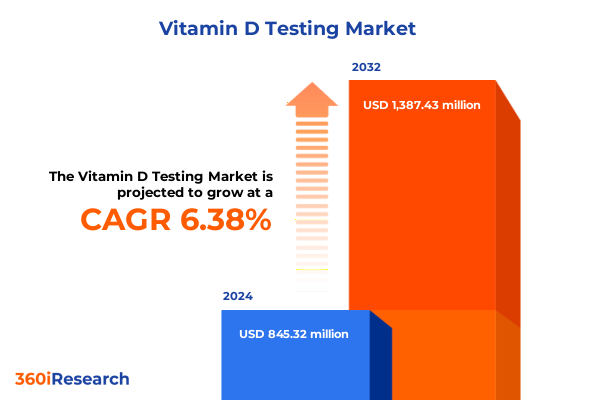

The Vitamin D Testing Market size was estimated at USD 887.54 million in 2025 and expected to reach USD 937.89 million in 2026, at a CAGR of 6.59% to reach USD 1,387.43 million by 2032.

The Critical Imperative of Vitamin D Testing in Modern Healthcare Amid Rising Deficiency Rates and Personalized Medicine Demands Across Diverse Patient Populations

Vitamin D testing has become an indispensable element of preventive healthcare as clinicians recognize the vast variability in serum 25-hydroxyvitamin D status across global populations. Systematic reviews highlight that North American cohorts benefit from routine food fortification and widespread supplement use, whereas individuals in Europe, the Middle East, Africa, and parts of Asia frequently exhibit suboptimal levels due to cultural habits, dietary patterns, and environmental factors.

This heightened focus reflects expanding clinical evidence that vitamin D performs critical roles beyond calcium homeostasis, including modulation of immune defenses and regulation of metabolic and cardiovascular health pathways. As a result, healthcare providers now integrate vitamin D assessments into comprehensive care protocols, leveraging test results to personalize nutritional guidance and mitigate chronic disease risks.

Concurrently, the rise of telehealth services and personalized medicine is accelerating demand for rapid, reliable vitamin D assays. Patients and practitioners alike seek diagnostic solutions that blend accuracy with convenience, prompting innovative delivery models such as at-home sample collection and remote result interpretation.

How Technological Innovations and Evolving Care Models Are Revolutionizing Vitamin D Testing with Greater Precision Speed and Patient Accessibility

Point-of-care and at-home vitamin D testing are reshaping the diagnostic landscape by bringing rapid result capabilities directly to patients. According to industry experts, the continued expansion of point-of-care testing-amplified by telemedicine adoption-will drive accessible, high-quality diagnostics in outpatient and remote settings, ultimately reducing barriers to timely clinical decision-making.

Simultaneously, laboratory automation and artificial intelligence are revolutionizing test workflows. Microfluidic lab-on-a-chip systems and advanced robotics streamline sample processing while machine-learning algorithms enhance result accuracy by adjusting for variables such as sample integrity and reagent performance. These capabilities not only boost throughput in high-volume settings but also minimize human error.

At the core of analytical innovation lie high-performance liquid chromatography paired with tandem mass spectrometry, which deliver unparalleled sensitivity and specificity in 25-hydroxyvitamin D quantification. These gold-standard techniques are complemented by improved immunoassay platforms that offer scalable performance for routine clinical laboratories, striking a balance between throughput and precision.

Collectively, these technological and operational advancements are redefining responsiveness and driving the evolution of vitamin D testing from a specialized niche to a mainstream diagnostic imperative.

Exploring the Widespread Cumulative Impact of Recent U.S. Tariff Policies on Vitamin D Testing Supply Chains and Cost Structures in 2025

In early April 2025, a universal 10% import tariff was enacted on nearly all goods entering the United States, immediately affecting critical diagnostic items. Shortly thereafter, country-specific escalations took effect, resulting in cumulative duties of up to 145% on lab-related goods from China and substantial levies on non-USMCA imports from Canada and Mexico.

These measures have increased the cost of key consumables, including calibrators, controls, and reagents, as well as the components used in analyzers and readers. Diagnostic laboratories and point-of-care centers are experiencing upward price pressure on testing kits and instrument maintenance supplies, impairing budget predictability and procurement planning.

To mitigate these headwinds, leading manufacturers are accelerating initiatives to reshore production and diversify supplier networks. Some firms have announced expansions of domestic manufacturing capacity and forged partnerships with U.S.-based distributors to secure priority allocation of essential supplies, aiming to contain cost escalation and ensure continuity of service.

