for market share. Leading providers differentiate by deepening integrations with major e-commerce platforms, launching specialized modules for vertical segments such as luxury apparel or mass-market footwear. Strategic partnerships with sensor manufacturers and mobile device vendors further bolster solution capabilities, enabling features like real-time gesture tracking and photorealistic texture mapping.

Moreover, the M&A landscape has grown active, with larger incumbents acquiring niche innovators to expand their technology portfolios and accelerate time to market. At the same time, venture capital investment continues to flow into promising early-stage companies that demonstrate scalable AI algorithms and novel user-experience paradigms. As competition intensifies, the ability to deliver seamless omnichannel experiences and robust analytics dashboards emerges as a critical differentiator, with top performers securing long-term contracts by embedding their platforms at the core of retailers’ digital ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Fitting Room market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3DLOOK Inc.

- AstraFit by Autumn Rock Limited

- Bold Metrics Inc.

- ELSE CORP SRL

- Fit Analytics Innovation GmbH by Snap Inc

- FXGear Inc.

- Intelistyle Ltd.

- Magic Mirror

- Memomi Labs Inc.

- Metail Limited

- MySize

- Perfect Corp.

- Perfitly

- Prime AI Ltd.

- Reactive Reality GmbH

- SenseMi DMCC

- SIZEBAY

- Texel Ltd. by Next Gen AI Ltd.

- True Fit Corporation

- Virtual On Ltd.

- Virtusize Co., Ltd.

- Walmart Inc.

- Zalando SE

- Zugara, Inc.

Guiding Industry Leaders with Actionable Strategies to Capitalize on Virtual Fitting Room Innovations, Mitigate Trade Disruptions, and Enhance Consumer Engagement

Industry leaders seeking to capitalize on virtual fitting room momentum should prioritize a dual focus on technological excellence and supply chain resilience. By investing in AI-driven personalization engines, organizations can refine fit recommendations and in-session style advice, fostering user trust and reducing cart abandonment. Concurrently, diversifying component sourcing and exploring regional manufacturing partnerships will mitigate exposure to future tariff shifts and logistics disruptions.

In parallel, retailers and technology providers should experiment with hybrid pricing schemes, blending subscription models for core functionalities with pay-per-use options for premium features like hyper-realistic rendering. Emphasizing cloud security best practices and obtaining relevant certifications will reassure enterprise clients concerned about sensitive customer data. Finally, forging alliances with device manufacturers, social media platforms, and logistics providers can create end-to-end value chains that seamlessly integrate virtual try-on experiences, from discovery to final delivery, amplifying consumer engagement and brand loyalty.

Detailing a Robust Mixed-Method Research Framework Combining Primary Interviews, Expert Surveys, and Secondary Data Analysis for Virtual Fitting Room Market Insights

The research methodology underpinning this report combines primary and secondary sources to ensure comprehensive coverage and analytical rigor. Primary research included in-depth interviews with C-level executives from leading retail brands, technology vendors, and logistics providers, supplemented by focused group discussions with early adopters of virtual fitting solutions. An online survey of retail decision-makers provided quantitative insights into deployment timelines, budget allocations, and performance metrics.

Secondary research leveraged a diverse array of public domain materials, including patent filings, financial reports, regulatory documentation, and industry conference proceedings. Data triangulation techniques were applied to reconcile discrepancies across sources and validate emerging trends. Throughout the research process, strict quality controls were maintained, encompassing multiple rounds of review by subject-matter experts in retail technology, ensuring that the findings accurately reflect the current state of the virtual fitting room market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Fitting Room market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Fitting Room Market, by Component

- Virtual Fitting Room Market, by Technology

- Virtual Fitting Room Market, by Pricing Model

- Virtual Fitting Room Market, by Platform Device

- Virtual Fitting Room Market, by Deployment

- Virtual Fitting Room Market, by Application

- Virtual Fitting Room Market, by Customer Type

- Virtual Fitting Room Market, by Region

- Virtual Fitting Room Market, by Group

- Virtual Fitting Room Market, by Country

- United States Virtual Fitting Room Market

- China Virtual Fitting Room Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Future Trajectory of Virtual Fitting Rooms Highlighting Market Opportunities, Technological Synergies, and Strategic Imperatives

The virtual fitting room represents more than a standalone innovation; it is a cornerstone of the retail transformation journey, bridging the gap between physical and digital commerce. As brands and technology providers refine immersive try-on experiences, they unlock new avenues for personalization, operational efficiency, and sustainable practices. The synergy between artificial intelligence, augmented reality, and cloud services will continue to elevate user experiences, setting higher benchmarks for realism and convenience.

Looking ahead, organizations that embrace flexibility-both in their technology architectures and supply chain strategies-will be best positioned to navigate evolving consumer expectations and geopolitical uncertainties. By leveraging the insights contained within this report, decision-makers can chart a course toward resilient growth, deliver differentiated customer experiences, and secure a competitive edge in the dynamic landscape of virtual fitting rooms.

Partner with the Associate Director of Sales & Marketing to Access In-Depth Virtual Fitting Room Market Research Tailored to Your Strategic Needs

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your access to the comprehensive market research report on virtual fitting room innovations and strategies. Ketan brings a wealth of industry knowledge and can guide you through the report’s detailed analysis, helping you identify the most relevant insights for your organization’s strategic planning.

Don’t miss the chance to leverage exclusive data on emerging technologies, tariff impacts, segmentation trends, and regional dynamics that will shape the future of digital try-on solutions. Reach out today to arrange a personalized consultation and discuss tailored licensing options that align with your business goals.

- How big is the Virtual Fitting Room Market?

- What is the Virtual Fitting Room Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?