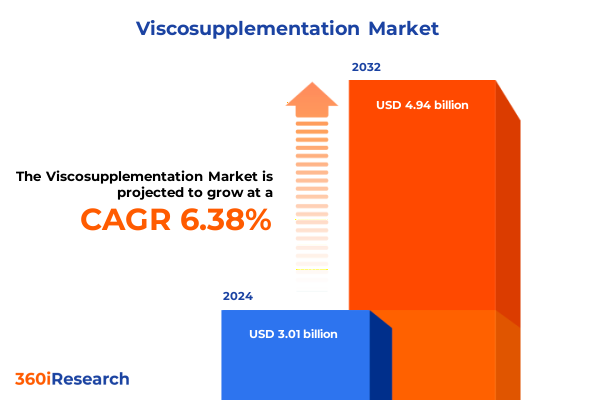

The Viscosupplementation Market size was estimated at USD 3.20 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 6.37% to reach USD 4.94 billion by 2032.

Unveiling the Latest Trends and Insights Shaping the Viscosupplementation Market for Enhanced Therapeutic Outcomes and Strategic Advantage

The field of viscosupplementation has undergone significant evolution in recent years as clinicians and patients alike seek advanced therapeutic options to manage joint degeneration and osteoarthritis symptoms. Innovations in formulation, delivery systems, and molecular engineering have elevated the role of hyaluronic acid injections beyond mere symptom relief, positioning these therapies as integral components of comprehensive joint care protocols. Today’s market is shaped by an increasing emphasis on precision medicine, where tailored treatment regimens and patient-centric outcomes drive product development and adoption.

Simultaneously, a convergence of regulatory scrutiny and reimbursement dynamics has prompted stakeholders to reexamine traditional approaches, fostering a climate of continuous improvement and real-world evidence generation. Technological integration, including digital monitoring tools and telehealth platforms, has further transformed patient engagement and treatment adherence, enhancing data collection and enabling more personalized therapeutic pathways. As a result, industry participants are challenged to innovate across clinical, commercial, and operational dimensions to stay ahead in an increasingly competitive environment.

Navigating Disruption Through Innovative Therapies and Digital Integration Redefining the Viscosupplementation Landscape Across Patient Care and Delivery Channels

The viscosupplementation landscape is experiencing transformative shifts driven by breakthroughs in cross-linked formulations that extend residence time and improve viscoelastic properties. Innovations such as multi-injection regimens and single-injection designs are redefining clinical practice, offering healthcare providers flexible treatment options tailored to patient needs. Concurrently, advancements in molecular weight optimization have led to both high and low molecular weight non-cross-linked variants that balance efficacy and safety profiles, supporting a more nuanced approach to joint lubrication and pain management.

Beyond product innovation, digital health solutions are reshaping distribution and patient support services. Integrated telemedicine platforms now facilitate virtual consultations, prescription management, and remote monitoring of therapeutic outcomes. This digital integration not only enhances access to care but also generates real-world evidence that informs payer coverage and clinical guidelines. Moreover, the surge in home-based administration models leverages patient education tools and remote supervision, empowering individuals to participate actively in their treatment journey. These shifts herald a new era of patient-centered care and operational efficiency within the viscosupplementation market.

Assessing the Far-Reaching Consequences of Newly Imposed Trade Duties on Domestic Production Strategies and Supply Chain Resilience in the United States

In response to the newly instituted trade duties on raw materials and finished products, industry participants have been compelled to reevaluate sourcing strategies and supply chain configurations. Increased import levies on hyaluronic acid precursors have driven manufacturers to diversify procurement footprints, with some establishing regional production hubs to mitigate cost pressures and reduce lead times. These adjustments have underscored the importance of supply chain resilience, prompting partnerships with contract developers and manufacturers located within tariff-exempt jurisdictions.

The cumulative burden of tariffs has also influenced pricing negotiations and reimbursement discussions, as payers seek to balance budgetary constraints with patient access imperatives. Some companies have responded by reformulating products to utilize alternative feedstocks or by pursuing value-based contracting models that align payment to clinical outcomes. In parallel, logistical adaptations-such as near-shoring of packaging operations and strategic stockpiling-have been implemented to ensure consistent deliverability to hospital and clinic pharmacies. These strategic responses to tariff-induced disruptions illustrate the market’s capacity for adaptation in the face of evolving trade policy landscapes.