As a result of these tariff-driven dynamics, stakeholders across the value chain are reevaluating strategic sourcing, adjusting inventory buffers, and exploring long-term collaborations to enhance supply chain resilience and uphold clinical delivery standards.

Unveiling Key Vitamin D Testing Market Segmentation Insights by Component Test Technique and End-User Applications Driving Strategic Focus

The vitamin D testing market encompasses a spectrum of product components, beginning with consumables such as calibrators, controls, and reagents that underpin assay performance. Instruments form the second pillar, with analyzers delivering high-throughput batch processing and compact readers facilitating point-of-care diagnostics. Meanwhile, testing kits integrate these elements into unified solutions tailored for diverse clinical environments.

Assessments of vitamin D status revolve around two primary analytes. The 1,25-dihydroxy form represents the hormonally active metabolite, offering insight into immediate physiological regulation, whereas the 24,25-dihydroxy variant reflects catabolic pathways, supporting deeper interpretation of vitamin D metabolism in specialized clinical scenarios.

Analytical approaches range from chemiluminescence immunoassay and enzyme-linked immunosorbent assay methodologies, valued for their operational efficiency in routine labs, to high-performance liquid chromatography and liquid chromatography–mass spectrometry techniques that provide elevated analytical fidelity. Radioimmunoassay retains legacy relevance in research settings, though it is increasingly supplanted by non-radioactive platforms.

End-user applications span diagnostic laboratories that anchor volume testing workflows, hospitals integrating vitamin D evaluation into broader clinical panels, and point-of-care testing centers delivering immediate results in decentralized care settings. Each segment demands nuanced product configurations to balance precision, speed, and ease of use.

This comprehensive research report categorizes the Vitamin D Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Test

- Technique

- End-User

Revealing Critical Regional Dynamics Shaping the Vitamin D Testing Landscape Across the Americas Europe Middle East Africa and Asia Pacific

In the Americas, robust healthcare infrastructure and preventive screening initiatives have positioned vitamin D testing as a routine element of wellness programs. Widespread insurance coverage and investments in laboratory networks facilitate seamless access to both traditional lab-based assays and emerging home-testing kits, empowering consumers to engage proactively with nutritional health assessments.

Europe, Middle East & Africa exhibit a bifurcated landscape. Publicly funded health systems across Western and Northern Europe support systematic screening, with geriatric and bone health programs routinely incorporating vitamin D measurement. Conversely, in regions of the Middle East and Africa, cultural practices around clothing and skin pigmentation have led to persistent deficiency concerns, driving targeted testing initiatives among women, children, and institutionalized populations.

Asia-Pacific is experiencing rapid momentum as urbanization and lifestyle shifts heighten awareness of vitamin D insufficiency. While advanced analytical platforms are concentrated in metropolitan centers, affordability challenges temper widespread adoption. Nevertheless, regulatory reforms and public health campaigns are catalyzing expanded diagnostic capacity, with a growing cadre of private and public laboratories offering comprehensive vitamin D panels.

These regional dynamics underscore the need for tailored engagement strategies, aligning product offerings and service models with local healthcare frameworks, regulatory environments, and cultural nuances to optimize market penetration and patient outcomes.

This comprehensive research report examines key regions that drive the evolution of the Vitamin D Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitor Intelligence on Leading Vitamin D Testing Innovators Highlighting Capabilities Collaborations and Competitive Positioning

Abbott Laboratories has demonstrated strategic agility amid evolving market conditions, reinforcing its immunoassay portfolio while investing in domestic production to counter tariff pressures. The company’s next-generation assay platforms emphasize rapid throughput and streamlined workflows, catering to both high-volume labs and decentralized testing environments.

F. Hoffmann-La Roche AG continues to intensify its focus on digital diagnostics, having introduced an AI-powered interpretation tool that contextualizes vitamin D results against patient history and laboratory variables. This integration of machine learning enhances clinical decision support and fosters deeper physician engagement in interpreting complex cases.

Siemens AG maintains its competitive edge through modular analyzer systems that integrate vitamin D assays alongside other nutritional panels, facilitating multiparametric testing with minimal workflow disruption. The scalability of these platforms allows laboratories to incrementally expand diagnostic capacity in response to fluctuating demand patterns.

Quest Diagnostics and DiaSorin S.p.A. are forging partnerships to extend home and point-of-care testing capabilities. Quest’s doorstep sample collection model and DiaSorin’s expanded CLIA-certified test menu exemplify a collaborative approach to delivering comprehensive vitamin D services across clinical and consumer-focused channels.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vitamin D Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Beckman Coulter, Inc. by Danaher Corporation

- Bio-Rad Laboratories, Inc.

