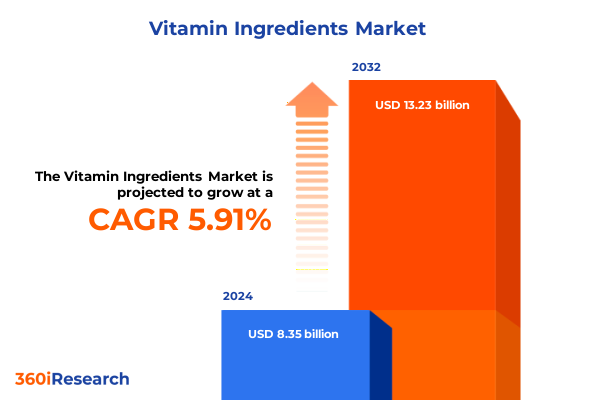

The Vitamin Ingredients Market size was estimated at USD 8.84 billion in 2025 and expected to reach USD 9.33 billion in 2026, at a CAGR of 5.92% to reach USD 13.23 billion by 2032.

Harnessing the Power of Vitamin Ingredients: An Overview of Market Drivers, Evolution, and Strategic Imperatives for Industry Stakeholders

The vitamin ingredients market stands at a pivotal juncture, driven by an accelerating consumer focus on health and wellness. The surge in preventive healthcare adoption and the desire for nutrient-rich diets have elevated the importance of vitamin fortification across multiple end-use industries. Concurrently, technological breakthroughs in extraction and synthesis methods have lowered production costs and expanded the range of available compounds, enabling manufacturers to meet evolving demand more efficiently. This dynamic environment has given rise to new partnerships between raw material suppliers, contract manufacturers, and branded product innovators, fostering a collaborative ecosystem that supports rapid product development and time to market.

In light of these developments, stakeholders must navigate a complex regulatory landscape characterized by stringent safety and purity standards. Global harmonization efforts aim to streamline compliance, yet regional variations in permissible limits and labeling requirements continue to pose challenges for multinational operations. As market participants recalibrate their strategies to accommodate these regulatory demands, an emphasis on quality assurance and traceability is emerging as a core competitive differentiator. Looking ahead, the integration of advanced analytics and digital traceability solutions promises to enhance supply chain transparency, ensuring that the benefits of vitamin ingredients are delivered reliably and sustainably to consumers.

From Consumer Health to Sustainable Sourcing: Exploring the Fundamental Shifts Reshaping the Vitamin Ingredients Landscape Worldwide

The vitamin ingredients landscape is experiencing transformative shifts driven by heightened consumer awareness, sustainability imperatives, and innovation in product formulation technologies. Health-conscious consumers are increasingly rejecting one-size-fits-all solutions in favor of targeted vitamin blends tailored to specific life stages and health conditions. This evolution is catalyzing a move toward personalized nutrition, with formulators leveraging omics technologies and AI-driven insights to develop next-generation ingredient portfolios that resonate with individual needs. Simultaneously, the demand for clean-label and naturally derived vitamins has intensified, prompting suppliers to invest in fermentation platforms and plant-extraction techniques that reduce environmental footprints and appeal to eco-conscious buyers.

At the same time, digital transformation is redefining commercial engagement models. E-commerce platforms and direct-to-consumer channels are enabling brands to cultivate deeper relationships with end users, gathering real-time feedback and lifestyle data to refine formula efficacy. Moreover, the emergence of blockchain-based supply chain solutions is facilitating unbroken visibility from raw material sourcing through finished product delivery. This intersection of digital and sustainability trends is reshaping the competitive landscape, compelling industry players to adopt agile business models that can swiftly integrate novel ingredients, respond to regulatory updates, and accommodate shifting consumer preferences.

Assessing the Far-Reaching Consequences of United States Tariff Adjustments in 2025 on Import Strategies and Supply Chain Resilience

The cumulative impact of United States tariffs introduced in 2025 has reverberated across the vitamin ingredients supply chain, compelling importers and domestic producers alike to revisit sourcing strategies and pricing structures. Tariff escalations on key precursors and finished goods have elevated landed costs, narrowing margins for manufacturers who depend on international procurement to access specialized compounds. In response, some suppliers have pivoted toward nearshoring strategies, forging partnerships with regional contract manufacturers in North America and Mexico to mitigate exposure to tariff volatility and shorten lead times.

Moreover, the tariff regime has intensified competitive pressure on synthetic vitamin producers that rely heavily on imported raw materials. To sustain profitability, a growing number of companies are channeling investments into domestic fermentation and bioconversion facilities, fueling a renaissance in localized vitamin synthesis. While these initiatives require significant capital outlays, they promise long-term resilience against future trade policy shifts. Meanwhile, formulators are exploring ingredient reformulations that blend tariff-impacted compounds with readily available alternatives, striking a balance between cost optimization and product performance. This strategic recalibration underscores the importance of dynamic risk management frameworks and robust scenario planning in an era of trade uncertainty.

