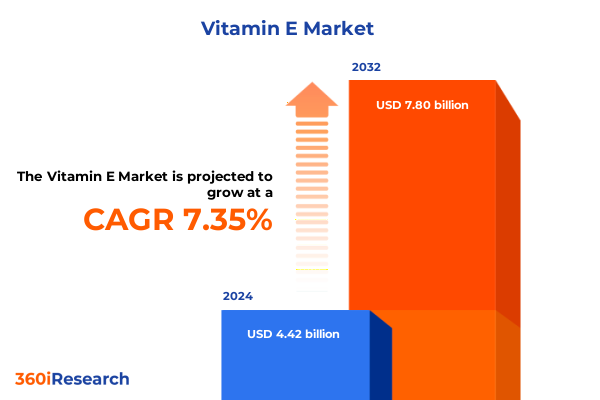

The Vitamin E Market size was estimated at USD 4.75 billion in 2025 and expected to reach USD 5.04 billion in 2026, at a CAGR of 7.34% to reach USD 7.80 billion by 2032.

Exploring the Central Significance of Vitamin E Across Diverse Sectors and Its Growing Importance in Health, Nutrition, and Industrial Innovations

Vitamin E has emerged as a cornerstone ingredient in an array of industries, driven by its multifaceted benefits and broad applicability. As a potent antioxidant, it plays a key role in neutralizing free radicals and preserving the integrity of lipids within biological systems, conferring skin protection in personal care formulations, extending the shelf life of food products, and enhancing the nutritional profile of dietary supplements. Beyond its core functionality, Vitamin E’s reputation has been bolstered by growing consumer interest in clean-label, natural solutions that align with healthier lifestyle trends. Consequently, manufacturers and brand owners are increasingly integrating Vitamin E into their product lines to meet evolving expectations around wellness and sustainability.

This comprehensive report delves into the market dynamics shaping the Vitamin E landscape, beginning with an exploration of principal value chain drivers and emerging themes that are poised to influence future growth trajectories. Through a balanced examination of technological advancements, regulatory shifts, and strategic initiatives by leading players, readers will gain a nuanced understanding of how Vitamin E continues to transcend traditional boundaries-spanning from animal feed and dietary supplements to advanced pharmaceutical applications. By setting the stage for deeper analysis, this introduction aims to contextualize the enduring relevance of Vitamin E while highlighting the critical forces that will define the next phase of industry transformation.

Assessing the Major Technological Advancements, Regulatory Evolutions, and Consumer-Driven Transformations Reshaping the Global Vitamin E Market Landscape

In recent years, the Vitamin E market has experienced a series of transformative shifts that underscore the industry’s capacity for rapid adaptation and innovation. On the technological front, novel extraction techniques-such as supercritical carbon dioxide and enzymatic-assisted methods-have enabled producers to enhance yields of natural tocopherols and tocotrienols while reducing solvent residues and operational costs. Concurrently, encapsulation technologies have advanced to protect Vitamin E’s stability, enabling controlled release and improved bioavailability across applications. These breakthroughs not only optimize product performance but also align with consumer demands for cleaner, more transparent sourcing and production methods.

Alongside these technical innovations, regulatory landscapes have evolved to accommodate more stringent safety standards and labeling requirements. In key markets, authorities have introduced updated monographs and guidance on allowable health claims, prompting manufacturers to substantiate efficacy and invest in clinical research. This regulatory momentum has been mirrored by intensified scrutiny of synthetic versus natural sources, driving a notable shift toward plant-derived tocopherols as brands seek to differentiate themselves through claims of authenticity and environmental stewardship. Moreover, rising consumer awareness around sustainability has catalyzed commitments to traceability and responsibly managed supply chains, further shaping procurement strategies.

These converging forces reflect a broader consumer-driven paradigm in which sustainability, transparency, and performance converge to set new benchmarks. As the industry continues to navigate evolving standards and sophisticated end-user expectations, the resulting interplay between technology, regulation, and consumer preferences is poised to redefine market structures and strategic priorities for years to come.

