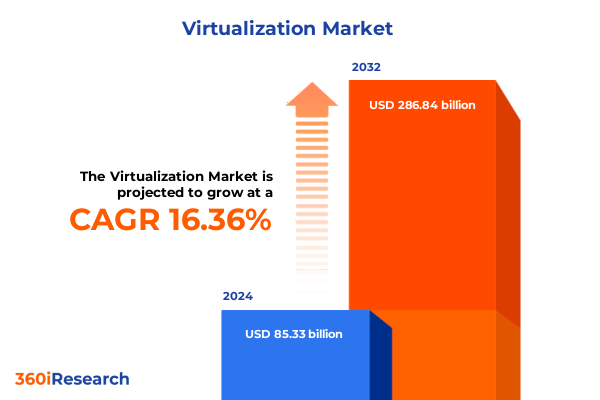

The Virtualization Market size was estimated at USD 98.91 billion in 2025 and expected to reach USD 114.84 billion in 2026, at a CAGR of 16.42% to reach USD 286.84 billion by 2032.

Understanding the Critical Role of Virtualization in Driving IT Agility, Efficiency, and Innovation Across Modern Enterprises

Virtualization has evolved from a niche optimization tool into a foundational pillar of modern IT architecture. By abstracting hardware resources into flexible software layers, organizations can achieve unprecedented levels of agility and operational efficiency. Since its inception in the early 2000s, virtualization has matured to encompass not only server consolidation but also desktop virtualization, network virtualization, and storage virtualization, all of which converge to support dynamic workloads and accelerate digital innovation.

In today’s technology-driven environment, virtualization underpins critical initiatives such as cloud migration, hybrid infrastructure management, and the delivery of software-defined services. It enables IT teams to provision and scale resources on demand, improving time-to-market for new applications while reducing capital expenditure on physical hardware. Furthermore, virtualization simplifies disaster recovery and business continuity planning by decoupling workloads from underlying infrastructure and allowing rapid failover across geographies.

This executive summary offers a strategic overview of the virtualization landscape in 2025, highlighting transformative shifts, tariff impacts, segmentation and regional insights, leading company strategies, and actionable recommendations. By examining these dimensions, we aim to equip decision-makers with the knowledge needed to navigate a market defined by rapid innovation, evolving regulatory pressures, and intensifying competition.

Exploring How Emerging Technologies Such as Containers, Edge Computing, AI, and Software-Defined Infrastructure Are Redefining Virtualization Strategies

As organizations strive for greater flexibility and control, virtualization technologies are undergoing a profound transformation. Containerization and microservices architectures are blurring the lines between traditional virtual machines and modern cloud-native workloads. Solutions such as Docker and Kubernetes now play a central role in application deployment, offering lightweight, portable environments that streamline continuous integration and delivery pipelines and enable rapid scaling of distributed services.

Network virtualization has also expanded its reach through the integration of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV). These trends empower organizations to programmatically manage network resources, dynamically allocate bandwidth, and deploy virtual network functions at the edge-reducing latency for mission-critical IoT and 5G applications while enhancing security through granular traffic segmentation.

Artificial intelligence and machine learning are increasingly embedded into virtualization management platforms, enabling proactive resource optimization, anomaly detection, and predictive maintenance. AI-driven orchestration tools can forecast workload demands, automatically adjust compute and memory allocations, and remediate potential failures before they impact performance, thereby driving higher infrastructure utilization and reducing operational overhead.

Moreover, the concept of the Software-Defined Data Center (SDDC) is gaining momentum, as enterprises virtualize compute, storage, and networking in a unified platform. This holistic approach simplifies administration, accelerates service delivery, and supports sustainability goals by consolidating hardware and optimizing energy consumption in data centers, reflecting an industry-wide commitment to reducing carbon footprints.

Assessing the Widespread Consequences of 2025 United States Tariff Policies on Hardware Costs, Supply Chains, and Virtualization Deployments

In 2025, the United States re-escalated tariff policies targeting key technology imports, with duties reaching as high as 145% on Chinese-manufactured components and up to 32% on goods from Taiwan. These measures, designed to bolster domestic production, have disrupted supply chains for servers, networking equipment, and storage arrays critical to virtualization deployments. The abrupt imposition and frequent adjustments of tariffs have introduced cost volatility, prompting IT buyers to revise procurement strategies and consider alternative sourcing to mitigate financial risk.

