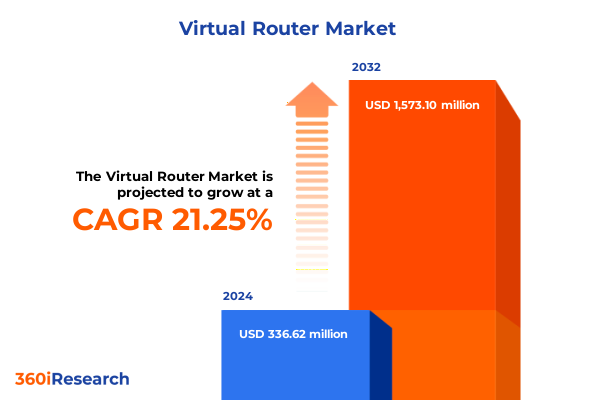

The Virtual Router Market size was estimated at USD 407.65 million in 2025 and expected to reach USD 487.98 million in 2026, at a CAGR of 21.27% to reach USD 1,573.10 million by 2032.

Exploring the Evolution of Virtual Routers A Comprehensive Overview of Technological Progress Market Drivers and Operational Benefits Shaping Modern Networks

The virtual router market stands at a pivotal juncture where technological innovation and evolving network demands converge to redefine how enterprises architect and manage their digital infrastructure. As organizations increasingly embrace the agility of software-defined solutions, virtual routers have emerged as a critical enabler of flexible, scalable, and cost-effective networking. This introduction sets the stage by exploring the core drivers that have transformed traditional routing paradigms, outlining the underlying forces that have led to widespread adoption of virtualization in network functions, and framing the scope of this executive summary.

Fundamentally, virtual routers decouple routing functionality from proprietary hardware, allowing network operators to deploy routing capabilities on commodity servers, cloud platforms, and edge nodes. This shift not only reduces capital expenditure but also accelerates the deployment of new services by eliminating hardware provisioning delays. Furthermore, the integration of virtual routers into software-defined networking (SDN) and network function virtualization (NFV) ecosystems has enabled centralized orchestration, enhanced programmability, and simplified management across heterogeneous environments. As we delve deeper in this report, the interplay between these technological advancements and market dynamics will become increasingly apparent, informing strategic decisions for stakeholders seeking to harness the full potential of virtualized routing solutions.

Unveiling Key Technological and Strategic Shifts Reshaping the Virtual Router Landscape for Resilient and Scalable Network Architectures

The landscape of network infrastructure has undergone transformative shifts over the past decade, driven by the relentless pursuit of agility, cost efficiency, and programmability. Initially dominated by traditional hardware-centric routers, the market progressively embraced software abstractions that redefined how routing logic is implemented and managed. This transformation accelerated as organizations sought to break free from vendor lock-in and leverage open standards to achieve greater interoperability.

Pivotal advancements such as cloud-native architecture have reoriented software design toward containerized deployments and microservices, empowering virtual routers to scale horizontally and recover automatically from failures. Similarly, the maturation of network function virtualization (NFV) has facilitated the encapsulation of routing functions into virtual network functions (VNFs), offering unprecedented flexibility in service chaining and network slicing. Concurrently, software-defined networking (SDN) has provided the central nervous system for network programmability, enabling dynamic traffic steering, policy enforcement, and unified orchestration across virtual and physical assets.

These technological paradigms have converged to foster an environment in which network operators can rapidly innovate, adapting to fluctuating traffic patterns, emerging security threats, and evolving regulatory requirements. The result is a landscape characterized by modular, API-driven ecosystems where virtual routers play a foundational role in delivering resilient connectivity, optimized traffic management, and accelerated service rollout.

Analyzing the Comprehensive Effects of 2025 US Tariff Policies on Virtual Router Supply Chains Cost Structures and Competitive Positioning

In 2025, the imposition and adjustments of United States tariffs on semiconductor components, networking hardware, and cloud computing equipment have exerted a cumulative impact on the virtual router market, resonating through supply chains, procurement strategies, and pricing models. Tariffs targeting critical semiconductor chips have led to elevated costs for underlying hardware, pressuring vendors to recalibrate product portfolios and explore alternative sourcing strategies to maintain competitive pricing and margin structures.