Illuminating Critical Market Segmentation Dimensions and Their Influence on Therapeutic Adoption and Commercial Success Across Diverse Endpoints

A nuanced understanding of market segmentation is critical for stakeholders seeking to align product portfolios with clinical demand and commercial potential. From the perspective of product type, cross-linked hyaluronic acid formulations have gained traction due to their extended intra-articular persistence, with treatment regimens spanning both multiple-injection and single-injection protocols. Conversely, non-cross-linked variants are differentiated by molecular weight profiles-ranging from high to medium to low-which influence viscosity, residence time, and injection experience, thereby shaping physician preferences across different patient populations.

Examining application areas reveals that knee osteoarthritis remains the primary target for viscosupplementation interventions, although shoulder and hip indications are expanding as evidence accumulates around joint-specific outcomes. Ankle osteoarthritis, once considered a niche segment, is witnessing incremental adoption driven by specialized clinical practices. Distribution channel analysis highlights the evolving role of online pharmacies, which leverage mail order services and prescription portals to streamline access, complementing traditional hospital and retail pharmacy networks. In tandem, end-user categorization underscores the growing significance of home care administration, enabled through both assisted and self-injection models, alongside established delivery via hospitals and outpatient clinics, including orthopedic practices and rheumatology centers. This layered segmentation framework illuminates opportunities for differentiated product positioning and targeted market outreach.

This comprehensive research report categorizes the Viscosupplementation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application Area

- Distribution Channel

- End User

Exploring Geographical Variations in Market Dynamics and Access to Care Shaping the Viscosupplementation Ecosystem in Major Global Regions

Regional dynamics reveal distinctive drivers and challenges across the major global markets. In the Americas, a mature healthcare infrastructure and established reimbursement pathways support a high level of technology adoption, with physicians exhibiting strong preferences for advanced cross-linked formulations. North American markets, in particular, demonstrate robust clinical trial activity and real-world evidence initiatives that inform payer decisions and guideline updates. Latin American countries are gradually increasing viscosupplementation uptake as emerging economies invest in healthcare modernization and expand access to specialty care.

Within Europe, Middle East and Africa, heterogeneity in regulatory frameworks and reimbursement models creates a varied landscape where market entry strategies must be finely calibrated. Western European nations maintain consistent pricing policies and formalized health technology assessments, whereas Eastern European and Middle Eastern regions offer growth prospects through private pay channels and localized partnerships. The Asia-Pacific region is characterized by rapid urbanization, rising prevalence of osteoarthritis, and focus on cost-effective therapies, incentivizing manufacturers to introduce both premium and value-oriented product offerings. Regional insights underscore the necessity for agile market strategies that account for local healthcare systems, patient affordability, and distribution infrastructure.

This comprehensive research report examines key regions that drive the evolution of the Viscosupplementation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Driving Breakthroughs and Commercial Excellence in the Evolving Viscosupplementation Sector

Leading players in the viscosupplementation sector have distinguished themselves through robust pipelines, strategic collaborations, and targeted commercialization initiatives. Major biopharma companies have leveraged partnerships with specialty device manufacturers to co-develop novel delivery systems that enhance injection accuracy and patient comfort. Simultaneously, innovative biotech firms are advancing next-generation hyaluronic acid analogs, engineered to optimize molecular cohesion and inflammatory modulation. These collaborative models accelerate time to market and strengthen intellectual property portfolios, enabling sustained competitive differentiation.

Corporate strategies also emphasize geographic expansion and channel diversification. Several companies have forged alliances with regional distributors to penetrate underserved markets, while others have invested in digital platforms to facilitate direct-to-patient sales and virtual support services. In parallel, selective mergers and acquisitions have been deployed to acquire complementary assets and bolster manufacturing capabilities. Through these multifaceted approaches, industry leaders are consolidating their market positions, driving therapeutic innovation, and creating value across the viscosupplementation ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Viscosupplementation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anika Therapeutics, Inc.

- Bioventus Inc.

- Ferring International Center SA

- LG Chem Ltd.

- Lifecore Biomedical, LLC

- Sanofi SA

- Seikagaku Corporation

- Smith & Nephew plc

- Teva Pharmaceutical Industries Ltd.

- TRB Chemedica AG

- Zimmer Biomet Holdings, Inc.

