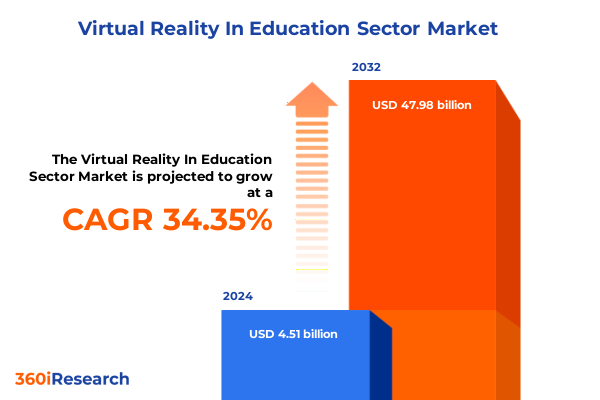

The Virtual Reality In Education Sector Market size was estimated at USD 6.05 billion in 2025 and expected to reach USD 8.11 billion in 2026, at a CAGR of 34.41% to reach USD 47.98 billion by 2032.

Pioneering Immersive Learning Through Virtual Reality to Revolutionize Educational Experiences and Empower Next Generation Learners

The integration of virtual reality into educational settings has transcended novelty, emerging as a fundamental catalyst for immersive learning. Educational institutions are now leveraging VR to create environments where abstract concepts become tangible experiences, enabling learners to explore complex subjects in ways previously unimaginable. This shift is driven not only by technological advancements but by a pedagogical imperative to foster deeper engagement and retention among students.

The adoption of VR tools is supported by pioneering companies such as Avantis, whose tailored headsets are enhancing classroom engagement through innovative immersive journeys tailored to curricular needs. Complementing this, Meta’s introduction of Meta for Education has broadened access to mixed and virtual reality platforms, empowering educators with managed solutions that facilitate the creation of interactive experiences across diverse subject areas. These developments reflect a growing consensus: VR is no longer peripheral to educational strategies but central to reimagining learning experiences for the digital age.

Navigating Transformative Shifts in Education: From Remote Learning Imperatives to AI-Enhanced Virtual Reality Engagement

The landscape of education is in the midst of transformative shifts, as traditional pedagogical models are disrupted by immersive virtual reality applications. Remote and hybrid learning imperatives, initially catalyzed by global events, have evolved into robust strategies that integrate VR as a core component of curriculum delivery. Educators increasingly recognize the capacity of VR to bridge geographical divides, bringing virtual laboratories, historical simulations, and language immersion environments directly into the classroom.

Concurrently, advancements in artificial intelligence are enhancing VR content personalization, enabling platforms to adapt learning pathways in real time based on student interactions and performance metrics. This synergy between AI and VR is fostering adaptive learning experiences that cater to individual needs, thereby driving engagement and reinforcing mastery of complex concepts. Such innovations mark a decisive departure from one-size-fits-all instruction toward dynamic, student-centered learning ecosystems.

Assessing the Cumulative Effects of Recent United States Tariff Measures on Virtual Reality Adoption in Educational Environments

The recent imposition of United States tariffs on imported virtual reality hardware and components has introduced significant cost pressures for educational institutions. With duties rising to 54% on Chinese goods and 46% on those from Vietnam, the landed cost of head-mounted displays and motion-sensing controllers has escalated substantially. Schools and universities are now compelled to reassess procurement strategies, factoring in total cost of ownership analyses to ensure sustainable adoption of VR technologies.

Moreover, supply chain disruptions have prompted a reevaluation of sourcing partnerships, with many providers shifting assembly operations to tariff-exempt jurisdictions where feasible. In parallel, service providers are bundling maintenance, consulting, and training agreements to mitigate upfront hardware expenses. These adaptive strategies illustrate the resilience of the education technology sector: even amid trade policy uncertainties, stakeholders are optimizing procurement and support frameworks to preserve momentum in immersive learning initiatives.

