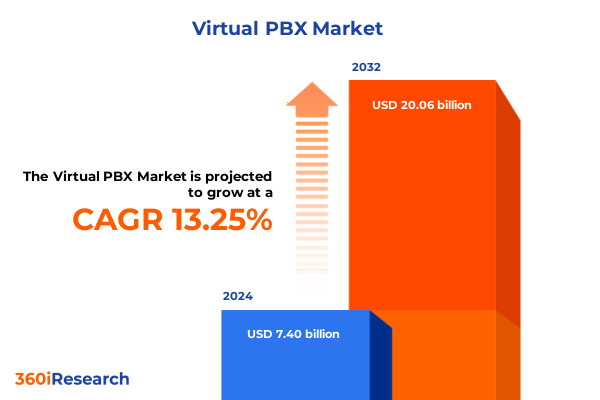

The Virtual PBX Market size was estimated at USD 8.35 billion in 2025 and expected to reach USD 9.42 billion in 2026, at a CAGR of 13.33% to reach USD 20.06 billion by 2032.

Exploring the Emergence of Cloud-Native Virtual PBX Technologies as the Cornerstone of Agile, Scalable, and Cost-Efficient Business Communication Strategies Worldwide

The rapid convergence of cloud computing, mobile connectivity, and unified communications has elevated Virtual Private Branch Exchange (PBX) systems from niche offerings to core infrastructure for businesses striving for agility and cost efficiency. In today’s environment, organizations of all sizes are seeking flexible telephony solutions that minimize upfront investments while delivering enterprise-grade features. Against this backdrop, Virtual PBX emerges as a transformative technology enabling seamless collaboration across distributed teams, supporting remote work policies, and delivering rich analytics to optimize customer engagement.

As companies navigate an increasingly digital-first paradigm, the imperative to modernize legacy telephony systems intensifies. Virtual PBX eliminates the constraints of traditional hardware deployments, granting IT leaders the ability to provision new lines, manage advanced call routing, and integrate voice, messaging, and data services with just a few clicks. This agility not only reduces operational overhead but also empowers organizations to respond rapidly to market opportunities. Consequently, decision-makers are prioritizing solutions that align with broader digital transformation initiatives, laying the foundation for the evolution of business communications.

Unveiling the Technological, Regulatory, and Customer-Driven Shifts That Are Redefining the Virtual PBX Competitive Landscape

The Virtual PBX landscape has undergone several transformative shifts in recent years, driven by technological maturation, evolving customer expectations, and shifting regulatory environments. Initially, adoption was restrained by concerns over call quality and security, but advances in voice-over-IP codecs, encryption protocols, and quality-of-service management have dramatically improved reliability and trust. Simultaneously, the proliferation of mobile devices has spurred demand for seamless integration across smartphones, tablets, and desktop environments, enabling a truly unified communications experience.

Moreover, the integration of artificial intelligence and automation capabilities has elevated Virtual PBX beyond mere call routing to intelligent interaction management. Features such as conversational IVR, sentiment analysis, and predictive call distribution are increasingly standard, allowing businesses to deliver personalized customer experiences at scale. Regulatory changes, including privacy and data sovereignty provisions, have also compelled providers to enhance compliance frameworks and local data residency offerings. Collectively, these shifts have set a new bar for functionality, security, and user experience in the Virtual PBX domain, prompting both established incumbents and emerging challengers to innovate relentlessly.

Analyzing How Progressive United States Tariff Measures Since 2018 Have Reshaped Virtual PBX Procurement Strategies and Deployment Models

Since the introduction of targeted tariffs by the United States government in 2018, the cumulative impact on Virtual PBX supply chains and service costs has become increasingly pronounced. Hardware components traditionally sourced from overseas suppliers witnessed incremental cost increases as tariff rates escalated, prompting both service providers and end users to explore alternative sourcing strategies and negotiate longer-term vendor contracts. These measures mitigated some immediate cost pressures but also introduced complexity into procurement workflows.

