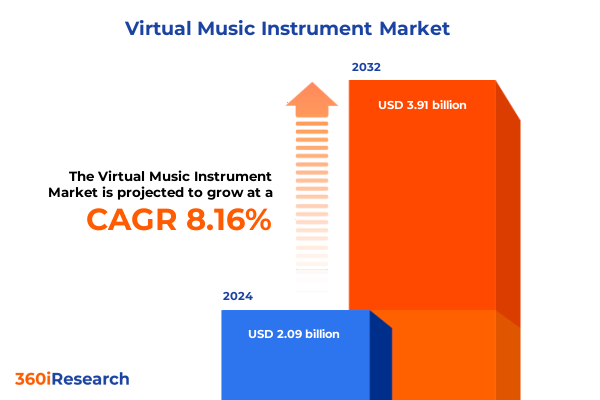

The Virtual Music Instrument Market size was estimated at USD 1.74 billion in 2025 and expected to reach USD 1.88 billion in 2026, at a CAGR of 8.04% to reach USD 2.99 billion by 2032.

An authoritative framing that positions the virtual music instrument landscape at the crossroads of hardware evolution, software innovation, and user-driven demand shifts

The virtual music instrument sector sits at the intersection of rapid software innovation and a long tradition of hardware craftsmanship, forming an ecosystem that supports creators from first-time learners to touring professionals. As digital audio workstations have migrated from dedicated studio suites to cloud-enabled, cross-platform environments and MIDI controllers have grown increasingly expressive, the boundary between physical and virtual instruments has blurred. This introduction situates the reader within that continuum, clarifying how product modalities, platform choices, and business models interact to shape user expectations and purchasing behaviour.

In practical terms, this means understanding that instrument type is a primary axis of differentiation: hardware-based offerings such as digital audio workstations and MIDI controllers coexist with software-first virtual instruments including virtual drums, orchestral instruments, pianos, and synthesizers. Platform dynamics further complicate vendor strategy, with distinct user journeys emerging on mobile-based virtual instruments compared with PC-based environments. Pricing structures from freemium models to one-time purchases and subscriptions govern both acquisition velocity and long-term monetization. Finally, applications ranging from education to live performance and music production align with discrete user needs among hobbyists, institutions, and professional musicians. With this orientation, the remainder of the document builds on the technological, commercial, and user-centred currents that define the market today.

How advances in software realism, hybrid hardware-software setups, and platform convergence are redefining product roadmaps and monetization strategies in music tech

The landscape for virtual music instruments has been transformed by several converging shifts that are reshaping product design, channel economics, and creative workflows. First, the rise of high-quality software instruments and advanced sample libraries has made studio-grade sounds accessible outside of traditional recording facilities. Parallel to that, compact and expressive controllers have accelerated the adoption of hybrid setups where performers rely on tactile hardware to control deeply programmable software instruments, producing a new norm for live rigs and compact studios.

Second, platform convergence and improvements in mobile processing power have created credible music-production experiences on phones and tablets, forcing vendors to re-evaluate feature parity and UX strategies between mobile-based virtual instruments and PC-based offerings. Third, monetization models have shifted toward recurring revenue structures in many product categories, although freemium and one-time purchase paths remain relevant for entry-level and premium niche products respectively. These shifts are further amplified by supply chain imperatives and geopolitical developments that have affected hardware sourcing, compelling manufacturers to diversify suppliers and to design for modularity and parts interchangeability. Taken together, these transformative changes underscore a market that rewards interoperability, predictable pricing paths, and a relentless focus on lowering the friction to creative expression.

A thorough assessment of how recent tariff policy changes in 2024–2025 have introduced cost, classification, and sourcing complexities that reshape hardware-dependent segments of the market

Policy shifts in 2024–2025 have materially altered the import landscape for hardware-intensive segments of the music instrument market, creating layered tariff outcomes that companies must actively manage. Official trade actions increased tariff rates on selected categories, including certain technology and semiconductor-related products, with new rates taking effect as part of statutory reviews and administrative decisions. These regulatory changes have created immediate cost pressures for manufacturers who rely on internationally sourced components, and they have introduced meaningful complexity into inventory planning and procurement cycles.