Unlocking Market Segmentation Insights to Reveal the Intricate Components and Diverse Uses of Virtual Reality in Education

In analyzing market segmentation by component, it becomes evident that hardware remains the foundational pillar, driven by demand for tactile controllers, head-mounted displays, and precision sensors. Yet software and services are integral to unlocking the full value of VR platforms, encompassing content development suites, learning management integrations, consulting engagements, installation support, maintenance protocols, and specialized training programs. Together, these elements form a comprehensive ecosystem that enables seamless deployment and ongoing optimization of virtual learning solutions.

From a technology perspective, educational VR applications span the spectrum from semi-immersive systems-where digital content augments physical environments-to fully immersive experiences that transport learners into entirely virtual domains. These modalities accommodate diverse pedagogical objectives, ranging from collaborative learning spaces and virtual field trips to highly specialized simulation laboratories in engineering, medicine, and STEM disciplines.

Application-driven segmentation reveals priority use cases such as collaborative learning environments, language laboratories, virtual classrooms, and curated virtual field trips. Simulation laboratories, in particular, support engineering design challenges, medical procedure training, and STEM experiment replication, offering risk-free, cost-effective alternatives to physical labs. Additionally, end-user analysis highlights the tailored needs of corporate training, higher education, K-12 environments, and vocational training programs, each demanding distinct content, hardware configurations, and support services to achieve targeted educational outcomes.

This comprehensive research report categorizes the Virtual Reality In Education Sector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Application

- End User

Illuminating Regional Dynamics to Understand How the Americas, EMEA, and Asia-Pacific Shape Virtual Reality Adoption in Education

In the Americas, leadership in VR education is underscored by strategic partnerships and grant-funded initiatives. Meta’s collaboration with New Mexico State University, backed by significant funding, exemplifies how institutions are cultivating VR champions to expand immersive teaching across K-12 classrooms. Concurrently, companies such as zSpace are securing awards for headset-free AR/VR laptops tailored to primary education, demonstrating the region’s commitment to inclusive, scalable solutions that address diverse learner needs.

Across Europe, governmental frameworks and research collaborations are accelerating VR integration. Pilot studies conducted in academic institutions in Germany and the Netherlands illustrate proactive investments in virtual lab projects, while Horizon Europe grants continue to fund cross-border initiatives focused on VR pedagogy. Organizations are leveraging these resources to develop curriculum-aligned applications that align with vocational training standards and stimulate hands-on learning in science and technology disciplines.

The Asia-Pacific region stands at the forefront of VR adoption, propelled by robust government support and private sector investments. Nations such as China, Japan, South Korea, and India are channeling funds into digital transformation programs, fostering collaborations between technology providers and educational bodies. This concerted effort is driving widespread deployment of VR-based training modules in both academic and corporate contexts, positioning APAC as a key driver of innovation in global immersive learning trends.

This comprehensive research report examines key regions that drive the evolution of the Virtual Reality In Education Sector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators: An In-Depth Look at Key Virtual Reality Companies Driving Educational Technology Advancements

Leading the charge in educational virtual reality, Meta continues to refine its Quest device lineup and expand platform capabilities through Meta for Education, offering managed mixed-reality services that empower developers and institutions to create bespoke learning experiences. zSpace holds a prominent position with its headset-free AR/VR Imagine laptops, designed specifically for elementary environments and recognized with industry awards for innovation and user engagement.

HTC Vive, through its VIVERSE ecosystem, is demonstrating the potential of secure, decentralized virtual workspaces for collaborative learning and remote instruction, highlighted at events such as LEARNTEC 2025. Additionally, emerging specialists like Avantis are tailoring VR headsets to curricular needs, while zSpace’s Career Explorer application is setting new benchmarks for career readiness simulations in grades 5-8, pairing immersive AR/VR with AI-driven guidance for personalized exploration of high-demand vocations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Reality In Education Sector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantis Systems Ltd.

- Avantis Systems Ltd.

- Curiscope Ltd.

- ENGAGE XR Limited

- EON Reality, Inc.

- Google LLC

- HTC Corporation

- HTC Corporation

- Immersive VR Education plc

- Labster, Inc.

- Lenovo Group Limited

- Lenovo Group Limited

- Meta Platforms, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Nearpod Inc.