Major hardware vendors have passed price increases to enterprise customers, with routers and switches experiencing hikes of 10–15% and server platforms facing surcharges of up to 20%. For example, HPE ProLiant servers and Cisco Catalyst switches have both undergone significant list-price increases in direct response to duties applied in early 2025. These surcharges have eroded budgetary flexibility, leading organizations to delay planned virtualization expansions or extend hardware refresh cycles to preserve cash.

Efforts by global OEMs to diversify manufacturing beyond China into Vietnam, India, and Southeast Asia have been largely negated by the expansive scope of the new tariffs, which now encompass goods regardless of origin outside the United States. Consequently, companies that shifted production to avoid earlier levies find themselves facing similar rate structures, forcing many to pause capacity expansions and renegotiate contracts with vendors to secure more favorable terms.

The ripple effects extend to virtualization strategy choices, as higher infrastructure costs drive increased interest in cloud-based virtualization services and hyperconverged infrastructure solutions that bundle compute, storage, and networking. Meanwhile, IT organizations are adopting lifecycle extension practices such as firmware upgrades and preventive maintenance to maximize existing assets. These shifts underscore the importance of cost management and supply chain resilience in sustaining virtualization initiatives under continuous trade policy uncertainty.

Uncovering Critical Insights Across Type, Component, Deployment, and End-User Segmentations to Guide Virtualization Strategy Decisions

The virtualization market can be dissected through four primary lenses-type, component, deployment model, and end-user vertical-each offering unique insights into adoption drivers and technology priorities. In terms of type, organizations are evaluating a spectrum that spans application virtualization, desktop virtualization, network virtualization, server virtualization, and storage virtualization. Within this mix, network virtualization distinctively bifurcates into Network Functions Virtualization (NFV) and Software-Defined Networking (SDN), reflecting a drive toward flexible, software-managed connectivity frameworks.

When considering components, the virtualization ecosystem divides between software platforms and service offerings. Services encompass both managed services and professional services, the latter subdividing into consulting, integration, and ongoing support. Managed services further segment into maintenance and monitoring functions, illustrating the recurring operational demands associated with keeping virtual environments optimized and secure.

Regarding deployment, the dichotomy between cloud-based and on-premises solutions continues to shape infrastructure strategies. Cloud deployments appeal for their rapid scalability and simplified administration, while on-premises implementations offer control over data residency, security policies, and compliance mandates. Hybrid models that blend these approaches are increasingly prevalent, as they reconcile the need for agility with regulatory and performance considerations.

End-user adoption spans key verticals including banking, financial services, and insurance (BFSI); government agencies; healthcare providers; IT and telecommunications firms; and retail enterprises. Each vertical exhibits distinct virtualization imperatives-from secure handling of sensitive customer data in BFSI to the requirement for 24/7 availability in healthcare-underscoring the importance of tailored virtualization strategies aligned with specific workload characteristics.

This comprehensive research report categorizes the Virtualization market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Deployment

- Organization Size

- End User Industry

Analyzing Regional Dynamics Driving Virtualization Adoption and Innovation Trends Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping virtualization trajectories across the globe. In the Americas, strong cloud infrastructure investments and a vibrant start-up ecosystem have driven high adoption rates of container-based virtualization and hyperconverged infrastructure. North American enterprises often lead in early trials of next-generation virtualization models, leveraging competitive cloud pricing and broad partner networks to accelerate innovation.

Europe, the Middle East, and Africa (EMEA) present a heterogeneous virtualization picture, influenced by varying regulatory regimes and data sovereignty requirements. In regions with strict privacy laws, organizations prioritize on-premises virtualization and private cloud models to maintain compliance. Meanwhile, countries with progressive digital agendas, such as the Nordics and the UAE, are pioneering software-defined data centers and edge virtualization to support smart city and IoT deployments.

The Asia-Pacific region continues to exhibit robust momentum, propelled by government-backed digital transformation initiatives and rapid expansion of 5G networks. Cloud service providers are partnering with telcos to deploy edge virtualization nodes that reduce latency for gaming, e-commerce, and telemedicine applications. Moreover, cost-conscious enterprises in emerging markets frequently adopt open-source virtualization platforms to balance performance requirements with budget constraints.

