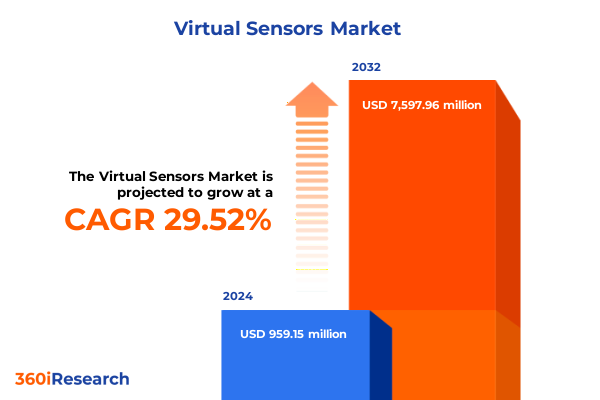

The Virtual Sensors Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.57 billion in 2026, at a CAGR of 29.73% to reach USD 7.59 billion by 2032.

Understanding the Rise of Virtual Sensors Pioneering a New Era of Connectivity and Intelligent Data Acquisition Technologies

The proliferation of connected devices and the rapid adoption of Internet of Things (IoT) infrastructure have catalyzed the rise of virtual sensors as indispensable enablers of intelligent operations. As physical sensor networks evolve to integrate advanced data fusion techniques, the concept of virtual sensing has emerged, leveraging existing instrumentation, machine learning algorithms, and software models to infer measurements that would otherwise depend on costly or inaccessible hardware. By synthesizing a range of digital outputs, virtual sensors unlock unprecedented levels of granularity, allowing organizations to monitor critical parameters such as temperature, vibration, pressure, or chemical concentrations without deploying additional physical devices.

This paradigm shift extends far beyond cost and logistics advantages, as virtual sensors usher in new possibilities for adaptive and predictive analytics. Through seamless integration with edge computing architectures, these software-driven solutions deliver real-time insights at the point of operation, enabling autonomous decision-making loops and reducing latency. Moreover, their inherent scalability positions them as an optimal choice for environments marked by rapid growth or fluctuating demands, from expanding smart building complexes to sprawling industrial campuses seeking condition-based maintenance strategies. In this context, virtual sensors represent more than a technological novelty; they form the cornerstone of next-generation digital transformation journeys, paving the way for more resilient, sustainable, and intelligent operations across a multitude of sectors.

Identifying the Key Technological and Market Shifts Redefining Virtual Sensor Capabilities and Industry Adoption Dynamics

Over the past few years, virtual sensors have transcended the boundaries of experimental pilots to become strategic assets in mainstream industrial and commercial ecosystems. This evolution has been driven by the convergence of several technological breakthroughs, including enhanced computational capabilities at the edge, broader availability of high-fidelity simulation models, and advancements in machine learning frameworks optimized for embedded environments. Such developments have collectively reduced the time to deployment and increased the accuracy of inferred measurements, virtually eliminating the traditional trade-off between speed and precision.

In parallel, macroeconomic and regulatory forces have steered organizations toward data-centric operational architectures. Environmental monitoring initiatives now demand continuous compliance reporting and transparent carbon tracking, prompting utilities and energy companies to adopt virtual sensing solutions for pipeline integrity checks and grid stability assessments. Similarly, the automotive sector is restructuring its vehicle development cycles around digital twins, wherein virtual sensors simulate in-vehicle conditions to optimize connected vehicle systems and fleet management protocols. Beyond industrial applications, the healthcare industry has begun embedding virtual sensor algorithms within hospital equipment monitoring frameworks and patient telehealth platforms, thereby expanding remote care capabilities while minimizing physical contact. Collectively, these shifts underscore a broader trend: virtual sensors are no longer supplementary tools but essential drivers of competitive differentiation in an increasingly data-driven marketplace.

Assessing the Ripple Effects of Enhanced U.S. Tariff Policies on Virtual Sensor Supply Chains and Market Viability in 2025

In 2025, the United States implemented a new wave of tariffs targeting semiconductor components, specialized microelectromechanical systems (MEMS), and sensor chipsets imported from several major manufacturing hubs. This policy recalibration introduced incremental duties on discrete sensor modules and system-on-chip packages that underpin many virtual sensor offerings. Consequently, organizations reliant on imported hardware for calibration baselines have encountered upward pressure on their operational expenditures, compelling procurement teams to renegotiate supply agreements or absorb additional costs.