The tariffs on networking equipment and telecommunications hardware have effectively accelerated the shift toward fully cloud-based deployments, as organizations sought to sidestep import duties by embracing virtualized infrastructure hosted in domestic data centers. In turn, providers have invested heavily in expanding cloud footprints across multiple U.S. regions to ensure resilience, latency optimization, and compliance with data sovereignty requirements. Although service-level fees have adjusted upward modestly since 2020, the broader transition away from on-premises hardware has yielded net cost savings in deployment and maintenance, underscoring how tariff dynamics have shaped strategic decision-making within the sector.

Identifying Multi-Dimensional Segmentation Insights Spanning Service, Pricing, Business Size, Vertical, Deployment, End-User Needs, and Technology Considerations

A multi-dimensional segmentation approach reveals nuanced opportunities and adoption patterns within the Virtual PBX market. Analysis by service type indicates that Data Services continue to underpin advanced analytics and unified communications integrations, while Messaging Services-comprising Chat Services and SMS Messaging-are increasingly leveraged for real-time customer engagement and internal collaboration. Meanwhile, Voice Services, which encompass traditional Call Forwarding alongside advanced VoIP capabilities, remain foundational for core telephony requirements, with VoIP Services driving differentiated feature sets.

Layering a pricing model perspective highlights a divergence in buyer preferences: Pay-As-You-Go structures appeal to small businesses and mid-sized enterprises seeking minimal upfront commitment, whereas subscription models resonate with larger organizations that prioritize predictable budgeting and comprehensive feature bundles. Business size segmentation shows that Large Enterprises demand highly customizable platforms, robust integrations, and dedicated support, while Mid-Sized Enterprises and Small Businesses focus on ease of use and packaged solutions that minimize administrative overhead.

Industry vertical segmentation uncovers distinct use cases and purchasing drivers. Within Finance, Banking Institutions and Investment Firms deploy Virtual PBX to enhance secure client communications and streamline contact center operations. Healthcare providers, including Hospitals and Private Practices, emphasize compliance, patient outreach, and telehealth integrations. Retail, spanning both Brick-and-Mortar outlets and E-Commerce platforms, leverages virtual telephony to unify in-store customer support and online order management. Deployment mode analysis contrasts the growing dominance of Cloud-Based solutions-favored for rapid provisioning and scalability-with On-Premises installations, which still retain traction among highly regulated organizations with stringent data residency mandates.

Examining end-user requirements reveals that Customizable Features, such as deep third-party Integrations, have become critical for enterprises seeking seamless interoperability with CRM and workforce management tools. Scalability considerations, manifest through User Expansion capabilities, drive adoption among high-growth firms that require on-demand capacity adjustments. Finally, technology segmentation contrasts legacy Analog Systems, often retained for specific use cases or transitional scenarios, with mature Digital Systems that offer richer functionality and reduced total cost of ownership.

This comprehensive research report categorizes the Virtual PBX market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Pricing Model

- Industry Vertical

- Business Size

- Deployment Mode

Mapping Diverse Adoption Patterns and Regulatory Requirements Driving Virtual PBX Deployment Across the Americas, EMEA, and Asia-Pacific Regions

Regional dynamics in the Virtual PBX market reflect varied levels of digital transformation maturity and regulatory complexity. In the Americas, North American organizations are leading adoption through broad deployment of cloud-native solutions, underpinned by advanced network infrastructure and supportive regulatory frameworks. LatAm markets are following suit, driven by growing SME digitization and mobile penetration, although economic volatility and import duties continue to influence provider strategies.

Within Europe, Middle East & Africa, the landscape is defined by a mosaic of regulatory regimes and data sovereignty requirements, prompting vendors to establish regional data centers and forge partnerships with local integrators. Western European markets exhibit strong demand for feature-rich VoIP and unified communications, whereas certain emerging economies in Eastern Europe and the Middle East are still transitioning from legacy telephony to fully virtualized platforms.