Beyond direct hardware costs, increased duties on network interface cards and specialized server architectures have compelled end users to reassess traditional deployment models. Many organizations have shifted workloads toward cloud service providers that absorb tariff-related expenses through economies of scale and multi-jurisdictional procurement practices, thereby mitigating localized cost pressures. This migration has not only accelerated cloud-centric virtual router adoption but also prompted OEMs to optimize software licensing frameworks for on-demand consumption, aligning with evolving customer preferences for opex-based models.

Moreover, tariff-driven uncertainties have incentivized strategic partnerships between chipset manufacturers, original design manufacturers, and virtual router software developers. By co-innovating on hardware-accelerated routing functions, these alliances aim to deliver performance-optimized solutions that offset tariff-induced cost increases. As we navigate the downstream effects of these policy changes, it becomes evident that tariff reshuffles have both challenged traditional value chains and catalyzed new collaborative models, ultimately reinforcing the agility imperative within the virtual router ecosystem.

In-Depth Analysis of Virtual Router Market Segmentation Spanning Components Technologies Deployment Industries Organization Sizes and Applications

A nuanced understanding of market segmentation delivers critical insights into how diverse customer needs and deployment contexts shape virtual router adoption and innovation. When examining segments based on component, the division between Service and Solution offers clarity on operational priorities. Services encompass installation integration, managed services, and support maintenance, reflecting the demand for end-to-end lifecycle management and ongoing optimization. Conversely, the Solution segment differentiates between integrated software-based routers that offer turnkey functionality and standalone virtual router software designed for seamless integration within existing infrastructures.

Drilling deeper into component technology, the emergence of cloud-native architecture underscores a shift toward containerized routing instances that benefit from microservices scalability. Network function virtualization (NFV) and software-defined networking (SDN) remain central, enabling modular deployment and centralized orchestration, while virtual machines continue to serve as a reliable foundation for VNFs. The rise of white-box networking further democratizes access, as disaggregated hardware running open-source routing software challenges traditional OEM models and fosters a competitive marketplace.

Deployment type also influences strategic decision-making, with cloud implementations offering elastic scaling and global reach, while on-premises deployments cater to stringent data sovereignty, latency and control requirements. When considering end-user industries, the financial sector’s emphasis on security and compliance contrasts with retail’s focus on customer-facing performance, and healthcare’s requirement for interoperability. Large enterprises and SMEs display distinct procurement behaviors that impact pricing models and partner selections, while applications such as campus networking, cloud connectivity, data center interconnect, edge computing and enterprise WAN illuminate specific traffic profiles and service delivery imperatives. These segmentation dimensions coalesce to map a dynamic market landscape where tailored offerings drive differentiated value propositions.

This comprehensive research report categorizes the Virtual Router market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Component Technology

- Deployment Type

- End User Industry

- Organization Size

- Application

Regional Dynamics and Adoption Patterns Impacting Virtual Router Deployment across the Americas Europe Middle East & Africa and Asia Pacific Regions

Regional insights reveal divergent adoption patterns and growth trajectories across the Americas, Europe Middle East & Africa, and Asia-Pacific, each influenced by unique regulatory environments, infrastructure maturity, and digital transformation agendas. In the Americas, strong investment in cloud services and early adoption of SDN and NFV have fostered a robust ecosystem for virtual router innovation. North American service providers and hyperscale cloud operators collaborate closely with software vendors to pilot advanced routing functions at the network edge, while Latin American markets are increasingly investing in digitalization initiatives to enhance connectivity and operational resilience.

Across Europe Middle East & Africa, regulatory frameworks emphasizing data sovereignty and cybersecurity have shaped deployment strategies, prompting organizations to favor hybrid models that combine cloud flexibility with on-premises control. Industry verticals such as government, defense and banking prioritize certified solutions that align with stringent compliance mandates, driving demand for hardened virtual routers with built-in security functions. Simultaneously, emerging markets within the region are leveraging public-private partnerships to modernize critical infrastructure, creating opportunities for virtualization and network function modularization.