Unlocking Segmentation Dynamics Across Ingredient Types, Sources, Forms, Applications, and Distribution Channels for Targeted Market Strategies

Deep insights emerge when examining the vitamin ingredients market through multiple segmentation lenses, each of which reveals distinct performance drivers and growth corridors. The distinction among multivitamin compounds, single vitamin A, B complex, C, D, E, and K ingredients underscores varied application requirements and formulation complexities; within the B complex, the individual vitamins B1 through B9 each carry unique functional benefits that dictate sourcing and regulatory strategies. Equally significant is the source segmentation, where natural origins such as animal-derived extracts, fermentation-based processes, and plant derivatives command premium positioning on the basis of perceived purity and sustainability, while synthetic sources offer cost efficiencies and scalability for high-volume applications.

Form variations further differentiate market dynamics, with liquids and powders facilitating seamless integration into functional beverages and food matrices, and softgels alongside tablets and capsules addressing consumer preferences for convenient dosage formats. Within the tablet & capsule form category, the choice between tablets and capsules influences manufacturing workflows and consumer acceptance. Application segments from animal feed to cosmetics, dietary supplements, food and beverage, and pharmaceuticals each present distinct formulation considerations; subchannels in food and beverage like bakery and confectionery, dairy, and functional beverages highlight the need for bespoke ingredient functionalities. Finally, distribution channels split between offline retail outlets such as pharmacies, specialty stores, supermarkets, and hypermarkets, and online retail options including direct-to-consumer websites and e-commerce platforms. This multi-dimensional segmentation framework enables market participants to align product development, marketing, and distribution strategies with nuanced end-user requirements.

This comprehensive research report categorizes the Vitamin Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Source

- Form

- Application

- Distribution Channel

Decoding Regional Nuances in the Vitamin Ingredients Arena to Inform Market Entry, Expansion Plans, and Tailored Growth Initiatives

Regional insights reveal differentiated growth drivers and strategic priorities across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, evolving dietary trends toward preventive health have spurred demand for high-potency vitamin blends, especially within North America, where a strong regulatory infrastructure supports innovation in dietary supplement labeling and health claims. Latin American markets, by contrast, are driven by expanding consumer spending power and rising urbanization, creating opportunities for affordable, mass-market formulations that balance efficacy with value.

Across Europe, Middle East and Africa, the emphasis varies from stringent regulatory compliance in Western Europe to emerging-market aspirations in the Gulf Cooperation Council countries, where governments are investing in food fortification programs to combat micronutrient deficiencies. The African region is witnessing grassroots initiatives to introduce fortified staples at scale, a trend that is catalyzing interest in stable, cost-effective vitamin premixes. Meanwhile, Asia-Pacific stands out as the fastest adopter of natural and fermented vitamin ingredients, supported by robust manufacturing ecosystems in China, India, and Southeast Asia. Growing health awareness among middle-class consumers is accelerating uptake of functional food and beverage products, giving rise to collaborative ventures between local suppliers and global brands seeking to tailor offerings to regional taste and regulatory norms.

This comprehensive research report examines key regions that drive the evolution of the Vitamin Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Competitive Strengths and Strategic Movements of Leading Players to Navigate Opportunities and Challenges in the Vitamin Ingredients Market

Leading players in the vitamin ingredients sector are differentiating their market positions through vertical integration, collaborative R&D ventures, and strategic capacity expansions. Major multinational corporations leverage their global networks to secure critical raw materials and optimize production footprints, while emerging specialty producers focus on innovative extraction technologies and niche ingredient portfolios to carve defensible market niches. Across the board, partnerships between academic research institutions and the private sector are accelerating the discovery of novel vitamin analogues and bioavailability enhancers, differentiating participants based on scientific prowess and product efficacy.

In addition to R&D collaborations, contract manufacturing organizations are establishing long-term supply agreements that guarantee capacity for high-demand formulations, thereby reducing time-to-market risks for brand owners. At the same time, companies are investing in digital platforms to streamline order management and improve customer engagement, integrating real-time analytics to predict demand fluctuations and inform production planning. Sustainability commitments are also influencing competitive dynamics: firms with robust environmental, social, and governance credentials are capturing premium positioning, particularly among institutional buyers and retailers prioritizing ethical sourcing practices.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vitamin Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIE Pharmaceuticals, Inc.

- Amway Corporation

- Archer-Daniels-Midland Company

- BASF SE

- Cargill, Incorporated

- dsm-firmenich AG

- DuPont de Nemours, Inc.

- Fermenta Biotech Limited

- Foodchem International Corporation

- Glanbia plc

- GNC Holdings, LLC

- Herbalife International of America, Inc.