In Asia-Pacific, the market is characterized by rapid digital adoption in countries such as Australia and Singapore, where cloud-based Virtual PBX solutions are embraced by both enterprise and government sectors. Meanwhile, emerging economies in Southeast Asia and India are witnessing accelerated uptake among small and mid-sized businesses, driven by competitive pricing models and mobile-first collaboration tools. Across the region, providers are tailoring offerings to local language and compliance requirements, fostering a dynamic competitive environment that rewards innovation and localization.

This comprehensive research report examines key regions that drive the evolution of the Virtual PBX market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Virtual PBX Providers Are Differentiating Through Innovation, Partnerships, and Global Cloud Infrastructure Investments

Key market participants are differentiating through strategic partnerships, product innovations, and geographic expansion. Leading providers offer comprehensive platforms that integrate advanced analytics, AI-driven contact center functionalities, and robust APIs for third-party ecosystem connectivity. Several companies have established global footprints by deploying multi-region cloud infrastructures, enabling low-latency performance and compliance with localized data protection mandates.

Innovation pipelines are focused on enhancing user experience through intuitive administration portals, mobile application improvements, and embedded collaboration tools. Partnerships with CRM and workforce management vendors have become a cornerstone of go-to-market strategies, providing seamless workflows for sales, support, and essential back-office functions. Emerging challengers are carving out niches by delivering vertical-specific solutions-such as compliance-centric telehealth modules and financial-grade encryption for banking applications-while also competing on flexible pricing schemes that cater to smaller enterprises.

Furthermore, investments in research and development are centered on future-proofing platforms with support for next-generation networking technologies, including 5G-enabled voice services and edge computing architectures. This forward-looking approach positions these companies to capitalize on evolving enterprise connectivity demands and underscores the importance of continuous innovation in a rapidly evolving market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual PBX market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3CX

- 8x8 Inc.

- AstraQom Prime LLC

- AT&T Intellectual Property

- Atlantech Online, Inc.

- Barracuda Networks, Inc.

- BullsEye Telecom by Lingo Management

- Callhippo

- Cisco Systems, Inc.

- D-Link Corporation

- DIALPAD, INC.

- DigitalWell

- Digitcom Telecommunications Inc.

- Freshworks Inc.

- FusionPBX

- Grasshopper by GoTo

- IFN.com Inc. d/b/a TollFreeForwarding.com

- Microsoft Corporation

- Mitel Networks Corporation

- Nextiva, Inc.

- Panasonic Corporation

- PortaOne, Inc.

- RingCentral, Inc.

- THE REAL PBX LIMITED

- TPX Communications

- UniTel Voice, LLC

- Verizon by XO Communication

- VirtualPBX.Com, Inc.

- Vonage America, LLC

- Xiamen Yeastar Information Technology Co., Ltd.

- Zoom Video Communications, Inc.

Crafting a Multi-Faceted Strategic Roadmap for Providers to Accelerate Cloud Migration, Embed AI Capabilities, and Strengthen Global Compliance Frameworks

To navigate the complexities of the Virtual PBX market and maintain a competitive edge, industry leaders should prioritize a sequence of strategic actions. First, accelerating the migration of on-premises customers to cloud-based platforms will not only mitigate tariff-related procurement risk but also unlock scalable revenue streams through subscription models. Second, embedding AI-driven features such as sentiment analysis, intelligent call routing, and automated workflows will elevate the value proposition and support premium pricing strategies.

Next, forging deeper alliances with CRM and enterprise software vendors will facilitate seamless integrations that resonate with key verticals, strengthening both customer stickiness and upsell opportunities. Simultaneously, diversifying data center footprints across regions will address data sovereignty concerns and optimize latency, reinforcing service-level commitments. In tandem, providers should refine pricing flexibility by introducing hybrid pay-as-you-go and tiered subscription plans to cater to the distinct needs of small, mid-sized, and large enterprises.