Legal and advisory practitioners have documented the sequencing and scope of these changes, noting that many of the tariff adjustments were implemented through Section 301 reviews and related administrative actions that applied to designated product groupings. Practitioners also emphasize that the tariffs in question generally attach to specific HTS codes and apply to direct imports from targeted jurisdictions, which means that downstream products may or may not be affected depending on classification and origin. This technical specificity has forced supply chain and customs teams to revisit tariff classification strategies and to model alternative sourcing scenarios.

Operationally, firms have faced a multilayered timeline of tariff introductions, increases, and reviews across different statutory authorities, which has produced both immediate pass-through decisions and longer-term strategic responses such as nearshoring or changes to bill-of-materials composition. Tracking services and legal analyses have summarized a mosaic of tariff measures that include variable ad valorem rates and scope expansions that affect categories adjacent to consumer electronics and semiconductors. As a result, procurement leaders are recalibrating safety stock, negotiating revised supplier agreements, and re-evaluating landed-cost models to maintain margin resilience.

At the ecosystem level, independent analyses of import dependency underscore that certain instrument categories - especially entry-level electronic keyboards, electric guitars, and a swath of accessories and components - rely heavily on manufacturing hubs that were subject to the tariff actions. The consequence has not been uniform: products that are software-centric or that can be fully produced domestically have experienced far smaller direct tariff exposure, while hardware-heavy instruments and imported components have borne the brunt of the cost adjustments. This bifurcation has incentivized a two-track supplier strategy for many vendors, balancing immediate mitigation with longer-term reconfiguration of component sources.

Market participants and trade commentators have reported tangible pricing adjustments and supply-side uncertainty in categories linked to electronic music gear and synthesizers, where tariff rate changes and administrative policy volatility have driven short-term cost spikes and raised the spectre of pass-through to consumers. These developments have accelerated conversations about product modularity, the trade-offs between vertical integration and outsourced manufacturing, and the need for financial hedging strategies to smooth margin volatility amid tariff-driven cost shocks.

Key segmentation insights that align instrument modality, platform choices, pricing models, application scenarios, and end-user profiles to product and channel strategy

Segmentation reveals how user needs and product design choices produce distinct commercial dynamics across instrument type, platform, pricing structure, application, and end user. When looking at instrument type, the divide between hardware-based products such as digital audio workstations and MIDI controllers and software-based virtual instruments including virtual drums, orchestral libraries, pianos, and synthesizers highlights different development cadences and distribution channels. Hardware products require supply chain continuity, compliance attention, and often longer lead times, whereas software instruments prioritize sample fidelity, CPU efficiency, and easy update paths that can be distributed digitally and iterated rapidly.

Considering platform differentiation, mobile-based virtual instruments have unlocked a broad user acquisition funnel that emphasizes accessibility, tactile mobile interfaces, and social sharing, while PC-based virtual instruments remain the workhorse for deep production workflows that demand CPU headroom, plugin compatibility, and integrated DAW environments. In terms of pricing structure, freemium models serve discovery and mass-market adoption, one-time purchases address customers seeking perpetual ownership and predictable costs, and subscription models enable continuous monetization and frequent product improvements. Application segmentation between education, live performance, and music production further exposes how product features map to user priorities; educational users prioritize simplicity and curriculum integration, live performers require latency control and robust presets, and music producers need advanced routing, automation, and high-fidelity libraries. Finally, end-user grouping into hobbyists, institutions, and professional musicians clarifies Go-To-Market approaches: hobbyists are sensitive to price-to-feature ratios, institutions value bulk licensing and support, and professionals demand reliable performance, integration, and service-level guarantees. These interlocking segmentation lenses should guide product teams, channel strategists, and pricing committees as they design propositions for target cohorts.

This comprehensive research report categorizes the Virtual Music Instrument market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Platform

- Pricing Structure

- Sound Generation Method

- Application

- Deployment Model

- End User

How regional supply chain resilience, regulatory diversity, and consumer adoption patterns across the Americas, Europe Middle East & Africa, and Asia-Pacific dictate bespoke market approaches

Regional dynamics exert differentiated pressures on supply chains, distribution channels, and developer ecosystems, creating distinct strategic imperatives across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, a mature ecosystem of music technology consumers and a concentration of studios and educational institutions support a dense aftermarket for accessories and upgrade paths; however, shifts in trade policy affecting imported components have increased the importance of flexible manufacturing and alternative sourcing to protect margins and maintain time-to-market.

