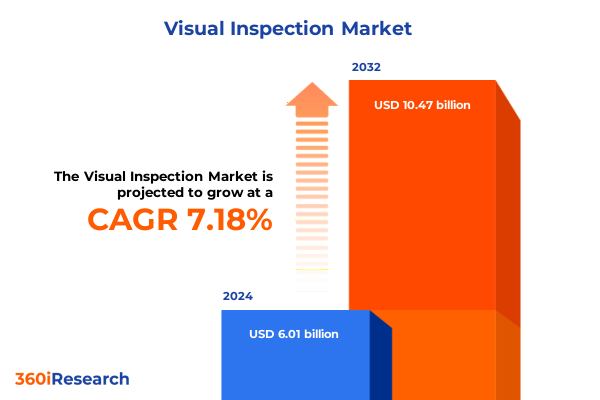

The Visual Inspection Market size was estimated at USD 6.44 billion in 2025 and expected to reach USD 6.87 billion in 2026, at a CAGR of 7.18% to reach USD 10.47 billion by 2032.

Envisioning the Future of Visual Inspection: Unveiling Key Developments Shaping Market Evolution and Strategic Imperatives

Visual inspection has emerged as a cornerstone of quality assurance and process optimization across manufacturing and service industries alike. As end users demand ever-higher standards of precision, speed, and consistency, traditional manual approaches are progressively giving way to automated, data-driven methodologies. This executive summary illuminates the fundamental drivers behind this evolution, distilling complex technological advancements and market dynamics into actionable perspectives for decision-makers. Through a nuanced exploration of recent breakthrough innovations, shifting regulatory environments, and evolving competitive pressures, we establish a clear context for understanding how organizations can harness the full potential of visual inspection solutions.

Against a backdrop of heightened global competition and increasing emphasis on operational resilience, an integrated visual inspection strategy emerges not only as a cost-mitigation tool but also as a catalyst for continuous improvement and digital transformation. In this report, we trace the convergence of hardware sophistication-ranging from advanced optics and high-resolution sensors-to intelligent software platforms that leverage artificial intelligence and machine learning. By weaving together these layers, we construct a comprehensive narrative that underscores the criticality of visual inspection in achieving zero-defect manufacturing, reducing downtime, and enabling predictive maintenance. This introduction thus sets the stage for a detailed examination of market shifts, tariff impacts, segmentation nuances, regional variances, corporate leadership, and strategic recommendations that will follow.

Unraveling Groundbreaking Technological and Operational Shifts Propelling the Visual Inspection Ecosystem into a New Era

The landscape of visual inspection is witnessing transformative shifts propelled by the rapid maturation of artificial intelligence and machine vision capabilities. Organizations are adopting deep learning algorithms that not only detect defects with unprecedented accuracy but also adapt dynamically to new product variants without extensive reprogramming. This transition from rule-based systems to adaptive AI-driven platforms is redefining the parameters of what constitutes a viable inspection solution.

Concurrently, the infusion of edge computing architectures is enabling real-time analysis at the point of capture, substantially reducing data latency and network dependency. By integrating edge nodes with scalable cloud infrastructures, enterprises are building hybrid frameworks that balance on-site speed with centralized data aggregation and advanced analytics. Standardization efforts, driven by industry consortia and regulatory bodies, are further facilitating interoperability between diverse hardware components and software modules, thus fostering a plug-and-play ecosystem that accelerates deployment timelines.

Moreover, a growing emphasis on sustainability and resource efficiency is steering investments toward energy-optimized lighting systems and modular camera arrays that can be reconfigured for multiple inspection tasks. This multi-dimensional transformation is raising the bar for suppliers, who now compete not merely on individual component performance but on their ability to deliver end-to-end solutions that integrate seamlessly into automated production lines. As a result, stakeholders must continuously recalibrate their strategies to remain aligned with the evolving benchmarks of speed, precision, and adaptability.

Assessing the Ripple Effects of 2025 United States Tariffs on the Visual Inspection Supply Chain and Cost Structures

In 2025, the United States implemented a suite of new tariff measures targeting imported hardware components vital to visual inspection systems. These levies, applied to categories including high-precision lenses, industrial cameras, and specialized sensors, have elevated procurement costs and prompted many manufacturers to reassess their supplier networks. The immediate outcome has been upward pressure on capital expenditure budgets, particularly within sectors that rely heavily on imported optics and imaging modules.

To counterbalance cost inflation, leading enterprises are pivoting toward strategies such as nearshoring and forging partnerships with domestic component producers. This realignment has accelerated investment in local manufacturing capabilities, driving innovation in home-grown optics fabrication and sensor assembly. At the same time, software providers have gained negotiating leverage, as organizations seek to offset hardware cost inflation by prioritizing advanced image processing and defect detection algorithms that can extract greater value from existing equipment.

The cumulative effect of these tariff adjustments is a bifurcation of the market: hardware suppliers face margin compression and longer lead times, while software and services vendors experience heightened demand for optimization solutions. Transitioning to diversified sourcing frameworks and hybrid inspection architectures has become imperative to mitigate supply chain risks. In this context, the 2025 tariffs have emerged not merely as a cost challenge but as a catalyst for supply chain resilience and strategic ecosystem reconfiguration.