Analyzing the Compound Effects of U.S. Tariffs on Vitamin E Imports Through 2025 and Their Implications for Cost Structures and Supply Chains

The imposition of U.S. tariffs on Vitamin E imports, particularly those sourced from China, has generated significant ripple effects throughout the supply chain, with cumulative implications that extend into 2025. Initially introduced under Section 301 measures, these duties escalated import costs and prompted many buyers to reevaluate their procurement strategies. While the tariffs aimed to protect domestic manufacturing and incentivize local production, they concurrently amplified price volatility and eroded margins for downstream users. Companies have responded by exploring alternative sources in Southeast Asia, investing in local toll manufacturing, and engineering hybrid supply agreements to mitigate risk.

As the tariff regime persisted into 2024 and intensified early in 2025, the industry witnessed a shift in cost structures that influenced both raw material sourcing and end-product pricing. Downstream formulators in sectors from cosmetics to animal feed faced pressure to absorb heightened input costs or pass them on to consumers. Some have opted to reformulate, seeking lower-cost analogs or blended solutions that preserve antioxidant efficacy while managing budgets. Meanwhile, domestic producers have accelerated capacity expansions-and in certain cases benefited from targeted incentives-to capture a larger share of the market formerly dominated by imports.

Commonly, this tariff-driven environment has underscored the importance of supply chain resilience and diversification. Firms that proactively adjusted their sourcing strategies by developing multi-regional supplier networks and forging strategic partnerships have been better positioned to navigate cost fluctuations and maintain uninterrupted operations. As 2025 progresses, understanding the layered impacts of these measures remains essential for both suppliers and end-users as they strive to balance competitive pricing with supply security and product quality.

Unlocking Critical Insights from Application, Form, Source, and Distribution Channel Segmentations to Understand Vitamin E Market Dynamics

The Vitamin E market’s complexity can be fully appreciated only by examining its diverse segmentation across application, form, source, and distribution channels. In terms of application, animal feed formulators leverage Vitamin E’s lipid-protective properties to enhance livestock health, while cosmetics and personal care companies incorporate it in specialized hair care, skin care, and sun care formulations designed to deliver antioxidant benefits and protect against environmental stressors. Dietary supplement manufacturers continue to innovate with blends and complexes that underscore immune support, cardiovascular health, and anti-aging attributes. Food and beverage developers, meanwhile, have introduced functional beverages fortified with Vitamin E alongside novel bakery and confectionery variants, as well as enriched dairy and frozen dessert options. In pharmaceutical contexts, Vitamin E is recognized for its role in adjunct treatments targeting neurological and dermatological conditions.

When viewed through the lens of form, market participants differentiate between capsules, oil, powder, and softgel delivery systems, each tailored to specific stability profiles, dosage requirements, and consumer preferences. Softgels and capsules account for a significant portion of dietary supplement products due to convenience, while powders and oils are favored in food applications and specialized cosmetic blends that demand precise formulation control.

A crucial axis of differentiation lies in source: natural versus synthetic Vitamin E. Natural tocopherols and tocotrienols have gained traction among brands seeking to meet clean-label mandates and command premium positioning, while synthetic equivalents remain relevant where cost efficiencies dominate. The natural category has further evolved with enhanced extraction techniques that isolate higher-purity tocotrienols, which are prized for distinct bioactive properties.

Distribution channels also play a defining role in market dynamics. Traditional brick-and-mortar outlets like drugstores, pharmacies, hypermarkets, and specialty stores coexist with a robust online ecosystem. E-commerce has bifurcated into branded websites that reinforce direct-to-consumer relationships and high-traffic marketplaces that amplify reach. This omnichannel environment requires agile channel management and targeted marketing strategies to ensure optimal product visibility and consumer engagement.

This comprehensive research report categorizes the Vitamin E market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Application

- Distribution Channel

Unraveling Regional Performance Drivers and Growth Trajectories for Vitamin E Markets Across Americas, EMEA, and Asia-Pacific Regions

Regional dynamics play a pivotal role in shaping the Vitamin E market, as demand drivers and regulatory frameworks vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the United States emerges as a mature market driven by sophisticated dietary supplement consumption, stringent quality and safety standards, and well-established supply chains. North America’s robust animal feed sector further supports demand, while Canada’s regulatory environment encourages innovative health claims that bolster product differentiation.