Across Europe, Middle East & Africa, regulatory diversity and heterogeneous distribution networks create both opportunities for premium localized experiences and challenges in standardizing product offerings. Vendors must reconcile local certification, VAT regimes, and performance expectations while investing in region-specific content and language support. In Asia-Pacific, deep manufacturing capabilities coexist with fast-growing consumer adoption of mobile-based virtual instruments and a strong DIY creator culture, which presents both a source of product innovation and competitive pressure. Taken together, these regional realities call for differentiated commercial playbooks: one that couples resilient supply chain design in the Americas with localization and compliance investments in EMEA and product adaptation and channel partnerships in Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Virtual Music Instrument market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive dynamics and company-level imperatives that reward deep audio-engine capabilities, platform partnerships, and content-driven differentiation

Competitive dynamics in virtual music instruments are defined by innovation velocity, IP-backed sample and synthesis engines, and an ability to support multi-platform workflows. Companies that succeed combine deep audio-engine expertise with compelling UX and a willingness to integrate across ecosystems; leaders commonly offer cross-licensing options, plugin compatibility, and robust content libraries. Strategic partnerships with DAW vendors, controller manufacturers, and platform app stores have become essential to secure distribution breadth and to embed products into the daily creative routines of users.

At the product level, firms that control both the sound engine and the content pipeline enjoy a differentiation advantage because they can bundle sonic identity with technical performance. Meanwhile, smaller and mid-sized vendors often specialize in signature sounds or unique controller mappings, carving out defensible niches that sustain loyal user communities. Observing channel behaviour, direct-to-consumer digital marketplaces accelerate iteration cycles and allow for dynamic pricing experiments, while physical retail and pro-audio channels remain important for high-touch demos, institutional procurement, and live-performance hardware sales. Strategic M&A activity and licensing deals continue to reshape the competitive set, as firms seek to shore up IP positions, expand content catalogs, or acquire complementary hardware competencies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Music Instrument market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Native Instruments GmbH

- Roland Corporation

- Yamaha Corporation

- MAGIX Software GmbH

- Avid Technology, Inc.

- Ableton AG

- PreSonus Audio Electronics, Inc.

- Moog Music, Inc.

- Reason Studios AB

- Arturia

- ROLI Ltd.

- Output, Inc.

- 8DIO Productions LLC

- Adobe Inc.

- BandLab Singapore Pte Ltd

- Bitwig GmbH

- Cockos Incorporated

- Dirac Research AB

- East West Communications, Inc.

- GoldWave Inc.

- Heavyocity Media, Inc.

- IK Multimedia Productions SRL

- Image Line nv

- inMusic Brands, Inc.

- Korg Inc.

- Mark of the Unicorn, Inc.

- MODARTT S.A.S.

- Plogue Art et Technologie, Inc.

- Spectrasonics

- Steinberg Media Technologies GmbH

- Swar Systems

- TAL Software GmbH

- Teenage Engineering AB

- Toontrack Music AB

- UJAM Music Technology GmbH

- Vienna Symphonic Library GmbH

Actionable, prioritized recommendations for executives to insulate operations from policy shocks, accelerate software monetization, and fortify distribution ecosystems

Industry leaders should pursue an integrated set of actions that mitigate near-term tariff exposure while positioning products for long-term resilience and growth. First, prioritize dual-sourcing and bill-of-material redesigns that reduce single-origin dependency for critical components; this preserves manufacturing agility and reduces the risk of sudden cost escalation. Second, accelerate software-first pathways that shift value capture toward content, services, and recurring revenue models, which are inherently less exposed to goods-related tariffs and can yield higher lifetime user value.