- bioMerieux SA

- BTNX Inc.

- Demeditec Diagnostics GmbH

- DiaSorin S.p.A.

- DIAsource ImmunoAssays SA by BioVendor Group

- Everlywell, Inc. by Everly Health, Inc.

- F. Hoffmann-La Roche Ltd

- J. Mitra & Co. Pvt. Ltd.

- Lucid Medical Diagnostics Pvt Ltd

- PerkinElmer, Inc.

- PRIMA Lab SA

- Promega Corporation

- Quest Diagnostics Incorporated

- QuidelOrtho Corporation

- RECIPE Chemicals + Instruments GmbH

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Shenzhen YHLO Biotech Co., Ltd.

- Siemens Healthineers AG

- Smith BioMed Ltd.

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Vitrosens Biotechnology

Actionable Strategic Recommendations for Industry Leaders to Enhance Vitamin D Testing Resilience Innovation and Market Competitiveness

Industry leaders should prioritize diversification of their manufacturing footprint by expanding domestic production capabilities and engaging multiple sourcing partners. This strategy will help mitigate cost volatility arising from external trade policies and strengthen supply chain resilience for both consumables and instruments.

Adopting advanced analytical techniques, such as mass spectrometry-based workflows and AI-driven data interpretation, can create differentiation through superior accuracy and clinical insight. Investment in digital platforms that enable remote result review and telehealth integration will further enhance value propositions for healthcare providers and patients alike.

Expanding point-of-care and at-home testing offerings through strategic alliances with pharmacy networks and telemedicine providers can unlock new access points, particularly in underserved regions. By leveraging portable devices and mobile sample logistics, organizations can capture incremental testing volumes while improving patient engagement and convenience.

Finally, fostering collaborative relationships with regulatory agencies and professional associations will streamline pathway approvals and facilitate early adoption of novel test formats. Proactive engagement in standard-setting initiatives can shape favorable guidelines and ensure that emerging diagnostic technologies align with clinical quality benchmarks.

Methodical Research Approach Combining Primary and Secondary Sources Data Triangulation and Expert Validation to Ensure Robust Vitamin D Testing Market Analysis

This research combines primary interviews with laboratory directors, clinical specialists, and supply chain executives to capture firsthand perspectives on operational challenges and technology adoption trends. Complementing these insights, a comprehensive review of peer-reviewed journals, regulatory filings, and trade publications ensured a robust secondary evidence base.

Data triangulation methods cross-reference segmentation schemes and regional patterns by integrating disparate information streams, including empirical performance metrics from technology pilots and supply chain disruption case studies. This multi-faceted approach underpins the validity of the identified growth drivers and risk factors.

An advisory panel of subject-matter experts in clinical diagnostics, healthcare policy, and market strategy provided critical validation of interim findings. Their iterative feedback guided refinement of analytical assumptions, reinforced conclusions, and endorsed the overarching strategic framework.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vitamin D Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vitamin D Testing Market, by Component

- Vitamin D Testing Market, by Test

- Vitamin D Testing Market, by Technique

- Vitamin D Testing Market, by End-User

- Vitamin D Testing Market, by Region

- Vitamin D Testing Market, by Group

- Vitamin D Testing Market, by Country

- United States Vitamin D Testing Market

- China Vitamin D Testing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Synthesis Emphasizing the Strategic Imperatives of Evolving Vitamin D Testing Practices and the Pathway Forward for Stakeholder Success

In conclusion, the vitamin D testing ecosystem stands at the convergence of advanced analytical methodologies, shifting care delivery paradigms, and complex trade and regulatory dynamics. Stakeholders who master the interplay of these forces will unlock pathways to operational excellence and sustained clinical impact.

As market segmentation deepens, regional nuances intensify, and competitive innovation accelerates, the imperative for adaptive strategies grows. Organizations that invest in supply chain diversification, technological differentiation, and strategic collaborations will be well-positioned to lead in an evolving diagnostic landscape.

By aligning product portfolios, service models, and R&D priorities with emerging clinical needs and policy environments, industry participants can deliver enhanced patient outcomes, foster provider trust, and secure long-term growth in the dynamic vitamin D testing arena.

Take Action Now to Access the Comprehensive Market Research Report on Vitamin D Testing by Engaging with Ketan Rohom Associate Director Sales Marketing

To explore the full breadth of market intelligence on vitamin D testing and gain competitive advantage, please reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can provide detailed guidance and facilitate access to the comprehensive report.

- How big is the Vitamin D Testing Market?

- What is the Vitamin D Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?