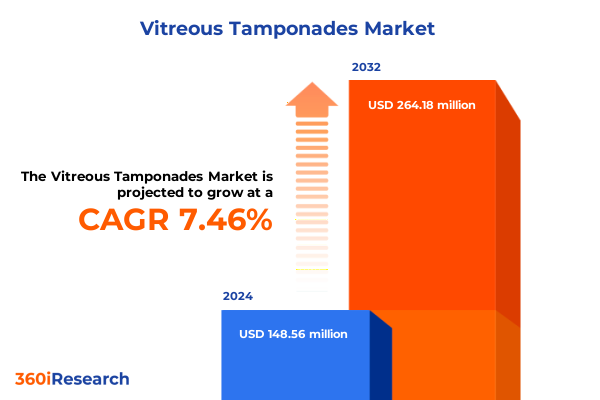

The Vitreous Tamponades Market size was estimated at USD 159.56 million in 2025 and expected to reach USD 171.42 million in 2026, at a CAGR of 7.46% to reach USD 264.18 million by 2032.

Exploring the Foundational Role and Evolution of Vitreous Tamponade Agents in Modern Retinal Surgery and Patient Outcomes

The science and clinical practice of retinal surgery rely fundamentally on vitreous tamponade agents to ensure retinal reattachment and stabilize intraocular architecture. From the earliest reported use of sterile air by Ohm in 1911 to the evolution of gas and liquid agents over the past century, tamponades have transformed the management of complex vitreoretinal conditions. The initial introduction of liquid silicone in the early 1960s marked a significant milestone, providing surgeons with long-term intraocular support that spurred further refinement in formulation and surgical techniques. As pneumatic retinopexy techniques emerged in the 1970s, expansile gases such as sulfur hexafluoride and perfluoropropane gained prominence due to their predictable expansion properties and resorption profiles.

Advancements in perfluorocarbon liquids and the advent of heavy silicone formulations during the 1980s and 1990s broadened the tamponade armamentarium by addressing inferior retinal breaks and proliferative pathologies. These innovations underscored the importance of balancing surface tension, buoyancy, and biocompatibility to achieve optimal clinical outcomes. Today, vitreous tamponades form the backbone of modern pars plana vitrectomy procedures, setting the stage for continual enhancements in patient safety and visual rehabilitation.

Identifying Transformative Shifts in the Vitreous Tamponade Landscape Driven by Technological Advancements and Clinical Innovations

The landscape of vitreous tamponades is being reshaped by a surge of translational research and material science breakthroughs. Hydrogel-based substitutes that mimic the natural vitreous matrix are at the forefront, leveraging in situ gelling properties and intrinsic biocompatibility to offer sustained tamponade forces without the toxicity concerns of traditional crosslinkers. Thermosensitive hydrogels, designed to transition from sol to gel at physiological temperatures, promise minimally invasive delivery through microcannulas while providing a refractive index comparable to native vitreous.

Simultaneously, bioactive tamponade agents are emerging as dual-function platforms capable of mechanical stabilization and controlled drug release. Polymer-based formulations have demonstrated successful delivery of anti-VEGF therapeutics and corticosteroids, potentially reducing the incidence of proliferative vitreoretinopathy and accelerating postoperative healing. Beyond these developments, next-generation research envisions spontaneously reabsorbing heavy liquids that combine the buoyancy of gases, the specific gravity of perfluorocarbon liquids, and the long-term tolerability of silicone oils, all within a single, self-limiting agent designed for both intraoperative use and gradual clearance from the vitreous cavity.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on the Vitreous Tamponade Supply Chain and Costs

In 2025, heightened United States tariff measures have introduced new complexities to the global supply chain for ophthalmic materials. Under Section 301 provisions, medical device imports from China now face additional duties ranging from 25% to 100%, depending on product categories such as surgical respirators, gloves, syringes, and related consumables. Although silicone oils and perfluorocarbon liquids are not explicitly targeted under these categories, the broader realignment of import duties has increased logistical and compliance costs, prompting many suppliers to adjust pricing strategies and reconsider sourcing geographies.

Moreover, reciprocal tariff reductions agreed in May 2025 temporarily lowered duties on select Chinese-origin materials from 125% to 10%, yet the relief excludes variable Section 301 tariffs and fentanyl-related levies, leaving residual layers of duties intact. As manufacturers navigate these overlapping regimes, the cumulative impact is manifest in extended lead times, elevated inventory carrying costs, and a renewed emphasis on nearshoring or dual-sourcing critical components. These shifts underscore the necessity for strategic supply chain resilience in an era of fluctuating trade policies.

