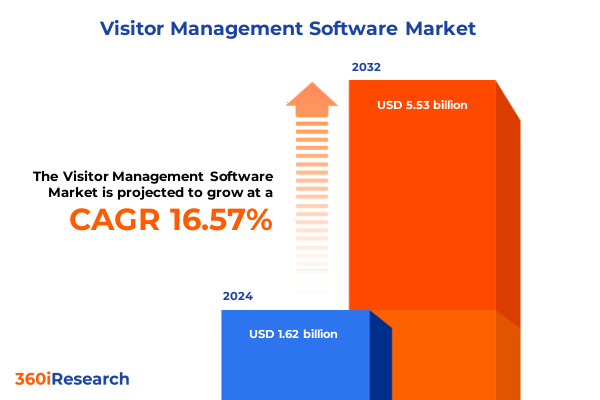

The Visitor Management Software Market size was estimated at USD 1.89 billion in 2025 and expected to reach USD 2.18 billion in 2026, at a CAGR of 16.55% to reach USD 5.53 billion by 2032.

Unveiling the Strategic Importance of Advanced Visitor Management Systems in Safeguarding Premises, Streamlining Operations, and Elevating Institutional Reputation

In an era defined by heightened security concerns, stringent compliance demands, and an uncompromising focus on operational efficiency, visitor management systems have emerged as a critical component of enterprise infrastructure. These solutions transcend mere sign-in sheets and identification verification; they deliver a cohesive framework that integrates access control, identity validation, and real-time analytics. Modern organizations recognize that safeguarding physical premises and delivering a seamless visitor experience are not mutually exclusive objectives. Instead, they represent complementary elements of a holistic approach to facility management and brand reputation.

Moreover, the convergence of digital transformation initiatives and evolving workplace models has accelerated the adoption of advanced visitor management platforms. As hybrid work patterns blur the lines between remote and on-site operations, enterprises seek cloud-enabled systems that ensure consistent security postures regardless of location. Concurrently, regulatory landscapes across industries mandate robust data privacy and audit capabilities, making comprehensive compliance reporting an indispensable feature rather than a differentiator. In this context, visitor management solutions have matured into strategic assets that not only mitigate risk but also drive operational insights and enhance stakeholder trust.

Navigating the Paradigm Shifts Driven by Digital Innovation, Cloud Migration, Biometric Integration, and Heightened Security Demands Shaping Visitor Management Solutions

The visitor management landscape has undergone transformative shifts as digital innovation, heightened security imperatives, and evolving workplace expectations intersect. In recent years, cloud migration has redefined the delivery model, enabling rapid deployment and continuous feature updates without the logistical constraints of on-premise infrastructure. This shift has been accelerated by the global health crisis, which underscored the value of touchless check-in, mobile credentialing, and remote functionality. As a result, organizations now demand platforms capable of orchestrating seamless experiences across physical and digital touchpoints.

Simultaneously, biometric integration and artificial intelligence have emerged as catalysts for differentiation. Facial recognition, iris scanning, and behavior analytics deliver unmatched accuracy and speed, reducing bottlenecks while bolstering security. These capabilities are increasingly embedded within visitor management offerings, fostering a proactive stance toward threat identification. Additionally, interoperability with existing security ecosystems-such as access control hardware, video surveillance, and identity governance solutions-has shifted from optional enhancement to foundational requirement. Underpinning all these trends is the drive for comprehensive reporting and analytics, empowering stakeholders to derive actionable insights from visitor patterns and compliance data.

Assessing the Far Reaching Consequences of United States Tariffs in 2025 on Software Solutions, Global Supply Chains, and Technology Adoption within Visitor Management

The imposition of new United States tariffs in 2025 has reverberated across global technology markets, precipitating notable impacts on visitor management solution providers. Tariffs targeting hardware components-ranging from server processors to biometric sensors-have raised the cost of integrated on-premise systems. Consequently, vendors have reevaluated their product portfolios, placing greater emphasis on software-only offerings and cloud-native architectures. The result is an accelerated migration toward subscription-based models that mitigate upfront capital expenditure and sidestep incremental tariff burdens.

Across supply chains, extended lead times for critical hardware have prompted organizations to reassess procurement strategies, often opting for modular deployments or leveraging local manufacturing partnerships to circumvent tariffs. Furthermore, the upward pressure on hardware pricing has intensified competition among cloud providers, driving innovation in infrastructure cost optimization. In response, leading visitor management platforms are negotiating bulk purchasing agreements and exploring alternative manufacturing regions to stabilize pricing. Ultimately, the tariff-driven environment has catalyzed a broader shift in buyer preferences, favoring flexible, scalable, and cloud-centric solutions over traditional integrated hardware-heavy implementations.