- Samsung Electronics Co., Ltd.

- Schell Games LLC

- Sony Group Corporation

- ThingLink Inc.

- Unimersiv Limited

- Veative Labs Pvt. Ltd.

- VictoryXR, Inc.

- Vuzix Corporation

- zSpace, Inc.

Strategic Recommendations for Industry Leaders to Capitalize on Virtual Reality Trends and Secure Competitive Advantage in Education

Industry leaders should prioritize strategic partnerships with VR content developers to ensure curriculum alignment and scalability. By co-creating tailored educational experiences, institutions can accelerate technology adoption and maximize learner engagement. Furthermore, investing in comprehensive professional development programs will equip educators with the skills needed to integrate VR tools effectively into lesson plans.

Supply chain resilience must be fortified through diversified sourcing strategies and service-level agreements that bundle hardware with consulting, maintenance, and training. Such agreements mitigate tariff-related cost shocks and foster long-term sustainability of VR initiatives. Additionally, leveraging data analytics capabilities to monitor usage patterns and learning outcomes will inform iterative improvements, enabling continuous refinement of content and delivery models.

Finally, organizations should explore opportunities to pilot semi-immersive and fully immersive scenarios across cross-disciplinary applications, from STEM simulations to virtual field trips. These pilot programs serve as proof points, demonstrating ROI and building stakeholder confidence, thereby laying the groundwork for broader deployment across institutional portfolios.

Comprehensive Research Methodology Detailing Multimodal Data Collection, Expert Validation, and Segmentation Analysis Processes

This research employs a multimodal methodology, integrating both primary and secondary data sources. Primary insights were gathered through structured interviews and focus group discussions with educational technologists, VR developers, and end-user stakeholders. Complementary survey data was collected from a representative sample of K-12 and higher education professionals to capture adoption drivers, challenges, and user satisfaction metrics.

Secondary research encompassed extensive review of corporate press releases, technology showcases, academic publications, and trade association reports. Key sources included industry news outlets such as UploadVR and Digital Education Awards, governmental grant databases, and peer-reviewed studies on immersive learning efficacy. Data triangulation techniques were applied to validate findings, and an expert advisory panel provided iterative feedback to refine segmentation frameworks and analytical models.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Reality In Education Sector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Reality In Education Sector Market, by Component

- Virtual Reality In Education Sector Market, by Technology

- Virtual Reality In Education Sector Market, by Application

- Virtual Reality In Education Sector Market, by End User

- Virtual Reality In Education Sector Market, by Region

- Virtual Reality In Education Sector Market, by Group

- Virtual Reality In Education Sector Market, by Country

- United States Virtual Reality In Education Sector Market

- China Virtual Reality In Education Sector Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings and Future Trajectories to Conclude the Evolutionary Impact of Virtual Reality in Education Sector

The convergence of technological innovation, pedagogical demand, and supportive policy frameworks has solidified virtual reality’s role as a transformative force in education. Despite challenges such as tariff-induced cost pressures and supply chain complexities, stakeholders have demonstrated adaptability through strategic sourcing, service bundling, and developmental partnerships.

Looking ahead, the maturation of AI-driven personalization, combined with progressing hardware affordability and interoperability standards, will unlock new frontiers in immersive learning. As educational ecosystems evolve, seamless integration of VR with broader digital infrastructures promises to foster holistic, experiential learning environments that cater to diverse learner preferences and institutional objectives. The evidence underscores that virtual reality is poised to redefine the educational landscape, offering a resilient, scalable approach to cultivating future-ready talent.

Take Action Now: Connect with Our Associate Director for Exclusive Insights and Secure Your Virtual Reality in Education Research Report

Ready to delve deeper into the transformative potential of virtual reality in education? Contact Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report today. Unlock tailored insights, detailed segmentation analysis, and expert recommendations that will equip your organization to stay ahead in this rapidly evolving landscape. Reach out now to explore partnership opportunities and gain the competitive edge you need to drive immersive learning initiatives forward.

- How big is the Virtual Reality In Education Sector Market?

- What is the Virtual Reality In Education Sector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?