Unveiling Key Insights from Product Type, Duration, Procedure, and End User Segmentation in the Vitreous Tamponade Market

Insights drawn from analysis of product-type segmentation reveal distinct adoption patterns: expansile gases retain dominance in standard retinal detachments where rapid resorption and superior tamponade forces are essential, heavy silicone oils have carved a niche in complex inferior detachments requiring denser-than-water support, and conventional silicone oils remain indispensable for long-term internal tamponade in proliferative pathologies. When viewed through the lens of tamponade duration, long-acting agents offer sustained support for severe proliferative vitreoretinopathy, medium-acting options strike a balance between operative ease and patient positioning requirements, and short-acting gases facilitate quicker visual recovery in routine macular hole repairs.

Examining segmentation by surgery type highlights that macular hole and epiretinal membrane procedures increasingly leverage short-acting gas formulations for prompt surface tension without necessitating extended prone positioning, whereas proliferative diabetic retinopathy interventions often require medium-duration gases to control neovascularization postoperatively. Retinal detachment surgeries display a bifurcated demand: inferior breaks see preferential use of heavy silicone oils, while superior detachments are effectively managed with a range of gas tamponades tailored to surgeon preference and patient compliance. From an end-user perspective, ambulatory surgical centers emphasize shorter-acting and easily resorbable agents to optimize throughput and minimize postoperative visits, while hospitals favor long-term silicone oils for complex cases that benefit from extended observation and multi-modal care environments.

This comprehensive research report categorizes the Vitreous Tamponades market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Tamponade Duration

- Surgery Type

- End User

Highlighting Regional Dynamics Shaping Demand for Vitreous Tamponade Therapies Across Americas, Europe Middle East Africa, and Asia Pacific

The Americas continue to set the pace in vitreous tamponade adoption, buoyed by a high prevalence of diabetic retinopathy-estimated at 9.6 million affected individuals in the United States in 2021-driving consistent demand for advanced surgical interventions and premium tamponade agents. Robust reimbursement policies and widespread availability of microincision vitrectomy systems further reinforce the region’s leadership in clinical uptake. In Europe, Middle East & Africa, tailored regulatory pathways and centralized approval mechanisms in core EU markets support the introduction of next-generation tamponades, yet heterogeneous funding models and varying procedure volumes across emerging economies temper overall adoption rates. European centers still report incidence of rhegmatogenous retinal detachment at approximately 13.3 cases per 100,000 inhabitants annually, highlighting ongoing procedural volumes that sustain stable demand for both gas and silicone-based agents.

Asia-Pacific stands out as the fastest-growing region, underpinned by rising healthcare expenditure, an expanding network of specialized eye hospitals, and a growing diabetic population facing vision-threatening sequelae. With reported regional incidence of retinal detachment in Western Pacific countries around 10.6 per 100,000, and advanced infrastructure developments in China, Japan, and South Korea, market penetration for novel hydrogel and heavy oil formulations is accelerating. Strategic collaborations between local manufacturers and global innovators, combined with competitive pricing models, are facilitating broader access to premium tamponade technologies.

This comprehensive research report examines key regions that drive the evolution of the Vitreous Tamponades market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Innovations Driving Competitive Strategies in the Vitreous Tamponade Sector

Leading companies have concentrated R&D investments on enhancing biocompatibility, refining tamponade-specific physiochemical properties, and advancing delivery systems. Established device manufacturers such as Carl Zeiss Meditec and D.O.R.C. Dutch Ophthalmic Research Center have introduced heavy silicone oil variants optimized for inferior tamponade, while Bausch Health and Novartis are leveraging proprietary formulations to integrate anti-proliferative drug delivery into silicone oil substrates. Fluoron GmbH, a specialist in perfluorocarbon liquids, has focused on high-purity PFCL grades, catering to complex cases that demand precise intraoperative stabilization. Concurrently, startups and academic spin-offs are driving hydrogel-based substitutes through early-stage trials, collaborating with polymer chemists and bioengineers to translate bench-scale innovations into clinical prototypes.

These competitive dynamics underscore a broader shift toward multi-function tamponade solutions, where mechanical support converges with therapeutic payload delivery. Companies prioritizing agile regulatory strategies and manufacturing flexibility are best positioned to capture early-mover advantages as reimbursement models evolve to recognize added clinical value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Vitreous Tamponades market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Laboratories, Inc.

- B. Braun Melsungen AG

- Bausch + Lomb Incorporated

- Carl Zeiss Meditec AG

- DORC International B.V.

- FCI Ophthalmics, Inc.

