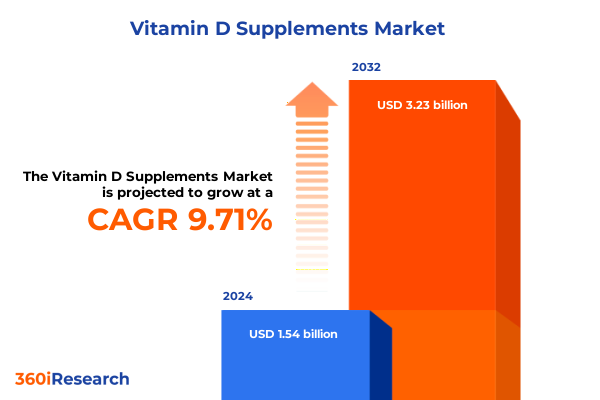

The Vitamin D Supplements Market size was estimated at USD 1.69 billion in 2025 and expected to reach USD 1.83 billion in 2026, at a CAGR of 9.68% to reach USD 3.23 billion by 2032.

Unveiling the Sunshine Vitamin’s Resurgence Amid Evolving Consumer Health Priorities and Scientific Breakthroughs Driving Supplement Demand

The critical role of vitamin D in human health has been reaffirmed by a growing body of research and consumer interest, transforming it from an under-appreciated micronutrient into a cornerstone of preventive wellness strategies. Once primarily associated with bone health and skeletal development, this "sunshine vitamin" now commands attention for its immune-modulating properties, prompting individuals and healthcare professionals alike to reassess its importance in daily nutrition. As deficiencies remain widespread-impacting population groups ranging from infants to older adults-vitamin D supplementation has emerged as an essential tool in closing nutritional gaps and supporting overall well-being.

Amid shifting consumer health priorities, industry stakeholders have accelerated innovation across formulations, distribution channels, and educational initiatives to meet rising demand. The transition from seasonal, region-dependent intake to year-round, accessible supplementation has been driven by both consumer awareness and scientific validation. Consequently, vitamin D now occupies a prominent position within the broader dietary supplement landscape, reflecting not just clinical recommendations but a cultural shift toward proactive health management. This section outlines the drivers behind vitamin D’s renaissance and sets the stage for a detailed exploration of market transformations.

Transformative Innovations and Consumer-Driven Trends Reshaping the Vitamin D Supplement Landscape Across Formats and Channels

The vitamin D market has undergone profound transformation over the past several years, propelled by global health events and evolving consumer expectations. The COVID-19 pandemic in particular illuminated the critical role of immune health, accelerating adoption of supplements that support defenses against respiratory infections. As a result, vitamin D usage in the United States jumped significantly, with consumers actively monitoring their vitamin D status and healthcare providers increasingly recommending supplemental intake to mitigate deficiency risks.

Simultaneously, personalization has emerged as a defining trend. Advances in digital health tools, from wearable trackers to genetic profiling platforms, enable consumers to tailor supplement regimens based on individual biomarkers and lifestyle metrics. Brands have responded with AI-driven services that curate personalized vitamin D protocols, recognizing that one-size-fits-all approaches no longer resonate with discerning audiences seeking precision nutrition.

Innovation in delivery formats has further reshaped product offerings. Traditional tablets and softgels are now complemented by nanoencapsulated powders, liposomal formulations, and oral sprays that enhance bioavailability and improve consumer compliance. Research indicates that nanoemulsion technologies can double the stability and absorption of vitamin D3 compared to conventional oil solutions, underscoring the potential for next-generation carriers to optimize serum levels more efficiently. At the same time, palatable formats such as gummies and dissolvable films address taste sensitivities and boost adherence, particularly among children and seniors.

Regulatory and sustainability considerations have also gained prominence. Industry collaboration with authorities has led to clearer labeling standards and expanded novel food approvals, helping differentiate between source materials and ensuring consumer trust. Moreover, the shift toward plant-based ingredients-such as lichen-derived cholecalciferol-reflects growing demand for ethical sourcing and environmentally conscious production methods. Taken together, these dynamics underscore a landscape in flux, where science, technology, and consumer values converge to redefine how vitamin D supplements are formulated, marketed, and consumed.