Exploring the Nuanced Market Segmentation of Visitor Management Deployments by Infrastructure, Enterprise Scale, Application Focus, and Industry Verticals for Strategic Clarity

A granular examination of market segmentation reveals critical dimensions that shape the competitive landscape and drive targeted value propositions. When considering deployment types, the divide between cloud and on-premise models emerges as a defining characteristic. Within the cloud segment, offerings span hybrid configurations that blend local control with scalability, private instances designed for enhanced security, and public environments optimized for cost efficiency. Conversely, on-premise implementations vary between integrated hardware solutions that deliver turnkey functionality and software-only packages that leverage customer-owned infrastructure.

Enterprise size further influences solution adoption, with large organizations prioritizing extensive feature sets, enterprise-wide integrations, and robust service-level agreements, while small and medium enterprises seek straightforward configurations, predictable pricing, and rapid time to value. Application-based segmentation underscores diverse use cases: check-in processes range from receptionist-assisted workflows to fully automated self-service kiosks; compliance management spans strict data privacy measures and comprehensive regulatory reporting; analytics modules cover both predictive insights and real-time dashboards; security management intertwines sophisticated access control with dynamic watchlist integration; and watchlist screening capabilities accommodate bespoke custom watchlists alongside government-maintained registers.

Industry vertical analysis illustrates that financial services institutions demand granular audit trails and stringent regulatory adherence, educational campuses focus on scalable solutions that cater to both K12 and higher education environments, government agencies at federal and subnational levels prioritize interoperability with existing security frameworks, and healthcare facilities balance the distinct needs of hospitals and clinics for rapid visitor throughput with data confidentiality.

This comprehensive research report categorizes the Visitor Management Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Industry Vertical

- Deployment Type

- Enterprise Size

Illuminating the Distinct Regional Dynamics Influencing Visitor Management Adoption Across the Americas, EMEA, and Asia Pacific Markets in a Post Pandemic Era

Regional dynamics play a pivotal role in shaping both demand patterns and solution design for visitor management systems. In the Americas, an emphasis on data sovereignty and stringent privacy legislation has driven organizations to adopt platforms with localized data storage and advanced consent management features. Moreover, the North American market’s appetite for integrated analytics has encouraged vendors to embed predictive modules that forecast visitor flows and optimize resource allocation. As digital transformation initiatives proliferate across Central and South America, cost-effective, cloud-based deployments are gaining traction, enabling institutions to leapfrog traditional infrastructure constraints.

In the Europe, Middle East & Africa region, regulatory complexity and diverse compliance regimes present unique challenges and opportunities. The GDPR framework has set a high bar for personal information handling, prompting solution providers to incorporate configurable data retention policies and granular access controls. Within the Middle East, national security mandates have elevated the importance of watchlist screening and biometric verification, while emerging African markets exhibit growing demand for mobile-first visitor management to accommodate remote and semi-urban environments.

Across Asia Pacific, rapid urbanization and digital government initiatives have accelerated the deployment of visitor management systems in industries ranging from manufacturing to hospitality. Countries with advanced digital infrastructure are pioneering AI-driven threat detection and mobile credentialing, whereas markets with nascent cloud adoption often rely on hybrid models that balance scalability with existing on-premise investments.

This comprehensive research report examines key regions that drive the evolution of the Visitor Management Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Providers Driving Innovation, Partnership Models, and Competitive Differentiation in the Dynamic Visitor Management Software Landscape

The competitive landscape of visitor management software is characterized by a blend of established security conglomerates and innovative pure-play technology vendors. Legacy providers have leveraged their deep expertise in access control and surveillance to extend into visitor-centric solutions, employing strategic partnerships to enrich functionality and enterprise reach. Conversely, emerging specialists have carved niches through cloud-first architectures, intuitive user interfaces, and tight integrations with modern identity platforms.

Strategic alliances between software vendors and hardware manufacturers have become increasingly common, facilitating turnkey deployments that reduce integration risks and accelerate time to deployment. In parallel, acquisition activity has consolidated the market, as larger players seek to incorporate biometric capabilities, advanced analytics engines, and industry-specific workflows into their existing portfolios. Innovation remains a key differentiator: leading vendors are harnessing machine learning to anticipate security risks, deploying mobile SDKs to simplify visitor credential issuance, and exposing open APIs to enable seamless interoperability with third-party solutions such as facility management platforms, HR systems, and emergency response tools.

This comprehensive research report delivers an in-depth overview of the principal market players in the Visitor Management Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelo, Inc.

- Envoy, Inc.

- Eptura Inc.

- Greetly, Inc.

- Happy Visitor Pvt. Ltd.

- Honeywell International Inc.

- iLobby Corp.

- Lobbytrack

- Proxyclick SA

- Qminder Ltd.