Deconstructing Market Segmentation Dynamics to Reveal Critical Insights across Component Inspection Type and Industry Verticals

An in-depth segmentation analysis reveals the nuanced trajectories of hardware and software components within the visual inspection domain. Hardware investments continue to center on core devices such as cameras, frame grabbers, lenses, lighting systems, and sensors, yet the balance of spend is progressively shifting toward integrated packages that bundle multiple optical elements with edge-based processors. On the software front, platforms underpinned by AI and machine learning models are outpacing traditional image processing suites, with defect detection algorithms and pattern recognition modules driving premium service offerings.

Inspection type further delineates market behavior, as automated visual inspection accelerates uptake in high-volume, precision-critical environments, while manual inspection retains relevance in low-throughput or highly customized production contexts. Across application segments, assembly verification and presence/absence checks have achieved near-ubiquity in electronics and automotive manufacturing, whereas barcode reading and packaging inspection are increasingly leveraged in pharmaceuticals and food & beverage for traceability and compliance.

Organizational scale exerts considerable influence on purchasing patterns: large enterprises favor end-to-end turnkey systems that integrate seamlessly with existing automation platforms, whereas small and medium-sized enterprises often adopt modular, pay-as-you-go solutions that minimize upfront capital commitments. Vertical-specific dynamics also emerge clearly, as aerospace & defense demand ultra-high-resolution imaging for micro-defect detection, while machinery and heavy equipment sectors prioritize ruggedized hardware capable of withstanding harsh operational conditions. These segmentation insights equip stakeholders with a granular understanding of where growth vectors intersect with tailored solution requirements.

This comprehensive research report categorizes the Visual Inspection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Inspection Type

- Application

- Organization Size

- Vertical

Mapping Regional Market Trajectories to Highlight Growth Drivers and Challenges across Americas Europe Middle East Africa and Asia Pacific

Regional characteristics are shaping distinct growth trajectories for visual inspection technologies. In the Americas, strong manufacturing hubs in North America are driving continuous investments in automation, with automotive and electronics sectors leading deployment of high-speed inspection lines. Latin American markets, while still emerging, display growing interest in retrofit solutions to enhance quality control without extensive capital expansion.

Across Europe, Middle East, and Africa, stringent regulatory frameworks related to product safety and traceability are compelling manufacturers to adopt advanced inspection platforms. The European Union’s digital transformation agenda further incentivizes smart factory initiatives, while Middle Eastern industrial diversification programs are channeling funds into automation infrastructure. In Africa, burgeoning manufacturing clusters are evaluating cost-effective hybrid models that blend manual oversight with selective automation.

Asia-Pacific stands out as the fastest-evolving region, underpinned by robust electronics production in China, semiconductor advancements in Taiwan, and precision engineering innovations in Japan and South Korea. India’s rapid industrialization and government incentives for industry 4.0 adoption are expanding opportunities for both hardware suppliers and AI-centric software vendors. These regional insights underscore the importance of tailoring go-to-market strategies to local regulatory landscapes, investment climates, and sectoral priorities.

This comprehensive research report examines key regions that drive the evolution of the Visual Inspection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Innovations that are Redefining Competitive Landscapes in Visual Inspection Technologies

Leading companies in the visual inspection arena are distinguished by their ability to marry technological innovation with customer-centric solutions. Established hardware providers have broadened their portfolios through strategic mergers and acquisitions, integrating specialized optics and lighting manufacturers to offer seamless systems while accelerating time to market. Meanwhile, software innovators have forged partnerships with academic institutions and research labs to refine their machine learning frameworks, unlocking higher defect classification accuracy and reduced false-positive rates.

Collaborative ecosystems are increasingly prevalent, as integrators forge alliances with robotics vendors and enterprise software platforms to deliver end-to-end automated inspection workflows. This has given rise to consortium-based development models, wherein multiple stakeholders co-create open architectures that ensure cross-compatibility and facilitate rapid innovation cycles. Additionally, a wave of venture-backed startups is injecting fresh perspectives into the market, introducing niche products such as hyperspectral imaging solutions and self-learning visual quality control modules that adapt in real time to evolving production conditions.

Competitive differentiation hinges not only on technology but also on services capabilities. Companies that combine proactive maintenance offerings, remote diagnostics, and cloud-based performance dashboards are cultivating stickier customer relationships and unlocking recurring revenue streams. As a result, the competitive landscape is being reshaped by players that can deliver holistic value propositions, blending cutting-edge hardware, intelligent software, and comprehensive lifecycle services.

This comprehensive research report delivers an in-depth overview of the principal market players in the Visual Inspection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- ANTARES VISION S.p.A

- Baker Hughes Company

- Basler AG

- Brevetti CEA SpA

- Carl Zeiss AG

- Cognex Corporation

- FARO Technologies, Inc.

- GE Vernova Inc.

- Hexagon AB

- International Business Machines Corporation

- Jekson Vision Pvt. Ltd.

- KEYENCE CORPORATION

- KPM Analytics

- Körber AG

- Mettler Toledo International Inc.

