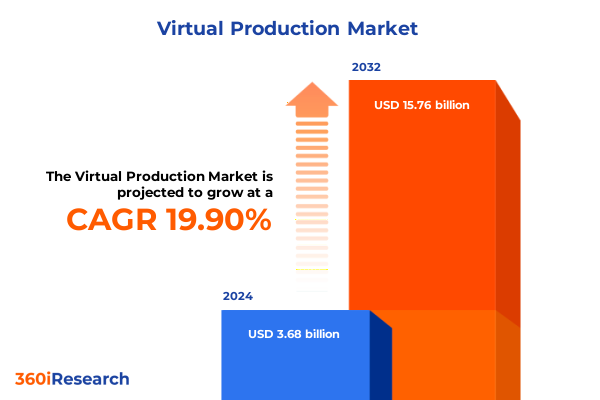

The Virtual Production Market size was estimated at USD 4.35 billion in 2025 and expected to reach USD 5.18 billion in 2026, at a CAGR of 20.16% to reach USD 15.76 billion by 2032.

Navigating the Dawn of Virtual Production: A Strategic Overview of Emerging Technologies and Industry Dynamics for Creators and Decision-Makers

Virtual production has rapidly evolved from a niche experimental technique into a cornerstone of modern content creation, transforming traditional filmmaking paradigms and accelerating time-to-screen for projects of every scale. By merging advanced LED display walls, real-time rendering engines, and precise camera tracking systems, this hybrid approach empowers directors and cinematographers to visualize and manipulate immersive digital environments live on set. This capability not only reduces costly reshoots and logistical complexities but also fosters unprecedented levels of creative collaboration among production teams, visual effects artists, and post-production specialists.

The COVID-19 pandemic catalyzed the adoption of virtual production tools as studios sought agile, remote-friendly workflows to maintain continuity amid widespread restrictions. Cloud-based collaboration platforms now enable distributed teams to co-create assets, iterate scene adjustments, and manage pipelines from anywhere in the world, ensuring that geographic borders no longer hinder the creative process. These advancements have led to a democratization of production resources, allowing smaller studios and independent content creators to access technologies once reserved for major motion pictures and large advertising campaigns.

This executive summary provides a strategic overview of the virtual production landscape, highlighting the transformative shifts, regulatory considerations, segmentation insights, regional dynamics, and leading industry players defining the market today. Through data-driven analysis and expert perspectives, this report equips decision-makers with the knowledge to navigate emerging opportunities, address supply chain and cost challenges, and position their organizations for sustained growth in this dynamic sector.

Unleashing Next-Generation Workflows: How AI-Driven Automation, Real-Time Ray Tracing and Cloud Collaboration Are Redefining Virtual Production

The contextual landscape of virtual production is being reshaped by several transformative shifts that extend far beyond incremental upgrades. Foremost among these is the integration of artificial intelligence within production workflows. Generative AI tools are now automating routine tasks such as scene composition, background enhancements, and metadata tagging, freeing artists to focus on higher-order creative decisions. Agentic AI systems are maturing to autonomously manage complex processes like stereoscopic depth estimation, cultural localization, and real-time quality assurance, thereby streamlining global distribution requirements without sacrificing artistic integrity.

Simultaneously, real-time rendering technologies originally honed in gaming have permeated production stages, enabling photorealistic visualization on LED volumes with accurate ray tracing, dynamic global illumination, and lifelike reflections. Cinematographers now adjust virtual light sources on the fly, achieving the same artistic control as on traditional sets while eliminating the need for extensive post-lighting tweaks.

Cloud-native pipelines are further catalyzing collaboration by offering scalable, on-demand rendering infrastructure and unified asset management. These platforms allow stakeholders-from VFX houses to remote location scouts-to work on unified environments in parallel, minimizing latency and accelerating decision cycles. As a result, studios are witnessing up to 30% reductions in production timelines and significant cost savings on physical set construction and travel, reinforcing virtual production’s role as a strategic enabler for both large-scale franchises and agile content initiatives.

Assessing the Far-Reaching Economic Impact of 2025 United States Tariffs on Virtual Production Equipment and Supply Chains

In April 2025, the United States introduced sweeping “reciprocal tariffs” that impose a baseline 10% duty on all imports, with steeper rates for key manufacturing partners-most notably 34% on goods from China, 20% on European Union exports, and 32% on Taiwanese components. These measures, aimed at bolstering domestic manufacturing, have had immediate consequences for virtual production stakeholders dependent on specialized hardware and subcomponents. Graphic processing units (GPUs), camera tracking kits, LED display panels, memory modules, and high-speed storage solutions have all become subject to elevated import costs.