- Fluoron GmbH

- Geuder AG

- Ophthalmic Innovation International, LLC

- Synergetics USA, Inc.

Crafting Actionable Strategic Recommendations to Navigate Market Complexities and Accelerate Growth in Vitreous Tamponade Solutions

Industry leaders should prioritize dual-use R&D programs that pair tamponade mechanics with pharmacologic interventions, ensuring regulatory filings reflect both structural and therapeutic benefits. Strategic alliances with contract manufacturers in tariff-advantaged regions can mitigate 2025 import duty pressures, safeguarding margin integrity while maintaining supply continuity. Investing in modular manufacturing platforms will enable rapid switching between gas, oil, and hydrogel product lines in response to shifting clinical preferences and reimbursement landscapes.

On the commercial front, targeted education initiatives highlighting next-generation tamponade attributes-such as spontaneous reabsorption profiles and drug-eluting capabilities-will be critical to gaining surgeon buy-in. Embracing digital training tools, including virtual reality simulation for complex tamponade handling, can differentiate offering portfolios and deepen clinical partnerships. Finally, pursuing value-based contracting frameworks that tie product reimbursement to documented improvements in reoperation rates or patient positioning burden will resonate with payers and strengthen long-term uptake.

Detailing the Rigorous Multi-Method Research Methodology Underpinning Insights into the Vitreous Tamponade Market

This analysis combined primary insights from in-depth interviews with vitreoretinal surgeons and procurement directors across ambulatory surgical centers and hospitals, alongside secondary research encompassing peer-reviewed journals, regulatory filings, and global trade databases. Tariff schedules were reviewed through the United States Trade Representative’s Federal Register notices and supplemented with legal analysis reports to assess Section 301 impacts. Historical evolution of tamponade agents was reconstructed using landmark publications and systematic reviews, ensuring a robust foundation of scientific consensus.

Regional adoption patterns were mapped by integrating epidemiological data from the CDC’s Vision and Eye Health Surveillance System and meta-analyses of retinal detachment incidence across WHO regions. Competitive landscapes were delineated through patent filings, corporate annual reports, and product pipeline disclosures. Finally, all insights underwent rigorous triangulation to validate consistency across independent data sources and expert perspectives, ensuring the recommendations reflect both current realities and foreseeable inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Vitreous Tamponades market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Vitreous Tamponades Market, by Product Type

- Vitreous Tamponades Market, by Tamponade Duration

- Vitreous Tamponades Market, by Surgery Type

- Vitreous Tamponades Market, by End User

- Vitreous Tamponades Market, by Region

- Vitreous Tamponades Market, by Group

- Vitreous Tamponades Market, by Country

- United States Vitreous Tamponades Market

- China Vitreous Tamponades Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Drawing Conclusive Perspectives on Future Directions, Anticipated Challenges, and Emerging Opportunities in Vitreous Tamponade Therapy

Vitreous tamponade therapies have traversed a remarkable journey from early air injections to sophisticated multi-functional agents poised for regulatory approval. While traditional gases and silicone oils remain mainstays, the burgeoning pipeline of hydrogel-based substitutes and bioactive formulations signals a paradigm shift. Navigating this evolution demands keen attention to supply chain resilience amidst shifting tariff landscapes, alignment with surgeon workflow preferences, and proactive engagement with payers on value demonstration.

Looking ahead, the convergence of materials science, drug delivery technology, and digital surgical training will define the next frontier. Companies that can seamlessly integrate these domains-while maintaining agility in regulatory pathways and tariff mitigation strategies-will shape patient outcomes and capture disproportionate market share. By synthesizing historical lessons with forward-looking innovation imperatives, stakeholders can chart a course toward more effective, safer, and economically sustainable vitreoretinal interventions.

Engage with Ketan Rohom to Secure the Definitive Market Research Report on Vitreous Tamponade Insights and Strategic Intelligence

To explore the full depth of market intelligence on vitreous tamponade agents and strategic pathways tailored to your organization’s unique objectives, reach out to Ketan Rohom. As Associate Director, Sales & Marketing, Ketan brings unparalleled expertise in translating complex ophthalmic research into actionable growth opportunities. Whether you seek detailed competitive benchmarking, customized regulatory analysis, or partnership facilitation, Ketan can guide you through the process of acquiring the comprehensive research report that aligns with your strategic imperatives. Engage today to ensure your organization is equipped with the insights necessary to lead innovation, optimize supply chains in a shifting tariff landscape, and capitalize on emerging regional dynamics in the vitreous tamponade market

- How big is the Vitreous Tamponades Market?

- What is the Vitreous Tamponades Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?