Assessing the Cumulative Economic and Operational Impacts of 2025 U.S. Tariff Measures on Vitamin D Supplement Supply Chains

Beginning in early April 2025, U.S. trade policies introduced both universal and reciprocal tariffs on imported products, with rates ranging from 10% for general imports to as high as 50% on select origins deemed to engage in unfair trade practices. These measures, enacted under Executive orders on April 2 and April 9 respectively, had sweeping implications for raw materials used in dietary supplements. While many essential nutrients received exemptions-encompassing vitamins A, C, D, E; CoQ10; and key minerals-numerous botanical and specialty ingredients encountered escalated duties, thereby increasing the cost of goods and complicating procurement strategies.

The Natural Products Association recently estimated that tariff exemptions spared the industry from $218 million to $247 million in additional costs during the first quarter after implementation, primarily safeguarding core ingredients such as vitamin D3 from direct duty burdens. Yet non-exempt inputs faced stacked tariffs that, in some instances, exceeded 70%, forcing manufacturers to absorb higher import costs or pass them on to consumers. Supply chain adjustments-including diversification of supplier networks and domestic production investments-became imperative to mitigate margin compression and maintain product availability.

Beyond direct financial impacts, potential inclusion of dietary supplements in Department of Commerce’s Section 232 pharmaceutical tariff investigations introduced further uncertainty. Industry associations emphasized the fundamental distinction between nutrient supplements and pharmaceuticals, warning that misclassification could trigger additional levies and disrupt access for millions of consumers relying on vitamin D for bone and immune health. Sustained advocacy efforts remain crucial in securing enduring tariff protections and ensuring regulatory clarity in the face of evolving trade policies.

In-Depth Segmentation Insights Revealing How Source, Form, End Users, Applications and Channels Drive Vitamin D Supplement Strategies

The vitamin D supplement arena encompasses diverse ingredient sources, each with distinct regulatory, ethical, and performance considerations. Cholecalciferol, also known as vitamin D3, remains the predominant form due to its superior potency and sustained elevation of serum 25-hydroxyvitamin D levels. In contrast, ergocalciferol or vitamin D2-while less bioactive-is valued in vegan-friendly formulas, reflecting the industry’s response to plant-based consumer demands and sustainable sourcing imperatives.

Format innovation has multiplied delivery options beyond classic capsules and tablets. Capsules persist as a mainstream choice for their convenience and precise dosing, whereas softgels have become a preferred vehicle for oil-based vitamin D blends that enhance solubility. The gummy segment, buoyed by pleasant flavor profiles and ease of ingestion, has differentiated further into gelatin-based and pectin-based variants to satisfy both animal-derived and vegan dietary preferences. Liquid sprays and emulsions, alongside powdered formats, appeal to consumers seeking rapid absorption and customizable dosing, particularly in therapeutic and clinical contexts.

End-user segmentation highlights distinct consumption patterns across demographics. Adult populations constitute the core consumer base, often prioritizing routine wellness maintenance, while athletes integrate targeted vitamin D supplementation to support musculoskeletal function and recovery. Pediatric formulations emphasize palatability and safety, and prenatal products are carefully calibrated to meet increased maternal requirements. Seniors, given age-related declines in endogenous synthesis, remain a critical cohort for high-potency D3 products designed to mitigate osteoporosis risk.

Application-wise, bone health continues to anchor the category’s foundational use, but immune support has surged in recent years, driven by scientific acknowledgment of vitamin D’s role in modulating innate and adaptive immune responses. General health positioning spans both maintenance protocols-which focus on daily nutritional adequacy-and broader wellness narratives that frame vitamin D as a cornerstone of holistic preventive care.

Distribution channel deployment ranges from omnichannel e-commerce strategies-leveraging both direct-to-consumer brand websites and mass marketplaces-to traditional brick-and-mortar outlets. Pharmacy and drugstore channels remain vital for their clinical familiarity and retail accessibility, while specialty stores cater to premium, niche formulations. Supermarkets and mass retail venues offer widespread availability and competitive pricing, underscoring the importance of multi-channel presence to capture diverse consumer journeys.

This comprehensive research report categorizes the Vitamin D Supplements market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Source

- Form

- End User

- Application

- Distribution Channel

Regional Dynamics Explored to Highlight Key Growth Drivers and Consumer Behaviors in Americas, EMEA and Asia-Pacific Vitamin D Markets

Across global regions, vitamin D supplement dynamics reflect distinct market drivers and cultural contexts. In the Americas, the United States leads with a mature retail infrastructure, robust e-commerce penetration, and a well-established regulatory framework that supports rapid product innovation. Consumer surveys indicate that nearly four in five Americans view dietary supplements as integral to maintaining health, driving demand for both mainstream and specialty vitamin D formulations.