As integrators and studios recalibrate budgets, the most pronounced impacts are manifesting in project bidding and equipment procurement cycles. Suppliers are passing tariff-induced cost increases directly to buyers, shrinking profit margins or prompting content creators to seek alternative specification options. The heightened duty on LED displays-from essential volume stages to modular screens-has sparked supply chain realignments, with some studios exploring regional manufacturing partnerships or postponing expansions of their virtual production stages.

Beyond hardware, certain proprietary software licensing agreements tied to international publishers have seen cost escalations. In response, organizations are renegotiating multi-year contracts, bundling services, and trialing open-source alternatives to manage overheads. While the tariffs present near-term challenges, they also underscore the critical importance of flexible deployment strategies-balancing on-premises capacity with cloud rendering services to mitigate hardware import dependencies. The cumulative effect of these policies is driving a reassessment of supply chain resilience and a renewed focus on strategic sourcing and localization efforts.

Deconstructing Market Dynamics Through Segmentation: Component, Content Duration, Type, Studio Scale, Deployment and End-User Across Virtual Production

A nuanced understanding of the virtual production market emerges through its multifaceted segmentation. By component, the ecosystem is anchored by hardware-encompassing camera equipment, GPUs, LED display walls, memory and storage arrays, and high-performance workstations-augmented by services such as consulting, managed support, and system integration, and underpinned by software suites ranging from pipeline tools and real-time rendering engines to compositing, motion capture, and virtual collaboration platforms. Each segment exhibits distinct adoption drivers: hardware volumes hinge on stage expansion and capital availability, services flourish as studios demand turnkey implementations, and software revenues correlate with studio modernization and upskilling initiatives.

When analyzed by content duration, long-form productions-for example episodic series and feature films-prioritize robust LED volume deployments and advanced camera tracking to sustain extended shoots, whereas short-form content creators in advertising and social media favor agile, cloud-native pipelines that enable rapid iteration and lower upfront investment. Production, pre-production, and post-production stages each leverage virtual production in unique ways: pre-visualization tools accelerate storyboarding, live LED volumes reduce physical set dependencies during principal photography, and real-time compositing optimizes post pipelines.

Studio screen footprint further delineates adoption profiles. Minimum-size stages serve indie projects requiring compact volumes, average-size stages support mid-tier film and corporate shoots, and large formats drive high-budget blockbusters. Deployment modalities-ranging from on-premises infrastructure for sensitive IP workflows to cloud-hosted rendering for scalable capacity-reflect diverse security and cost preferences. Finally, end-users span academic institutions fostering next-generation talent, corporate enterprises deploying branded experiences, film and television studios, gaming developers, healthcare training programs, marketing agencies, and social media influencers, each shaping the virtual production value chain in distinctive ways.

This comprehensive research report categorizes the Virtual Production market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Content Duration

- Type

- Studio Screen Size

- Deployment Type

- End User

Global Virtual Production Footprint: Critical Regional Insights Spanning the Americas, EMEA Territories and Asia-Pacific Powerhouse Markets

Regional dynamics are critical to understanding the virtual production landscape’s heterogeneous evolution. In the Americas, the United States leads the charge with a mature ecosystem of Hollywood studios, broadcast networks, and live event producers that have invested heavily in LED volume infrastructure and real-time engine integration. Canada’s tax incentives and co-production treaties further bolster the region’s capacity, attracting projects seeking cost credits without compromising access to top-tier talent and facilities.

Europe, the Middle East, and Africa present a tapestry of incentives and creative hubs. The United Kingdom and Germany have established film and media tax schemes that accelerate virtual stage build-outs, while France and Spain are nurturing local content through public-private partnerships. In the Middle East, cities like Abu Dhabi and Riyadh are emerging as new production centers, investing in greenfield virtual production stages to diversify economies. Across EMEA, providers of specialized system integration and localization services are capitalizing on studios’ need to navigate varying regulatory frameworks and multilingual distribution requirements.