Across all regions, the combination of geopolitical considerations, local ecosystem capabilities, and regulatory frameworks drives distinct virtualization strategies. Understanding these regional nuances is essential for vendors and service providers aiming to tailor offerings and optimize go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Virtualization market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Providers and Their Strategic Moves Shaping the Virtualization Ecosystem and Competitive Landscape in 2025

In the rapidly evolving virtualization ecosystem, leading technology providers are redefining strategic roadmaps and competitive positioning. Broadcom’s acquisition of VMware has ushered in substantial shifts to licensing models and partner programs. The transition to invitation-only cloud service provider frameworks and subscription-only licensing has prompted customers and resellers to explore alternative hypervisors and open-source solutions as a hedge against rising costs and restrictive terms.

Microsoft continues to fortify its desktop virtualization footprint through Azure Virtual Desktop, offering multi-session Windows 11 deployments with integrated security and autoscaling capabilities. By embedding virtualization services within the broader Microsoft 365 and Azure ecosystem, Microsoft provides enterprises with unified management tooling and native connectivity to cloud-based identity and device management platforms.

Citrix has responded to market demands by enhancing its Desktop as a Service (DaaS) portfolio, prioritizing mobile workforce enablement and GPU-accelerated workloads. Its platform now supports seamless device switching, broad OS compatibility, and integrated collaboration tools, making it an appealing choice for organizations with distributed teams and graphics-intensive applications.

Nutanix is distinguishing itself through a commitment to hyperconverged infrastructure and a hypervisor-agnostic strategy. At.NEXT 2025, the company unveiled "Project Beacon," which allows its Acropolis Operating System to run natively on Kubernetes without a traditional hypervisor. This milestone underscores Nutanix’s ambition to unify virtualization and containerization across hybrid and edge environments.

Amazon Web Services continues to innovate with the AWS Nitro System, a specialized hardware and hypervisor combination that offloads I/O and security functions to dedicated cards. This approach delivers near-bare-metal performance along with enhanced security, enabling AWS to introduce new instance types and isolated execution environments such as Nitro Enclaves for confidential computing workloads.

This comprehensive research report delivers an in-depth overview of the principal market players in the Virtualization market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accops Systems Private Limited.

- Adobe Inc.

- Alibaba Group

- Amazon Web Services, Inc.

- ATSCALE, INC.

- Broadcom Inc

- Calsoft Inc.

- CData Software, Inc.

- Cisco Systems, Inc.

- Cloud Software Group, Inc.

- Cognizant Technology Solutions Corporation

- Datameer, Inc.

- Datometry, Inc.

- Dell Technologies Inc.

- Delphix, Inc.

- Denodo Technologies Inc.

- Google LLC by Alphabet Inc.

- Gotham Technology Group, LLC

- Hewlett Packard Enterprise Company

- Infosys Limited

- International Business Machines Corporation

- Lyftrondata, Inc.

- Microsoft Corporation

- Millennium Technology Services Holding LTD

- NComputing Co. LTD

- NextAxiom Technology, Inc.

- Nutanix Inc

- Open Text Corporation

- OpenLink Software, Inc.

- Oracle Corporation

- SA SYSTANCIA

- Salesforce, Inc.

- Sangfor Technologies Inc.

- SAP SE

- SAS Institute Inc.

- Starburst Data, Inc.

- Stone Bond Technologies L.P.

- Zipstack Inc.

Implementing Actionable Strategies for Industry Stakeholders to Capitalize on Virtualization Advances While Mitigating Risks and Navigating Market Disruptions

To maintain a competitive edge, industry leaders must proactively embrace emerging virtualization paradigms while mitigating associated risks. Organizations should prioritize the evaluation of containerization and microservices to modernize application architectures, ensuring that development and operations teams align on cloud-native best practices. By integrating workload security measures such as zero-trust segmentation and automated vulnerability scanning, enterprises can reduce exposure within virtual environments and adhere to stringent compliance requirements.

CIOs and IT directors are advised to diversify their hardware supply chains to hedge against ongoing tariff volatility. This involves establishing relationships with both domestic manufacturers and alternative international assemblers unaffected by current trade restrictions. Additionally, adopting hybrid virtualization models-blending on-premises private clouds with public cloud services-can provide a balanced approach to cost efficiency, performance requirements, and regulatory compliance.