- Sign In App Limited

- SwipedOn Limited

- Teamgo Pty Ltd.

- The Receptionist, LLC

- Traction Guest Inc.

- Veris VMS Pvt. Ltd.

- VisitUs Reception Pty Ltd.

- Vizito BVBA

- Vizitor App Pvt. Ltd.

- VPass Pty Ltd.

Strategic Imperatives and Pragmatic Steps for Industry Leaders to Capitalize on Emerging Technologies, Regulatory Trends, and Customer Expectations in Visitor Management

To thrive in this rapidly evolving environment, industry leaders must embrace a series of actionable imperatives that align with both current realities and emerging opportunities. First, prioritizing investment in AI-driven analytics will enable organizations to shift from reactive incident management to proactive risk mitigation. By leveraging predictive algorithms that analyze visitor patterns, enterprises can anticipate congestion points, optimize staffing, and identify anomalies before they escalate.

Equally important is adopting a hybrid cloud strategy that balances the agility of public cloud services with the security assurances of private or on-premise deployments. Such an approach fosters resilience against tariff-induced hardware cost fluctuations and accommodates varying regulatory requirements across geographies. In addition, forging partnerships with complementary solution providers-such as access control manufacturers, identity management platforms, and emergency notification services-will deliver holistic value propositions and differentiate offerings in a crowded market.

Finally, elevating the user experience through intuitive self-service interfaces, mobile credentialing, and seamless integration with existing corporate directories will enhance adoption rates and drive stakeholder satisfaction. Flexible pricing models, including subscription tiers aligned with feature sets and usage volumes, will further ensure that solutions remain accessible to organizations of all sizes.

Detailing the Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Quantitative Modeling to Ensure Robust Visitor Management Market Insights

This research employs a robust, multi-faceted methodology designed to ensure comprehensive and reliable insights into the visitor management market. Primary research activities comprised structured interviews and roundtables with a diverse array of stakeholders, including CIOs, facility managers, security directors, and compliance officers. These engagements provided firsthand perspectives on deployment challenges, feature prioritization, and vendor selection criteria.

Secondary research formed the backbone of market context, drawing upon a wide spectrum of publicly available sources. Industry publications, technology whitepapers, patent filings, financial statements, and regulatory documents were meticulously reviewed to validate emerging trends and competitive dynamics. Quantitative analysis involved the application of advanced modeling techniques, such as regression analysis to identify key adoption drivers and scenario-based forecasting to assess the potential impact of economic and regulatory shifts.

To ensure data integrity, findings were triangulated across multiple sources, and an expert advisory panel of security consultants and software architects provided critical validation. This iterative process of cross-verification and calibration guarantees that insights are both reflective of current market realities and adaptable to future developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Visitor Management Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Visitor Management Software Market, by Application

- Visitor Management Software Market, by Industry Vertical

- Visitor Management Software Market, by Deployment Type

- Visitor Management Software Market, by Enterprise Size

- Visitor Management Software Market, by Region

- Visitor Management Software Market, by Group

- Visitor Management Software Market, by Country

- United States Visitor Management Software Market

- China Visitor Management Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Synthesizing Core Insights and Future Outlook to Empower Decision Makers in Harnessing Visitor Management Innovations for Enhanced Security, Compliance, and Efficiency

The convergence of security imperatives, digital transformation, and regulatory compliance has propelled visitor management from a peripheral administrative function to a central strategic priority. Organizations that adopt modern systems gain not only heightened protection against unauthorized access and data breaches but also actionable intelligence to optimize facility utilization and enhance stakeholder experiences. The interplay between cloud-first adoption, biometrics, and AI-driven analytics underscores the industry’s shift toward proactive, data-centric security paradigms.

Looking forward, the capacity to navigate external forces-such as evolving regulatory landscapes, geopolitical trade dynamics, and emerging technological innovations-will distinguish market leaders from followers. By leveraging flexible deployment architectures, embracing advanced analytics, and fostering strategic partnerships, organizations can build resilient visitor management frameworks that support future growth. Ultimately, harnessing these insights will empower decision makers to design environments that are not only secure and compliant but also welcoming and efficient, fostering trust among employees, visitors, and regulators alike.

Seize the Opportunity to Elevate Your Organization’s Security and Operational Excellence by Engaging with Ketan Rohom to Secure Your In-Depth Market Research Report

Embarking on this journey toward a secure and streamlined visitor management ecosystem is within reach. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to obtain the detailed research report that will serve as your strategic guide. By securing this comprehensive analysis, you will gain unparalleled visibility into emerging trends, competitive dynamics, and practical recommendations tailored to your organization’s unique security and operational challenges. Reach out today to transform your approach to visitor management and position your enterprise at the forefront of innovation and compliance.

- How big is the Visitor Management Software Market?

- What is the Visitor Management Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?