Across Europe, regulatory oversight emphasizes substantiated health claims and standardized labeling conventions, prompting formulation strategies that rely on clinically validated efficacy. Western European countries remain heavy consumers of natural Vitamin E in skin and sun care products, while markets in Eastern Europe and the Middle East display growing interest in functional foods and nutraceuticals, offering expansion potential for nimble producers. In Africa, market access is influenced by import logistics and partnership models that bridge local distribution gaps.

Asia-Pacific stands out as the fastest-growing region, propelled by rising disposable incomes, expanding middle classes, and increased health awareness. China remains a dominant player in both production and consumption, with domestic firms investing heavily in local extraction facilities. India’s burgeoning nutraceutical sector and focused government initiatives on animal health contribute to accelerating uptake. Southeast Asian economies are leveraging favorable agricultural inputs and strategic investments to scale production, reinforcing the region’s appeal as both a supply hub and a key consumer market.

Understanding these geographically distinct growth trajectories and regulatory contours is fundamental for stakeholders seeking to optimize market entry strategies, tailor value propositions, and establish resilient regional architectures that align with evolving consumer and policy landscapes.

This comprehensive research report examines key regions that drive the evolution of the Vitamin E market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Innovation, Capacity Expansion, and Competitive Positioning within the Vitamin E Market

A cadre of established and emerging players defines the competitive terrain of the Vitamin E market, each deploying unique capabilities to secure market share and drive innovation. Key global players are advancing extraction capacities, refining proprietary formulations, and forging strategic alliances that reinforce their leadership positions. Investments in specialized manufacturing facilities have enabled scaled production of high-purity natural tocopherols and tocotrienols, catering to premium end-use segments in personal care and pharmaceuticals.

In parallel, synthetic Vitamin E manufacturers maintain relevance by optimizing chemical synthesis pathways to reduce production costs and improve consistency, thereby serving price-sensitive segments such as large-scale feed additives. Mid-sized enterprises leverage agility to introduce novel blends and co-formulations, often capitalizing on targeted health trends like plant-based nutrition, cognitive support, and anti-inflammatory benefits. Regional specialists in Asia-Pacific have gained traction through cost-competitive natural extraction, supported by favorable raw material availability and streamlined regulatory approvals.

Collaborative models also feature prominently, as industry participants forge partnerships with biotech firms, contract research organizations, and academic institutions to accelerate product development, validate efficacy claims, and navigate evolving regulatory demands. These alliances not only enhance product portfolios but also expand geographic footprints and distribution networks. As consolidation trends persist, stakeholders can expect continued M&A activity and joint ventures aimed at fortifying supply chains and unlocking new application areas.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vitamin E market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Organic Materials S.A.

- Archer Daniels Midland Company

- BASF SE

- Beijing Gingko Group

- Brenntag AG

- BTSA Biotecnologias Aplicadas SL

- Cargill Inc

- COFCO Tech Bioengineering Tianjin Co Ltd

- dsm-firmenich AG

- ExcelVite Sdn Bhd

- Fenchem Biotek Ltd

- Kemin Industries Inc

- Kensing LLC

- Kuala Lumpur Kepong Berhad – Davos Life Science

- Merck KGaA

- Mitsubishi-Chemical Foods Corporation

- Musim Mas Group

- Nagase Group

- Orah Nutrichem Pvt Ltd

- Riken Vitamin Co Ltd

- Tama Biochemical Co Ltd

- Vance Group Ltd

- Wilmar International Limited

- Zhejiang Medicine Co Ltd

Formulating Strategic Recommendations for Industry Stakeholders to Capitalize on Vitamin E Market Opportunities and Navigate Emerging Challenges Effectively

To effectively capitalize on the evolving Vitamin E landscape, industry leaders must adopt a multi-pronged strategic approach. Prioritizing investment in advanced extraction and purification technologies will be critical to optimizing cost structures while satisfying growing demand for natural tocopherol and tocotrienol variants. By integrating sustainability metrics and securing certifications for responsible sourcing, companies can differentiate their offerings and meet consumer expectations around ethical and environmental stewardship.

Moreover, expanding research and development efforts into novel delivery systems-such as nanoemulsions and targeted encapsulation-can unlock new performance attributes and application niches, particularly within high-value personal care and pharmaceutical segments. Concurrently, organizations should cultivate diversified supplier networks across multiple regions to enhance supply chain resilience and mitigate tariff-induced risks. Developing localized manufacturing capabilities will not only reduce exposure to geopolitical headwinds but also enable tailored formulations that reflect regional regulatory and cultural preferences.