However, these emergent tariffs have also spurred a strategic recalibration across the value chain. Facing higher import duties, sensor solution providers have accelerated domestic production initiatives and diversified component sourcing to mitigate cost volatility. Collaborative ventures between established original equipment manufacturers and local semiconductor foundries have been announced to co-create sensor substrates optimized for virtual sensing algorithms. Transitioning production closer to end markets not only buffers companies against future tariff fluctuations but also bolsters supply resilience in the face of geopolitical uncertainties. Meanwhile, a subset of agile technology firms is capitalizing on open-source hardware architectures to reduce dependency on restricted component inventories and to maintain cost-competitive offerings in a dynamically shifting trade environment.

These adaptive strategies underscore a larger narrative: despite immediate cost headwinds, the recalibrated tariff landscape is fostering innovation in supply chain design and encouraging a shift toward modular, software-centric virtual sensor solutions. Organizations that proactively realign their sourcing and manufacturing footprints stand to benefit from reduced geopolitical risk and enhanced control over component lifecycles, positioning themselves for long-term stability in an increasingly protectionist trade environment.

Deriving Insights from Multi-Dimensional Segmentation of Virtual Sensor Market Based on Application Industry and Organization Size

When examining the virtual sensor domain through the lens of application categories, it becomes clear that asset tracking frameworks are catalyzing a shift toward digital logistics, with real-time location inference now achievable without extensive hardware retrofits. Simultaneously, environmental monitoring solutions have transitioned from periodic manual sampling to continuous virtualized assessments, enabling rapid response to pollution thresholds and regulatory demands. Within manufacturing and energy infrastructures, predictive maintenance algorithms harness virtual sensor outputs to preempt equipment failures, reducing unplanned downtime and optimizing maintenance cycles. On the smart building front, integrated HVAC and lighting systems leverage virtual temperature and occupancy sensors to adaptively modulate energy consumption, promoting sustainability goals while maintaining occupant comfort.

Analyzing this segmentation further by end-use industry reveals nuanced adoption patterns. In automotive applications, connected vehicles rely on virtual tire pressure and engine diagnostics sensors to improve safety protocols, whereas fleet management platforms use inferred telematics data to streamline routing and fuel usage. The energy and utilities sector benefits from virtual pipeline monitoring to detect anomalies in flow rates or pressure drops, while smart grid monitoring constructs digital overlays that predict load imbalances and facilitate dynamic energy distribution. Healthcare organizations integrate virtual monitoring into hospital equipment dashboards to track device performance, and patient monitoring systems are increasingly embedding virtual respiratory and cardiac sensors within telemedicine platforms to enhance remote care continuity. Meanwhile, large enterprises often lead in high-value use cases that demand extensive data fidelity and integration, whereas small and medium-sized enterprises gravitate toward plug-and-play virtual sensor packages that minimize integration complexity and upfront investment.

These layered segmentation insights underscore the importance of aligning virtual sensor deployments with specific operational objectives and organizational capabilities. By tailoring solution architectures to match both the application scenario and the structural scale of the end user, decision makers can maximize the efficacy of virtual sensing initiatives and ensure that anticipated performance outcomes align with strategic goals.

This comprehensive research report categorizes the Virtual Sensors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Organization Size

- Application

- End-Use Industry

Unveiling Regional Nuances Shaping Virtual Sensor Adoption Trends Across the Americas EMEA and Asia-Pacific Markets

Regional landscapes present distinct drivers and constraints for virtual sensor adoption, shaped by economic structures, regulatory environments, and technology infrastructure maturity. In the Americas, established industrial ecosystems in North America are complemented by emerging digitalization initiatives in Latin America. Corporations headquartered in the United States and Canada are pioneering virtual sensing initiatives in smart building portfolios and advanced manufacturing clusters, drawing on robust IoT connectivity frameworks. At the same time, resource-rich nations in South America are exploring virtual pipeline monitoring to optimize extraction operations under fluctuating commodity prices.