Virtualization roadmaps should include an explicit focus on lifecycle management and sustainability. Extending the operational lifespan of existing infrastructure through proactive maintenance and firmware optimization not only delays capital expenditure but also reduces environmental impact. Leaders can further enhance efficiency by implementing software-defined data center principles, consolidating siloed resources, and leveraging energy-aware orchestration tools.

Finally, decision-makers must closely monitor vendor strategies, ensuring that partner program changes, licensing transitions, and product consolidations do not disrupt critical operations. Establishing a governance framework to reevaluate vendor relationships on an annual basis will provide the agility needed to pivot toward emerging solutions that offer superior value and alignment with long-term business objectives.

Detailing a Robust Research Methodology Integrating Primary Interviews, Secondary Analysis, and Rigorous Validation to Ensure Comprehensive Insights

This research employs a multifaceted approach combining primary and secondary sources to deliver a comprehensive view of the virtualization market. Primary insights were derived from in-depth interviews with C-level executives, virtualization architects, and domain experts from leading enterprises. These conversations provided nuanced perspectives on adoption drivers, technology selection criteria, and future investment priorities.

Secondary research encompassed an exhaustive review of industry publications, vendor technical whitepapers, regulatory filings, and third-party analyst reports. By triangulating data from multiple reputable sources, we ensured that the findings reflect current market dynamics, emerging trends, and potential regulatory shifts affecting virtualization technologies and associated hardware.

Quantitative validation was achieved through surveys distributed to IT decision-makers across various verticals and geographies. Responses were aggregated and statistically analyzed to identify common patterns, ranking criteria by adoption frequency and satisfaction levels. This quantitative layer adds empirical weight to qualitative observations and highlights areas of consensus among practitioners.

Throughout the research process, rigorous validation protocols were maintained. Data points were cross-checked against publicly available financial disclosures, industry benchmarks, and recent technology announcements to confirm accuracy. The methodology ensures that strategic recommendations and market insights are grounded in verifiable evidence and real-world application.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Virtualization market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Virtualization Market, by Type

- Virtualization Market, by Component

- Virtualization Market, by Deployment

- Virtualization Market, by Organization Size

- Virtualization Market, by End User Industry

- Virtualization Market, by Region

- Virtualization Market, by Group

- Virtualization Market, by Country

- United States Virtualization Market

- China Virtualization Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Key Findings and Implications to Emphasize the Strategic Importance of Virtualization in Achieving Business Agility and Operational Excellence

The virtualization market in 2025 is characterized by rapid technological innovation, evolving regulatory landscapes, and shifting competitive dynamics. Containerization and AI-driven automation have become integral to modern virtualization strategies, enabling organizations to achieve unprecedented agility and operational resilience. At the same time, U.S. tariff policies have introduced new cost pressures and supply chain complexities that require adaptive procurement and hybrid deployment approaches.

Segmentation analysis reveals distinct adoption patterns by technology type, deployment model, and end-user industry, underscoring the importance of tailored strategies aligned with workload requirements and regulatory constraints. Regional insights highlight the diversity of virtualization use cases across the Americas, EMEA, and Asia-Pacific, driven by factors such as data sovereignty, digital transformation agendas, and infrastructure maturity.

Key vendor profiles demonstrate that both incumbent and emerging providers are refining their offerings to capture growth opportunities-through partnership ecosystems, hypervisor innovations, and security-focused architectures. This competitive landscape demands that enterprises maintain vigilance over licensing changes and strategic realignments to safeguard continuity and cost predictability.

In summary, virtualization remains a critical enabler of business transformation. By leveraging the insights contained within this report, decision-makers can develop informed roadmaps that balance technological advancement with risk management, driving both short-term efficiency gains and long-term competitive advantage.

Connect with Ketan Rohom to Unlock the Full Market Research Report and Gain Exclusive Virtualization Insights to Advance Your Strategic Decision-Making

For tailored insights and comprehensive analysis on the virtualization market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can provide you with the complete market research report. Engaging with Ketan will unlock detailed data, in-depth competitive benchmarks, and strategic guidance to support your decision-making process and ensure you stay ahead in today’s dynamic virtualization landscape.

- How big is the Virtualization Market?

- What is the Virtualization Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?