Translating Insights into Strategic Actions to Enhance Competitive Positioning and Patient Outcomes in the Expanding Viscosupplementation Market

To navigate the complexities of the current market environment, industry participants should prioritize the development of differentiated value propositions that emphasize clinical efficacy and patient experience. Establishing real-world evidence programs in collaboration with leading orthopedic and rheumatology centers can substantiate product claims and support payer negotiations. Concurrently, investing in digital engagement tools-such as telehealth consultations and remote adherence monitoring-can enhance patient satisfaction and demonstrate outcomes in a measurable way, thereby reinforcing stakeholder confidence.

Additionally, optimizing supply chain resilience through strategic supplier diversification and regional manufacturing footprints will mitigate the impact of trade policy shifts. Companies should explore innovative contracting models, including risk-sharing agreements, to align product pricing with demonstrated therapeutic performance. Developing targeted marketing initiatives that address the specific needs of home care populations, outpatient clinics, and hospital systems will further refine market penetration efforts. By translating these insights into strategic actions, organizations can strengthen their competitive positioning and deliver superior value to both clinicians and patients.

Detailing a Rigorous and Transparent Approach to Data Collection Analysis and Interpretation That Underpins the Credibility of Market Findings

This report is grounded in a comprehensive research framework that integrates multiple data sources to ensure validity and reliability. Primary research included structured interviews with key opinion leaders in orthopedics and rheumatology, in-depth discussions with supply chain and distribution executives, and patient focus groups to capture experiential insights. Secondary research encompassed a thorough review of peer-reviewed journals, regulatory filings, clinical trial registries, and industry white papers. Proprietary databases tracking product launches, patent filings, and market entry dates supplemented these sources to enrich the analysis.

Data synthesis involved triangulating findings across diverse inputs, reconciling any discrepancies through iterative validation rounds with subject matter experts. Quantitative modeling employed rigorous statistical techniques to examine trends in adoption rates, therapy utilization patterns, and channel performance, while qualitative assessments provided context around regulatory and reimbursement environments. The iterative nature of this methodology ensures that conclusions are robust, transparent, and reflective of both current realities and emerging trajectories within the viscosupplementation sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Viscosupplementation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Viscosupplementation Market, by Product Type

- Viscosupplementation Market, by Application Area

- Viscosupplementation Market, by Distribution Channel

- Viscosupplementation Market, by End User

- Viscosupplementation Market, by Region

- Viscosupplementation Market, by Group

- Viscosupplementation Market, by Country

- United States Viscosupplementation Market

- China Viscosupplementation Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing Key Insights and Strategic Imperatives to Guide Decision Making and Drive Growth in the Highly Competitive Viscosupplementation Arena

The collective insights presented in this executive summary underscore a market in flux-driven by innovative formulations, digital transformation, and evolving trade policies that require agile strategic responses. Key segmentation analyses reveal opportunities to target distinct patient populations and optimize channel strategies, while regional comparisons highlight the importance of localized market approaches. Corporate intelligence points to a landscape where strategic alliances and targeted acquisitions play a pivotal role in sustaining growth and fostering innovation.

By synthesizing these findings, decision-makers can chart a roadmap that balances short-term tactical gains with long-term positioning advantages. Emphasizing value creation through clinical differentiation, operational efficiency, and patient-centric engagement will be essential to capitalize on the dynamic opportunities ahead. Ultimately, a cohesive strategy rooted in data-driven insights will enable organizations to thrive in the competitive and evolving realm of viscosupplementation.

Empowering Your Strategic Planning with Expert Analysis and Offering a Pathway to Unlock Invaluable Market Intelligence Through Direct Engagement

Harnessing expert insights and strategic analysis can significantly enhance your planning process and give you a competitive edge in addressing evolving market challenges. To access comprehensive data and in-depth perspectives that inform critical business decisions, we invite you to engage directly with our Associate Director of Sales & Marketing, Ketan Rohom. By connecting with him, you can explore tailored solutions, customize report deliverables to suit your organizational objectives, and secure a timely delivery of essential market intelligence. Reach out today to unlock actionable recommendations and secure your copy of the definitive research report on viscosupplementation, empowering your team to capitalize on emerging opportunities and drive sustained growth.

- How big is the Viscosupplementation Market?

- What is the Viscosupplementation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?