Across Europe, the Middle East, and Africa, regulatory directives aimed at carbon neutrality are propelling healthcare facilities and energy utilities toward virtual environmental sensing solutions. European Union standards for emissions monitoring have driven widespread integration of virtual exhaust gas sensors in industrial facilities, while Middle Eastern oil and gas conglomerates are piloting digital twin platforms augmented by virtual sensor inputs to enhance reservoir management. Africa’s burgeoning telecom infrastructure is laying the groundwork for remote patient monitoring programs that leverage software-derived health metrics in regions with limited physical medical assets.

In the Asia-Pacific region, rapid urbanization and large-scale infrastructure projects present a fertile ground for virtual sensors. Smart city programs in Southeast Asia and China are embedding virtual air quality indices into urban dashboards, while Japan’s manufacturing sector is adopting predictive maintenance frameworks grounded in virtual vibration and thermal sensors. India’s healthcare market, meanwhile, is accelerating telehealth adoption, integrating virtual cardiac and respiratory monitoring tools to address capacity constraints. These regional nuances emphasize that success in virtual sensor deployments hinges on a deep understanding of local regulatory landscapes, infrastructure readiness, and unique operational challenges.

This comprehensive research report examines key regions that drive the evolution of the Virtual Sensors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning and Innovation Focus of Leading Players Driving Competitive Dynamics in Virtual Sensors

Leading technology firms and industrial conglomerates are actively extending their portfolios to include virtual sensor platforms, recognizing the substantial opportunities presented by software-driven data acquisition. Legacy automation providers are embedding virtual sensing modules within their existing control systems, offering upgrade paths that minimize disruption to installed bases. Meanwhile, pure-play software firms are partnering with edge hardware specialists to deliver end-to-end solutions that encompass data capture, analytics, and visualization in a single package.

Strategic collaborations and acquisitions are also shaping competitive dynamics. Several multinational corporations have acquired niche startups offering advanced machine learning algorithms specialized in virtual sensor calibration, thereby accelerating their time-to-market for integrated solutions. Others are forging alliances with telecom operators to leverage 5G networks for real-time data transmission, enhancing the responsiveness of virtual sensor applications in remote or mobile environments. Technology innovators are investing heavily in research and development of self-tuning sensor models that adapt to changing operational contexts, reducing the need for manual recalibration and bolstering reliability.

These developments indicate that the market for virtual sensors is maturing, with incumbents and disruptors alike striving to differentiate through domain-specific expertise and scalable architectures. Organizations evaluating vendor options should assess providers’ track record in delivering secure, interoperable platforms, as well as their commitment to evolving standards and ecosystem partnerships. Ultimately, companies that combine deep vertical domain knowledge with robust digital platforms will be best positioned to capture the value at the intersection of physical operations and data-driven intelligence.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtual Sensors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Aspen Technology, Inc.

- Elliptic Laboratories A/S

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Infineon Technologies AG

- International Business Machines Corporation

- Microsoft Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Rockwell Automation, Inc.

- Schneider Electric SE

- Siemens AG

- STMicroelectronics N.V.

- Yokogawa Electric Corporation

Formulating Pragmatic Strategic Imperatives to Guide Industry Leaders in Leveraging Virtual Sensor Innovations for Competitive Advantage

To capitalize on the momentum behind virtual sensor technologies, industry leaders should prioritize the integration of edge artificial intelligence capabilities that enable autonomous decision-making at the device level. By embedding lightweight inference engines within virtual sensor architectures, organizations can reduce data transmission overhead and enhance real-time responsiveness, particularly in mission-critical applications such as industrial automation and healthcare monitoring.

Collaboration with telecommunications providers is another imperative, as the expansion of 5G and private wireless networks unlocks new use cases for mobile and distributed virtual sensing solutions. Joint development agreements can facilitate optimized network slices that guarantee low-latency connectivity and high reliability, laying the groundwork for scalable deployments across diverse geographies and operational conditions.

Furthermore, a robust cybersecurity framework must be established to protect virtual sensor data pipelines from emerging threats. Implementing end-to-end encryption, secure device authentication, and continuous vulnerability assessments will safeguard both intellectual property and operational continuity. Simultaneously, decision makers should explore modular subscription-based licensing models to lower adoption barriers for small and medium-sized enterprises while providing clear upgrade paths for large-scale enterprises.