Europe, accounting for over a quarter of the worldwide vitamin D market, benefits from comprehensive food fortification programs and heightened public awareness of bone health. The European Commission’s novel food authorizations have facilitated the introduction of advanced calcifediol ingredients, while stringent labeling standards and clean-label preferences foster transparency and premium positioning. Markets in Germany, the UK, and the Nordic countries showcase particularly strong uptake, supported by national guidelines recommending year-round supplementation for high-risk populations.

Asia-Pacific presents both high deficiency prevalence and significant growth potential, driven by government-led campaigns, expanding middle-class health consciousness, and a burgeoning e-commerce ecosystem. India and China spearhead regional demand, with over half of dairy products in these markets now fortified with vitamin D, and online retail channels delivering unmatched convenience to urban and rural consumers alike. Meanwhile, Middle East & Africa, despite abundant sunlight, contends with lifestyle and clothing factors that perpetuate deficiency among more than 65% of the population, prompting targeted awareness initiatives and rapid gains in supplement sales in Gulf Cooperation Council nations.

This comprehensive research report examines key regions that drive the evolution of the Vitamin D Supplements market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players’ Strategic Moves and Innovations Charting the Future of Vitamin D Supplementation Worldwide

A diverse ecosystem of manufacturers, ingredient suppliers, and brand owners drives competition and innovation within the vitamin D supplement sector. Royal DSM stands out with its proprietary calcifediol ingredient, ampli-D®, which secures novel food approval in Europe and accelerates serum level restoration by up to 2.5 times compared to conventional vitamin D3. This science-backed solution underscores the value of differentiated bioactive forms in addressing deficiency swiftly and effectively.

Consumer-focused brands continue to expand their portfolios and refine their positioning. Nature’s Bounty has unified its messaging through an emotionally resonant campaign, emphasizing inherent bodily capabilities supported by targeted supplementation. By integrating a wide range of products-from bone health to immune support-under a cohesive brand promise, the company reinforces consumer trust and loyalty across digital, mass-retail, and pharmacy channels.

Meanwhile, Nordic Naturals and Solgar have bolstered their offerings in chewable and softgel segments, respectively, catering to consumers seeking high-quality, taste-driven formats. Their timely product launches demonstrate an ongoing emphasis on palatability and convenience without compromising scientific rigor. At the same time, conglomerates such as Nestlé, Abbott, Amway, Glanbia, Bayer, Haleon, Herbalife, Nature’s Sunshine, Bionova, Arkopharma, American Health, H&H Group, Nu Skin, and Vitaco leverage global distribution networks and strategic acquisitions to scale supply capabilities, optimize cost efficiencies, and extend their reach into adjacent wellness categories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vitamin D Supplements market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bluebonnet Nutrition Corp.

- Carlson Labs

- Doctor's Best Inc.

- Garden of Life LLC

- Jarrow Formulas Inc.

- Life Extension Foundation

- MegaFood Inc.

- Nature's Bounty Co.

- Nature's Way Products LLC

- New Chapter Inc.

- Nordic Naturals Inc.

- NOW Foods Inc.

- Ortho Molecular Products Inc.

- Pfizer Inc.

- Pure Encapsulations LLC

- Rainbow Light Nutritional Systems Inc.

- SmartyPants Vitamins Inc.

- Solgar Inc.

- Swanson Health Products Inc.

- Zahler Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Vitamin D Supplement Trends and Navigate Market Disruptions

To thrive in the evolving vitamin D supplement market, industry leaders must adopt a multi-pronged strategy that prioritizes resilience, innovation, and consumer engagement. First, enhancing supply chain flexibility is essential; diversifying ingredient sourcing-from traditional lanolin-derived cholecalciferol to lichen-based D3-can mitigate tariff-related disruptions and strengthen sustainability credentials.

Next, investment in advanced delivery systems-such as liposomal, nanoencapsulated, and spray formulations-will address absorption challenges and elevate product differentiation. Collaborating with contract research organizations to validate bioavailability gains can reinforce scientific claims and enhance regulatory compliance.