Strategic partnerships with academic institutions and biotech innovators can further accelerate product validation and streamline the introduction of scientifically substantiated health claims. In the commercial realm, a refined omnichannel strategy that balances direct-to-consumer digital platforms with traditional retail outreach will maximize market penetration. Finally, establishing robust data analytics capabilities to track evolving consumer insights and regulatory changes will equip decision-makers with the agility required to seize emerging opportunities and navigate potential disruptions.

Outlining the Comprehensive Research Approach and Methodological Framework Employed to Deliver Robust and Reliable Vitamin E Market Insights

The research underpinning this market analysis employed a structured methodology that combined rigorous secondary data collection with targeted primary research engagements. Initially, a comprehensive review of publicly available resources-including regulatory filings, patent databases, industry associations, and peer-reviewed journals-provided foundational context on extraction methods, application trends, and competitive landscapes. This secondary phase was complemented by a series of in-depth interviews with key executives, R&D scientists, procurement managers, and channel partners to validate market drivers and refine segmentation frameworks.

Quantitative data points were triangulated through cross-comparison of multiple sources to ensure consistency and reliability, while qualitative insights shed light on emerging themes and strategic initiatives. The segmentation model was constructed to reflect four critical dimensions-application, form, source, and distribution channel-thus enabling granular analysis of demand patterns and value chain dynamics. Regional market evaluations were conducted using a bottom-up approach, incorporating country-level data on production capacities, import-export volumes, and regulatory environments.

Finally, the study underwent an internal validation process that engaged subject matter experts to challenge assumptions, verify data integrity, and ensure that conclusions are robust and actionable. This comprehensive, multi-layered methodology ensures that the resulting insights accurately capture the nuanced realities of the Vitamin E market and support informed decision-making across strategic, commercial, and operational domains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vitamin E market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vitamin E Market, by Form

- Vitamin E Market, by Source

- Vitamin E Market, by Application

- Vitamin E Market, by Distribution Channel

- Vitamin E Market, by Region

- Vitamin E Market, by Group

- Vitamin E Market, by Country

- United States Vitamin E Market

- China Vitamin E Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Implications to Provide a Clear Path Forward in the Evolving Vitamin E Market Environment

The evolution of the Vitamin E market is characterized by a confluence of scientific innovation, shifting regulatory landscapes, and intensifying consumer demand for natural, performance-oriented solutions. From the advancement of extraction technologies and encapsulation strategies to the strategic ramifications of U.S. tariff policies, stakeholders must remain vigilant in monitoring cost dynamics and supply chain developments. Segmentation insights have revealed differentiated growth vectors across applications, forms, sources, and distribution channels, underscoring the need for tailored approaches in product development and channel management.

Regionally, the Americas, EMEA, and Asia-Pacific each present distinct opportunities and challenges shaped by regulatory frameworks, economic conditions, and consumer behaviors. Leading companies have demonstrated the value of strategic partnerships, capacity investments, and agile innovation roadmaps in maintaining competitive advantage. Going forward, a holistic perspective that integrates sustainability metrics, technological adoption, and proactive risk mitigation will be essential for capturing long-term value.

In conclusion, the Vitamin E industry stands at a pivotal juncture where strategic foresight and operational excellence will determine market leadership. By leveraging the insights presented within this report, decision-makers can chart a clear path toward sustainable growth, differentiated positioning, and resilient supply chain configurations in an increasingly complex global environment.

Engage with an Expert to Gain Comprehensive Vitamin E Market Intelligence and Tailored Strategic Insights

To explore the full suite of insights and gain tailored analysis on the vitamin E landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report covering the latest industry developments, strategic intelligence, and competitive benchmarking. With specialized support and customized data packages aligned to your strategic objectives, this partnership offers direct access to expert guidance and ongoing advisory, empowering your organization to navigate complex market dynamics and capitalize on emerging growth opportunities. Engage today to unlock the value of actionable intelligence and position your business for sustained success in the rapidly evolving vitamin E sector.

- How big is the Vitamin E Market?

- What is the Vitamin E Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?