By adopting these strategic imperatives-edge AI integration, telecom partnerships, stringent security protocols, and flexible commercial models-organizations can navigate the complexities of virtual sensor deployment and unlock sustained competitive advantages in a rapidly evolving technological landscape.

Detailing a Robust Mixed Methodology Integrating Primary and Secondary Research Techniques for In-Depth Virtual Sensor Market Analysis

This analysis is underpinned by a mixed methodology that integrates primary engagements with senior decision makers and domain experts alongside comprehensive secondary research. Primary data collection involved structured interviews with end users spanning automotive manufacturers, energy utilities, healthcare providers, and smart building operators to capture first-hand insights on deployment challenges, performance benchmarks, and future priorities. In parallel, discussions with technology vendors, system integrators, and component suppliers shed light on innovation roadmaps and commercialization strategies.

Secondary research encompassed an extensive review of technical journals, conference proceedings, patent filings, and regulatory documents to map the evolution of virtual sensor technologies. Market commentary from industry associations and trade publications was analyzed to corroborate emerging trends and validate the competitive landscape. Data triangulation techniques were employed to reconcile divergent viewpoints, ensuring the reliability and comprehensiveness of the findings.

Quantitative and qualitative data were synthesized through a structured framework that emphasizes thematic consistency and actionable insights. The research process also included validation workshops with select industry stakeholders, enabling iterative refinement of key themes and sensitivity testing of the strategic imperatives. This rigorous approach guarantees that the presented conclusions and recommendations reflect a balanced perspective grounded in empirical evidence and stakeholder consensus.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtual Sensors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtual Sensors Market, by Component

- Virtual Sensors Market, by Organization Size

- Virtual Sensors Market, by Application

- Virtual Sensors Market, by End-Use Industry

- Virtual Sensors Market, by Region

- Virtual Sensors Market, by Group

- Virtual Sensors Market, by Country

- United States Virtual Sensors Market

- China Virtual Sensors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Core Findings and Synthesizing Strategic Implications for Stakeholders in the Evolving Virtual Sensor Ecosystem

The ascendancy of virtual sensors marks a pivotal juncture in the trajectory of connected systems, transforming how organizations perceive and interact with physical processes. Core findings reveal that the integration of advanced analytics, edge computing, and modular software architectures has obliterated previous limitations around cost, scalability, and deployment velocity. Simultaneously, evolving trade policies and regional infrastructure imperatives are reshaping supply chains, underscoring the importance of local manufacturing and strategic sourcing partnerships.

Segmentation-driven insights highlight that each application domain and end-use sector demands tailored virtual sensing models, while organization size dictates commercialization preferences and integration complexity. Moreover, regional analyses demonstrate that regulatory frameworks and digital maturity levels are critical determinants of adoption pace and solution design. Competitive dynamics continue to intensify as established incumbents expand their digital portfolios and agile challengers introduce disruptive business models enhanced by open-source hardware and software ecosystems.

For stakeholders across the value chain-from component manufacturers to systems integrators and end users-the strategic implications are clear: success in the virtual sensor market will depend on the ability to synchronize technological innovation with operational realities. Leaders must invest in flexible architectures, collaborate across ecosystems, and maintain a forward-looking posture to harness the full benefits of software-driven sensing solutions. Ultimately, the convergence of data, connectivity, and intelligent inference heralds a new era of operational excellence and resilience.

Engaging with Ketan Rohom to Access Comprehensive Virtual Sensor Market Intelligence and Empower Informed Strategic Decision Making

We invite you to elevate your strategic initiatives by engaging directly with Ketan Rohom, Associate Director, Sales & Marketing. With an in-depth understanding of the virtual sensor landscape and its transformative potential across industries, he can guide you through the tailored insights and proprietary data contained within this comprehensive report. By securing your copy, you will gain exclusive access to detailed analysis of market dynamics, segmentation nuances, regional trajectories, and competitive benchmarks. Reach out to Ketan to schedule a personalized consultation and discover how these actionable intelligence packages can inform your next critical investment decisions and drive sustained growth in an era defined by data-driven innovation

- How big is the Virtual Sensors Market?

- What is the Virtual Sensors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?