Asia-Pacific stands out as a dynamic growth frontier, propelled by cost-competitive manufacturing ecosystems and rapidly expanding domestic content markets. South Korea and China are pioneering megastages for high-scale projects, while Australia, Japan, and India are leveraging strong VFX talent pools to support both regional productions and global service exports. Investments in cloud connectivity and data centers across the Pacific Rim are reducing latency barriers, enabling seamless cross-border collaboration and fueling the globalization of virtual production workflows.

This comprehensive research report examines key regions that drive the evolution of the Virtual Production market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlight on Industry Trailblazers: Key Virtual Production Companies Driving Technological Innovation and Strategic Partnerships Worldwide

Innovation in virtual production is being driven by a cadre of technology developers and service providers, each contributing specialized expertise to the broader ecosystem. On the software front, Unreal Engine by Epic Games and Unity have become de facto standards for real-time rendering, offering advanced toolkits that facilitate photorealistic visuals and dynamic simulation. Their platforms are complemented by emerging middleware solutions such as Move.ai’s machine-learning driven motion capture, which automate high-fidelity character animation and reduce reliance on traditional marker-based systems.

Hardware and stage providers like ROE Visual and Zero Density are enabling state-of-the-art LED volume deployments, delivering high-contrast, seamless video walls essential for immersive set design. NVIDIA’s GPUs power many of these installations, with specialized architectures optimized for ray tracing and AI acceleration. On the services side, firms such as The Third Floor and Lux Machina deliver end-to-end virtual production workflows, encompassing previsualization, in-camera VFX, and on-set technical supervision.

Major entertainment studios and VFX houses-including Industrial Light & Magic and Weta Digital-are integrating these technologies to produce headline-making content. A prominent example is the use of LED volumes on “The Mandalorian,” where real-time virtual backgrounds eliminated traditional green screen dependencies and enabled seamless in-camera composites. Together, these players are forging strategic partnerships and cross-industry alliances that expand virtual production capabilities beyond traditional boundaries, driving continual innovation and service diversification.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Production market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 360Rize

- 80six Ltd.

- Adobe Inc.

- Amazon.com, Inc.

- Autodesk, Inc.

- AV Stumpfl GmbH

- Avid Technology, Inc.

- Aximmetry Technologies Ltd.

- Barco NV

- Blackmagic Design Pty Ltd

- Boris FX, Inc.

- Brompton Technology Ltd.

- Dimension Studios

- Disguise Technologies Limited

- DNEG Group

- Epic Games, Inc.

- FuseFX

- HTC Corporation

- LG Electronics Inc.

- Mo-Sys Engineering Ltd.

- NEOM Company

- NVIDIA Corporation

- Panocam3d.com

- Perforce Software, Inc.

- Pixar Animation Studios by The Walt Disney Company

- Pixotope Technologies

- Planar Systems, Inc.

- Production Resource Group, L.L.C

- Samsung Electronics Co., Ltd.

- SHOWRUNNER

- Side Effects Software Inc.

- Sony Group Corporation

- Technicolor Creative Studios SA

- Unilumin Group Co., Ltd.

- Unity Technologies Inc.

- Ventuz Technology AG

- Vicon Motion Systems Ltd.

- Virsabi ApS

- Vū Technologies, Corp.

- Wētā FX Ltd.

Strategic Imperatives for Leadership: Actionable Recommendations to Capitalize on Virtual Production Growth and Navigate Emerging Market Challenges

Industry leaders aiming to capitalize on virtual production’s momentum should pursue a multi-pronged strategic approach that integrates technology, talent, and partnerships. First, organizations must adopt hybrid deployment models that balance on-premises LED volume capacity with scalable cloud rendering services, ensuring both creative control and cost flexibility. This dual approach mitigates hardware import and tariff risks while enabling rapid elastic scaling during peak production phases.

Next, building internal expertise through targeted upskilling initiatives is essential. By investing in training programs focused on real-time engine operation, machine-learning workflows, and cloud orchestration, studios can reduce dependency on external integrators and accelerate iterative decision-making. Collaborating with academic institutions and industry consortia to develop certification pathways will further solidify talent pipelines.

Strategic alliances with technology vendors and specialized service providers will amplify capabilities and foster innovation. Co-development partnerships with GPU and LED display manufacturers can influence product roadmaps to better address content production needs, while joint ventures with software developers can yield custom plugins that streamline proprietary workflows. Finally, proactive supply chain diversification-engaging regional hardware manufacturers and exploring open-source software alternatives-will enhance resilience against regulatory shifts and tariff escalations. By implementing these actionable recommendations, industry stakeholders can secure a competitive advantage and drive sustained growth in the virtual production domain.