In Asia-Pacific, rapid urbanization, proliferation of 5G networks and government-led smart city programs have spurred demand for scalable, software-driven routing platforms. Telecommunications operators in East and Southeast Asia are integrating virtual routers within network slicing frameworks to deliver differentiated services, while Australian enterprises emphasize edge deployments to optimize latency-sensitive applications. These regional nuances underscore the importance of contextual strategies, as vendors tailor offerings to meet localized requirements and capitalize on distinct growth pockets.

This comprehensive research report examines key regions that drive the evolution of the Virtual Router market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Strategic Moves Innovative Offerings and Competitive Highlights of Leading Virtual Router Market Participants

Key companies in the virtual router market have adopted a spectrum of strategies to solidify their positions and differentiate their offerings. Leading incumbents have invested heavily in research and development, blending proprietary routing software with cloud-native microservices to deliver high-performance, scalable solutions. Strategic alliances and acquisitions have further strengthened their portfolios, as they incorporate specialists in NFV orchestration, Kubernetes-based networking and advanced security modules.

At the same time, agile challengers leverage open-source frameworks and white-box hardware to undercut traditional pricing structures, appealing to cloud providers and service integrators seeking customization and interoperability. These nimble players cultivate developer communities and engage in collaborative ecosystem initiatives to accelerate feature development and foster standards alignment. Partnerships between chipset vendors and software firms have also become prevalent, driving hardware-accelerated routing capabilities that mitigate performance overhead and enhance encryption throughput.

Beyond technology differentiation, competitive positioning hinges on go-to-market strategies, with companies offering flexible licensing, pay-as-you-go consumption models and managed services that reduce deployment complexity. Expansion into adjacent domains such as SD-WAN, security virtual appliances and edge computing platforms has broadened addressable markets, enabling companies to cross-sell bundled solutions and deliver end-to-end connectivity stacks. Collectively, these strategic maneuvers underscore a market where innovation velocity and ecosystem collaboration are key determinants of leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Router market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon.com, Inc.

- Arista Networks, Inc.

- Broadcom Inc.

- Cisco Systems, Inc.

- Fortinet, Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- IP Infusion, Inc.

- Juniper Networks, Inc.

- Microsoft Corporation

- MikroTik SIA

- Netgate, Inc.

- Nokia Corporation

- NVIDIA Corporation

- Palo Alto Networks, Inc.

- Telefonaktiebolaget LM Ericsson

- VMware, Inc.

- VyOS Networks Corporation

- ZTE Corporation

Strategic Imperatives and Actionable Roadmap for Industry Leaders to Navigate Virtual Router Market Opportunities and Challenges with Confidence

Industry leaders must adopt a proactive stance to capitalize on the virtual router market’s evolving dynamics and mitigate potential headwinds. First, prioritizing investments in cloud-native development and container orchestration will ensure routing functions can scale seamlessly and integrate with modern DevOps pipelines. By aligning with emerging API standards and contributing to open-source projects, organizations can reduce development cycles and foster interoperability across vendor ecosystems.

Second, establishing strategic partnerships with chipset manufacturers and system integrators will facilitate the co-creation of hardware-accelerated virtual routers that deliver carrier-grade performance while offsetting tariff-induced cost pressures. These alliances should also encompass cybersecurity experts to embed advanced threat detection and encryption capabilities at the routing plane, addressing rigorous compliance requirements.

Third, leaders should tailor deployment frameworks to regional demands, offering a flexible mix of cloud, on-premises and edge implementations that align with local regulations and infrastructure profiles. Developing modular service packages-combining installation, managed services and support-will cater to both large enterprises and SMEs, ensuring that solution portfolios resonate across diverse customer segments.

Finally, fostering a customer-centric innovation model through continuous feedback loops and usage analytics will drive iterative enhancements, enabling companies to anticipate performance bottlenecks and deliver differentiated features. By operationalizing these strategic imperatives, industry leaders can secure a competitive edge and steer the market toward sustainable growth and resilience.