Finally, investing in robust security frameworks-featuring end-to-end encryption, multi-factor authentication, and continuous compliance monitoring-will be indispensable for winning trust in regulated sectors such as finance and healthcare. By executing this multi-faceted roadmap, market players can harness emerging opportunities, mitigate external risks, and solidify their leadership position in the evolving Virtual PBX landscape.

Detailing a Robust Hybrid Research Framework Employing Primary Interviews, Quantitative Surveys, Secondary Data Analysis, and Expert Validation

This research leverages a hybrid methodology combining primary and secondary data sources to ensure depth, granularity, and reliability of insights. Primary research included structured interviews with C-suite executives, IT decision-makers, and service provider representatives to capture real-world deployment experiences, feature requirements, and buying criteria. Additionally, detailed surveys were conducted across enterprises of varying sizes and industry verticals to quantify adoption drivers and barriers.

Secondary research encompassed an extensive review of corporate filings, regulatory documents, patent filings, and industry white papers to map evolving technology trends, tariff developments, and competitive landscapes. Market triangulation techniques were applied by cross-validating quantitative survey findings against vendor case studies and publicly disclosed financial performance indicators. The synthesis of qualitative inputs and quantitative data allowed for the identification of key themes, regional patterns, and emerging disruptors.

To maintain analytical rigor, all findings underwent peer review and validation through advisory discussions with external industry experts. Data normalization procedures were employed to reconcile discrepancies across sources, ensuring consistency and accuracy. This robust methodology underpins the actionable insights and strategic recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual PBX market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual PBX Market, by Service Type

- Virtual PBX Market, by Pricing Model

- Virtual PBX Market, by Industry Vertical

- Virtual PBX Market, by Business Size

- Virtual PBX Market, by Deployment Mode

- Virtual PBX Market, by Region

- Virtual PBX Market, by Group

- Virtual PBX Market, by Country

- United States Virtual PBX Market

- China Virtual PBX Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing How Technological Innovations, Tariff Dynamics, and Multi-Dimensional Segmentation Are Shaping the Future of Virtual PBX Solutions

In summary, Virtual PBX has transcended its origins as a cost-saving telephony alternative to become a pivotal component of unified communications strategies across industries. Technological advancements in AI, cloud infrastructure, and integration capabilities have elevated user expectations and competitive differentiation. Concurrently, tariff dynamics and regional regulatory nuances have accelerated cloud adoption, reshaping procurement practices and deployment models.

Multi-dimensional segmentation reveals that Messaging Services, advanced VoIP features, and data-driven analytics are driving value creation, while flexible pricing, end-user customization, and rapid scalability remain paramount for adoption. Regional insights underscore a landscape where mature markets in North America and Western Europe co-exist alongside high-growth opportunities in Asia-Pacific and LatAm. In this competitive arena, leading providers are distinguishing themselves through global cloud investments, strategic partnerships, and vertical-specific innovations.

Going forward, providers and enterprise buyers alike must embrace a holistic strategy-prioritizing cloud migration, AI integration, and comprehensive security frameworks-to capitalize on emerging opportunities. By aligning product roadmaps with evolving end-user requirements and regional compliance needs, stakeholders can chart a course toward sustained growth and market leadership in the dynamic Virtual PBX ecosystem.

Secure Exclusive Access to Strategic Virtual PBX Intelligence by Connecting with the Dedicated Associate Director of Sales & Marketing at 360iResearch

To obtain the comprehensive insights and strategic guidance detailed within this Virtual PBX market research report, we invite you to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep industry expertise and can tailor an acquisition package that aligns with your organizational goals. By partnering with Ketan, you will secure not only access to robust data and analysis but also timely support for implementation and integration of findings. Reach out to begin the process of unlocking actionable intelligence that will empower your business communications strategy and drive competitive advantage.

- How big is the Virtual PBX Market?

- What is the Virtual PBX Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?