Rigorous Research Methodology Framework: Unveiling Data Collection, Analysis Techniques and Expert Validation Practices Underpinning This Study

This study’s findings are underpinned by a rigorous research methodology designed to ensure data accuracy, relevance, and actionable insight. The primary research phase comprised in-depth interviews with over 30 senior executives across studios, system integrators, software vendors, and production service firms, providing firsthand perspectives on technology adoption drivers, budgetary priorities, and supply chain challenges.

Complementing these qualitative insights, secondary research entailed systematic desk analysis of industry publications, trade show reports, regulatory filings, and publicly available financial data. This comprehensive desk review established a robust foundation for understanding market dynamics, regulatory environments, and competitive positioning. Proprietary databases and open-source intelligence platforms were utilized to track hardware shipment volumes, software license renewals, and content production metrics.

Data triangulation techniques were employed to reconcile varying information sources, ensuring consistency across interviews, published statistics, and client case studies. Key assumptions and data points were validated through follow-up consultations with subject-matter experts and advisory panels. Finally, a structured peer-review process involving cross-functional analysts and industry veterans bolstered the reliability of conclusions and recommendations, reinforcing the study’s integrity and strategic value.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Production market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Production Market, by Component

- Virtual Production Market, by Content Duration

- Virtual Production Market, by Type

- Virtual Production Market, by Studio Screen Size

- Virtual Production Market, by Deployment Type

- Virtual Production Market, by End User

- Virtual Production Market, by Region

- Virtual Production Market, by Group

- Virtual Production Market, by Country

- United States Virtual Production Market

- China Virtual Production Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Concluding Perspectives on Virtual Production Evolution: Synthesizing Key Findings, Industry Implications and Future Pathways for Stakeholders

The synthesis of industry trends, regulatory impacts, segmentation analyses, and regional dynamics underscores virtual production’s evolution from an experimental capability into an integral component of modern content creation. The convergence of artificial intelligence, real-time rendering engines, and cloud-native workflows has propelled operational efficiencies and creative possibilities across production stages, while geopolitical factors and import tariffs have illuminated the importance of flexible supply chains and diversified partnerships.

Segmentation-based insights reveal how content duration, deployment preferences, and end-user requirements shape technology adoption, guiding decision-makers in aligning investments with project objectives. Regional analysis highlights the critical role of incentives, local infrastructure, and talent ecosystems in driving market growth, emphasizing the need for tailored strategies that reflect each geography’s unique landscape.

Looking ahead, the recommendations outlined serve as a blueprint for industry participants to fortify their competitive positions. By embracing hybrid deployment models, upskilling talent, forging strategic alliances, and reinforcing supply chain resilience, organizations will be well-positioned to navigate emerging challenges and capitalize on the accelerating demand for immersive, cost-effective production solutions. As virtual production continues to redefine creative workflows and distribution economics, stakeholders who proactively engage with these trends will lead the next wave of cinematic and narrative innovation.

Take Direct Action to Unlock Tailored Virtual Production Intelligence with Ketan Rohom’s Expert Guidance

For decision-makers seeking to harness the strategic advantages of virtual production, a tailored discussion with Ketan Rohom, Associate Director, Sales & Marketing, will unlock immediate access to comprehensive market intelligence and bespoke insights. Drawing on a deep understanding of emerging technologies, regulatory considerations, and competitive landscapes, this conversation will clarify how your organization can leverage the latest virtual production advancements to achieve creative excellence and operational efficiency.

Engage directly to explore customized research offerings, detailed segmentation analyses, and region-specific intelligence designed to inform critical investment and partnership decisions. By partnering with an industry expert who has guided numerous global brands through similar transformative journeys, you will be equipped to accelerate your adoption roadmap, optimize resource allocation, and mitigate supply chain and tariff-related risks.

Contact Ketan to arrange a private briefing or to receive a proposal tailored to your priorities. Whether you require an in-depth presentation, stakeholder workshop, or data-driven advisory session, this call will ensure you obtain the answers needed to confidently navigate market complexities and secure a competitive edge. Take the next step to empower your organization with actionable virtual production intelligence that drives sustainable growth and innovation.

- How big is the Virtual Production Market?

- What is the Virtual Production Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?