Third, invest in modular product architectures and documentation that simplify repair, localized manufacturing, and component substitution, thereby lowering the friction for nearshoring or regional assembly. Fourth, strengthen partnerships across platform providers and educational institutions to expand adoption funnels and to build defensible distribution channels that are less price-sensitive. Fifth, implement transparent customer communications and tiered pricing strategies that manage pass-through decisions carefully, aligning premium support and guaranteed supply bundles with customers who value continuity. Finally, institutionalize scenario planning and customs expertise within commercial and procurement teams so that future policy shifts are anticipated and rapidly operationalized, rather than reacted to under duress.

A transparent mixed-methods research approach combining primary interviews, comparative product analysis, and policy review to yield actionable and defensible insights

This research used a mixed-methods approach integrating qualitative expert interviews, product- and channel-level feature analysis, and secondary-source policy review to construct a multi-dimensional view of the virtual music instrument landscape. Primary inputs included structured interviews with senior product managers, procurement leads, performing artists, and educational program directors, which were synthesized to capture use-case requirements, procurement constraints, and experiential expectations. Secondary inputs encompassed regulatory filings, customs notices, technical documentation, and market commentary to validate supply-side assumptions and to identify policy-driven inflection points.

Analytical methods combined comparative feature mapping across instrument types and platforms with scenario-based supply chain stress testing to evaluate the operational implications of tariff movements. Pricing model analysis focused on user acquisition dynamics and revenue persistence across freemium, one-time purchase, and subscription models, while regional analysis emphasized distribution channels, regulatory compliance, and local partnership inventories. Throughout, triangulation techniques were applied to reconcile potential respondent bias and to validate thematic conclusions, and all findings were cross-checked against publicly available policy documents and practitioner advisories to ensure defensible recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Music Instrument market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Music Instrument Market, by Instrument Type

- Virtual Music Instrument Market, by Platform

- Virtual Music Instrument Market, by Pricing Structure

- Virtual Music Instrument Market, by Sound Generation Method

- Virtual Music Instrument Market, by Application

- Virtual Music Instrument Market, by Deployment Model

- Virtual Music Instrument Market, by End User

- Virtual Music Instrument Market, by Region

- Virtual Music Instrument Market, by Group

- Virtual Music Instrument Market, by Country

- United States Virtual Music Instrument Market

- China Virtual Music Instrument Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding synthesis that integrates supply chain resilience, software-first strategies, and cross-platform interoperability as the pillars of enduring competitive advantage

In conclusion, the virtual music instrument market stands at a moment of strategic inflection where product architecture, distribution choreography, and policy sensitivity intersect. Software realism and platform convergence are broadening access and reshaping user expectations, while hardware segments remain exposed to supply chain and trade policy dynamics that can materially affect cost structures. The dual imperative for vendors is clear: mitigate immediate operational risk through supply diversification and tariff-aware procurement, and simultaneously double down on software-driven value propositions that decouple revenue from physical goods.

Looking forward, leaders who adopt modular designs, embrace cross-platform interoperability, and execute disciplined scenario planning around policy volatility will be best positioned to protect margins and capture long-term user engagement. Decision-makers should treat current policy-induced disruptions as catalysts for structural improvements-streamlining production choices, clarifying pricing architecture, and reinforcing distribution partnerships-so that the industry not only endures near-term shocks but emerges more adaptable and competitive in the years ahead.

Purchase the comprehensive market research report and arrange an executive briefing with Ketan Rohom (Associate Director, Sales & Marketing) to enable strategic decisions

To acquire a definitive and actionable market research report tailored to executive decision-makers in the virtual music instrument ecosystem, please contact Ketan Rohom (Associate Director, Sales & Marketing) to purchase the comprehensive study. The report delivers a standalone, professionally structured package that synthesizes product-, platform-, pricing-, application-, and end-user-level analysis along with regional dynamics, competitive profiling, and practical go-to-market scenarios designed for C-suite and product leads.

Purchasing this report enables direct engagement with a senior sales representative to evaluate licensing options, custom add-ons, and strategic briefing sessions. Ketan Rohom (Associate Director, Sales & Marketing) can arrange an executive summary brief, unpack methodology specifics, and outline tailored deliverables such as competitor deep dives, channel displacement risk assessments, and prioritized product investment recommendations. Reach out to arrange a secure transaction and schedule a follow-up consultation to align the research deliverables with your strategic goals.

- How big is the Virtual Music Instrument Market?

- What is the Virtual Music Instrument Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?