Comprehensive Research Framework and Methodological Approach Underpinning the Virtual Router Market Analysis with Rigorous Validation

This analysis is grounded in a rigorous research methodology designed to ensure the highest standards of reliability, relevance and rigor. Secondary research formed the foundation of our study, leveraging a broad spectrum of public domain sources, including technical whitepapers, regulatory filings, industry forums and vendor documentation. These sources provided contextual understanding of market trends, technology advancements and policy developments related to virtual routing.

Complementing desk research, extensive primary research was conducted through in-depth interviews with network architects, senior IT executives, service providers and independent analysts. These conversations yielded nuanced perspectives on procurement drivers, deployment challenges and innovation roadmaps. Additionally, surveys targeting end users across key industries furnished quantitative insights into adoption rates, feature preferences and investment priorities.

Data triangulation techniques were employed to validate findings, cross-referencing information from multiple sources to resolve discrepancies and enhance confidence in our conclusions. A structured framework guided the evaluation of segmentation variables, ensuring that component, technology, deployment type, industry vertical and application dimensions were analyzed with consistency. Quality control processes, including peer reviews and expert validation, underpinned each stage of the research to uphold accuracy and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Router market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Router Market, by Component

- Virtual Router Market, by Component Technology

- Virtual Router Market, by Deployment Type

- Virtual Router Market, by End User Industry

- Virtual Router Market, by Organization Size

- Virtual Router Market, by Application

- Virtual Router Market, by Region

- Virtual Router Market, by Group

- Virtual Router Market, by Country

- United States Virtual Router Market

- China Virtual Router Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesis of Key Findings Highlighting the Future Trajectory and Strategic Imperatives for Virtual Router Innovations and Adoption

In synthesizing the extensive research and analysis presented throughout this executive summary, several core themes emerge as pivotal to the future of virtual routing. The convergence of cloud-native architectures, NFV and SDN underpins a network fabric that is more agile, programmable and cost-effective than ever before. At the same time, regulatory dynamics and tariff fluctuations have underscored the need for strategic flexibility in sourcing and deployment decisions, driving collaborations that blend software innovation with hardware optimization.

Segmentation insights highlight the importance of tailored solutions that resonate with diverse customer needs-whether they prioritize turnkey software packages, managed services, or modular integration frameworks. Regional nuances emphasize that a one-size-fits-all approach is insufficient; instead, successful market players will calibrate their strategies to address regulatory requirements, infrastructure maturity and sector-specific imperatives across the Americas, EMEA and Asia-Pacific.

Ultimately, the virtual router market is entering a phase where innovation velocity and collaborative ecosystems will dictate competitive leadership. Organizations that align technology roadmaps with emerging standards, forge cross-industry partnerships and maintain a relentless focus on end-user value will be best positioned to harness the transformative potential of virtualization. As the digital landscape evolves, virtual routers will remain a cornerstone of network modernization, driving connectivity innovations and operational excellence.

Engage Directly with Ketan Rohom for Tailored Insights and Secure Your Access to the Complete Virtual Router Market Research Report Today

To gain a comprehensive understanding of the evolving virtual router market, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, for personalized guidance and exclusive access to our detailed market research report. Ketan Rohom brings extensive expertise in technology research and client engagement, ensuring that your organization receives tailored insights that align with your strategic objectives. By partnering with Ketan, you will secure actionable intelligence on emerging trends, competitive dynamics, and regional adoption patterns that will empower your decision-making process. Reach out to explore customized solutions, schedule a briefing, and discover how this report can drive your network transformation initiatives. Your journey toward informed investment, innovative deployment strategies, and accelerated ROI begins with a direct conversation. Seize the opportunity to explore every facet of virtual router advancements, from NFV and SDN integration to cloud-native deployments and tariff impact analyses. Connect with Ketan Rohom today to ensure your organization remains at the forefront of network agility, operational efficiency, and technological leadership.

- How big is the Virtual Router Market?

- What is the Virtual Router Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?