- Kemin Industries, Inc.

- Lonza Group AG

- Matrix Life Science Private Limited

- Nutrilo GmbH

- Piramal Pharma Solutions Private Limited

- Tate & Lyle PLC

- United Laboratories Private Limited

Charting a Path Forward with Actionable Strategies Designed to Enhance Innovation, Streamline Operations, and Secure Sustainable Growth

To capitalize on market momentum and fortify strategic positioning, industry leaders should prioritize a multifaceted approach that emphasizes innovation, operational agility, and sustainability. Embedding advanced process technologies such as continuous flow chemistry and precision fermentation into manufacturing pipelines can unlock efficiency gains and reduce dependency on imported feedstocks. Concurrently, investing in modular production units enables rapid capacity adjustments and supports the seamless introduction of new vitamin derivatives tailored to evolving consumer needs.

Furthermore, cultivating collaborative ecosystems with ingredient suppliers, contract manufacturers, and digital solution providers enhances upstream transparency and accelerates product development cycles. In the commercial arena, aligning marketing narratives with consumer values around clean labels and traceability can strengthen brand credibility. Leaders should also explore joint ventures and licensing agreements that grant access to proprietary technologies and regional distribution networks. Finally, adopting a robust trade risk management framework that includes alternative sourcing strategies and dynamic pricing mechanisms will safeguard profitability amid shifting tariff landscapes, ensuring long-term resilience and sustained competitive advantage.

Employing Rigorous Research Methodologies to Deliver Comprehensive Insights Through Diverse Data Sources and Advanced Analytical Techniques

This research employs a rigorous methodology that integrates qualitative and quantitative techniques to deliver holistic market insights. Primary data collection encompassed in-depth interviews with senior executives, formulation scientists, and supply chain experts across key geographies, ensuring firsthand perspectives on emerging trends and strategic priorities. Complementary secondary research involved analyzing industry publications, regulatory filings, patent databases, and company disclosures to validate hypotheses and map competitive activities.

Quantitative analysis leveraged trade databases, customs records, and internal shipment logs to illuminate import–export dynamics and tariff impacts, while statistical modelling techniques identified correlation patterns between ingredient prices and end-use demand drivers. Scenario planning workshops facilitated the construction of multiple future states, assessing trade policy evolutions and technological adoption rates. Data triangulation was central to this approach, with cross-validation mechanisms applied to reconcile discrepancies and enhance the robustness of findings. This comprehensive methodology underpins the reliability and depth of the strategic recommendations provided.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vitamin Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vitamin Ingredients Market, by Ingredient Type

- Vitamin Ingredients Market, by Source

- Vitamin Ingredients Market, by Form

- Vitamin Ingredients Market, by Application

- Vitamin Ingredients Market, by Distribution Channel

- Vitamin Ingredients Market, by Region

- Vitamin Ingredients Market, by Group

- Vitamin Ingredients Market, by Country

- United States Vitamin Ingredients Market

- China Vitamin Ingredients Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Consolidating Key Insights and Strategic Implications to Empower Decision Makers and Stakeholders in the Vitamin Ingredients Domain

In summary, the vitamin ingredients market is characterized by accelerating consumer demand for targeted nutrition, evolving regulatory frameworks, and an imperative for sustainable sourcing practices. The 2025 tariff adjustments in the United States have catalyzed strategic shifts toward nearshoring and process innovation, highlighting the importance of trade risk management. Multi-layered segmentation insights emphasize the need for tailored approaches across ingredient types, sources, forms, applications, and distribution channels. Regional nuances in the Americas, Europe Middle East and Africa, and Asia-Pacific demand localized strategies that align with unique regulatory, cultural, and economic conditions.

Competitive dynamics underscore the value of R&D integration, digital engagement, and sustainability credentials as differentiators. Actionable recommendations call for agile manufacturing platforms, collaborative ecosystems, and robust trade frameworks. The rigorous research methodology combining primary interviews, secondary data analysis, and scenario planning ensures that these insights are grounded in empirical evidence. Together, these elements equip decision makers with the strategic intelligence necessary to navigate challenges and seize growth opportunities in the rapidly evolving vitamin ingredients domain.

Engage Directly with Associate Director of Sales & Marketing to Secure the Comprehensive Market Research Report and Elevate Your Business Outcomes

Discover how this report can refine your market approach and drive tangible growth outcomes. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to explore customized insights tailored to your strategic priorities. He will guide you through key report highlights, answer your questions about specific market segments, and support the integration of research findings into your operational and commercial plans. Schedule a meeting today to access exclusive discount opportunities and secure the intelligence that will position your organization at the forefront of the vitamin ingredients industry

- How big is the Vitamin Ingredients Market?

- What is the Vitamin Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?