Third, expanding omnichannel presence is critical. Brands should optimize direct-to-consumer platforms while forging partnerships with leading marketplaces and specialty retailers. Enabling seamless digital experiences, from virtual consultations to subscription-based personalization, will foster deeper customer relationships and lifetime value.

Finally, a commitment to regulatory advocacy and transparency will bolster consumer trust. Engaging with policymakers to clarify supplement classification and labeling standards-while actively supporting modernization of regulatory frameworks-will safeguard market access and drive category credibility. Embracing eco-friendly sourcing, clean-label certifications, and third-party testing protocols will further differentiate offerings and resonate with health and environmentally conscious consumers.

Robust Research Methodology Outlining Rigorous Data Collection, Analysis Frameworks and Validation Techniques Behind This Vitamin D Study

This research combined rigorous secondary and primary approaches to ensure comprehensive and reliable insights. Secondary data were sourced from public policy documents, trade press, peer-reviewed journals, and industry association reports, providing context on tariff policies, ingredient innovations, and consumer surveys. Primary research included structured interviews with senior executives at leading supplement firms, ingredient suppliers, and trade associations, as well as online surveys of healthcare professionals and end-users to capture nuanced perspectives on formulation preferences and purchasing drivers.

Analytical frameworks-such as SWOT analysis, PESTEL evaluation, and Porter’s Five Forces-were applied to assess market attractiveness, competitive intensity, and external drivers. Data triangulation techniques reconciled disparate data points, while statistical validation tests confirmed the robustness of quantitative findings. All sources were cross-verified against regulatory filings, customs datasets, and proprietary subscription databases to uphold accuracy and eliminate bias. The methodology ensures that conclusions drawn herein reflect the most current market realities and anticipate future shifts in the vitamin D supplement landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vitamin D Supplements market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vitamin D Supplements Market, by Ingredient Source

- Vitamin D Supplements Market, by Form

- Vitamin D Supplements Market, by End User

- Vitamin D Supplements Market, by Application

- Vitamin D Supplements Market, by Distribution Channel

- Vitamin D Supplements Market, by Region

- Vitamin D Supplements Market, by Group

- Vitamin D Supplements Market, by Country

- United States Vitamin D Supplements Market

- China Vitamin D Supplements Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Integrating Insights to Project Future Pathways for Vitamin D Supplements in an Era of Personalized Nutrition and Evolving Regulations

Vitamin D supplementation stands at the confluence of robust science, shifting consumer behaviors, and dynamic regulatory environments. The market’s resurgence is driven not only by clinical recognition of vitamin D’s broad health benefits but also by consumer demand for accessible, personalized, and ethically sourced solutions. Formulation advances-from nanoencapsulation to plant-based cholecalciferol-underscore the sector’s commitment to efficacy and sustainability.

Looking ahead, the ability of industry players to navigate trade complexities, leverage digital transformation, and uphold transparent communication will determine their competitive edge. As regional dynamics evolve-with the Americas, EMEA, and Asia-Pacific each presenting unique growth vectors-the most successful organizations will be those that integrate scientific innovation with compelling consumer narratives and resilient supply chains.

Ultimately, vitamin D supplements will continue to play an integral role in preventive health strategies, with opportunities for innovation in adjacent formats, tailored dosing, and integrated lifestyle solutions. By synthesizing insights across segmentation, regional markets, and competitive landscapes, stakeholders can forge a path toward sustainable growth and enhanced consumer well-being.

Connect with Ketan Rohom to Secure Detailed Vitamin D Market Intelligence and Drive Growth with Comprehensive Research Reports

Unlock unparalleled market insights and strategic guidance by partnering with our expert, Ketan Rohom. As Associate Director of Sales & Marketing, Ketan brings a wealth of knowledge in dietary supplement trends, rigorous analytical methodologies, and a deep understanding of global market dynamics. By engaging with Ketan, you’ll gain access to the full Vitamin D Supplements market research report, complete with detailed segmentation, regional breakdowns, competitive intelligence, and actionable recommendations tailored to your organization’s objectives. Elevate your decision-making and capitalize on emerging opportunities: reach out to Ketan today to learn how this comprehensive report can empower your portfolio and foster sustainable growth in the vitamin D sector.

- How big is the Vitamin D Supplements Market?

- What is the Vitamin D Supplements Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?