- MISTRAS Group, Inc.

- Mitsubishi Electric Corporation

- Mitutoyo America Corporation

- National Instruments Corporation

- Nommas AI

- Olympus Corporation

- Omron Corporation

- Ravin AI

- Robert Bosch GmbH

- Rolls Royce PLC

- Siemens AG

- Stevanato Group

- Teledyne Technologies Incorporated

- Wenglor Sensoric Group

- Wipotec GmbH

Strategic Imperatives and Best Practices for Industry Leaders to Capitalize on Emerging Opportunities in Visual Inspection

To capitalize on emerging opportunities, industry leaders should prioritize a dual-track investment approach that balances hardware modernization with software‐driven optimization. Allocating resources toward modular camera and lighting arrays can future-proof physical infrastructure, while concurrent investment in AI/ML-based inspection platforms will maximize analytical agility. Establishing strategic partnerships with semiconductor foundries and optics manufacturers will mitigate tariff-induced supply chain risks and foster co-innovation initiatives.

Moreover, enterprises must cultivate an ecosystem of skilled talent by instituting training programs focused on data science, computer vision, and system integration. This will enable cross-functional teams to accelerate time to value and reduce dependency on external consultants. Equally important is the implementation of cybersecurity frameworks tailored to the unique vulnerabilities of vision-enabled devices, ensuring the integrity of image data and the robustness of decision-making algorithms.

Finally, decision-makers should pilot sustainability initiatives that leverage visual inspection to minimize material waste and energy consumption. By embedding quality control deeper into production loops, organizations can detect anomalies earlier and avert downstream defects. Through these strategic imperatives, companies will not only address immediate operational challenges but also lay the groundwork for long-term competitive advantage in a rapidly evolving market.

Elucidating Rigorous Research Framework and Methodological Approaches Underpinning Comprehensive Visual Inspection Market Analysis

This research draws upon a rigorous, multi-layered methodology designed to ensure both breadth and depth of market coverage. Primary insights were obtained through in-depth interviews with over 50 industry executives, including C-level decision-makers, operations leads, and technology officers representing hardware manufacturers, software vendors, and system integrators. These qualitative inputs were complemented by a systematic review of secondary sources, encompassing peer-reviewed journals, governmental trade publications, and publicly available patent filings.

Quantitative data were validated via a structured data triangulation process, integrating correlations among input variables, vendor financial disclosures, and customs import/export records. Segmentation matrices were constructed to capture the diversity of component categories, inspection modalities, application use cases, organizational scales, and industry verticals. Regional market sizing and trend analyses leveraged official economic indicators and industry consortium reports to contextualize growth drivers and regulatory influences.

To safeguard analytical objectivity, the study underwent multiple rounds of expert panel review, incorporating feedback from external advisors specializing in computer vision, industrial automation, and global trade policy. The final report presents findings that are both empirically grounded and strategically relevant, offering stakeholders a robust foundation for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Visual Inspection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Visual Inspection Market, by Component

- Visual Inspection Market, by Inspection Type

- Visual Inspection Market, by Application

- Visual Inspection Market, by Organization Size

- Visual Inspection Market, by Vertical

- Visual Inspection Market, by Region

- Visual Inspection Market, by Group

- Visual Inspection Market, by Country

- United States Visual Inspection Market

- China Visual Inspection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Critical Findings and Strategic Outlook to Guide Stakeholders through Evolving Visual Inspection Horizons

The interplay of advanced hardware, intelligent software, and shifting trade dynamics has ushered in a new era for visual inspection. As organizations navigate the challenges posed by increased tariffs and supply chain realignment, the convergence of AI-driven algorithms and modular optical systems offers a clear pathway to enhanced productivity and quality assurance. Segmentation analysis highlights the pivotal roles of both automated inspection in high-volume manufacturing and targeted solutions for specialized applications, underscoring the need for adaptive go-to-market strategies.

Regional insights reveal that while mature markets in North America and Europe are steering toward fully integrated smart factories, Asia-Pacific continues to invest heavily in capacity expansion and precision engineering. The competitive landscape is being reshaped by companies that excel in delivering holistic value, coupling advanced imaging hardware with lifecycle services and cloud-based performance analytics. Against this backdrop, strategic investments in talent development, cybersecurity, and sustainability will determine which organizations emerge as leaders in the evolving visual inspection ecosystem.

Ultimately, the future favors those who embrace a holistic vision-one that integrates cutting-edge technology, robust supply chain frameworks, and a service-oriented mindset. By internalizing the insights presented herein, stakeholders can chart a course toward operational excellence and sustained competitive differentiation.

Engage Directly with Ketan Rohom to Obtain Comprehensive Visual Inspection Market Intelligence and Drive Strategic Decision Making

For a deeper exploration of these insights and to secure your organization’s competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to obtain the full market research report. He stands ready to guide you through the detailed findings, answer any questions on strategic implications, and customize a delivery plan that meets your specific requirements. Engage today to unlock unparalleled visibility into emerging trends, validate your business strategies with robust data, and position your enterprise at the forefront of visual inspection innovation.

- How big is the Visual Inspection Market?

- What is the Visual Inspection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?